How to Buy Bitcoin in the UK in 2024

According to FCA research, nearly 5 million people own cryptocurrencies in the UK. As the world’s largest cryptocurrency by market capitalization, Bitcoin is the most popular.

If you’re wondering how to buy Bitcoin in the UK, this guide explains everything you need to know. We explain the investment process with a trusted provider and compare the best Bitcoin exchanges accepting GBP payments.

Buy Bitcoin in the UK Through a Crypto Exchange

UK investors have many options when buying Bitcoin online. You’ll need to choose a suitable cryptocurrency exchange that offers a safe and cost-effective experience. Many exchanges supported debit/credit cards, bank transfers, and e-wallets. This makes the Bitcoin investment process seamless.

After you’ve bought Bitcoin, it’s wise to keep your digital assets in a cryptocurrency wallet. Most UK investors use a mobile wallet for added convenience. This enables you to check how your Bitcoin investment is performing at the click of a button. Desktop and hardware wallets are another option.

The value of Bitcoin will rise and fall like any other asset. This is based on market forces, similar to shares and mutual funds. To make a profit, you’ll need to sell Bitcoin at a higher price than you originally paid. When it’s time to exit the investment, you can also sell Bitcoin for GBP through a cryptocurrency exchange.

What is Bitcoin? The Basics

Still asking the question, what is Bitcoin?

- Put simply, Bitcoin is a digital asset that uses cryptographic technology.

- Bitcoin can be transferred without going through intermediaries, meaning the network is ‘decentralized’.

- Only 21 million Bitcoins will ever exist, making it a finite asset class.

- Although Bitcoin could be used as a medium of exchange, most people view it as an investment vehicle. This is because Bitcoin has produced unprecedented returns since it was launched in 2009.

- In the last five years alone, the Bitcoin price has increased by over 1,000%.

Step-by-Step Process of Buying Bitcoin in the UK

Now let’s take a closer look at how to buy Bitcoin in the UK. We walk you through the process every step of the way, ensuring that first-time investors enjoy a smooth investment experience.

Step 1: Choose a Crypto-Trading Service or Venue

The first step is choosing the best way to invest in Bitcoin. The most common option for UK investors is a cryptocurrency exchange. These platforms are similar to share dealing platforms, but they specialize in digital assets rather than stocks. This means in addition to Bitcoin, you’ll also have access to some of the best altcoins.

Here’s what to consider when selecting a cryptocurrency exchange for buying Bitcoin:

- Safety: Not all cryptocurrency exchanges offer a safe and secure experience. It’s important to research the exchange’s reputation, how long it’s been operating, and whether it holds a regulatory license. We’d also suggest checking the exchange’s ‘proof of reserves’. This ensures the exchange has enough reserves to cover client balances.

- Payment Methods: First-time investors should choose a Bitcoin exchange that accepts their preferred payment method. Many opt for debit/credit cards, as the investment will be processed instantly. Some exchanges also accept e-wallets like PayPal and Skrill, not to mention local bank transfers via the Faster Payments network.

- Minimum Investment: Bitcoin is a volatile investment, so avoid investing more than you can afford to lose. This means investors should check the minimum investment requirement for their chosen exchange. Minimum requirements are often just a few pounds, which is ideal for beginners.

- Fees: The best cryptocurrency exchanges in the UK offer low fees. This should include low deposit fees and competitive trading commissions. You should also check how much the exchange charges to withdraw Bitcoin to a private wallet. This shouldn’t cost more than the Bitcoin network fee.

- Supported Cryptocurrencies: Many UK investors will build a diversified portfolio of cryptocurrencies. Alongside Bitcoin, this might include Ethereum, XRP, Solana, Cardano, BNB, and Dogecoin. If you’re also looking to diversify, explore what other cryptocurrencies the exchange supports.

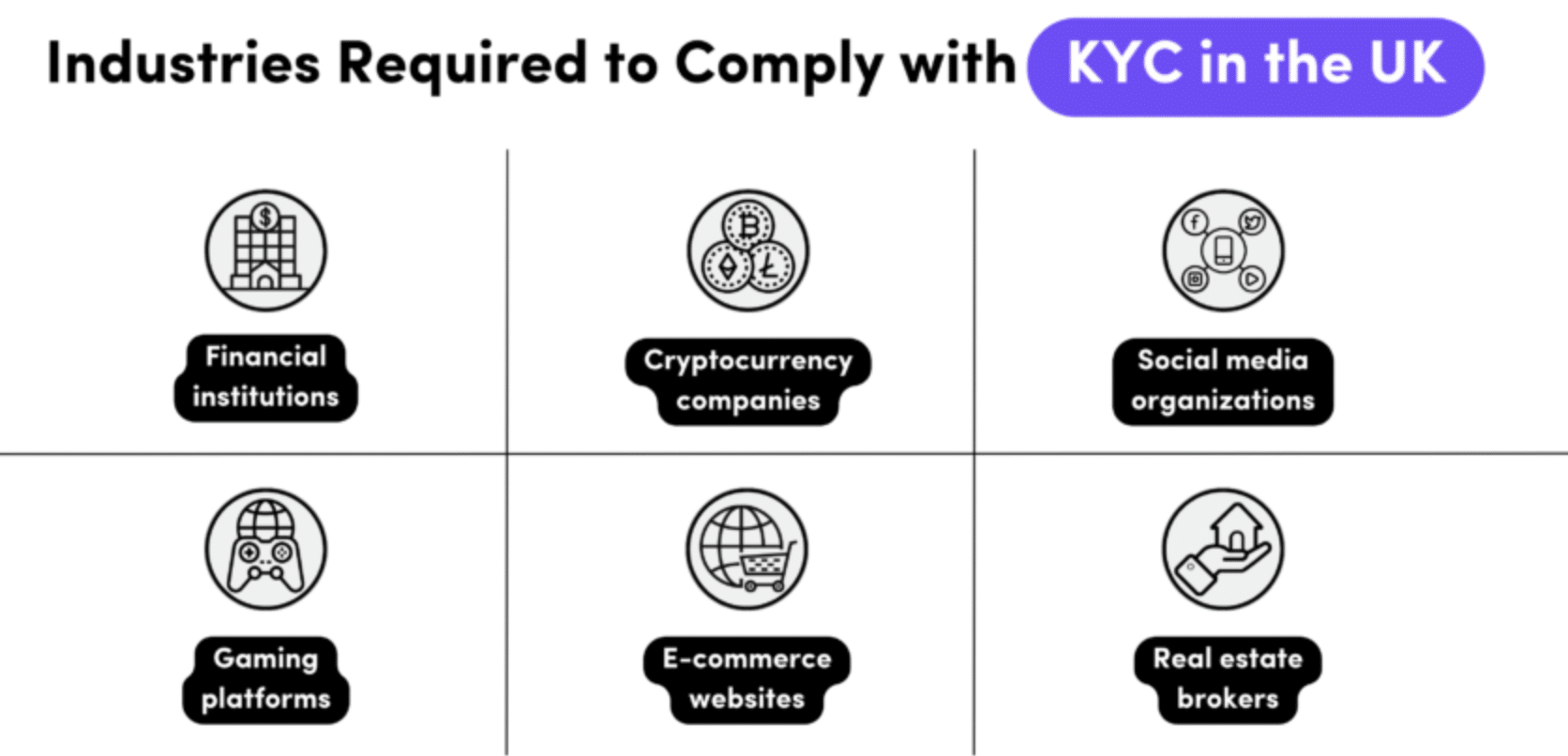

Step 2: Open a Verified Cryptocurrency Exchange Account

After you’ve selected a cryptocurrency exchange, you’ll need to open an account. Most exchanges only require an email address and a chosen password. This often enables investors to trade cryptocurrencies anonymously. However, the exchange will need to verify your identity if you want to use ‘fiat money’.

This means using a traditional payment method, such as a debit/credit card or bank transfer. The KYC (Know Your Customer) process will initially require some personal information and contact details. This includes your full name, home address, date of birth, email, and mobile number.

Next, you’ll need to upload some ID verification documents. This includes a passport or driver’s license, plus a recently issued proof of address. Bank/credit card statements and utility bills are usually accepted. Most Bitcoin exchanges will verify the documents in real time, meaning your account should be verified in minutes.

Note: Some cryptocurrency exchanges use third-party payment processors. Common examples include Moonpay, Mercuryo, and Banxa. These providers will conduct their own KYC procedures. This means the KYC process might not be triggered until you make a payment.

Step 3: Connect Your Exchange to a Payment Option

So far, you’ve opened an account with a cryptocurrency exchange and verified your identity. The next step is to deposit some funds into your newly opened account.

The list of accepted payment methods will vary depending on the exchange. That said, most exchanges enable you to deposit funds with Visa or MasterCard. Although this means you’ll benefit from an instant deposit, some exchanges charge 3-5% on debit/credit card payments. So always check what fees apply before making the deposit.

You might also be able to deposit funds with an e-wallet like PayPal, Google/Apple Pay, or Skrill. Another option – and often the cheapest method, is a local bank transfer. Many UK exchanges support the Faster Payments network, so the transfer should appear within minutes.

Step 4: Place an Order

Now that you’ve got funds in your cryptocurrency exchange account, you’re just one step away from buying Bitcoins in the UK. The specific investment process can vary depending on the exchange. That said, most require you to place an order. This is similar to buying shares from a UK stock broker.

So, you’ll first need to search for Bitcoin on the exchange platform. You’ll likely see a Bitcoin chart with live prices. Look for the order box and choose between a ‘Market’ or ‘Limit’ order.

- Market Orders: Beginners should opt for a market order. This is because the order will be executed by the exchange instantly. You’ll get the next best available price.

- Limit Orders: Alternatively, limit orders allow you to specify the exact price at which your investment is executed. For instance, suppose Bitcoin is currently trading at £32,000. However, you want to buy Bitcoin when it drops to £31,500 – giving you a more favorable entry price. In this instance, a limit order would be the best option.

Once you’ve selected the order type, you’ll need to specify the investment amount. Finally, confirm your order by clicking the respective button.

Do note that limit orders are only executed once the target price has been triggered. Until then, the limit order will remain pending. Market orders are always processed instantly, assuming there’s enough liquidity on the exchange.

Step 5: Safe Storage

Now that you’ve placed an order, the Bitcoins will appear in your exchange account. The exchange will store the Bitcoins in their custodial wallet, meaning it’s responsible for keeping them safe. However, considering the recent FTX collapse – a cryptocurrency exchange that has since declared bankruptcy, it’s safer to withdraw the Bitcoins to a private wallet.

In doing so, you will retain full control of your Bitcoins. This means you can store and transfer the Bitcoins whenever you like, without needing authorization from an exchange. We discuss how the best cryptocurrency wallets work further down.

Once you’ve downloaded and set up a wallet, you’ll need to request a withdrawal from the cryptocurrency exchange. The exchange will need the unique address associated with your wallet. After requesting a Bitcoin withdrawal, most exchanges should approve it within minutes. You should receive an email once the withdrawal is processed.

It should then take about 10 minutes for the Bitcoins to appear in your wallet. You can keep the Bitcoins there until you’re ready to cash out.

Selling Bitcoin in the UK

in the UK? Selling Bitcoin at a higher price than you originally paid will result in a profit. But what’s the best way to sell Bitcoin in the UK?

- The best option is to use the same cryptocurrency exchange that you originally used to make the purchase.

- Assuming the Bitcoins are stored in a private wallet, you’ll first need to deposit them into the exchange.

- Once the deposit arrives, you can then create a sell order. This is the same as creating a buy (market/limit) order but in reverse.

- After you’ve sold Bitcoin to GBP, you can then request a withdrawal from the exchange. Many exchanges allow you to withdraw GBP to a UK bank account.

Where to Buy Bitcoin in the UK

Knowing where to buy Bitcoin in the UK can be a headache, considering the number of exchanges in the market. This section reviews some of the leading Bitcoin exchanges for safety, low fees, and user-friendliness.

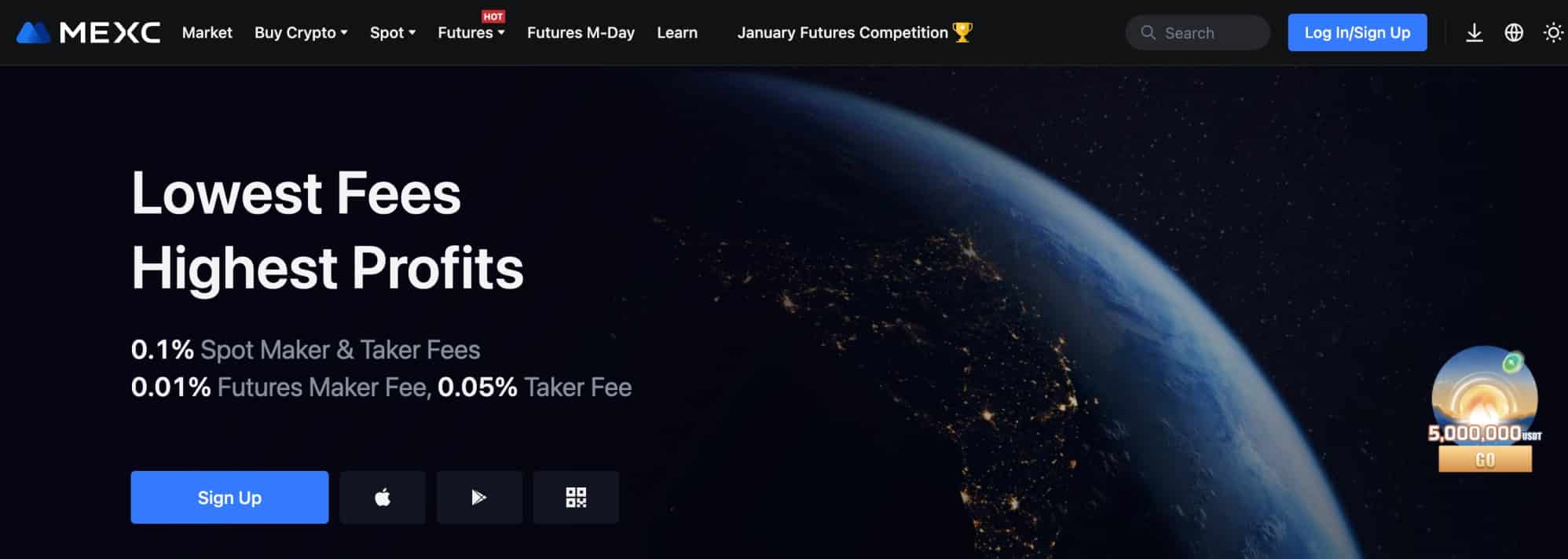

1. MEXC – Overall Best Place to Buy Bitcoin in the UK

is a top-rated cryptocurrency exchange that was launched in 2018. At just 0.1% per slide, MEXC offers some of the lowest trading commissions in the market. This means for every £1,000 worth of Bitcoin traded, you’ll pay just £1 in commission. MEXC is also ideal for first-time investors, as it accepts Visa and MasterCard payments.

The minimum debit/credit card deposit is just £8.50 and the payment will be processed instantly. However, MEXC doesn’t offer e-wallet or bank transfer deposits for UK investors. Nonetheless, as one of the world’s most popular exchanges, MEXC offers premium liquidity. This means you’ll get some of the best Bitcoin exchange rates available.

What’s more, MEXC is available on web and mobile browsers. It also offers a native mobile app for iOS, Android, and Windows. In addition to Bitcoin, MEXC supports some of the best cryptocurrencies to buy. This includes everything from Dogecoin and XRP to Solana and Cardano. MEXC also offers flexible Bitcoin savings accounts with APYs of 1.8%.

Pros

- Buy Bitcoins in the UK with a debit/credit card

- Trading commissions of just 0.1%

- Offers a user-friendly trading experience

- Supports hundreds of other cryptocurrencies

- Earn interest via Bitcoin savings accounts

Cons

- UK investors can’t buy Bitcoin with an e-wallet or bank transfer

- Some trading products aren’t available in the UK

| Exchange | Deposit Fee | Commission to Buy Bitcoin |

| MEXC | Stated when making the debit/credit card deposit | 0.10% |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong.

2. OKX – Free GBP Deposits via UK Faster Payments

OKX is a great option if you prefer depositing funds with a UK bank transfer. The exchange supports the Faster Payments network, meaning transfers are processed quickly. What’s more, OKX doesn’t charge fees on UK bank payments, making it a cost-effective place to buy Bitcoin.

OKX also offers competitive trading commissions. Standard accounts pay just 0.1% per slide. Discounts are available to regular users when meeting minimum trading milestones. In addition to bank transfers, OKX also accepts UK debit/credit cards. The fee is built into the Bitcoin exchange rate at the time of the order.

OKX supports hundreds of cryptocurrencies, so is also a good option for building a diversified portfolio. Although OKX also offers Bitcoin savings accounts, this product isn’t available to UK investors. OKX can be accessed on web browsers or its native mobile app. OKX also doubles as a non-custodial cryptocurrency wallet, giving you full control of your Bitcoins.

Pros

- Deposit GBP via Faster Payments without paying fees

- Also accepts Visa and MasterCard purchases

- Pay just 0.1% when buying and selling Bitcoin

- Offers a non-custodial wallet app

- Supports hundreds of altcoins

Cons

- Bitcoin interest accounts aren’t available in the UK

- Debit/credit card fees are built into the exchange rate

| Exchange | Deposit Fee | Commission to Buy Bitcoin |

| OKX | No fees on GBP bank deposits. Debit/credit fees are built into the Bitcoin exchange rate at the time of the payment | 0.10% |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong.

3. Binance – Low Trading Commissions and Fast Withdrawals

Not only is Binance the largest cryptocurrency exchange by trading volume but it has over 128 million users. One of Binance’s best features is its low trading commissions. Buying and selling Bitcoin costs just 0.1% of the trade amount. Lower commissions are offered when trading larger volumes.

In terms of deposits, Binance no longer accepts GBP bank transfers. It does, however, support debit/credit card payments. This enables you to buy Bitcoin in the UK instantly. The minimum purchase requirement is just £15. Binance charges a 2% transaction fee on debit/credit card payments, which includes the trading commission.

We also found that Binance offers super-fast Bitcoin withdrawals. In most cases, the withdrawal should be processed in minutes. Binance also offers a cryptocurrency wallet app, although this comes with custodial storage. UK investors have access to over 350 other cryptocurrencies, including Dogecoin, XRP, and Cardano.

Pros

- Largest cryptocurrency exchange by trading volume

- Low commissions of just 0.1%

- Debit/credit card payments are processed instantly

- Huge liquidity ensures competitive exchange rates

- Bitcoin withdrawals are usually approved in minutes

Cons

- No longer accepts UK bank transfers

- 2% deposit fees when using Visa or MasterCard

| Exchange | Deposit Fee | Commission to Buy Bitcoin |

| Binance | 2% fee when using debit/credit cards | 0.10% |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong.

Other Alternatives to Buying Bitcoin in the UK

Although cryptocurrency exchanges are the most popular way to buy Bitcoin in the UK, other options exist. This section explores some of the alternative ways to invest in Bitcoin.

How to Buy BTC at a Traditional Stock Broker

A small number of UK stock brokers offer exposure to Bitcoin. The benefit here is that the broker will be authorized and regulated by the FCA. This isn’t always the case with traditional cryptocurrency exchanges.

That said, we found that stock brokers offer limited Bitcoin trading tools. Moreover, there are often restrictions on withdrawals. This means you won’t be able to transfer the Bitcoins to a private wallet.

Buy Bitcoin at an ATM

The UK was once home to hundreds of Bitcoin ATMs. However, the FCA has since cracked down on unregistered cryptocurrency ATMs, meaning there’s now just a handful left.

Nonetheless, if you do have a Bitcoin ATM located in your area, here’s how to use a Bitcoin ATM:

- The first step is to select how much Bitcoin you want to buy

- Depending on the transaction amount, you might be asked to scan your UK passport or driver’s license

- You’ll then be asked to insert cash notes into the ATM

- The ATM will then print a receipt with details of how to claim the Bitcoins. Alternatively, some ATMs will ask you to scan your Bitcoin wallet address via a QR code.

Not only are Bitcoin ATMs few and far between in the UK but they’re also expensive. Fees will often exceed 10% of the transaction amount. This means you’d need Bitcoin to increase in value by over 10% just to break even. Therefore, other options should be considered when exploring how to buy Bitcoin in the UK.

How to Buy Bitcoin With PayPal

PayPal used to allow UK investors to buy Bitcoin directly on its platform. This meant that investors could use their PayPal balance or make a deposit with a linked payment method. However, PayPal has temporarily suspended its cryptocurrency service to UK investors. This is because of tighter rules on cryptocurrency sales, as per FCA guidance.

That being said, it’s still possible to buy Bitcoin with PayPal in the UK. Put simply, you’ll need to choose a cryptocurrency exchange that accepts PayPal deposits. Coinbase is one option, although this carries fees of 3.99%. Another option is to deposit funds with PayPal via a peer-to-peer exchange. However, this comes with increased risks of being scammed.

How to Buy Bitcoin With a Credit Card

Many exchanges allow UK investors to buy Bitcoin with a credit card. The process works the same as using a debit card, meaning the payment will be processed instantly. However, there are some considerations to make.

For a start, some UK credit card companies are known to block cryptocurrency-related transactions. According to Forbes, this includes Tesco Bank, TSB, and Virgin Money. Even if your credit card issuer does allow Bitcoin purchases, you should consider the risks of doing so.

After all, Bitcoin is a volatile asset class. Using credit to invest can be disastrous if the price of Bitcoin declines rapidly.

- For instance, suppose you buy £2,000 worth of Bitcoin with a credit card. Bitcoin is trading at £30,000 when you invest.

- When you receive your credit card statement, Bitcoin is trading at £20,000 – a decline of over 33%.

- This means your £2,000 investment is now worth about £1,334.

- However, you’ll still owe the credit card company £2,000.

- If you don’t pay the balance in full, you’ll end up paying high interest rates.

Ultimately, it’s best to use your own money when buying Bitcoin in the UK.

How to Buy Bitcoin Through a Trust or an Exchange-Traded Fund (ETF)

The London Stock Exchange doesn’t currently list any Bitcoin trusts or ETFs. That said, the SEC recently approved a wave of Bitcoin ETF applications, which will be listed on US exchanges. Considering that most UK stock brokers provide access to the US markets, this will open Bitcoin ETFs to UK investors.

Here’s how it will work.

ETF managers like BlackRock will purchase large volumes of Bitcoin on behalf of investors. The ETF manager will then issue shares, which trade on stock exchanges. In theory, the value of the shares will reflect Bitcoin’s market price. The benefit is that investors can gain exposure to Bitcoin without needing to worry about cryptocurrency exchanges or wallets.

On the contrary, the investment process works much the same as buying shares. This means you can use a traditional stock broker that’s regulated by the FCA. What’s more, you can cash out your Bitcoin ETF investment at any time during standard market hours.

Buying BTC Via Peer-to-Peer (P2P) Trading Platforms

Another option to consider is peer-to-peer exchanges. This enables you to buy Bitcoin directly from a seller with your preferred payment method. This often includes local bank transfers, Wise, PayPal, and other popular e-wallets.

- After selecting your preferred payment type and investment amount, the peer-to-peer exchange will list suitable sellers.

- Each seller will set their own Bitcoin exchange rate, which is often above the actual market price.

- Next, the seller will send their payment details, such as a bank account number and sort code.

- Before sending the payment, you’d need to make sure the seller has deposited the Bitcoins into an escrow wallet.

- Once payment is sent, you’ll notify the seller. They’ll then check the payment has been received before releasing the Bitcoins from escrow.

Peer-to-peer exchanges used to be popular with investors who want to buy Bitcoin anonymously. However, increased pressure from regulators means that sellers often ask for ID from buyers. Moreover, peer-to-peer exchanges can be risky, as scams are known to take place.

How to Buy Bitcoin Through a Crypto Wallet

Some cryptocurrency wallets double up as Bitcoin exchanges. This means you can buy Bitcoin without leaving the wallet interface. Payment methods often include debit/credit cards and e-wallets. However, most wallet providers use third-party payment processors like Moonpay and Banxa.

These payment providers are notorious for charging high fees – often between 3-5%. This is in addition to the fee charged by the wallet provider. Nonetheless, once you’ve completed the purchase, the Bitcoins will be added to your cryptocurrency wallet. This offers a fast and convenient investment process.

Can I Buy Bitcoin With Leverage in the UK?

- UK investors used to be able to buy Bitcoin with leverage. This was typically offered via contracts-for-differences (CFDs) – a type of leveraged derivative.

- However, the FCA banned cryptocurrency derivatives in January 2021. This means that retail clients can no longer access leveraged Bitcoin products in the UK.

Where to Store Your Bitcoin

When exploring how to buy Bitcoin in the UK, it’s crucial to think about storage. Bitcoins are stored in ‘wallets’, which usually come as a mobile or desktop app. Hardware and paper wallets are another option.

There are many different types of Bitcoin wallets, so it’s important to understand how each one works before proceeding.

Custodial vs Non-Custodial

First, you’ll need to choose between a custodial and a non-custodial wallet.

- Custodial: Custodial wallets give you full control of your Bitcoins. You’ll own and control your Bitcoins 100%, as you won’t need authorization from a third party when transferring funds. Moreover, nobody can access the wallet without the private keys, which only you have access to.

- Non-Custodial: Non-custodial wallets are offered by third parties, such as cryptocurrency exchanges. The third party is responsible for keeping your Bitcoins safe. They usually offer safeguards like two-factor authentication and IP address whitelisting. However, you won’t have access to your private keys. What’s more, you’ll need the third party to approve transfers before they’re processed.

Even as a beginner, we’d suggest using a custodial wallet. This way, you don’t need to trust an intermediary, let alone ask for approval when making a transfer.

However, if you misplace your password, private keys, and backup passphrase, you won’t be able to access your wallet. Any Bitcoins stored within the wallet will be lost forever.

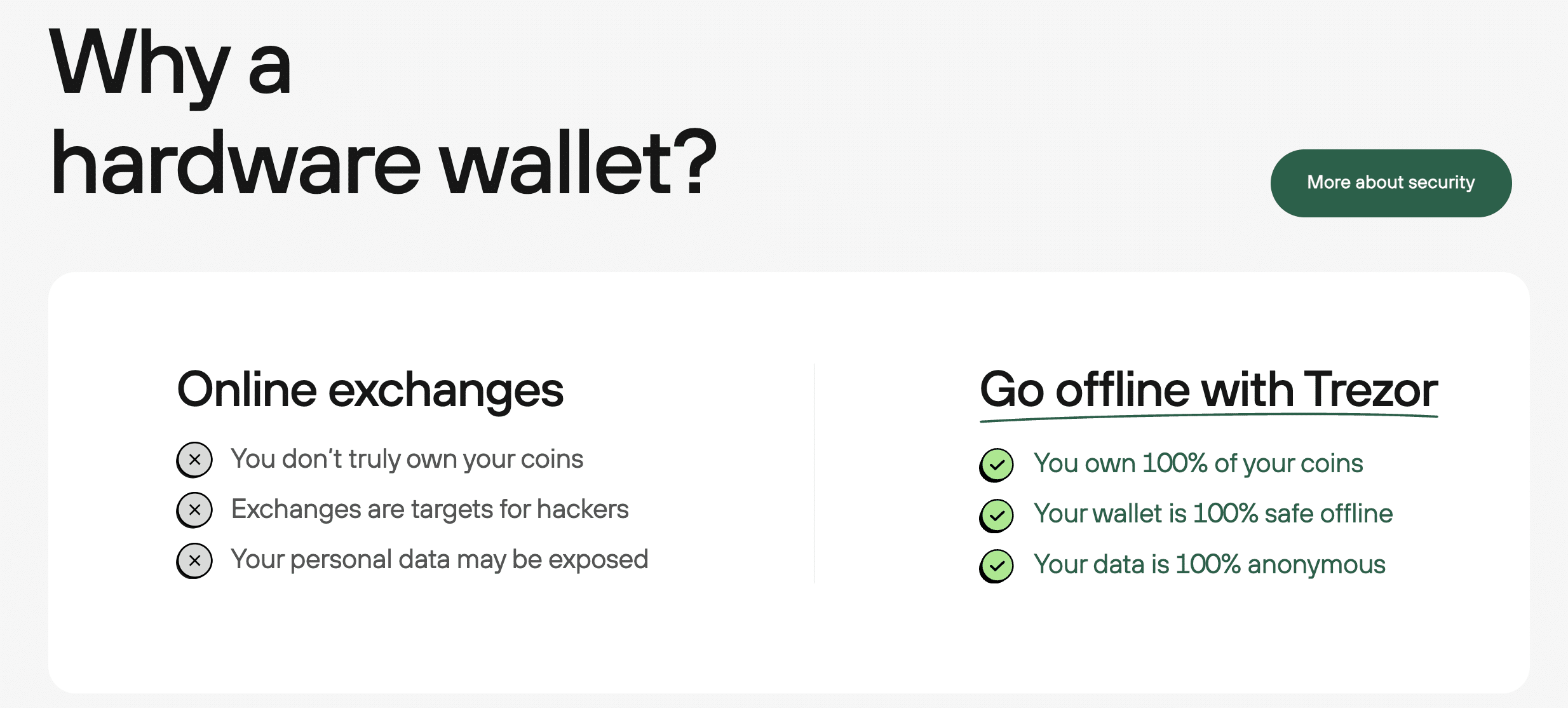

Cold Wallets

You’ll also come across the terms ‘cold’ and ‘hot’ wallet when exploring Bitcoin. Starting with cold wallets, they offer the most secure way to store cryptocurrencies. This is because cold wallets are always offline, meaning your private keys aren’t exposed to servers and remote hacking attempts.

The best cold wallets sit within the ‘non-custodial’ category. What’s more, cold wallets usually come as a hardware device. You’ll need to enter a PIN on the device when making transfers. If you forget the PIN, you can recover the wallet with the backup passphrase. Your passphrase will also assist if the wallet is lost or stolen.

Hot Wallets

Hot wallets are usually software-based. Most come as a mobile app for iOS and Android, which offers a convenient way to store, send, and receive Bitcoin. Some software wallets are available as desktop software for Windows and Mac.

Although hot wallets are convenient, they’re considered less secure than cold wallets. This is because hot wallets are always connected to live servers. The best hot wallets can be custodial or non-custodial, depending on the provider.

How do Bitcoin Private Keys Work?

- Bitcoin wallets always come with a private key. This is the unique password for your Bitcoin wallet.

- Opting for a non-custodial wallet ensures that only you have access to the private key.

- The private key offers access to your wallet in the event you forget your password or PIN.

- It can be used to recover access remotely, meaning you don’t need the device that the wallet is installed on.

- This also means that private keys are attractive to hackers, as they’ll be able to access your wallet and steal the Bitcoins stored inside.

- As such, never share your private keys with anyone.

Key Considerations Before Buying Bitcoin in the UK and Other Regions

This section details some key considerations to make before buying Bitcoin. This will ensure you invest in Bitcoin with your eyes wide open.

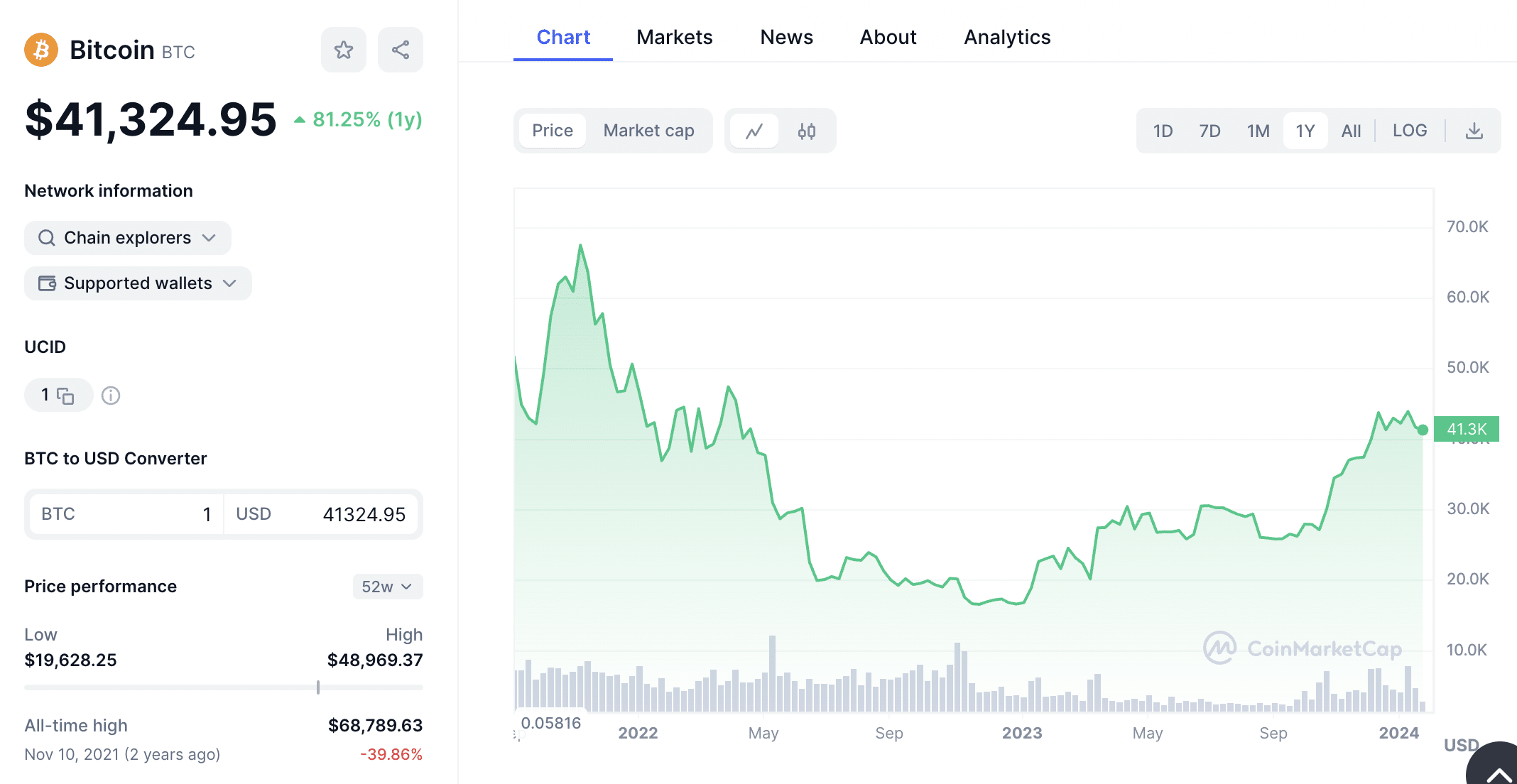

Bitcoin Volatility and the Risk of Loss

Before investing in Bitcoin, it’s crucial to consider the risks. Bitcoin is a volatile asset class, meaning its value can rise or fall sharply at any time.

For example, consider that Bitcoin was priced at over $68,000 (about £53,000) in November 2021. Just over a year later Bitcoin was trading at just over $16,000 (about £12,000). Had you invested at its peak, you would have been looking at a loss of over 75%.

That said, Bitcoin has since recovered to highs of over $48,000 (about £37,000), meaning a recovery of 200%. To reduce the impact of volatility, consider dollar-cost averaging your Bitcoin investments.

New UK Travel Rules on Crypto

In September 2023, the FCA introduced new Travel Rules on cryptocurrency transfers. In a nutshell, this requires cryptocurrency exchanges to collect additional information on wallet-to-wallet withdrawals.

For example, suppose you buy Bitcoin from a UK exchange and then request a withdrawal to somebody else’s private wallet. You’ll be asked to provide the name of the person or company that controls the wallet.

The Travel Rule was installed to combat the risks of money laundering and terrorist financing.

The Importance of Security

Bitcoin’s decentralized framework is both a benefit and a drawback. While you can own and store Bitcoin without using an intermediary, digital assets are attractive to criminals. This is because Bitcoin is a pseudonymous network, meaning that transactions aren’t tied to the user’s name.

As such, hackers are always on the lookout for ways to steal Bitcoins from private wallets. As we mentioned, never share your private keys with anyone. And if you’re investing larger amounts, make sure you use a hardware wallet with cold storage. This ensures your Bitcoins aren’t exposed to live servers.

Ultimately, however, if your Bitcoins are stolen – you’ll have nowhere to turn.

Understanding Identity Verification Requirements

When learning how to invest in Bitcoin in the UK, you should be aware of identity verification processes. Put simply, cryptocurrency exchanges are legally required to verify your identity when using fiat money.

This covers conventional payment types like bank transfers and debit/credit cards. The verification process will require a government-issued ID and recently-issued proof of address.

Assessing Fees Associated with Bitcoin Purchases

Fees can eat away at your Bitcoin profits, so make sure you understand what you’re paying before proceeding.

Bitcoin fees can include:

- Deposits: Most cryptocurrency exchanges charge fees when using fiat money to deposit funds. This is usually a percentage of the deposit amount.

- Trading Commissions: You’ll pay a commission when buying and selling Bitcoin. This is similar to share dealing fees. That said, commissions often cost just 0.1% of the trade size.

- Spreads: Spreads are a hidden fee that beginners should be aware of. This is the gap between the ‘bid’ and ‘ask’ price of Bitcoin. The spread will vary depending on the exchange you’re using. The larger the spread, the more you’re paying to trade Bitcoin.

- Withdrawals: Exchanges usually charge withdrawal fees. If you’re withdrawing Bitcoin to a private wallet, this should reflect the current network fee. GBP withdrawals will depend on the payment method and the exchange.

Bitcoin Minetrix – Overall Best Bitcoin Alternative to Buy With High Staking Rewards

Bitcoin Minetrix ($BTCMTX) is a brand new platform that allows $BTCMTX token holders to mine Bitcoin without having to invest in expensive hardware.

By purchasing and staking $BTCMTX, token holders are rewarded with credits which can then be spent on cloud mining time. This means no barrier to entry, small upfront costs, no fixed contracts or hidden fees and investors have access to their tokens at all timers.

Alongside exposure to the accumulative price of Bitcoin, token holders can also earn passive staking rewards of up to 59%.

With a mobile application currently in development, there has never been a better time to invest in the project and get your money. Tokens can be unstaked at any time giving you complete control over your investment. Once unstaked, token can then be transferred to an exchange for sale, if you so wish.

It’s a platform that offers not only potential upside returns but also a chance to gain exposure to Bitcoin mining.

Users can examine the Bitcoin Minetrix Roadmap to learn more about the project. You can also enter the Bitcoin Minetrix Telegram channel and follow it on X (Twitter) to get the latest news and updates on listings.

How to Buy Bitcoin in the UK Bottom Line

Buying Bitcoin in the UK is not only simple, but the process shouldn’t take more than five minutes. The best option is to use a trusted cryptocurrency exchange like MEXC.

In doing so, you can buy Bitcoin with Visa or MasterCard at competitive fees. Just make sure you understand the risks; your Bitcoin investment could go to zero.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong.

References

- https://www.fca.org.uk/publication/research-notes/research-note-cryptoasset-consumer-research-2023-wave4.pdf

- https://www.fca.org.uk/consumers/confirming-your-identity

- https://www.nytimes.com/2022/11/11/business/ftx-bankruptcy.html

- https://www.fca.org.uk/news/press-releases/financial-conduct-authority-continues-crackdown-unregistered-crypto-atms-uk

- https://www.reuters.com/technology/paypal-halt-uk-crypto-sales-until-2024-2023-08-16/

- https://www.fca.org.uk/news/press-releases/fca-bans-sale-crypto-derivatives-retail-consumers

- https://www.fca.org.uk/news/statements/fca-sets-out-expectations-uk-cryptoasset-businesses-complying-travel-rule

FAQs

How do I purchase Bitcoin UK?

There are many ways to purchase Bitcoin in the UK – but the easiest option is to use a cryptocurrency exchange. After opening an account, you can usually buy Bitcoin with a debit/credit card or local bank transfer.

What is the fastest way to buy Bitcoin in the UK?

The fastest way to buy Bitcoin in the UK is with a debit/credit card. The process of registering an account with an exchange, uploading ID, and buying Bitcoin should take under five minutes.

Do UK banks sell Bitcoin?

No, UK banks do not sell Bitcoin. To buy Bitcoin in the UK, it’s best to use a trusted cryptocurrency exchange.

Is it legal to buy Bitcoin in the UK?

Yes, UK residents can legally buy Bitcoin in the UK. The only restrictions are on cryptocurrency derivatives like CFDs.

Do I need to pay taxes on Bitcoin UK?

Yes, Bitcoin is taxed the same as other investments like shares and ETFs. You’ll likely pay capital gains taxes on any profits made. That said, UK investors get £6,000 (2023/24) and £3,000 (2024/25) worth of capital gains allowances.

Eric Huffman

Eric Huffman

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell