Top 5 Stablecoins: Features and Differences

Institutional investors and new crypto startups are increasingly becoming interested in development of stablecoins that may solve one of the main problems for crypto adoption – price volatility.

Source: iStock/M_a_y_a

Source: iStock/M_a_y_a

Design of a stablecoin allows to keep a relatively stable price of this asset. They are most useful when trading cryptocurrencies: instead of relying on HODLing onto the volatile nature of other coins, you can trade in stablecoins instead of fiat. If you’d like to look above simple trading, think of stablecoins as replacements for fiat in terms of stability, with features of cryptocurrency.

Currently, most people in the cryptoverse have heard about Tether and perhaps also TrueUSD, but what about others? We have made an overview of five stablecoins, biggest by market capitalization, highlighting the attributes of each.

Top 5 stablecoins

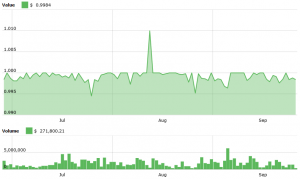

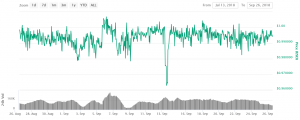

Tether (USDT)

Market Cap: USD 2.8 billion (September 26)

Rank: 8 (by market capitalization)

Type: fully collateralized, backed by USD

Overview: USDT is a cryptocurrency asset issued on the Bitcoin blockchain. Each USDT unit is reportedly backed by a U.S. Dollar held in the reserves of the Tether Limited and can be redeemed through the Tether Platform. To prove that the amount of USD in the bank account is the same or more than the USDT in circulation, Tether Limited publishes the bank account balance on its website’s Transparency page.

Points of Interest: first major adopted stablecoin, available on most major exchanges, but also a lack of real transparency, no official audit has been done, accusations of lack of funds.

_______

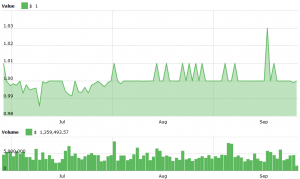

TrueUSD (TUSD)

Market Cap: USD 94 million

Rank: 67

Type: fully collateralized, backed by USD

Overview: TrueUSD is a USD-backed ERC20 stablecoin that is fully collateralized, legally protected, and transparently verified by third-party attestations. It uses multiple escrow accounts to reduce counterparty risk and to provide token-holders with legal protections against misappropriation. It uses TrustToken’s smart contracts to ensure 1:1 parity.

Points of Interest: uses escrow accounts (centralized by nature), but the TrustToken framework ensures the legitimacy of the process. However, it is significantly less available than USDT.

_______

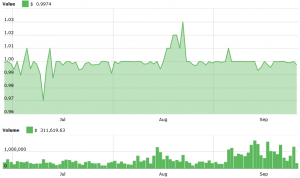

Dai (DAI)

Market Cap: USD 55 million

Rank: 94

Type: fully collateralized, backed by ETH

Overview: Dai is a stablecoin issued by MakerDAO, which also created the MKR token. DAI is set to be a decentralized stablecoin that will react automatically to changes in the market in order to stabilize its price against other types of currency. Despite being backed by ETH, the cryptocurrency’s value mirrors the value of the USD currency.

Points of Interest: no third party involvement, backed by crypto instead of fiat but this opens the possibility of a black swan event (where ETH price crashes well below the one-to-one collateralization ratio in a time frame too short for the system to handle.)

_______

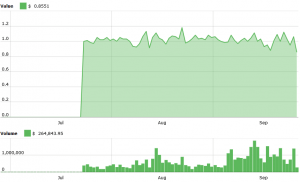

BitUSD (BITUSD)

Market Cap: USD 10.9 million

CoinMarketCap Rank: 310

Type: fully collateralized, backed by BTS, the core asset of BitShares, a decentralized cryptocurrency exchange.

Overview: The BitUSD is a market-pegged asset on the BitShares blockchain. It is backed by BTS, and the minimum required collateral for most bitAssets (including the bitUSD) is ~2x. This means that you need to put USD 200 worth of BTS into the contract to borrow just 100 bitUSD. In the end, the market peg is achieved by a social consensus in such that 1 bitUSD should be worth 1 USD. Hence, trading against the peg should make you lose money because someone else will make a profit from trading towards the peg.

Points of Interest: the process can be complicated to understand, and the value fluctuates due to market instability.

_______

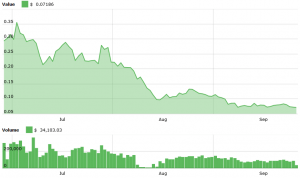

Havven (HAV) / Nomin (nUSD)

HAV

_____

nUSD

Market Cap: USD 4.5 million / USD 976,600

CoinMarketCap Rank: 498 / 861

Type: fully collateralized, backed against each other

Overview: Havven is a dual-token system that aims to collateralize its token nomin (stable value of USD 1 and variable supply) with its token havven (variable value and fixed supply), relying solely on the markets forces and the underlying security of the blockchain technology to keep this stability. In order for any supply of nomin to exist, a certain amount of havven needs to be kept in escrow, locked away, as a collateral for the system. Whenever someone escrows a quantity of havven, nomins are issued and sold by the system at a limit order of USD 1 in a decentralized exchange (for ETH, for example), increasing the supply of nomins in the pool. If someone wishes to regain access to some (or all) of their havven, a limit buy order of USD 1 is placed by the system, and the nomins purchased are destroyed.

Points of Interest: decentralized, not pegged against an outside asset, self-reliant, but not very well-known outside of its fanbase.