Is Crypto Dead in 2024? What The Future Holds

Ever since the launch of Bitcoin, traditional financial analysts and non-crypto users have been predicting the death of crypto. Yet in the past decade, crypto has not only survived — the number of tokens and the value of the crypto economy have grown substantially.

Despite that growth, predictions by pundits that crypto is dead or dying are just as popular as ever. So is crypto dead, or at least on its way to an early grave? In this guide, we’ll take the pulse of the crypto world and explain what the future of crypto could hold.

Summary: Is Crypto Dead in 2024?

Despite predictions that crypto is dying, the crypto market is alive and well. Here’s a quick rundown of everything you need to know:

- The global value of cryptocurrencies is on the rise and investment in crypto is increasing.

- The crypto industry has achieved major technical advancements and is promoting real world use cases that have the potential to increase crypto adoption further.

- Regulators and traditional financial institutions around the world have increasingly accepted cryptocurrencies, paving the way for them to be treated as legitimate investment assets.

- Crypto could face setbacks such as regulatory crackdowns, hacks, and development challenges in the future. However, these setbacks are largely preventable and are unlikely to stop or reverse the crypto market’s momentum.

The Current State of the Crypto Market

The best way to answer the question, ‘Is Bitcoin dead?’ is to take a closer look at the current state of the cryptocurrency market:

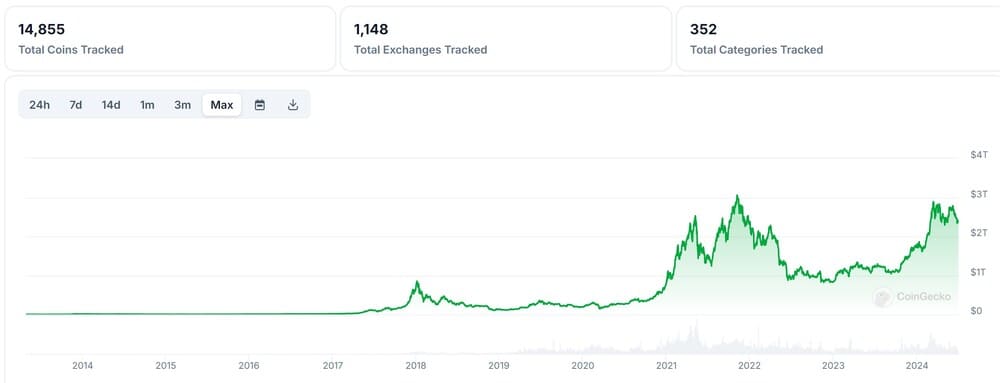

- The global market capitalization of all cryptocurrencies combined is $2.38 trillion. That’s down slightly from an all-time high of just over $3 trillion in 2021, but significantly up from $800 billion in 2022.

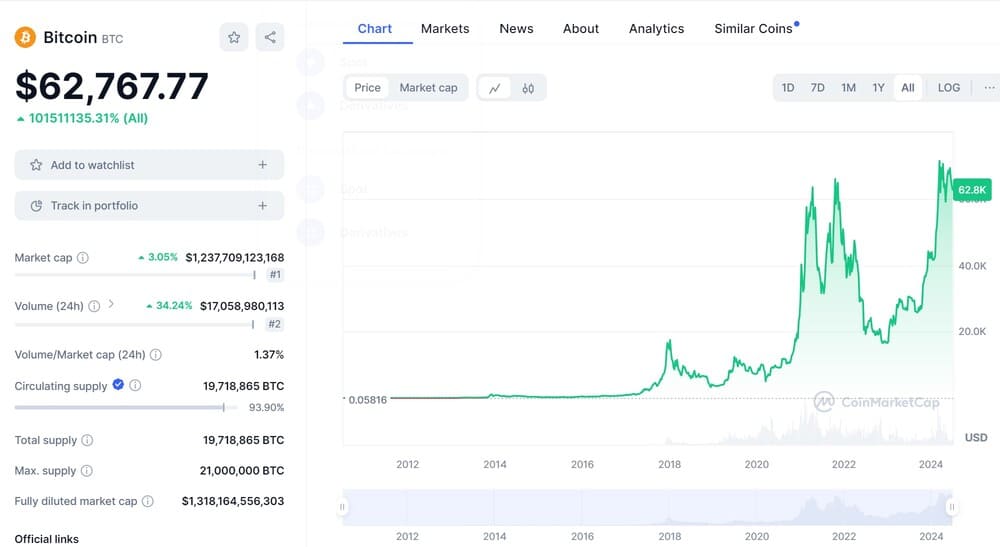

- Bitcoin has a market cap of $1.2 trillion. It hit an all-time high of $73,737.94 in March 2024 and is currently trading around $61,000.

- Ethereum has a market cap of $407 billion. It’s currently trading around $3,400 and last hit an all-time high of $4,878.26 in 2021.

- The market cap of Tether, the leading stablecoin, is $112 billion, an all-time high. The total market cap of all stablecoins is over $154 billion, also an all-time high.

- There are now 14,851 cryptocurrencies across 1,148 crypto exchanges.

- There are now more than 580 million cryptocurrency users worldwide. That’s up from 432 million at the start of 2023. More than 25% of people in the US use cryptocurrency.

- Venture capitalists invested $2.5 billion in crypto in Q1 2024. That’s down from an all-time high of $12 billion in Q1 2022, but the number of crypto investment deals is on the rise.

This data suggests that while the crypto market has yet to recover to its 2021 highs in some ways, the answer to the question ‘Is blockchain dead?’ is a resounding no. Rather, the market’s recovery from the 2022-23 crypto winter is well underway.

The price of Bitcoin already hit a new all-time high and crypto adoption is steadily rising. Crypto investment appears to be recovering, too, although it’s too early to say for sure whether investment can reach 2021 levels in the near future.

The growth of stablecoins is particularly noteworthy, since this is arguably one of the most important areas for future cryptocurrency growth. Stablecoins enable instant, decentralized payments around the world, so all-time highs in the market value of Tether and other stablecoins is a bullish signal for the crypto ecosystem.

5 Reasons Why Crypto Isn’t Dead in 2024

Crypto’s growth following the 2022-23 winter can be traced to 5 fundamental factors. These factors will also shape crypto’s future, so it’s important to understand what they are and what’s in store.

1) Real Technological Advancement

While it’s easy to think of ‘crypto’ as a monolith, the truth is that it’s a diverse technological ecosystem with new advancements all the time. What started with a single technological revolution — the introduction of a blockchain as a public ledger — has transformed into a series of advancements that continues to introduce new utility into the world.

Let’s take a closer look at 3 of the most important technological advancements that have taken place in crypto in recent years.

Proof of Stake Validation

Bitcoin was created using what’s known as proof-of-work validation. In order to validate transactions, computers would have to solve difficult computational problems. The process is energy-intensive and, as Bitcoin has grown in value, has increasingly shut out individuals in favor of dedicated Bitcoin mining companies.

More recently, alternative mechanisms to validate transactions on a blockchain have been developed. The most important of these is known as proof-of-stake validation, in which individuals stake cryptocurrency to the chain as a guarantee that they will faithfully approve transactions. If an individual or validator is found to be unfaithful, they will lose their staked crypto.

Many of the fastest-growing blockchains—including Ethereum, Solana, Avalanche, and TON—now use proof-of-stake validation. This has enabled blockchains to operate with far lower energy consumption compared to the Bitcoin blockchain and made it easier for anyone to participate in validating on-chain transactions.

Automation Through Smart Contracts

Another significant evolution in blockchain technology came in 2015 with the launch of Ethereum, which introduced the concept of smart contracts. These are pieces of on-chain code that automatically execute specific transactions when specific conditions occur.

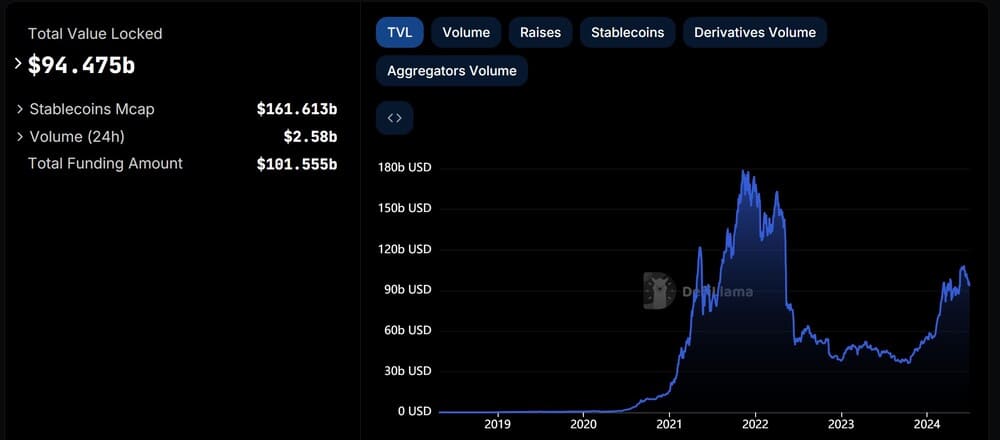

Smart contracts have enabled an enormous breadth of new decentralized applications, most notably decentralized finance (DeFi). Thanks to smart contracts, crypto lenders could offer crypto-denominated loans on-chain and charge interest or liquidate collateral automatically according to a loan’s conditions. The DeFi ecosystem was worth more than $170 billion in 2021 and today is worth $94 billion (up from $36 billion during the crypto winter).

Smart contracts have the potential to unlock even more applications, such as bringing real-world assets onto blockchains or decentralizing digital infrastructure. While they were first introduced in 2015, crypto developers are still discovering new ways to apply smart contracts.

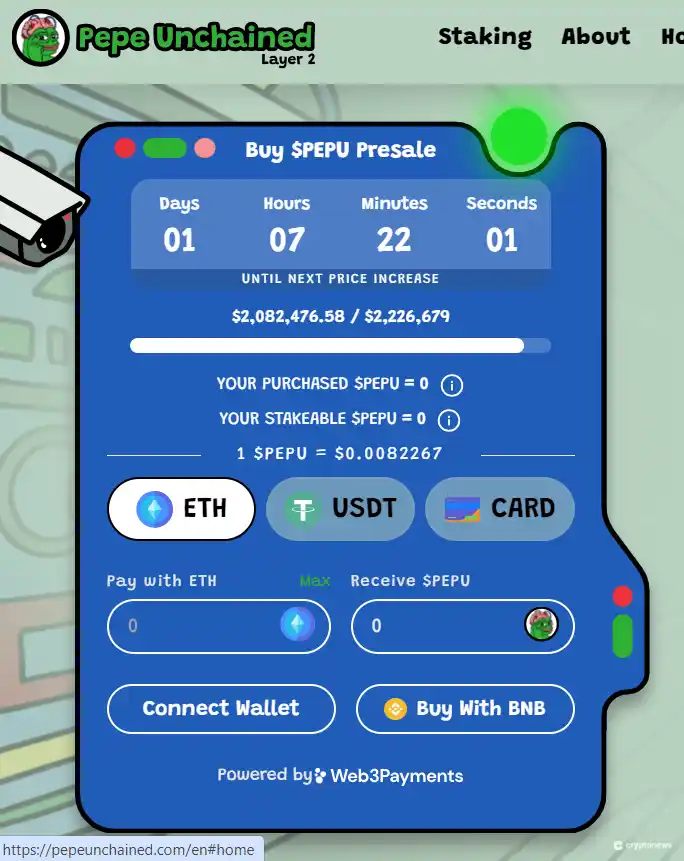

Layer 2 Solutions

Layer-2 solutions are blockchains built on top of blockchains. Most commonly, they’re built on top of the Ethereum blockchain, which is the second-largest after Bitcoin and is renowned for its security.

Layer-2 solutions are important to the future of crypto because they enable faster and cheaper transactions while maintaining security. For several years, slow transaction processing and high costs on the Ethereum blockchain posed a threat to continued development of the crypto ecosystem. Layer-2 solutions are integrated into the Ethereum ecosystem and provide far more scalability for developers.

Some of the most popular Ethereum Layer-2 blockchains include Polygon, Base, Optimism, and Arbitrum. These networks are rapidly growing in value and enable decentralized applications that were previously too costly to run on Ethereum.

2) Institutional Adoption

While crypto has always been separate from traditional finance, or TradFi, it is increasingly being adopted into the traditional financial ecosystem. That’s important for the future of cryptocurrency because it means access to more funding for new blockchain projects and decentralized applications. It also gives more legitimacy to crypto as an investment-grade asset class and can make financial regulators think more carefully about how to enable crypto to continue growing.

Eventually, adoption by TradFi could lead to greater adoption of crypto by everyday users and for global payment rails. Crypto’s foundational technology — blockchain — means it may be better suited for certain traditional financial activities (like payments) than existing financial technology.

Big Corporate Investment

It’s not only financial institutions that are increasingly investing in crypto — companies are, too. Microstrategy, a publicly traded technology company, now holds nearly $14 billion worth of Bitcoin on its balance sheets. Other companies including Tesla and Block also have large Bitcoin holdings.

Companies are also investing in crypto in less obvious ways. Companies like Budweiser have launched NFT collections, while retailers have set up shop in blockchain-based metaverses like Decentraland. While this investment was interrupted by the crypto winter, the move of large corporations into crypto could help increase adoption and open future opportunities for more value to move onto blockchains.

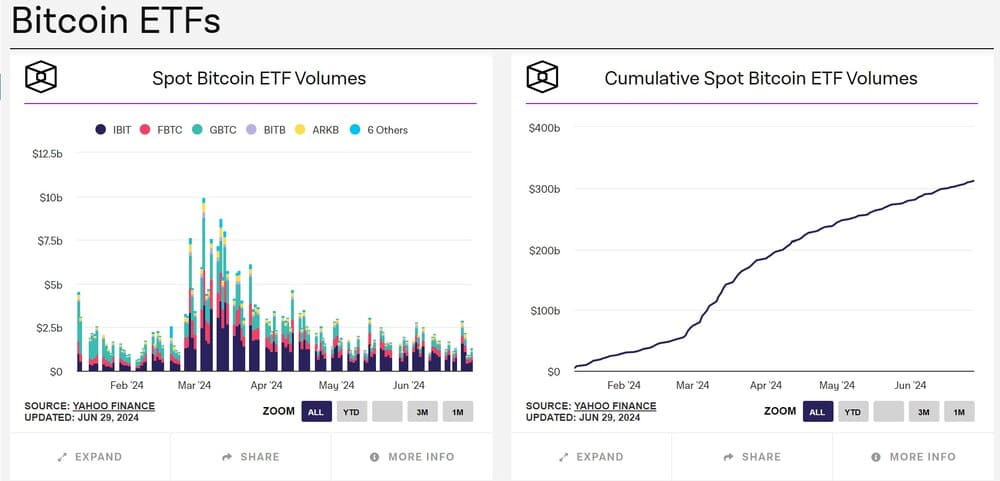

Crypto ETFs

Another major milestone in crypto adoption came in 2024 with the launch of the first crypto ETFs in the US. Bitcoin Exchange Traded Funds (ETFs) were denied by the US Securities and Exchange Commission for several years but were finally approved after a lawsuit. In the first months of trading, Bitcoin ETFs rocketed to a market cap of more than $76 billion.

Ethereum ETFs could be next, as the SEC has conditionally approved them. Trading is expected to start in summer 2024.

The launch of ETFs is important because it opens the crypto world to individual investors who don’t want to figure out how to invest in cryptocurrencies on their own. Eventually, crypto ETFs could also make it possible for major funds, such as retirement funds, to invest in crypto.

3) Real-World Use Cases

Crypto is also staking out a role for itself in real-world financial processes. It seeks to be faster, cheaper, and more trustworthy than existing processes, making it a superior alternative for individuals and institutions.

Let’s take a closer look at two of the most important areas where crypto is transforming global finance.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) focuses on bringing many of the most important aspects of traditional finance onto blockchains. It includes lending, savings, insurance, trading and market-making, and more.

The ultimate goal of DeFi projects is to serve as blockchain-based banks. They can make crypto loans, pay out interest to depositors, and hold their own investments to hedge market risk.

DeFi offers several advantages compared to traditional finance. First, DeFi removes the need for middlemen present in many traditional financial transactions. There are no bankers, institutional traders, or others to take a cut of transactions and inflate the price of every financial interaction.

In addition, since DeFi is decentralized, it’s resistant to censorship from mainstream financial systems. Governments and banks don’t get to decide which transactions are allowed and which are not. Industries like cannabis and gambling that have long been barred from the traditional financial industry can find a home in DeFi. It’s also created some growing sectors including tokenizing real world assets that are proving to have mainstream appeal to investors.

Finally, DeFi projects offer access to a global market. There are no artificial boundaries at the level of countries, so users can compete in a truly global marketplace and move assets seamlessly into different currencies or market opportunities.

Cross-Border Payments

Cross-border payments are another important real-world application of crypto. Bitcoin was the first to enable this, making it easy to send value (in the form of BTC) across borders with no restrictions.

It’s now possible to send value around the world in any cryptocurrency, often at much lower cost compared to sending money through traditional banks or money services. That’s a major benefit for millions of people around the world who live abroad and send money home to their families. It’s also great for companies that have globally distributed workforces or vendors and need to make cross-border payments cheaply and quickly.

Further advances in cross-border payments could be on the horizon thanks to crypto. For example, Ripple has built a crypto-based payment network that could allow banks to send money around the world to one another at a fraction of the current cost. Eventually, it could be as easy to send money internationally thanks to crypto as it is to send money within the US today. Check out our article on Is XRP Dead to find out how Ripple’s cryptocurrency is faring in the current year.

4) Proven Market Resilience

Despite many predictions over many years that cryptocurrency is dead, the crypto ecosystem is alive and well. It’s proven its ability to grow organically and to bounce back after repeated setbacks. It’s extremely noteworthy that rather than fade into oblivion after the 2022-23 crypto winter, the crypto market has bounced back and is on track to being stronger than ever by many metrics, including market size and market sentiment.

This resilience suggests that the crypto ecosystem, and the underlying blockchain technology, will become a long-lasting force in financial technology. As potential investors gain more confidence in crypto’s staying power, more people, companies, and financial institutions are likely to adopt crypto.

5) Role as a Legitimate Asset Class

While cryptocurrency was seen for many years as ‘illegitimate’ or unregulated, that’s increasingly no longer the case. Cryptocurrency has a large, global ecosystem of companies behind it, including centralized crypto exchanges, publicly traded crypto miners, and financial institutions with crypto investments.

Even the US SEC, which has long obstructed the growth of crypto, has relented in the past year. It enabled Bitcoin ETFs to launch and will soon allow Ethereum ETFs. It has lost or dropped numerous lawsuits against crypto companies, paving the way for greater legal and regulatory certainty for the industry.

Meanwhile, Europe recently passed comprehensive crypto legislation, Markets in Crypto Assets (MiCA), that puts clear rules in place for crypto and gives it legitimacy as its own asset class. Similar legislation is in progress in the US and in other countries around the world.

This legitimacy is crucial to the continued integration of crypto into traditional financial systems and for eventual use by governments. Greater regulatory certainty is also likely to encourage more investment in the space from both institutional and individual investors.

3 Big Challenges Crypto Faces For The Future

While the future looks bright for crypto in many ways, the path forward isn’t without challenges. Here are some of the most significant hurdles that crypto faces in the years ahead.

1) Regulatory Crackdowns

One of the most important near-term challenges facing the crypto industry is regulatory scrutiny. While crypto regulation has made important advancements in recent years with the passage of MiCA in the EU, the industry still faces regulatory challenges in the US, China, India, and other countries around the world.

In the US, the specter of regulation has played an especially important role in modulating the price of major cryptocurrencies. Bitcoin rose on news that spot ETFs would be approved, then fell after SEC lawsuits against major exchanges like Binance and Coinbase progressed. Attempts to pass comprehensive crypto legislation in Congress have failed, leaving the industry in regulatory limbo.

Abroad, many countries have outright bans on crypto while others remain skeptical of the impact crypto has on their national currencies. This regulatory scrutiny has held back wider adoption of crypto, and it is possible regulators could crack down more harshly on crypto in the future.

Institutional adoption of cryptocurrencies makes harsh regulatory crackdowns less likely, since such crackdowns would also impact TradFi institutions and traditional markets. However, the risk remains until comprehensive crypto legislation is drafted in the US and abroad.

2) Security Vulnerabilities and Hacks

As with any digital technology, security is an important concern that could impact future trust in crypto. Up to now, there have been no significant hacks on major blockchain networks. This is likely to continue to be the case in the future due to the built-in security of blockchains, which prevent any entity from hijacking transactions.

However, there have been hacks on crypto exchanges, crypto wallet software, and new crypto projects. Some of these hacks have been quite large — the Ronin Bridge hack in 2022 stole $625 million worth of cryptocurrency.

Hacks of this magnitude are important because they shake confidence in the safety of cryptocurrency and give the industry an image of lawlessness, which can discourage wider adoption. Even smaller hacks on individual wallets can make potential investors more wary of crypto and reluctant to hold digital assets.

It’s likely that hacks will continue in the crypto space, especially as the value of the crypto market climbs again. It’s up to individual projects, software makers, and the developer community at large to proactively secure crypto networks and tech. A more mature market for crypto insurance could also make crypto more attractive to would-be investors who are concerned about losing their tokens to a hack.

3) Technological Complexity

Another potential challenge crypto faces is the technological complexity of improving upon current blockchains. Leading blockchains today are highly decentralized and highly complex, but they must be made faster and cheaper in order to enable new applications and wider adoption. Achieving this requires bringing together skilled developers working collaboratively without compromising the decentralized nature of these networks.

This is a difficult task facing the crypto industry as a whole. Failure to continue technological development could cause crypto adoption to stutter and prices to fall.

However, considering that blockchain technology is still relatively new, there is likely a lot of low-hanging fruit for developers to pursue. Technological complexity is unlikely to become a significant limiting factor for crypto growth before the end of the decade.

Conclusion

We often hear financial pundits ask, ‘Is cryptocurrency dead yet?’ It’s alive and kicking, and is currently on a path of fast growth and new all-time highs in adoption.

Crypto is advancing thanks to technological advancement, institutional adoption, the introduction of real-world uses, battle-tested resilience, and increasing legitimacy as an investment-grade asset. While it faces challenges like regulatory crackdowns, security vulnerabilities, and complexity, crypto appears poised to continue its growth streak through the remainder of the decade.

FAQs

Is the crypto market dead?

Despite pronouncements that crypto is dead, the crypto market is alive and growing. Token prices and crypto adoption are both on the rise, and total investment in the crypto market is up as well.

Will the crypto market recover?

The crypto market is already on the path to recovery from the 2022-23 bear market, also called the crypto winter. The price of Bitcoin hit a new all-time high in 2024 and cryptocurrencies are increasingly being embraced by traditional financial institutions.

Does cryptocurrency have a future?

Cryptocurrency has a bright future ahead. Adoption of crypto is growing worldwide, and new technological innovations are making it faster and cheaper to process transactions on blockchains. Cryptos like Bitcoin and Ethereum are also increasingly intertwined with the traditional financial system, ensuring they’ll stick around for the foreseeable future.

Will crypto die out?

It doesn’t seem likely that crypto will die out. Token prices are rising and more people around the world are trying cryptocurrency than leaving it. Crypto is also enabling new decentralized technologies that aren’t possible without trustless blockchains.

What could cause crypto to die?

The biggest challenges facing crypto are regulatory crackdowns, security vulnerabilities, and technological complexity. Regulatory crackdowns on crypto pose the biggest threat, but governments around the world are generally finding ways to accept and regulate crypto rather than ban it entirely.

References

- Global Cryptocurrency Owners Grow to 580 Million Through 2023 (Crypto.com)

- Cryptocurrencies – United States (Statista)

- Crypto & Blockchain Venture Capital – Q1 2024 (Galaxy)

- Explained: Proof-of-Work vs. Proof-of-Stake Carbon Footprint (Bitwave)

- What Are Ethereum Layer 2 Blockchains and How Do They Work? (Ledger)

- MicroStrategy Acquires Additional 11,931 Bitcoins and Now Holds 226,331 BTC (Microstrategy)

- Blockchain in cross-border payments: 2024 guide (BVNK)

- What Is Markets in Crypto-Assets (MiCA)? (Investopedia)

- Axie Infinity’s Ronin Network Suffers $625M Exploit (Yahoo)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Kane Pepi

Kane Pepi

Nick Pappas

Nick Pappas

Eliman Dambell

Eliman Dambell