How to Mine Crypto in 2024 – Step-By-Step Guide to Mining Cryptocurrency

Crypto mining is one of the main ways in which investors can acquire cryptocurrencies like Bitcoin. It involves using computing power to solve mathematical puzzles. Whoever solves the puzzle first receives crypto tokens as a reward.

Anyone can participate in crypto mining, even if they only have a personal computer or smartphone. In this guide, we’ll explain how to mine crypto and take a closer look at whether crypto mining is worthwhile.

What is Crypto Mining?

Crypto mining is the process of validating transactions on a blockchain and earning crypto tokens as a reward. Transactions on a blockchain—for example, the Bitcoin blockchain—are bundled into sets known as blocks. For a block to be added to the blockchain, it first needs to be validated.

The validation process involves solving a cryptographic puzzle. To solve the puzzle, computers simply guess at the block’s unique hashkey until they get it correct. When a computer guesses correctly, the block is validated and added irrevocably to the blockchain.

As a reward for this validation effort, the user who correctly guessed the hashkey receives newly minted cryptocurrency. In the case of Bitcoin, this newly minted Bitcoin comes from the total supply of 21 million Bitcoins, about 1.4 million of which are still locked in the blockchain.

Importantly, the process of guessing hashkeys for a block is a competition. Whoever gets the hashkey first receives the reward. Other users don’t receive crypto if they guessed hashes but didn’t guess correctly.

Why Is It Called Crypto Mining?

The term ‘crypto mining’ dates back to the origin of Bitcoin in 2009 and has been applied to all blockchains that use a similar transaction validation mechanism.

Crypto mining got its name because it resembles a digital version of traditional gold mining. Users put in effort—in this case, computational effort rather than back-breaking labor—and receive a reward—crypto tokens rather than gold.

Another similarity to traditional mining is that not every effort will result in a reward. A Bitcoin miner might win the competition to correctly guess the hashkey on one block and earn crypto tokens. However, they might lose the competition on other blocks and receive no reward, akin to how a miner might come up empty if they dig away at a dry vein of rock.

Types of Cryptocurrency Mining

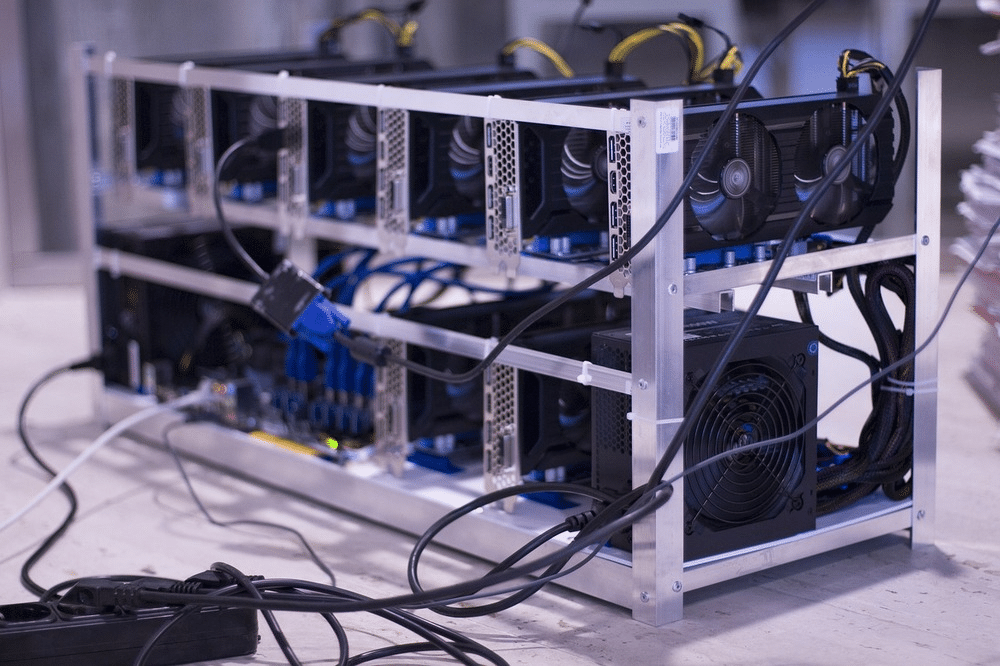

While all crypto mining essentially works in the same way—computers guessing hashkeys—mining can be divided into subtypes based on the type of computers used. Let’s take a look at some of the most common types of crypto mining.

- CPU mining: CPU mining was once the most common way to mine Bitcoin at home, and it’s now frequently used to mine less popular crypto tokens. CPU mining involves using central processing units (CPUs) like the kind found on most personal computers and laptops. CPUs are slower than other types of processors, but miners don’t need any specialized equipment to start CPU mining.

- GPU mining: GPU mining is the next step up in processing power from CPU mining. Many personal computers have graphics processing units (GPUs), so you may not need to buy additional hardware to get additional computational power for mining. GPUs are also relatively inexpensive compared to other types of mining hardware.

- ASIC mining: ASIC mining is the current state-of-the-art form of crypto mining. It uses extremely powerful application-specific integrated circuit (ASIC) processors that are many times faster than CPUs and GPUs. The drawback to ASIC mining machines is that they’re expensive and are designed to only mine a single cryptocurrency. That is, an ASIC Bitcoin mining rig will only ever be used to mine Bitcoin.

- FPGA mining: FPGA mining uses field-programmable gate arrays (FPGAs) to mine cryptocurrencies. They’re faster than GPUs, but slower than ASIC processors. FPGA mining equipment has mostly fallen out of favor since ASIC miners were developed.

Crypto mining can be further classified based on how miners are organized. Here are a few key terms to know:

- Cloud mining: Cloud mining involves renting computing power from a mining operation over the internet. Miners can remotely control the processors they’re renting to determine what cryptocurrency to mine, what hashkey guessing algorithm to use, and more. Cloud Bitcoin mining sites can be a cost-effective way for individuals to get into crypto mining without having to spend thousands of dollars upfront on mining equipment.

- Solo mining: Solo mining involves just a single person operating a crypto mining operation. The individual miner owns all their own equipment and keeps all the rewards when they mine a block. This approach is highly risky and involves high upfront costs, but the potential payout is also relatively high.

- Pool mining: Crypto mining pools involve groups of miners pooling their computational resources. Any rewards earned by miners in the pool are distributed among all the pool members. This approach reduces the risk of crypto mining and increases the chances of winning a block. However, the payout an individual receives from winning a block is smaller.

Can All Cryptos Be Mined?

Not all cryptocurrencies can be mined. Broadly speaking, there are two mechanisms to validate transactions on a blockchain: proof-of-work (PoW) and proof-of-stake (PoS).

Proof-of-work blockchains require crypto mining to validate transactions. The “work” being done is the computational work involved in guessing hashkeys. Proof-of-work blockchains and their associated cryptocurrencies include:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Zcash (ZEC)

- Ethereum Classic (ETC)

- Dogecoin (DOGE)

- Dash (DASH)

- Monero (XMR)

Proof-of-stake blockchains don’t require crypto mining. Instead, these blockchains rely on “validators” who stake cryptocurrency and receive rewards for validating transactions. If a validator acts maliciously, they’ll lose the cryptocurrency they staked. Proof-of-stake blockchains and their associated cryptocurrencies include:

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Avalanche (AVAX)

- Polygon (MATIC)

- Algorand (ALGO)

Are All Cryptos Mined the Same Way?

All proof-of-work cryptocurrencies are mined in the same way. All require miners to go through the same process of guessing hashkeys until a block’s hash is discovered and new tokens are released.

However, there are differences in how competitive certain crypto tokens are to mine. For example, competition for Bitcoin is fierce. It’s nearly impossible to succeed in Bitcoin mining without dedicated ASIC machines.

Competition for less popular cryptocurrencies, such as ZCash or Monero, is much less intense. Miners may be able to break even using GPUs or even CPUs.

Another minor difference is that many cryptocurrencies have a fixed supply. For example, there will only ever be 21 million Bitcoin. But this isn’t always the case—Dogecoin has an unlimited supply, meaning that there’s no limit to how many DOGE tokens can be mined in the future.

How to Mine Crypto – A 5-Step Guide

Now that we’ve covered the basics of crypto mining, let’s take a closer look at how to mine crypto. We’ll break the process down into 5 steps to make it easy for new miners to get started.

Step 1: Choosing Which Crypto to Mine

The first step in mining is to decide what to mine. This is important because even though all mineable cryptos work similarly, there are many differences when it comes to the practicalities of mining different tokens.

For example, mining Bitcoin requires a large upfront investment. Competition is fierce, so you will need to rent or buy ASIC mining machines. You may also need to join a Bitcoin mining pool.

Mining cryptocurrencies like ZCash requires much less upfront investment since you can use CPUs and GPUs. However, the potential payoff from mining is much lower as well.

Which crypto you should focus on comes down to what they hope to achieve. If you want a passive income source without a huge investment, then mining a less popular token makes the most sense. If you want to start a mining business and has plenty of capital to invest, then it may make sense to dive into Bitcoin, Bitcoin Cash, Litecoin, or Ethereum Classic mining.

It’s also important to think about the future of these cryptocurrencies. If you’re bullish on Bitcoin because Bitcoin ETFs were recently approved, then that could be another reason to mine BTC over alternative tokens.

Step 2: Buying Crypto Mining Equipment

Once you have decided what crypto to mine, you’ll need the right mining equipment for the job. What that equipment is depends on the exact token and how much you want to invest in mining. You can purchase GPUs relatively inexpensively, but more powerful ASIC miners cost several thousand dollars each.

In any case, there are two ways to invest in crypto mining equipment: renting processing power through cloud mining or buying equipment outright.

Many miners choose cloud mining because it simplifies the mining process. You don’t have to set up or maintain physical equipment. Instead, you can take control of operational machines and start mining right away. There’s also much less upfront investment required compared to buying your own equipment.

The drawback to cloud mining is that prices can fluctuate over time. If you plan to mine crypto for several years, paying for rented machines can end up costing more than buying your own equipment. In addition, watch out for scams when searching for a cloud mining platform.

Buying your own mining equipment requires a larger upfront investment and you have to set up your equipment before you can start using it. You also have to maintain your equipment over time.

The benefit is that you can buy equipment exactly to your specifications and configure it according to your needs. In the long run, you may end up paying less for a Bitcoin mining rig that you own compared to mining equipment rented through the cloud.

Step 3: Setting up a Crypto Wallet

In order to receive cryptocurrency rewards you earn from successful mining, you need a crypto wallet. The good news is that there are many free crypto wallets available. Popular options include MetaMask, Guarda, Exodus, Trust Wallet, and more. Just make sure that the wallet you want to use is compatible with the crypto token you plan to mine.

When setting up a crypto wallet, it’s important to set a strong password and write down your seed phrase. You’ll need your seed phrase to access your wallet from another device in the future. It’s estimated that around 6 million BTC (worth more than $500 billion) have been lost because owners forgot their wallet seed phrases.

Step 4: Configuring your Mining Device

The process of configuring your crypto mining equipment will vary depending on whether you’re using a cloud mining platform or your own equipment.

If you’re using a cloud mining platform, it’s likely that your platform has its own mining software. You’ll need to select what crypto you want to mine, what hash guessing algorithm to use, and where to send mined tokens. Some cloud mining platforms offer more configuration options than others, and this is something to consider when choosing a cloud mining provider.

If you’re using your own Bitcoin mining rig, you’ll need to download crypto mining software. Popular software platforms include: CG Miner, Awesome Miner, Easy Miner, ECOS, and BFGMiner.

These mining software tools range from simple, helping you run a single mining processor with ready-to-run defaults, to highly complex, enabling you to monitor and control groups of processors and automatically switch between mining different coins based on price. If you’re just starting out, choose a simple software that makes it easy to monitor your mining operation and view your earnings.

Step 5: Joining a Mining Pool

Joining a crypto mining pool is optional, but it’s a good step for many miners. Joining a crypto mining pool can increase your chances of earning a return from mining. The reward from each successfully guessed block will be smaller since you’re sharing with other miners, but pooling resources means that you’re likely to win more blocks.

There are many mining pools available for different cryptocurrencies. Some popular pools include DXPool, Poolin, Braiinspool, ViaBTC, Prohashing, Slush Pool, and F2Pool.

When choosing a mining pool, consider its historical payout rate, whether it has any membership fees, and what the minimum computational contribution requirements are. Watch out for scams, since there have been many crypto scams involving fake mining pools.

Is Cryptocurrency Mining Worth It?

Cryptocurrency miners can turn a profit, but it’s not guaranteed. It takes a lot of work and investment to make crypto mining worthwhile.

Every miner’s situation is different, and the crypto market is notoriously volatile. So, there’s no definitive answer as to whether crypto mining is worth it or not. With that said, let’s consider some of the factors that can help you determine whether crypto mining is right for you.

How Much Do I Have to Invest in Crypto Mining?

How much you have to invest in mining cryptocurrency depends on what token you want to mine and what kind of return you want to achieve.

You’ll stand to earn the biggest return from mining major cryptocurrencies like Bitcoin, Ethereum Classic, or Litecoin. However, mining these tokens also requires the biggest upfront investment. You’ll need ASIC mining equipment to compete with major mining operations—CPUs and GPUs simply won’t cut it.

In fact, you’ll likely need to buy many ASIC machines to compete as a Bitcoin miner. That means spending at least $10,000 on equipment and potentially upwards of $100,000.

It’s also important to consider the cost of operating these machines, which takes a lot of electricity. The average cost to mine 1 Bitcoin is currently between $10,000-$15,000. That could rise to almost $40,000 after the next Bitcoin halving in April 2024. That means that if Bitcoin fell below this price, Bitcoin miners could actually lose money.

The good news is that the investment required for less popular coins is much smaller. In fact, it’s possible to start mining with the computer you already own or with GPUs that cost a few hundred dollars. You won’t see huge returns—likely a few thousand dollars a year—but you can make a profit without much upfront investment.

How Am I Taxed on My Crypto Mining Earnings? (2024 Tax Rules)

Earnings from crypto mining are fully taxable just like any other source of income. You’ll pay taxes on your earned tokens at your normal income tax rate.

In addition, you’ll pay capital gains taxes on any appreciation you earn after receiving your mined cryptocurrency. As an example, if you mine 1 Bitcoin at $40,000 and then sell it for $45,000, you’ll pay income tax on $40,000 and capital gains tax on $5,000.

If you operate crypto mining as a business, you can offset your mining profits with losses and equipment costs. This can help reduce your tax bill, but you’ll still have to pay taxes on any net profits you earn.

Is Crypto Mining a Good Investment?

Whether crypto mining is a good investment depends on current mining conditions. When token prices are going up and mining competition is relatively low, crypto mining can deliver strong profits. However, if token prices fall or mining difficulty increases substantially, miners may not break even on their equipment and electricity costs.

The benefit to crypto mining is that it has the potential to generate passive income, which isn’t the case for many other types of investments. However, miners still need to follow the crypto market to decide when it makes sense to operate a Bitcoin mining rig and when it makes sense to turn the equipment off.

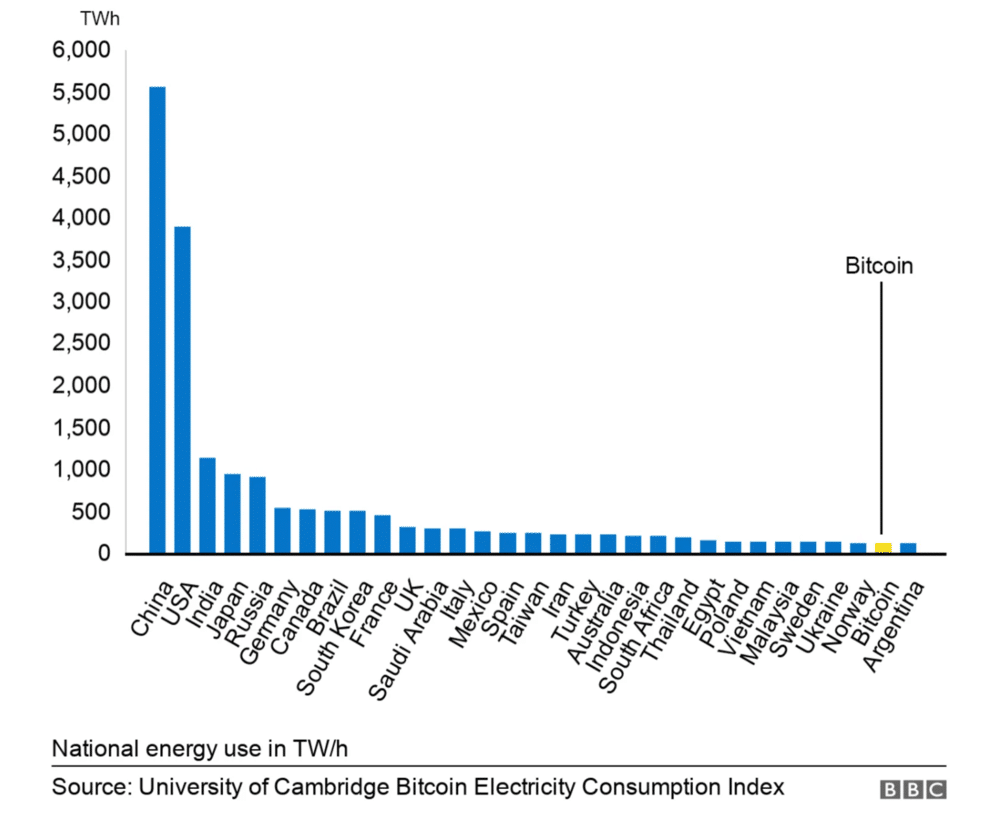

How Much Energy Does Crypto Mining Use?

Crypto mining uses a massive amount of electricity. According to some estimates, Bitcoin mining alone uses 127 terawatt-hours per year, which is just slightly less than the entire country of Norway.

CoinGecko estimates that a solo miner would require 266,000 kilowatt-hours of electricity to mine a single Bitcoin. At the average US electricity price, that means mining a single Bitcoin costs around $45,000.

Energy consumption for other cryptocurrencies is much lower. For example, it’s estimated that Litecoin requires about half as much energy to mine as Bitcoin.

The high energy cost of crypto mining poses environmental concerns. Even when cryptocurrency is mined using renewable energy sources like solar and wind power, mining increases overall energy demand and results in more greenhouse gas emissions. Bitcoin alone is estimated to account for around 0.2% of global CO2 emissions.

Can I Mine Crypto on My iPhone?

It’s possible to mine cryptocurrency on an iPhone and there are several mining apps for this purpose.

However, it’s doubtful that mining on an iPhone could be profitable. iPhones and other smartphones have relatively small CPUs that can’t compete well with computer CPUs, GPUs, or ASIC processors for mining.

That’s not to say that users can’t earn crypto by mining with an iPhone. While an iPhone is less likely to win blocks, it could still win rewards on occasion. However, the wear and tear mining would put on the phone’s processor would end up costing much more—when you have to buy a new phone in a few months—than any crypto earned by iPhone mining is worth.

Why Does Crypto Need Miners?

Proof-of-work cryptocurrencies like Bitcoin need miners in order to validate transactions. The process of guessing hashkeys is a mathematical way to ensure that every transaction reported in a block actually happened.

So, mining guarantees that every transaction that’s added to the blockchain is fully valid. This is crucial since blocks (and the transactions they contain) are immutable once added to the blockchain.

The mining process is also essential to bringing new tokens into circulation. Mining rewards are released from the blockchain, adding to the circulating supply. This gives cryptocurrencies like Bitcoin and Litecoin a small but healthy degree of inflation—similar to how the supply of gold is inflated as more of it is mined.

This small amount of inflation is crucial to keep tokens in circulation and enable real-world transactions to happen without delays.

How Do I Choose The Best Crypto To Mine?

Choosing what to mine requires considering a few factors:

- How much money you want to invest in mining equipment

- How much electricity costs in your area

- Current difficulty and block reward for different crypto tokens

- Bullish/bearish trends for different crypto tokens

- Your risk/reward tolerance

In general, popular coins will require more investment, higher operating costs, and higher risk in exchange for potentially higher payouts. Less popular tokens will have lower upfront mining costs, lower risk, and likely lower payouts.

Keep in mind that changing mining and market conditions mean that it may make sense to have the flexibility to mine multiple tokens. For example, you can mine Litecoin when its difficulty is relatively low or the price of $LTC is rising. When Litecoin mining becomes more difficult, you can switch to mining ZCash or Dash.

How Does Mining Confirm Transactions?

Crypto mining uses a form of cryptography known as hashing to validate transactions in a block. When transactions are grouped into a block, they’re assigned a unique hashkey. In the case of Bitcoin, this hashkey is 256 numbers and letters.

A hashkey is unique for a given set of transactions. So, if a malicious actor were to change anything about any transaction in a block—the timestamp or amount, for example—the block would receive an entirely different hashkey.

When miners guess the hashkey and it matches the original hashkey assigned to the block, this provides confirmation that none of the transactions in the block have been modified.

Importantly, it takes a lot of computing power to find a block’s hashkey. So, it’s virtually impossible for a malicious actor to spoof a hashkey for a modified block—even if they had a supercomputer.

How Much Can I Make Mining Crypto?

How much you can make mining cryptocurrency varies widely based on what token you’re mining, its price, your electricity costs, and more. There’s no guarantee you’ll turn a profit mining crypto, but many miners are able to come out ahead.

Estimates for profits can be widely different for solo miners, but you can typically expect to earn a few dollars per mining machine per day. After factoring in your initial investment in mining equipment, it may take up to 2 years of mining before you turn a profit.

An economy of scale is important for mining. Large Bitcoin mining companies are better able to turn a profit because they have a huge number of Bitcoin mining rigs at work, increasing the likelihood that they win blocks and earn rewards. You may be able to increase your profitability by joining a mining pool, but pools can also increase your costs and diminish your payouts.

Crypto Mining Pros and Cons

Let’s explore some of the pros and cons of mining cryptocurrency in May 2024

Pros

- Earn newly minted cryptocurrency that can be sold at exchanges

- Can start mining at home using your computer

- Many crypto tokens support mining with varying levels of profitability

- Helps validate transactions and ensures blockchain networks run smoothly

Cons

- High initial investment for advanced mining rigs

- No guarantee that mining will be profitable

- Uses a lot of energy (high electricity costs to operate)

- Mining difficulty and reward rate can change over time

Is Crypto Mining Legal?

Crypto mining is completely legal in the US and most other countries where cryptocurrency is legal. There are no licenses required to mine crypto in the US, although miners who want to mine crypto as a business may need to get a business license.

Certain US states have considered laws that would restrict large crypto mining operations because of their energy use. However, these laws don’t apply to solo miners operating small at-home operations.

Conclusion – Should I Start Mining Crypto?

Crypto mining is a way to earn passive income in Bitcoin, Litecoin, Dogecoin, ZCash, and other proof-of-work cryptocurrencies. Mining typically requires a large upfront investment in computer equipment and can involve high operating costs because of its electricity usage. However, the payoff can be significant when mining and market conditions are right.

Ultimately, whether crypto mining is right for you comes down to your risk tolerance. Not all miners turn a profit, but many do. Remember that it will take time to recoup your initial investment. Never invest money in crypto mining that you can’t afford to lose.

Crypto Mining FAQs

What Does It Mean to Mine Crypto?

Mining cryptocurrency involves guessing the hashkey for a block of transactions in order to validate it and add it to the blockchain. The miner who guesses the correct hashkey first receives a reward in the form of new tokens minted from the blockchain.

How Do I Mine Crypto on My PC?

It’s possible to mine crypto on a PC using solo mining software like CG Miner, Awesome Miner, Easy Miner, and others. PCs can perform CPU mining or, if your computer has a GPU, GPU mining. These are relatively inefficient forms of mining, so it’s a good idea to mine less popular tokens like ZCash or Dash rather than Bitcoin.

How Do I Mine Crypto on My iPhone?

You can mine crypto on an iPhone using mining apps like Mobile Miner, ECOS, or Crypto Miner. iPhones are only capable of CPU mining and are unlikely to turn a profit. Mining may put extra wear and tear on your phone which could reduce its lifespan.

How Do I Mine Crypto on a Mac?

You can mine cryptocurrencies on a Mac computer using software like CG Miner, ECOS, Awesome Miner, and Easy Miner. Mac computers are capable of CPU and GPU mining. They can be profitable when mining less popular tokens like ZCash, Dash, Monero, and others.

Can I Mine Crypto at Home?

You can mine crypto at home using your computer or a dedicated crypto mining rig. Keep in mind that your electricity bill is likely to increase since crypto mining uses a lot of power. You can also mine from home by cloud mining, which involves renting and operating mining equipment over the internet.

How Much Does it Cost to Mine Crypto?

Costs to mine cryptocurrency can vary widely depending on what equipment you use and your electricity costs. You can get started with your personal computer for little cost, but a dedicated ASIC mining rig may cost $10,000-$20,000.

How Long Does it Take to Mine Crypto?

How long it takes to mine crypto varies by token and based on how many miners are active. For Bitcoin, a new block is mined roughly every 10 minutes. However, a single miner is unlikely to win every block, so it could be hours or even days between blocks that you mine.

References

- https://www.blockchain-council.org/cryptocurrency/how-many-bitcoins-are-left/

https://bitproit.com/asic-vs-gpu-mining/ - https://bitcoinmagazine.com/guides/what-are-bitcoin-mining-pools

- https://www.coindesk.com/learn/proof-of-work-vs-proof-of-stake-what-is-the-difference/

- https://www.coindesk.com/learn/want-to-buy-dogecoin-read-this-first/

- https://www.reuters.com/technology/bitcoin-etf-hopefuls-still-expect-sec-approval-despite-social-media-hack-2024-01-10/

- https://www.makeuseof.com/pros-cons-crypto-cloud-mining/

- https://www.makeuseof.com/how-much-bitcoin-is-lost-forever/

- https://news.sophos.com/en-us/2023/09/18/latest-evolution-of-pig-butchering-scam-lures-victim-into-fake-mining-scheme/

- https://www.coindesk.com/consensus-magazine/2023/07/26/bitcoin-miners-buy-up-rigs-as-prices-near-all-time-lows/

- https://z.cash/learn/can-i-make-money-mining-zcash/

- https://coinledger.io/blog/how-to-handle-cryptocurrency-mining-on-your-taxes

- https://rmi.org/cryptocurrencys-energy-consumption-problem/

- https://www.coingecko.com/research/publications/bitcoin-mining-cost

- https://www.bls.gov/regions/midwest/data/averageenergyprices_selectedareas_table.htm

- https://solarmagazine.com/how-much-energy-does-it-take-to-mine-different-cryptocurrencies/

- https://agupubs.onlinelibrary.wiley.com/doi/10.1029/2023EF003871

- https://apps.apple.com/us/app/mobile-cryptocurrency-miner/id1332864093

- https://www.coinbase.com/learn/crypto-basics/what-is-inflation

- https://blog.goodaudience.com/how-a-miner-adds-transactions-to-the-blockchain-in-seven-steps-856053271476

- https://blockworks.co/news/us-crypto-mining-regulation-states

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Kane Pepi

Kane Pepi