How to Make a Uniswap Trade – A Step-by-Step Guide

Uniswap is viewed as a prominent decentralized exchange (DEX) operating on the Ethereum blockchain. The exchange offers a seamless platform for users to trade and buy various ERC-20 tokens without relying on intermediaries. Newly launched cryptocurrencies often list on Uniswap before they make it to centralized exchanges (CEX).

Below, we present a comprehensive step-by-step guide to navigating the platform and detail how to make a Uniswap trade.

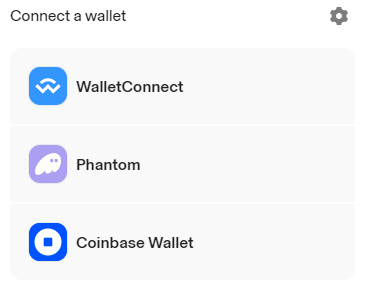

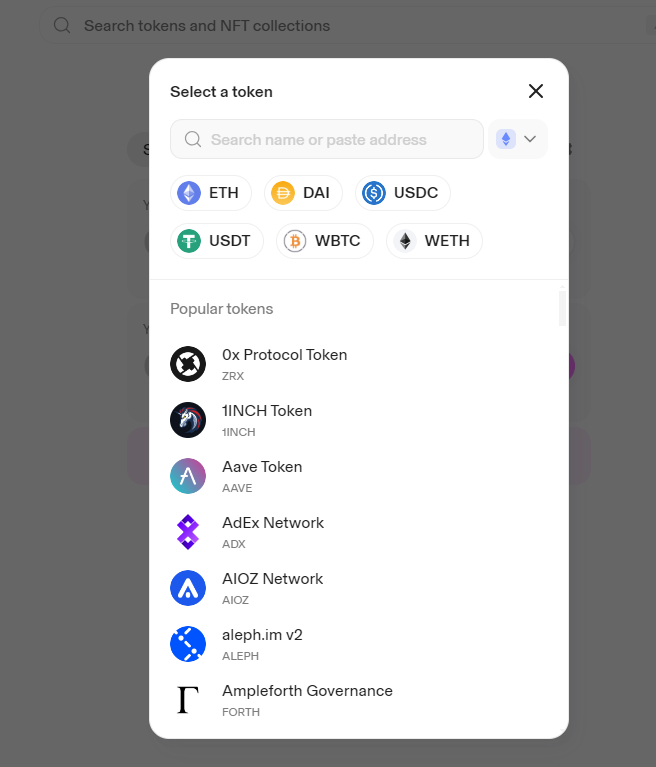

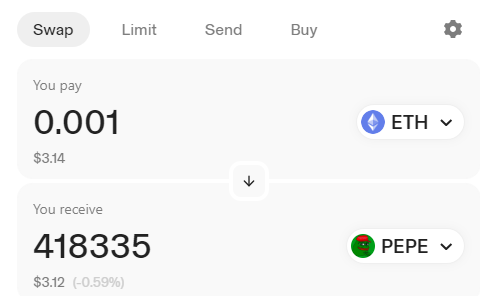

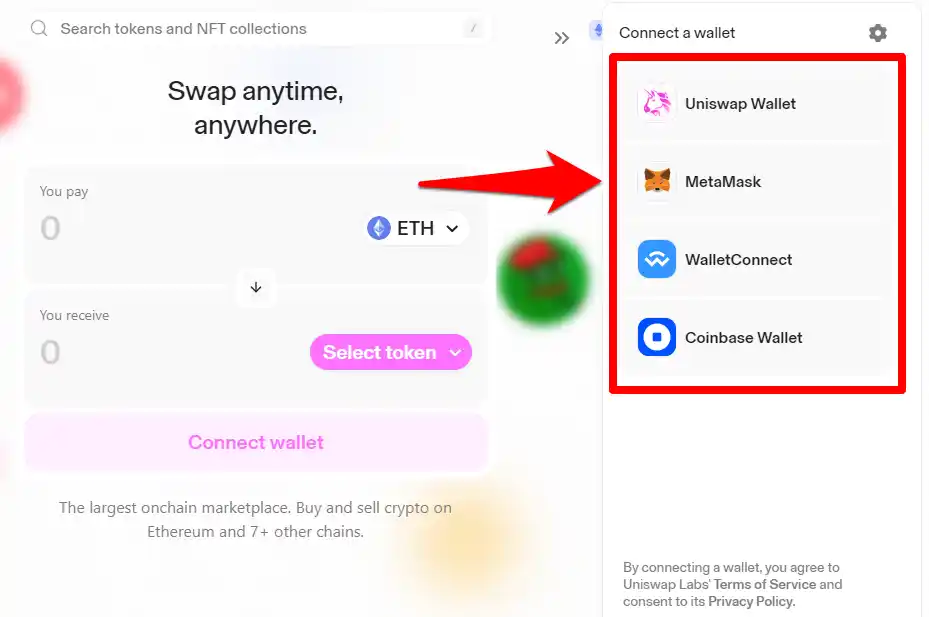

Unlike traditional exchanges, Uniswap does not rely on order books; instead, it employs an innovative algorithmic pricing mechanism to determine exchange rates. With its user-friendly interface and commitment to decentralization, Uniswap has garnered widespread acclaim, among both new and seasoned traders. In contrast to centralized exchanges, which require users to undergo lengthy registration processes and relinquish control of their funds to third-party custodians, Uniswap allows users to retain full control of their assets at all times. Start by visiting the Uniswap platform and connect your crypto wallet. MetaMask is a popular choice, but Uniswap supports various wallets like Coinbase Wallet and Phantom. Select the one you want, and you will be guided to sync it to the Uniswap exchange. Once your wallet is connected, choose the tokens you want to trade. If you’re swapping ETH for another token, ensure you have enough ETH for gas fees. Click on “Select a token” and enter the token’s wallet address, or search for it. Next, enter the amount of the token you want to swap. Uniswap will automatically calculate the estimated amount of the other token value you’ll receive based on current market rates. End the process by confirming the transaction on your wallet, and wait for it to be processed. Once the transaction deadline is confirmed, you’ll receive the swapped tokens in your wallet. Another key aspect of Uniswap is its automated market-making (AMM) algorithm, which determines the prices of tokens based on the ratio of assets in the liquidity pools. This algorithm ensures fair and transparent pricing, mitigating the risk of price manipulation often associated with centralized exchanges. So when a user wants to make a trade on Uniswap, they simply connect their crypto wallet to the platform and select the token pair they wish to trade. Uniswap then calculates the exchange rate based on the ratio of tokens in the liquidity pool and executes the trade at the prevailing market price. After the trade is completed, the liquidity pool is rebalanced to reflect the equivalent value of the new token ratios. Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. When trading on Uniswap, users need to set a maximum amount of slippage tolerance to account for potential price fluctuations during high volatility. Setting an appropriate slippage tolerance ensures that trades are executed at or near the expected price. This is important due to the volatile nature of crypto trading, where significant price swings can be a frequent occurrence. Uniswap transactions are subject to Ethereum’s network congestion and transaction fees, known as gas fees. Users need to be mindful of transaction deadlines to avoid failed transactions or paying excessive gas fees. Setting appropriate gas fees and transaction deadlines ensures the timely execution of trades without incurring unnecessary costs. As Uniswap operates through smart contracts deployed on the Ethereum network, there are inherent risks associated with smart contract vulnerabilities or exploits. Users should exercise caution and conduct thorough research before interacting with Uniswap or any DeFi protocol to mitigate the risk of potential financial losses due to smart contract bugs or hacks. The liquidity of a trading pair on Uniswap directly impacts the execution of trades and the overall user experience. Pairs with higher liquidity typically offer tighter spreads and lower slippage, resulting in more favorable trading conditions. Before trading on Uniswap, users should assess the liquidity of their desired trading pairs to ensure optimal trading outcomes. Gas fees on the Ethereum blockchain are essential for processing transactions and interacting with smart contracts. However, gas fees can vary depending on network congestion and transaction complexity. Users should monitor gas prices and adjust their transaction settings accordingly to minimize gas fees while ensuring timely transaction execution. MetaMask is a popular Ethereum wallet and browser extension that allows users to interact with Ethereum-based decentralized applications (DApps) like Uniswap. To use Uniswap with MetaMask: Step 1: Visit the Uniswap website and connect your MetaMask wallet by clicking “Connect Wallet” in the top-right corner. Step 2: Log in to your MetaMask account, and once synced you will be able to access Uniswap’s trading interface. Step 3: Now choose the token you want to trade and enter the amount. Confirm the transaction in MetaMask, and once confirmed on the Ethereum blockchain, your trade will be completed. Coinbase Wallet is a mobile cryptocurrency wallet that allows users to store, send, and receive various cryptocurrencies, including Ethereum-based tokens. To use Uniswap with Coinbase Wallet: Step 1: Open the Uniswap website on your mobile browser and tap “Connect Wallet.” Select “Coinbase Wallet” as your preferred option and follow the prompts to connect your wallet. Step 2: Once connected, you can browse available token pairs on Uniswap and initiate trades directly from your Coinbase Wallet. Step 3: Review the transaction details and confirm the trade within the Coinbase Wallet app. Once confirmed, your trade will be processed on the Ethereum blockchain. Trust Wallet is a mobile cryptocurrency wallet that supports a wide range of cryptocurrencies and tokens. To use Uniswap with Trust Wallet: Step 1: Download the Trust Wallet app from the App Store or Google Play Store and create or import your wallet. Step 2: Open the Trust Wallet app and go into the “Discover tab”, where you can see the Uniswap exchange listed. Select this and you will be taken to the Uniswap site. Step 3: Once there you will be given the option to connect. You can then explore available token pairs on Uniswap and initiate trades directly from your Trust Wallet. Additionally, UNI acts as a governance token and an incentive for liquidity providers on Uniswap, allowing them to earn a share of trading fees and governance rewards. Furthermore, UNI holders can participate in the decentralized governance of the Uniswap protocol, ensuring its continued evolution and decentralization. It is a top 25 cryptocurrency with a market cap of $4.5 billion and a daily trading volume of $144 million. The token has experienced volatility in recent months after the U.S. Securities and Exchanges Commission (SEC) warned Uniswap of potential actions against it. While Uniswap is accessible globally, regulatory scrutiny varies across different countries. For example, some countries like the United States have stringent regulations concerning cryptocurrency trading platforms, while others have adopted more crypto-friendly policies. China is one of the most notable countries that completely banned crypto trading. Pros: Cons: Overall, crypto enthusiasts have continuously turned to Uniswap for its decentralized and innovative approach to trading. Its user-friendly interface and robust liquidity pools have attracted a diverse user base, ranging from casual traders to experienced investors. In 2023, Uniswap was found to have a bigger liquidity pool than Coinbase. These alternatives to Uniswap cater to specific niches within the decentralized finance (DeFi) ecosystem, providing users with a range of options based on their trading preferences and requirements. To find more of the best decentralized exchanges in 2024 read our guide. Despite its challenges, such as high gas fees and impermanent loss, Uniswap plays a significant role in the decentralized finance (DeFi) ecosystem, empowering users and promoting financial inclusivity. Follow our dedicated Uniswap price page for the latest updates.

Uniswap fees can be high due to network congestion on the Ethereum blockchain, resulting in increased gas fees required to process transactions. Uniswap trading fees are typically lowest during periods of lower network activity on the Ethereum blockchain, such as during off-peak hours. Various cryptocurrency wallets are compatible with Uniswap, including MetaMask, Trust Wallet, and Coinbase. Slippage in Uniswap refers to the difference between the expected price of a trade and the actual price at which it is executed due to market volatility or changes in liquidity. Yes, individuals in the United States can engage in trading on Uniswap, but they should be aware of regulatory considerations and tax obligations.

What is Uniswap?

Uniswap is a decentralized exchange that enables automated trading of tokens on the Ethereum blockchain. By eliminating the need for centralized intermediaries, Uniswap facilitates automated token swaps directly from users’ wallets. It does this by leveraging smart contracts and liquidity pools.How to Trade on Uniswap

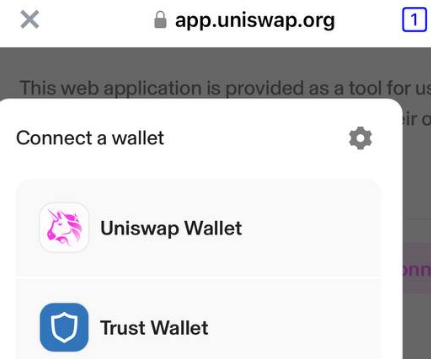

Trading on Uniswap is a simple process due to its user-friendly interface. You can connect your wallet, find a token, and place a step in a few simple steps. Let’s break this down for you.Step 1: Connect Your Wallet

Step 2: Select Tokens

Step 3: Enter Amount

Step 4: Confirm Transaction

How does Uniswap work?

Uniswap operates on the principle of automated market-making (AMM) and utilizes liquidity pools to facilitate decentralized token swaps. These pools provide liquidity and allow users to contribute their assets to the platform, thereby enabling liquidity for various token pairs. This innovative approach ensures continuous liquidity and eliminates the need for order books, enabling trades to be executed seamlessly and without delay.What You Need to Know Before Trading on Uniswap

Before you begin using the Uniswap decentralized exchange (DEX) it is important to understand some of the key functions. Here are some of the key things to know before using the platform,Slippage Tolerance

Transaction Deadlines

Smart Contract Risks

Liquidity

Gas Fees

How to Use Uniswap With Crypto Wallets

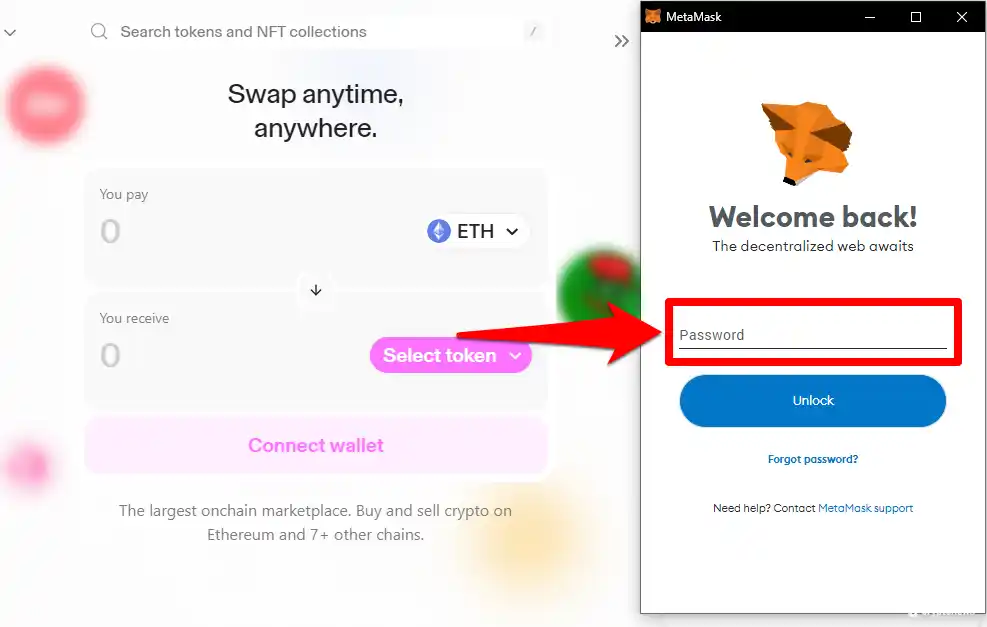

There are several crypto wallets that you can use to connect to the Uniswap exchange. Let’s take you through the process of how to connect some of these.How to Use Uniswap with Metamask

How to Use Uniswap with Coinbase

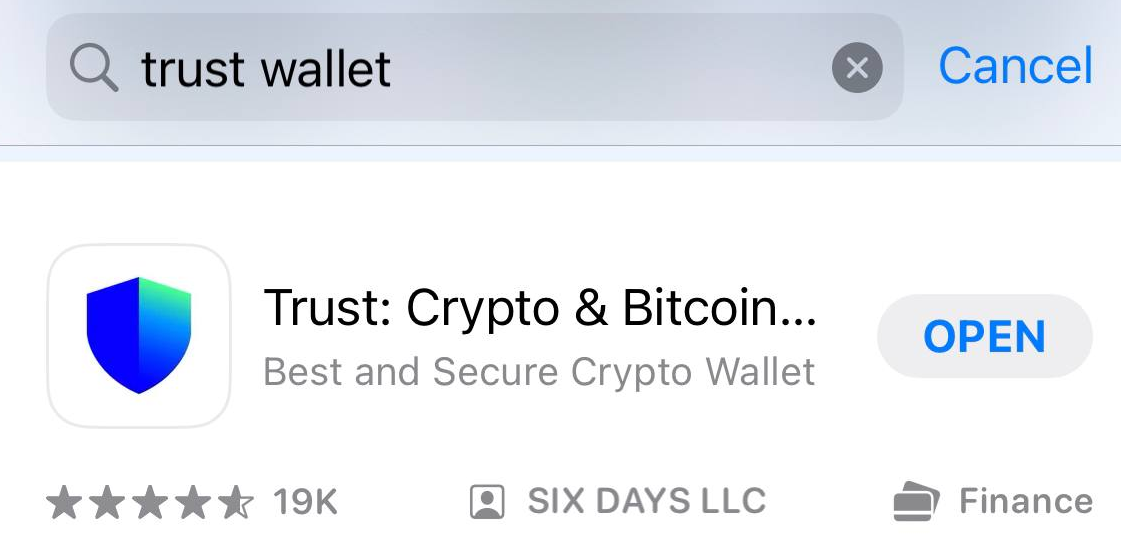

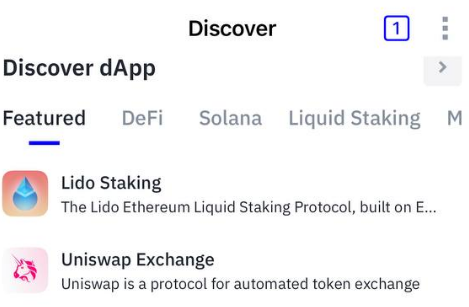

How to Use Uniswap with Trust Wallet

What does the UNI Token Do?

The UNI token, launched by Uniswap in September 2020, plays a pivotal role in governing the protocol and empowering its ecosystem. UNI tokens holders have voting rights, allowing them to propose and vote on changes to the protocol, such as fee adjustments and governance proposals.Which Countries Allow Uniswap Trading?

Uniswap operates on a decentralized and permissionless blockchain, meaning it can be accessed and utilized by anyone with an internet connection, regardless of their location. As a result, there are no specific restrictions on Uniswap trading based on geographic location. However, users should be aware of any regulatory requirements or restrictions imposed by their local jurisdictions regarding cryptocurrency trading and decentralized exchanges.Pros and Cons of Trading on Uniswap

Although there are several positives to using Uniswap, there are also some drawbacks, let’s look at both of these in more depth.

Who is Uniswap Trading Best Suited for?

Uniswap trading is best suited for traders seeking decentralized and permissionless access to cryptocurrency markets. It is ideal for traders who prioritize privacy, security, and control over their funds, as well as those interested in participating in decentralized finance (DeFi) ecosystems. Additionally, Uniswap trading may appeal to liquidity providers looking to earn passive income by providing liquidity to the protocol’s various liquidity pools.Alternatives to Trading on Uniswap

While Uniswap is a leading decentralized exchange in the cryptocurrency space, there are several options available to users seeking alternative trading platforms. Some notable alternatives to Uniswap include:

Conclusion

In learning how to make a Uniswap trade you now have a comprehensive viewpoint on the DEX ecosystem. Uniswap has revolutionized the cryptocurrency trading landscape by offering decentralized, permissionless, and user-friendly access to liquidity.Trading on Uniswap FAQs

Why are Uniswap fees so high?

When are Uniswap trading fees lowest?

Which wallets work with Uniswap?

What is slippage in Uniswap?

Can you make Uniswap trades in the US?

References

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi

Dassos Troullides

Dassos Troullides