8 Best Arbitrum Network Tokens to Buy Right Now

Arbitrum enables ERC-20 tokens to bridge to its proprietary network. This provides ERC-20 tokens with significantly cheaper and more scalable transactions when compared to the Ethereum blockchain. In this guide, we analyze and rank the best Arbitrum network tokens to buy right now.

List of the 8 Best Arbitrum Network Tokens to Buy in 2024

Here’s a list of the best Arbitrum network tokens to buy right now:

- AiDoge – This is one of the best Arbitrum network tokens in our view. AiDoge is a presale project offering its AI tokens at a discount. The project has developed an AI-backed tool that can create memes. Each meme is unique, and users simply need to provide AiDoge with some text. The AIDoge presale has already raised over $5.5 million.

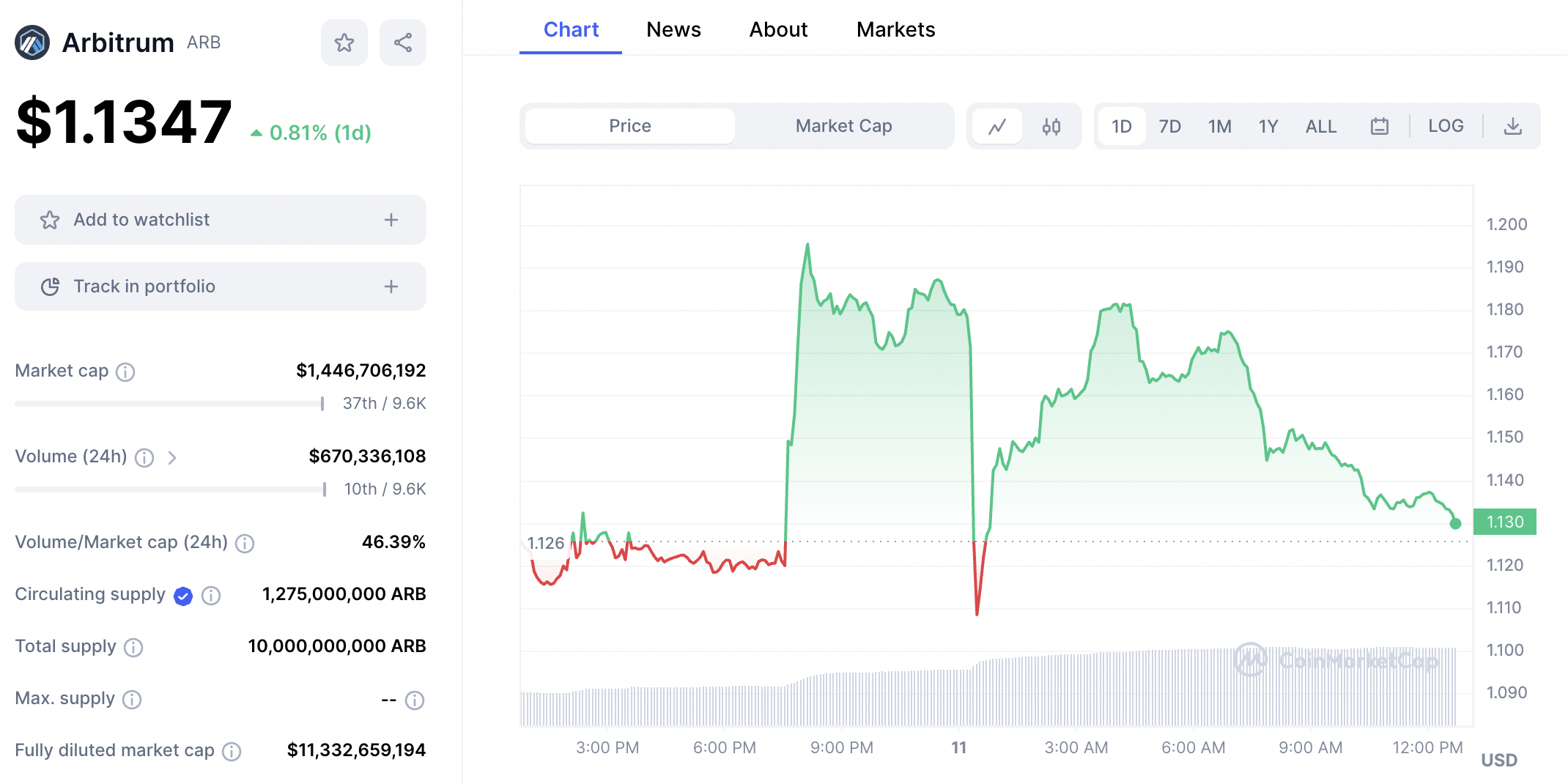

- ARB – ARB is the native crypto token fueling the Arbitrum network. Not only is ARB used for paying transaction fees and earning yields via staking, but it’s also a governance token. This enables ARB holders to vote on network-related decisions. ARB was listed on exchanges in March 2023, so it’s still an emerging crypto.

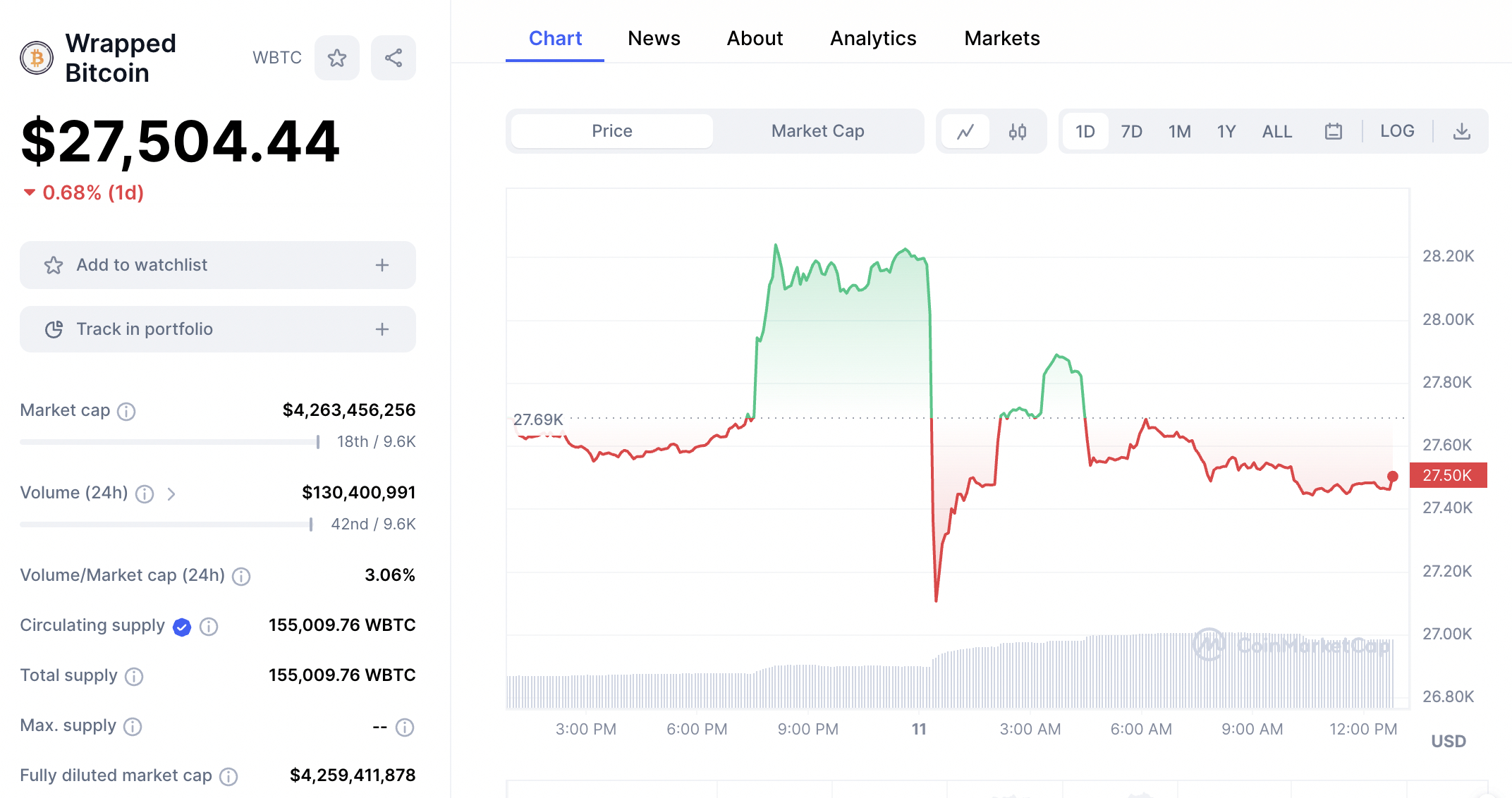

- Wrapped Bitcoin – This is an ERC-20 token that is pegged to the value of Bitcoin. The project’s pegging framework is based on locked BTC tokens that are minted 1:1 with WBTC. Put simply, those holding Wrapped Bitcoin can access decentralized finance services on the Ethereum blockchain. When going via the Arbitrum bridge, this offers a more cost-effective and speedy process.

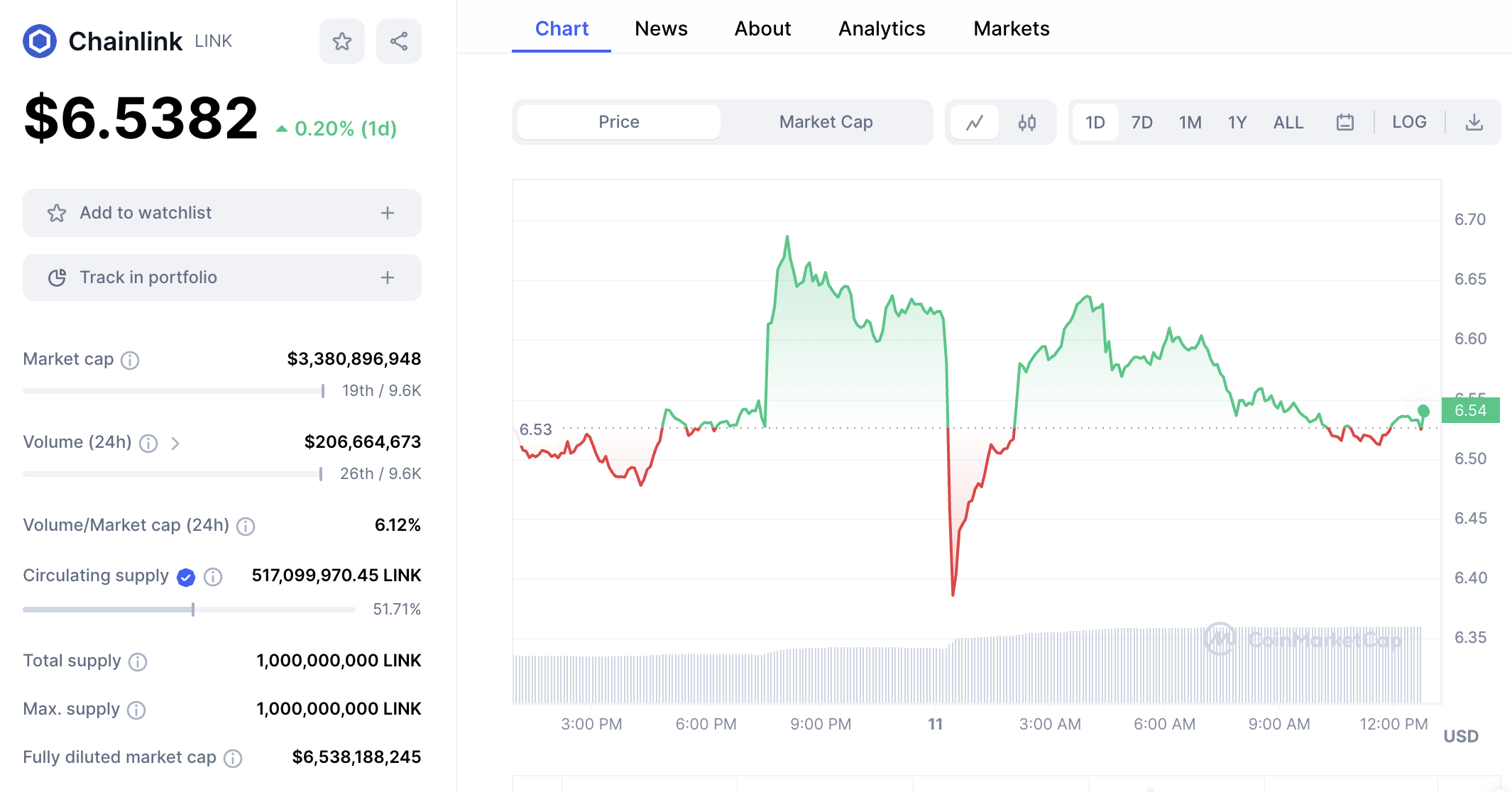

- Chainlink – This Arbitrum token provides real-world data to smart contracts. Known as ‘Oracles’, Chainlink ensures that smart contracts have access to real-time information that is accurate and up-to-date. Chainlink, backed by its native token LINK, uses a consensus mechanism across thousands of data points to achieve its goals.

- Uniswap – Uniswap is a popular decentralized exchange supporting cross-chain token swaps, lending pools, and yield farming. While Uniswap is built on the Ethereum blockchain, its Arbitrum bridge ensures that traders benefit from fast, cheap, and scalable transactions.

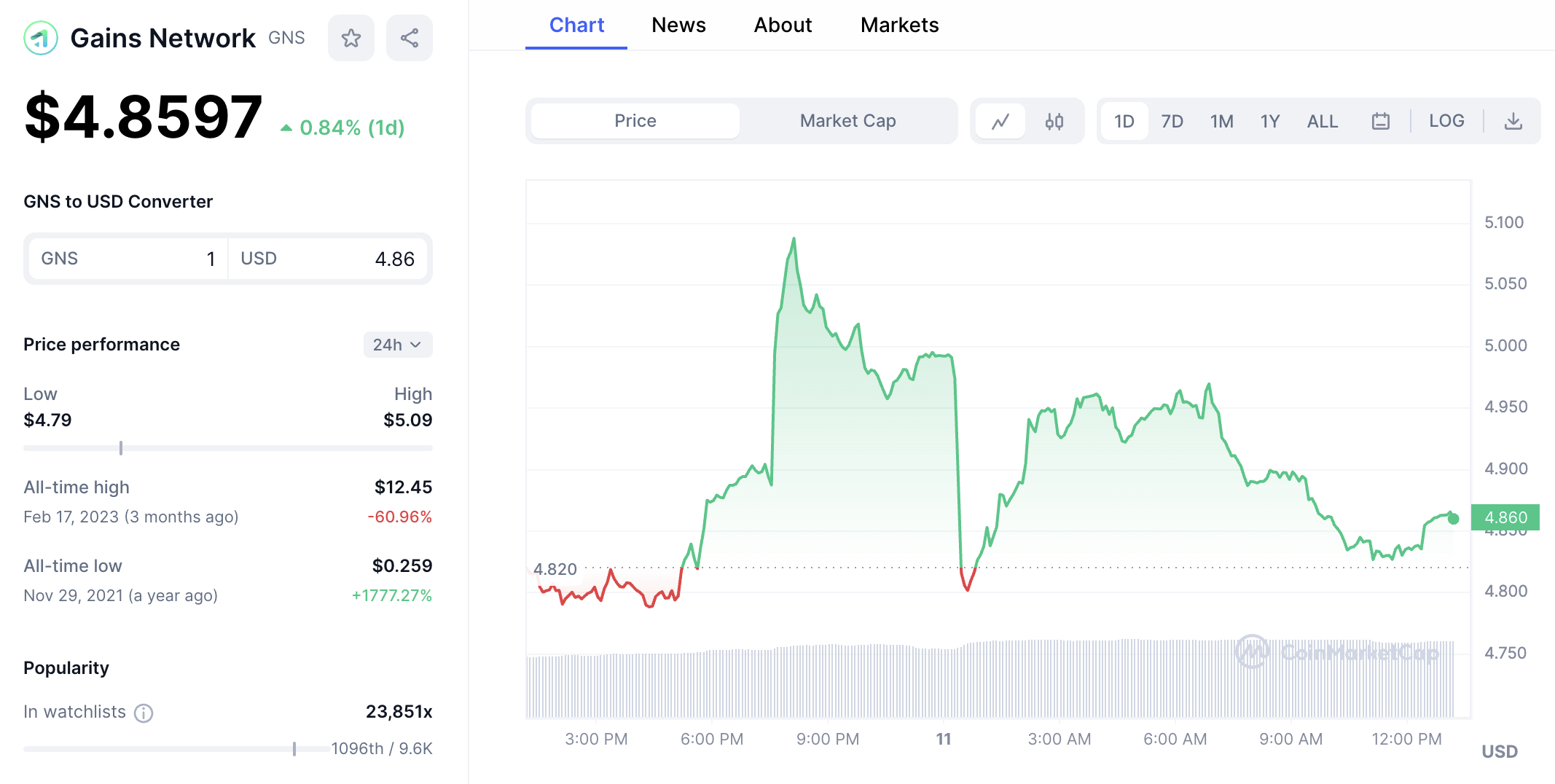

- Gains Network – This project has developed a decentralized trading platform that supports leveraged products. Not only crypto but stocks and forex too. Due to its synthetic framework, Gains Network offers leverage of up to 150x on Bitcoin. Gains Network is backed by GNS tokens, which offer holders reduced trading fees.

- SushiSwap – Another decentralized exchange with a bridge to the Arbitrum network is SushiSwap. This platform offers a simple and anonymous way to buy and sell crypto via an automated market maker. SushiSwap offers cross-chain capabilities, enabling token swaps on multiple blockchains.

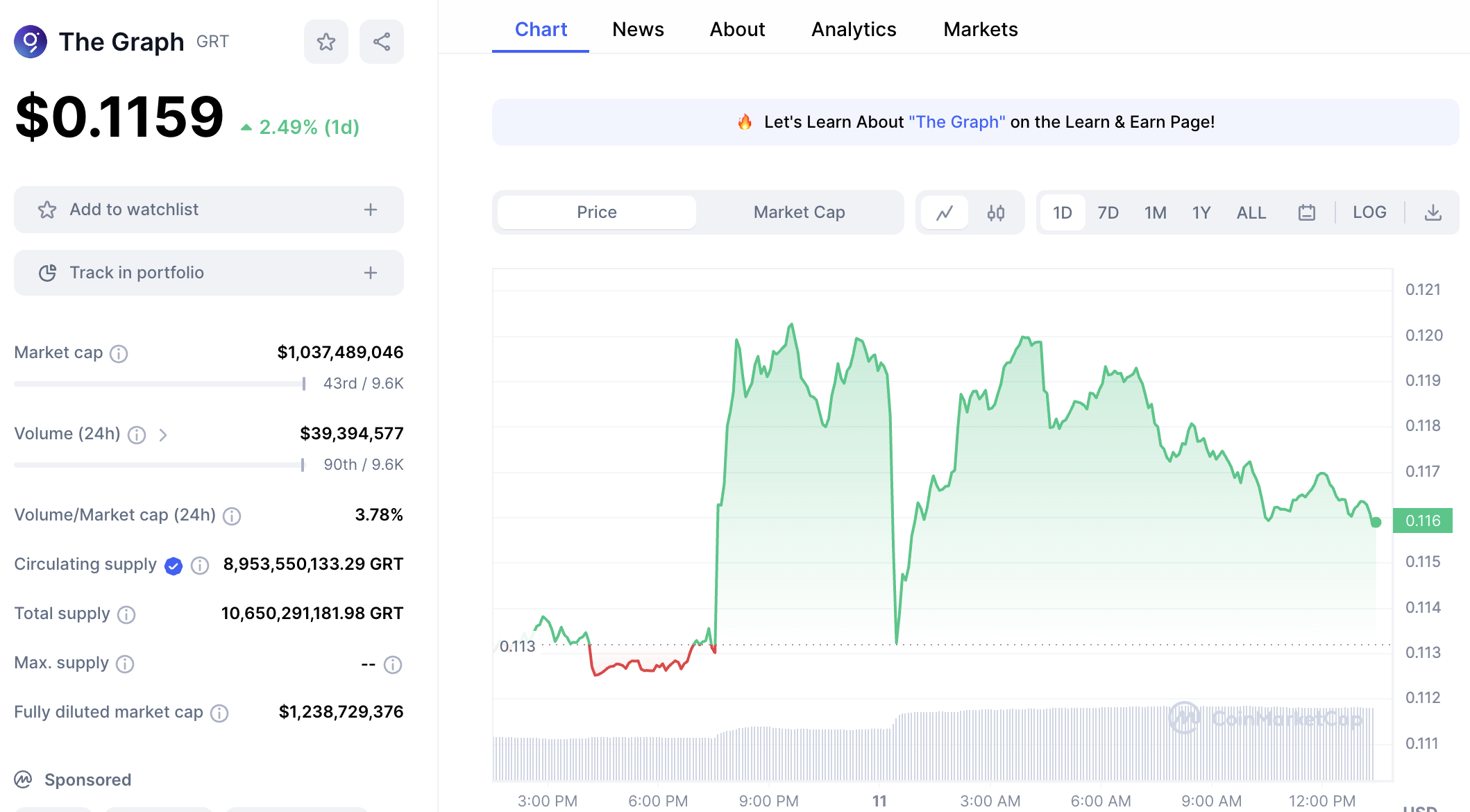

- The Graph – Just like Chainlink, the Graph plays a crucial role in the world of decentralization. Its protocol enables blockchains to index data. This increases efficiency and reduces transaction overload. Developers require the project’s native token, GRT, to query blockchain transactions.

Full Analysis of the Best ARB Tokens to Buy

In this section, we analyze the best Arbitrum network tokens to buy. We cover key factors surrounding the project’s objectives, token use cases, pricing performance, and more.

1. AiDoge – Overall Best Arbitrum Network Tokens to Buy

In our view, AiDoge is one of the best Arbitrum network crypto projects to invest in. This is a new cryptocurrency project that is currently raising funds via a presale launch. More than $5,5 million worth of AI tokens have been sold so far. AI is the native token backing the AiDoge project, which enables users to instantly create memes.

AiDoge’s tool is backed by artificial intelligence. Users enter a text prompt, and the tool generates a new and unique meme. Each meme comes with an image and can be shared on social media. What’s more, as AiDoge is backed by the blockchain, users can authenticate ownership of their unique memes via NFTs.

2. ARB – Utility Token Fueling the Arbitrum Network

ARB is the native token of the Arbitrum network. The tokens have many use cases, including governance. This means that those holding ARB tokens can vote on key proposals impacting the project. Moreover, ARB tokens can also be used for paying fees. This will be required when transactions are carried out in the Arbitrum ecosystem.

ARB tokens can also be used for staking. The most competitive rates can be found on the best decentralized exchanges, such as Uniswap. ARB tokens were listed on exchanges in March 2023. This makes ARB one of the newest crypto launches in 2024. According to CoinMarketCap, ARB tokens opened trading at $1.18 each.

3. Wrapped Bitcoin – ERC-20 Token Pegged to Bitcoin to Access DeFi Services

We found that Wrapped Bitcoin is also one of the best Arbitrum network tokens to buy. In a nutshell, Wrapped Bitcoin is pegged to the original Bitcoin. For every 1 WTBC in circulation, 1 BTC is locked in a smart contract.

Wrapped Bitcoin operates on the Ethereum blockchain, but it is also bridged to Arbitrum for increased efficiency. The objective of Wrapped Bitcoin is to enable Bitcoin investors to access decentralized finance (DeFi) products.

4. Chainlink – Connecting Smart Contract Blockchains With the Real-World

Chainlink plays a crucial role in the world of smart contract technology. Through ‘Oracles’, Chainlink provides smart contract blockchains with real-world data. In turn, smart contracts can execute autonomously through accurate, real-time information.

For example, suppose an insurance smart contract is scheduled to pay out if a flight is delayed or canceled. The Chainlink oracle can scan real-time flight information from thousands of different sources. Chainlink can provide the smart contract with its findings once a consensus has been reached.

5. Uniswap – Decentralized Exchange Supporting Cross-Chain Token Swaps and DeFi Yields

Uniswap is a popular decentralized exchange built on top of the Ethereum framework. Since bridging to Arbitrum, its exchange supports efficient transactions. This includes lower swap fees and faster settlement times.

Not only does Uniswaop support ERC-20 token trading but plenty of other networks. This includes Polygon, Optimism, Celo, BNB Chain, and Arbitrum. Uniswap also offers a range of DeFi services, enabling users to earn income on their idle tokens. This includes lending pools, staking, and yield farming.

6. Gains Network – Decentralized Trading Platform With Leveraged Crypto, Stocks, and Forex

Gains Network is also one of the best ARB coins to buy. This project has built a decentralized trading platform that supports leveraged products. Those trading cryptocurrencies can amplify their stake by up to 150x.

Gains Network also offers leverage of up to 1,000x and 100x on forex and stocks respectively. This platform may appeal to traders living in countries where leverage is either prohibited or limited.

7. SushiSwap – Popular Decentralized Exchange and DeFi Protocol With Cross-Chain Capabilities

Next on this list of the best Arbitrum network tokens to buy is SushiSwap. This is another decentralized exchange on the Ethereum blockchain that is bridged to Arbitrum. After all, SushiSwap facilitates a significant amount of transactions, so it requires complete efficiency.

Not only in terms of token swaps but DeFi services too. The latter includes flexible yield farming pools with competitive interest rates. SushiSwap also has cross-chain capabilities. In addition to Ethereum and Arbitrum, this includes Gnosis, Celo, BNB Chain, Harmony, Optimism, and many others. SushiSwap is backed by its own governance and investment token, SUSHI.

8. The Graph – Indexing Services Enabling Blockchains to Reduce Transaction Overload

The Graph is also one of the best Arbitrum network tokens to buy right now. In a nutshell, the Graph enables blockchains to index their data. This achieves two primary goals – increased efficiency and reduced transaction overload.

Moreover, the Graph allows developers to easily and quickly search for blockchain data. This removes the need to manually find transactions. GRT, the project’s native token, is required when developers wish to execute queries.

An Overview of the Arbitrum Network

Arbitrum was designed to solve Ethereum’s inefificencies. When bridging to Arbitrum, Ethereum-based projects benefit from much cheaper GAS fees. This is in addition to faster transactions and increased scalability.

Arbitrum is a layer 2 solution for the Ethereum blockchain. This means that ERC-20 tokens can bridge to the Arbitrum network for increased efficiency. For example:

- Ethereum can handle approximately 30 transactions per second. Arbitrum can handle up to 40,000 transactions per second.

- Ethereum transaction fees are currently averaging approximately $7.50. DeFi ecosystems on the Ethereum network are paying even higher fees. For example, Uniswap and KyberSwap are currently averaging $11.62 and $16.65 respectively. In comparison, Arbitrum fees are currently averaging between $0.19 and $0.51.

As per the above, ERC-20n projects bridging to the Arbitrum network benefit from much cheaper and more scalable transactions. This is especially crucial for projects that have a high transaction throughput, such as decentralized exchanges and DeFi protocols. Arbitrum was founded in 2018 but its native token, ARB, wasn’t listed on crypto exchanges until March 2023. ARB is required to pay transaction fees. Moreover, ARB can be used for staking and provides holders with governance rights. According to CoinMarketCap, there are more than 200 tokens bridged to the Arbitrum network. This enables investors to build a diversified portfolio of ARB tokens.

How Does Arbitrum Compare With Other Networks?

Arbitrum is considerably more efficient than legacy blockchains like Bitcoin, Ethereum, and Litecoin. This is the case in terms of scalability, speed, and cost-effectiveness. This is why over 200 tokens are now compatible with the Arbitrum network.

Arbitrum is one of the most efficient blockchain networks in the crypto space. As noted above, the network was created as a layer 2 solution for Ethereum. While thousands of projects trust Ethereum’s framework for its security, the blockchain is still inefficient.

Reasons to Buy Arbitrum Network Coins

Now let’s explore why some of the best Arbitrum network tokens to buy offer an interesting value proposition.

Cheap Transactions

All transactions on the Ethereum blockchain require GAS fees. This covers all smart contract transactions too. For example, suppose an investor wishes to swap ETH for USDT on the Uniswap decentralized exchange. This requires a smart contract to be executed, meaning the investor needs to pay fees. However, due to the sheer number of transactions processed by the Ethereum blockchain, GAS fees are high. As noted earlier, ERC-20 token swaps in the Uniswap ecosystem are currently averaging $11.62. This makes low-value token swaps unviable. In contrast, the best Arbitrum network coins discussed today benefit from super-low fees. This is currently averaging $0.19 and $0.51. This will particularly benefit projects like AiDoge. This is because every time a user creates a new meme, a smart contract is executed. And thus, this requires a new transaction and GAS fees.

Scalable Transactions

An even greater challenge facing the Ethereum blockchain is regarding scalability. Put simply, the world’s second-largest cryptocurrency by market capitalization can only handle up to 30 transactions per second. This is one of the main reasons why ERC-20 projects are bridging to Arbitrum in their droves. After all, Arbitrum can handle 1,333 times more transactions per second at 40,000. In turn, this keeps transaction fees low, as the network is not constantly running at maximum capacity.

Lots of Small-Cap Gems

When exploring the best Arbitrum network tokens to invest in, we came across a range of small-cap gems. These are often new projects that are still developing their core product or service. As such, growth investors will buy into the project while it still carries a small valuation.

A prime example of this is AiDoge. This small-cap project is currently running its presale campaign. This means that investors can buy AI tokens at the earliest point possible. More than $5.5 million has been raised so far, and a discounted entry price is still available.

In another example, SushiSwap currently has a market capitalization of just $200 million. During the prior bull market, SushiSwap was valued at nearly $3 billion. As such, this offers a hugely discounted entry price in anticipation of the next bull run.

Tips on Choosing the Best Arbitrum Network to Invest in

There are over 200 ERC-20 tokens bridged to the Arbitrum network. Collectively, this amounts to a market capitalization of over $140 billion. So it makes sense to only focus on projects with the best long-term potential. Below, we explain some top strategies to find the best Arbitrum network cryptocurrency to buy in 2024.

Understand the Project Concept

When searching for the best crypto to buy, investors should ensure they understand a project before investing. The best way to do this is to visit the project’s website and read its whitepaper. Also, look for the tokenomics and roadmap.

Once the project concept is understood, evaluate why it has bridged to Arbitrum. For example, we mentioned that AiDoge is expecting unprecedented demand for its meme-generation tool. This means that the Ethereum blockchain alone will not suffice. As such, AiDoge has bridged to Arbitrum to ensure users can create memes quickly and cost-effectively.

Look for Bear Market Discounts

Some of the best Arbitrum network tokens to buy are trading at huge bear market discounts. Crucially, this is often because of the broader market sentiment rather than any issues pertaining to the project itself. This is much the same as blue-chip stocks declining when there is a stock recession. For example, we mentioned earlier that SushiSwap was valued at almost $3 billion during the prior bull market. But currently, it’s valued at just over $200 million. This means that SushiSwap has lost over 90% of its value. A shrewd value investor might view this as a positive. After all, if SushiSwap is able to get back to its $2.9 billion valuation during the next bull run, that’s an upside of 1,400%.

Real-World Use Cases

It is also important to assess the use cases of the token before investing. Put simply, if there is no identifiable reason for the project to have a token, it might be best to avoid it. Just remember that the most successful crypto tokens have actual utility. In other words, holding and using the tokens offer a measurable benefit. For example, AI tokens are required to buy credits to create AiDoge memes. No other cryptocurrency is accepted. This means $AI tokens have a solid use case. Similarly, ARB is required to pay network fees on the Arbitrum blockchain. While GRT is required to query blockchain data in the Graph ecosystem.

Conclusion

Aribtrum is one of the hottest networks in the crypto space at present, with over 200 ERC-20 tokens already forming a bridge. This facilitates fast, cheap, and scalable transactions – something that Ethereum cannot currently offer. One of the best Arbitrum network tokens to buy today is AiDoge. More than $5.5 million has been raised in the AiDoge presale, with $AI tokens available to buy at a discount. Once the project’s meme generation tool is launched, users will require $AI tokens to buy credits. Therefore, some analysts believe demand for $AI tokens could see unprecedented levels.

FAQs

What tokens are available on Arbitrum?

More than 200 tokens are available on Arbitrum, including AiDoge, Tether, Wrapped Bitcoin, Chainlink, and Uniswap.

Is Arbitrum an ERC20 token?

No, Arbitrum’s native token, ARB, operates on its proprietary network.

What is the best Arbitrum token to buy?

One of the best Arbitrum network tokens to buy is AiDoge, a presale project building an AI-backed meme generation tool.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Sergio Zammit

Sergio Zammit

Eric Huffman

Eric Huffman