Smallest Exchanges: Who Are They?

We’ve all heard about Binance, Bitfinex, Kraken, Coinbase and other big cryptocurrency exchanges. But if they’re the biggest ones, who are the smallest? And what separates the ones everyone has heard of from lesser known ones, keeping smaller exchanges from achieving a similar trading volume?

Cryptonews.com looked at primarily exchanges with less than USD 10,000 in trading volume over 24 hours. As of the time of writing, there are 15 such exchanges listed on Coinmarketcap.com, including those whose total 24-hour trading volume is unknown – only three. All data is from Coinmarketcap.com and updated for September 14th, 2018.

Spoiler alert: the reason is often some sort of specialization.

Small coins and fiat specialization

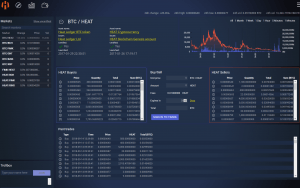

There can be many specializations. The first one in our case means that the exchange’s majority of trading volume is made up from pairings of coins at least below the top 10 line by market cap – often way under that line. One of those small coins is HEAT, with a market cap of less than USD 1.2 million and 830th spot on Coinmarketcap, traded in HEAT/BTC pairings on the HEAT Wallet exchange (volume USD 564).

Svante Lehtinen, the CEO of the exchange, explains that this is also not the only reason: “The HEAT exchange is a distributed asset exchange, meaning that all trades happen on the decentralized HEAT cryptocurrency blockchain, holdings are stored on a client’s side, etc. It’s one of the first ones, launched in 2016. The main reason for poor market penetration is the unwillingness to market it and obtain high user base, as well as developing the technology, and more recently the legal infrastructure to be capable of serving mainstream trading volumes. As we know, this goal is still unreached by any decentralized exchange, which, however, are likely to replace the centralized competitors during the next few years by large.”

The exchange is a victim of malicious actors as well. “The secondary reason for the lack of success and for that not happening is committed, continuous and high effort trolling from unknown parties to slow down market awareness and discredit the aspiring, complex technology,” Lehtinen told us.

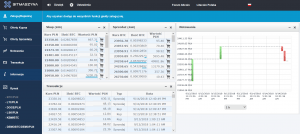

There is also the case of fiat specializations: two exchanges offer Bitcoin and Litecoin in exchange for Polish złoty (PLN): Bitmaszyna (volume of USD 72) and Dgtmarket (volume unknown). However, just the fact that they offer PLN pairings is not a complete explanation, as there are similar exchanges that trade much better. Those are BitBay (volume more than USD 18 million), Coinroom (volume more than USD 7.5 million) and BitMarket (volume around USD 500,000).

A huge difference between these two groups in the case of PLN is that the small exchanges only offer their websites in Polish, while the big ones offer it in English, presumably reaching wider audiences. While the first group can only be used by those who speak Polish, the second is for every English-speaking person – and the fact that they offer PLN pairs only comes as an added bonus. Another possible reason is that the larger exchanges that offer PLN pairings seem simpler to use and just look better. Although that may not be a big factor, it may make a difference in the case of less tech-savvy users.

Language and growth plans

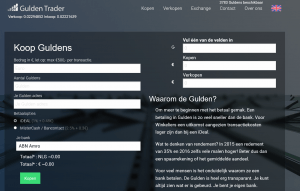

The language is also one feature of the GuldenTrader exchange, a Dutch cryptocurrency exchange that only trades with NLG/EUR pairs and the website is completely in Dutch – but you can change the language to English if you prefer, although navigation can be confusing. Gulden (NLG) is a coin that is ranked 301st on Coinmarketcap.com and has a market cap of slightly above USD 10 million. Its Dutch exchange is even tinier, with a volume of USD 908. However, there might be hope: Rogier Bruggeman of GuldenTrader told us in an emailed statement, “More coins will be added starting November,” also revealing that they are working on a new exchange: “We are almost ready with our first version of the software and will start a marketing campaign next year.”

Another way that GuldenTrader is trying to attract new users is through an incentive program: “Another interesting fact is the opportunity to get internal shares that generate dividend. All trade fees are split between 100.000 shares in dividend. The exchange holds 80% of the shares and the rest are on the market. Al shares on the market are from our traders. Once trade volumes are high enough, we hope to pay dividend each day! The shares on the market can also be traded,” Bruggeman told us, adding: “What can be done to generate more volume? Get more traders that like to see their favorite coin or token listed against euro.”

The other exchanges with small trading volumes have most, if not all, of these characteristics: LEOxChange offers LEOcoin pairings (rank 1089 on the Coinmarketcap.com) and has a total daily trading volume of USD 13. ISX is a tiny Icelandic exchange that offers a single pairing: AUR/ISK (Auroracoin, ranked 586th with the Icelandic Krona). The largest of these exchanges is C-Patex, offering trading with Dogecoin, Reddcoin, EmberCoin (1803rd) or PeepCoin (1026th).

In conclusion, the exchanges are small because they are catering to a small subset of the crypto community, either by interest in tiny coins, fiat currencies or languages. Although some of them might boost their numbers with adding more coins, most of them will probably never see mass market adoption – because the percentage of the population speaking Icelandic is extremely small. However, that changes nothing in the fact that these exchanges will often have a loyal userbase, enough to keep them going – even if under the radar.