Why XRP Price is up 7.5% to $0.3498 – Is it Time to Buy?

During the European session, the XRP price is up 7.5%, bringing nostalgic price action back to the market. More than 4.3 million unique addresses now hold XRP, Ripple’s native token. Despite facing its own set of difficulties and the persistent Crypto Winter that has driven several assets to multi-month lows, the XRP coin has reached this milestone.

Although XRP has not been immune to the attacks, the asset’s recent success is illustrative of its development despite the turbulence. So let’s take a look at a few fundamentals that are driving optimization for Ripple.

XRP Price and Tokenomics

The current XRP price is $0.3487, and the 24-hour trading volume is $1.2 billion. On Saturday, the XRP/USD pair opened the day at $0.3439, placing a high of $0.3576 and a low of $0.3438 level. In the previous 24 hours, XRP has increased by 6.99%.

CoinMarketCap now ranks #7, with a live market cap of $17 billion. There are 49,826,021,773 XRP coins in circulation, with a maximum supply of 100,000,000,000 XRP coins.

US Court Approves Plan for SEC-Ripple Lawsuit

In December 2022, the Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, the developer of the XRP cryptocurrency token, for marketing what the SEC views as unregistered securities.

Defense attorney James K. Filan claims that a New York court has authorized the combined plans of the US Securities and Exchange Commission (SEC) and Ripple Labs, which include timelines for reworking on regulating filling concerns in impending summary judgments.

This step is considered essential to end the protracted legal battle finally.

#XRPCommunity #SECGov v. #Ripple #XRP District Judge Torres has approved the parties' joint scheduling proposal to govern sealing issues relating to the upcoming summary judgment motions. pic.twitter.com/Tm34kZwi2f

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) September 12, 2022

Ripple vs. SEC: Establishing a Shared Understanding

Chris Larsen, a co-founder of Ripple, and Brad Garlinghouse, the company’s CEO, were named defendants. The corporation refutes claims that XRP is security as the sale of stocks and bonds is subject to stringent oversight by government authorities in the United States.

The SEC asked for its planned expert witnesses’ confidentiality in a request filed on September 9. Some have claimed in the past that these sorts of procedures are necessary to prevent the harassment of witnesses.

Ripple strongly disagreed with the idea and insisted that the case be kept open to the public. Defense attorney James K. Filan tweeted that he and the prosecutor may have discovered some common ground.

The SEC and Ripple decided to unseal parts of their respective court files in a joint letter to the presiding US District Judge Analisa Torres, making the case public. However, it’s still likely that some details will need to be omitted.

What’s Next?

SEC and Ripple will have seven days from the filing date to issue updated public summaries. Ripple has declined to negotiate a settlement with the SEC, citing its desire to protect the cryptocurrency industry from excessive government oversight as its justification.

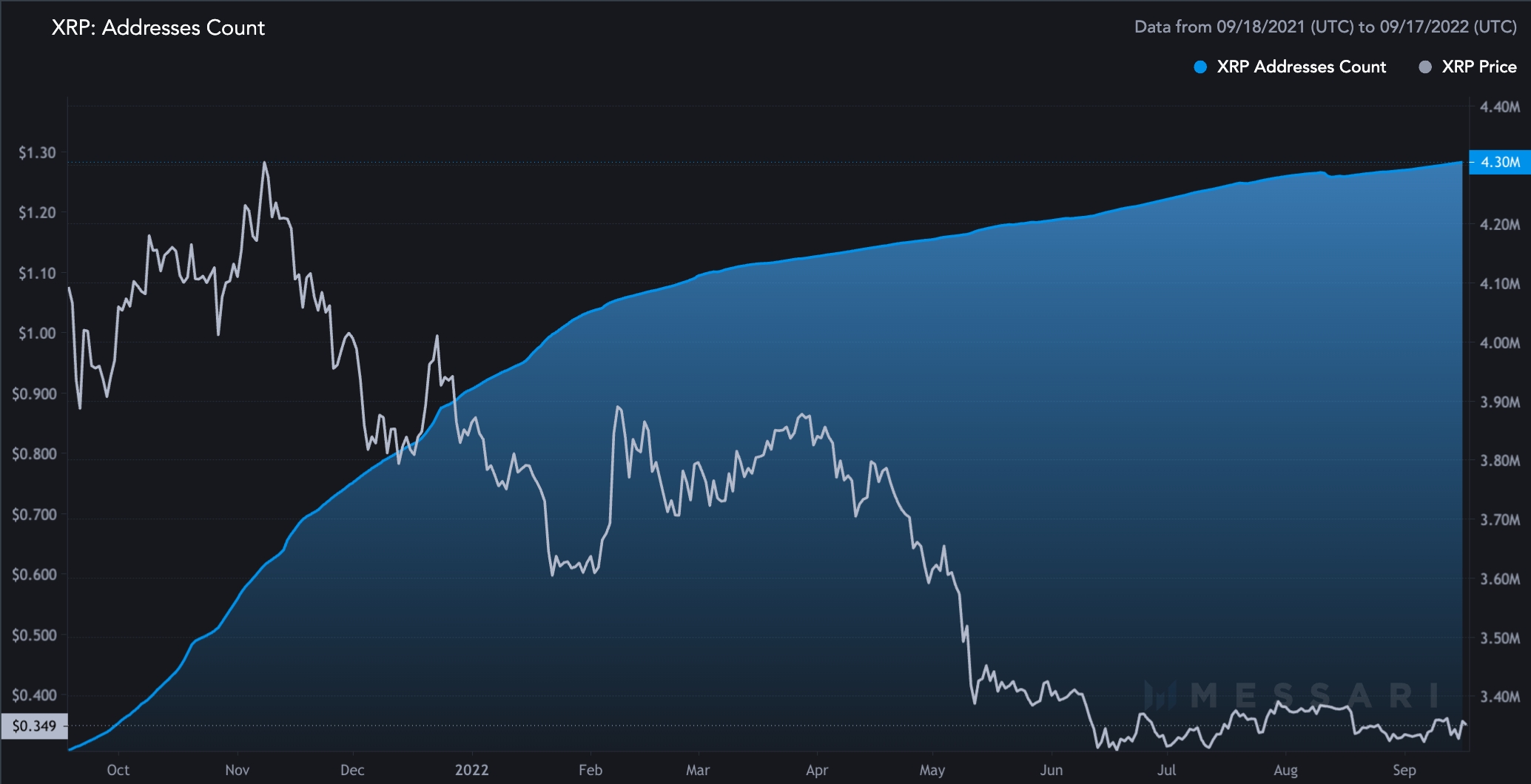

XRP Wallet Addresses Crosses 4.3 Million

As of this writing, the total number of XRP wallet addresses is 4,303,972, as reported by crypto market intelligence firm Messari.

- 301 of these 4.3 million addresses have XRP worth more than $10 million.

- More than $1 million in XRP is hosted by 823 unique IPs.

- In total, 4,299,813 wallets hold XRP worth at least $1.

According to Messari’s statistics, there have been 66,977 XRP addresses in use over the last 24 hours: 52,575 as recipients and 21,429 as senders. As a result, the number of live addresses in the past month has increased by 29%.

| Key Stats: XRP Wallet Addresses | |

| Yesterday | 4,303,972 |

| 7 days ago | 4,298,350 |

| 30 days ago | 4,281,293 |

| 1 year ago | 3,305,578 |

| % change from 7 days ago | 0.13% |

| % change from 30 days ago | 0.53% |

| % change from 1 year ago | 30.20% |

Ripple and Travelex Bank to Launch Crypto-payments in Brazil

Ripple, a provider of cryptocurrency solutions and enterprise blockchain located in the United States, has teamed up with Travelex Bank to roll out cryptocurrency-based payment methods in Brazil.

Our partnership with Travelex Bank marks the start of #crypto-enabled payments solutions in Brazil. 🇧🇷

— Ripple (@Ripple) September 13, 2022

With $780B+ in payments sent into Brazil annually, crypto will facilitate more affordable, faster cross-border payments. See how our solution will help. https://t.co/N8AOqk99kn

Ripple chose Travelex Bank because it is the only bank in Brazil to focus solely on foreign exchange. Ripple’s On-Demand Liquidity (ODL) will be utilized in conjunction with the two companies efforts to serve their consumers better when making international payments.

Through cooperation with Travelex Bank, Ripple introduced its On-Demand Liquidity (ODL) service in Brazil in August 2022. With the ODL service, consumers may make international money transfers quickly, with low settlement costs, and without having to keep any capital on hand in the receiving market.

In addition, Travelex Bank has partnered with Ripple to make it easier for their customers to use a variety of international money transfer and payment services, including remittances, global payments, access to automated teller machines (ATMs), prepaid cards that can be loaded with multiple currencies, and more.

XRP Bounced off Key Support at $0.33

The XRP/USD pair is trading at $0.3481 on the daily timeframe, having formed a symmetrical triangle pattern. This pattern extends strong resistance near the $0.3596 level, which XRP has failed to cross above twice in the last month. This forms a double top pattern, and bulls are likely to struggle if this level of $0.3596 is not breached.

The 50-day exponential moving average (EMA) is also expected to provide strong resistance near $0.3590. Increased XRP demand, on the other hand, could cut through $0.3596 and open up more room for buying until the $0.3915 level.

On the downside, the XRP/USD pair finds immediate support at $0.3215 and $0.3045. Finally, the leading technical indicators such as RSI and MACD are in favor of a buying trend, implying that the bullish bias is likely to prevail, and we may see XRP approaching the $0.3915 level soon.

In addition to XRP, meme coins are receiving attention, particularly the Tamadoge presale, which is ‘Selling Out Fast.’ Check out the Tamadoge price prediction for 2022, 2023, and 2025.