Who Just Moved USD 1 Billion in Bitcoin? (UPDATED)

More than 94,500 bitcoins (USD 1 billion) were on the move Friday morning, causing a ruckus on the crypto Twitter. Such a transaction constitutes one of the largest wealth transfers recorded on the Bitcoin blockchain. According to the transaction tracker Whale Alert, the transfer took place at 03:30:05 UTC. (Updated at 13:00 UTC: updates in bold.)

Naturally, the Cryptoverse began guessing what does such a transaction mean. On most occasions, large bitcoin transfers are performed by exchanges or other custodial services but in this case, it remains unconfirmed who is the sender or the receiver. More than USD 1 billion transaction cost BTC 0.06534852 (USD 700) in fees.

According to economist and trader Alex Krüger, the bitcoins on the move belong to the largest non-exchange owned address.

Others were quick to guess that it might be clients moving their funds to Bakkt Warehouse, a crypto custody service, before the physically-delivered futures trading begins on September 23rd. Previously, Bakkt announced that its warehouse will start accepting clients deposits precisely on September 6th and today they confirmed this.

And, of course, some people attributed the transfer to the self-proclaimed Bitcoin creator Craig Wright, who recently was ordered to pay billions in BTC by the court as the judge rejected his testimony.

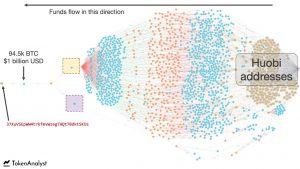

Meanwhile, blockchain intelligence firm TokenAnalyst claims that at least one-third of the coins originate from cryptocurrency exchange Huobi addresses.

At the moment, the receiving address is the fifth largest Bitcoin wallet.

___

Read more: Huobi Confirms That USD 1B Transaction Did Not Include Their Own BTC

___

Whichever the case, it’s unusual to observe such large transactions being conducted in one go. According to the blockchain and smart contracts pioneer Nick Szabo, such large transaction doesn’t come without risks. For example, it makes it highly lucrative for the recipient to reverse the transaction, assuming that they can afford to run a 51% attack for more than 40 days. Although such a course of action is highly unlikely, he still calls it “tempting fate.”

Meanwhile, other crypto Twitter participants dubbed the transaction “a ballsy move.”

At pixel time (12:58 AM UTC), bitcoin trades at c. USD 10,900 and is up by almost 3% in the past 24 hours and by more than 13% in the past week.