UK Witnesses 826% Surge in ‘Buy Bitcoin’ Google Searches

Google searches for ‘buy Bitcoin’ have gone up more than 800% in a single week in the UK, but Google Trends show multiple spikes in interest this quarter alone globally.

Bitcoin has witnessed a massive rise in interest during the last week across the world, but the trend has been noticeably led by the United Kingdom. The country has seen searches for buying bitcoin jump 826% in this short time frame. This is according to data from Cryptogambling.tv, as reported by Cointelegraph.

“The remarkable surge in ‘buy Bitcoin’ searches in the UK, combined with the cryptocurrency’s resurgence, underscores the growing interest and potential impact of traditional financial institutions’ involvement in the world of digital assets,” a spokesperson from Cryptogambling.tv was quoted as saying.

Google Trends data show that ‘buy Bitcoin’ today hit another value of 100, which is the peak popularity for the term in a particular time frame. Zooming further out, the spike in searches has been noticeable, starting over the last weekend.

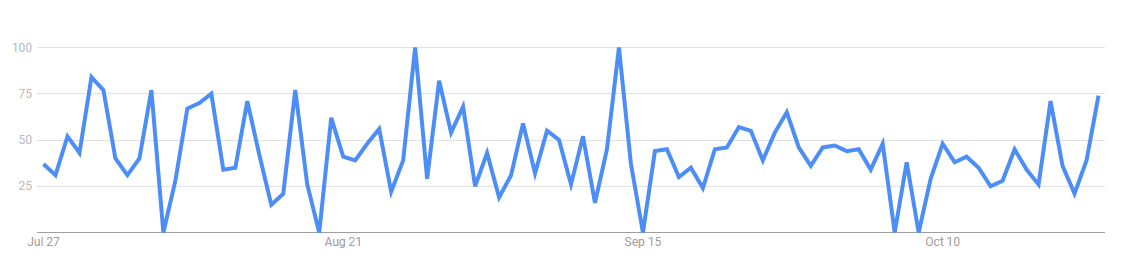

But notably, it is not an isolated event. There have been several significant spikes in the UK over the last month alone. If we zoom out to the 90-day range, allowing more data into the chart, we find even higher spikes in late August and mid-September.

‘Buy Bitcoin’ chart, UK, 90 days

The situation, however, is slightly different when observing global searches for the same term. Let’s focus on the 7-day range first: while the UK saw its highest point just today, worldwide, the trend went downwards over the past couple of days, reaching a value of just 29 today. Its 100 – the highest popularity seen in this time period – was hit on Tuesday.

Now zooming out to 30 days, the situation is a lot less ‘spikey’ – it is relatively stable across this time frame. October 20 and 23 were the days when people worldwide searched ‘buy Bitcoin’ the most in this time period, with values of 100 and 99, respectively. The lowest was, interestingly, on October 22, with a value of 72.

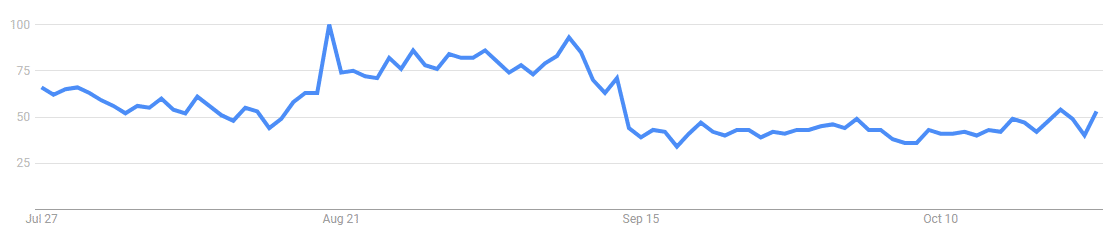

Over the 90 days, late August was the time when people globally were the most interested in this search term, followed by early September – similar to what the UK saw – while they were the least interested in late September and early October.

‘Buy Bitcoin’ chart, worldwide, 90 days

Searches for ‘should i buy bitcoin now’ spiked worldwide in the last week, reaching their highest on October 25. Zooming out to observe the entire last year, this spike was just a third of the interest shown in mid-November 2022. This should not take away from the fact that this latest increase was a massive one compared to the week prior, jumping from 0 to 100, literally.

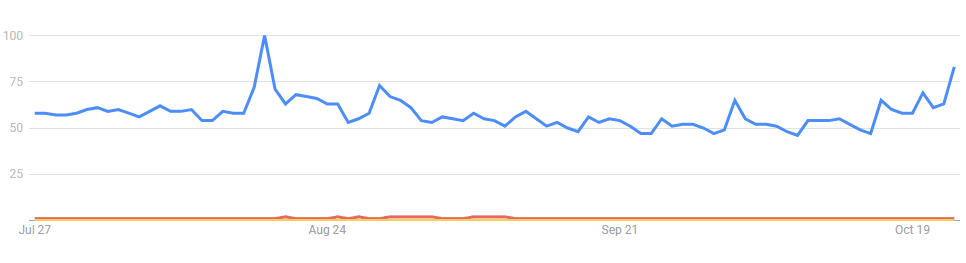

‘Bitcoin’ on its own has been by far more searched term than the two above. This week’s ‘bitcoin’ searches were the highest both for the 7-day and 30-day periods.

Over the past 90 days, this week’s searches of ‘bitcoin’ were the second-highest, behind mid-August, while November 2022 holds the highest spot over the 12-month period.

‘Bitcoin’ (blue), ‘buy Bitcoin’ (red), and ‘should i buy bitcoin’ (yellow) chart, worldwide, 90 days

This latest global spike in the renewed interest in crypto and purchasing BTC naturally coincided with the latest rally.

At the time of writing, on Friday morning (9:40 UTC), BTC traded at $34,125, down 1% in a day. It was up 15% in a week, and double that – 30% – over the past month.

It began its rally over the last weekend and reached just below $35,000 on Wednesday, according to CoinGecko.

BTC 7-day price chart:

Another factor in the latest rally is the ongoing discussion surrounding bitcoin spot exchange-traded funds (ETFs) and the potential positive effect it would have on the world’s first crypto.