Solana Week’s Worst Performer in Top 100 After Network Restart

The smart contract platform Solana’s native SOL token stood out as today’s worst performer among the top 10 coins by market capitalization, as well as the week’s worst in the top 100.

The weak performance comes after what has been a rough week for Solana, with a complete network outage and subsequent restart.

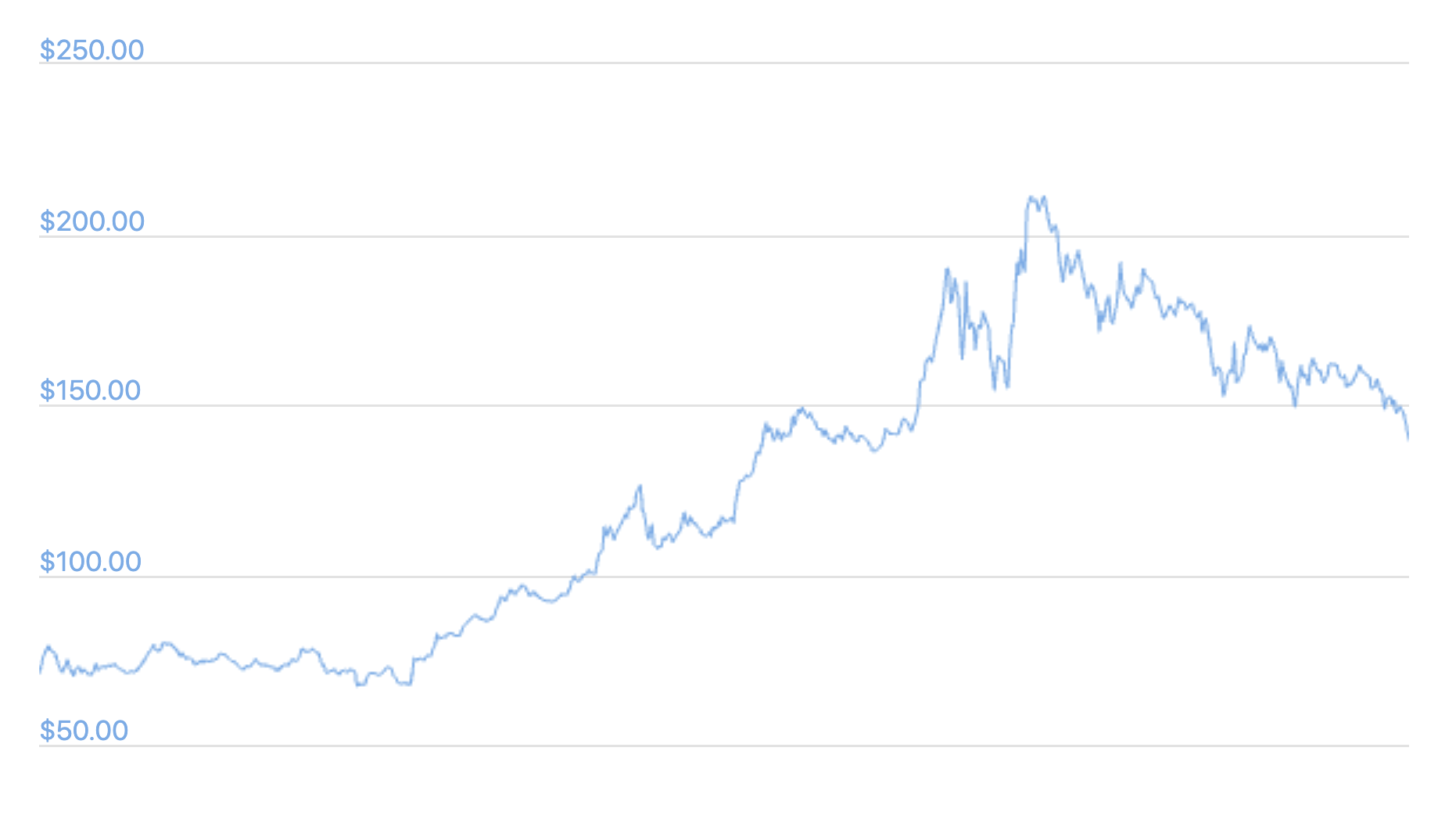

At 09:53 UTC, the SOL token, ranked 7th by market capitalization, was down by nearly 13% over the past 24 hours, trading at a price of almost USD 140.

For the past seven days, the coin has now fallen by nearly 26%, the most among the 100 most valuable cryptoassets by market capitalization, per CoinGecko’s ranking.

The drop over the past week coincides with the major network outage that Solana experienced on Tuesday after a massive increase in transaction load, which reportedly “flooded” the transaction processing queue.

Following the outage, Solana stakeholders moved to perform a restart of the network, which the Solana Foundation on Wednesday said should restore “full functionality” within a few hours.

Almost a day later, the foundation said on Twitter again that “several mitigations” had been deployed on the network by engineers to “increase network resiliency during periods of extreme transaction load.” It added that “a detailed post mortem” report will be published in the coming weeks “as further fixes are deployed.”

But with the network now up and running again, SOL’s price has continued to suffer in the market, with the tokens of both of the two main competing platforms Ethereum (ETH) and Cardano (ADA), ranked as the second and third most valuable cryptoassets, by far outperforming SOL over the past week.

At press time, ETH was up 2.4% for the past seven days, while ADA was down by 4.7% over the same period, trading at USD 3,517 and USD 2.40, respectively.

Commenting on the network outage and subsequent restart in the Solana subreddit, some Solana community members took the opportunity to question the decentralization of the network, given how one Solana stakeholder described that validators decided to “stop our nodes” and wait for “Solana Foundation’s instructions” on what to do next.

“So a group of basically randos who became validators can meet in private and bring the whole thing to a screeching halt?,” one Reddit user asked, while another countered that it’s still “early days and new tech.”

“It’s awesome that the requestors were able to test the environment to this level of stress,” the same user added.

Meanwhile, on September 16, the Solana Status Twitter account announced that DYN, “the DNS provider of explorer.solana.com, and several Solana.com domains & endpoints, is currently experiencing an outage.” This does not impact the blockchain, they said, while the block explorer remains accessible at solscan.io.

Solana and its native SOL token have seen a rapid growth this year, with SOL rising more than 5,374% on a 1-year basis.

The Solana platform has also seen exponential growth in the total value locked (TVL) in decentralized finance (DeFi) projects on the platform, with a rise from USD 1.22bn on August 1, to USD 9.25bn as of today, per DeFi tracking site Defi llama.

____

Learn more:

– Solana Full Service Expected Soon, SOL Recovering

– Ethereum Alternative Solana Almost Doubles In a Week, Flips XRP

– Ethereum, Solana, Polygon & Co Form A New Hot Market Of Blockchains

– Power Ledger Migrates to Solana But Keeps Its Token On Ethereum