Polygon MATIC Price Prediction – zkEVM Coming on March 27th So Expect Accumulation at These Levels

Ethereum’s leading layer 2 blockchain, Polygon is struggling with a stubborn bearish wave since early last week. MATIC price is down 0.9% on the day to exchange hands at $1.25 at the time of writing, while bulls work around the clock to prevent losses from extending below support established at $1.20.

Most of the applied technical indicators could favor a prolonged trend reversal, as we will discover with analysis from both technical and macro perspectives. Meanwhile, upholding support at $1.25 would be the safest bet for bulls to push for the resumption of the uptrend to $1.60 and $2.00, respectively.

Can Polygon’s zkEVM Launch On March 25 Propel MATIC Price Bull Market

The Polygon ecosystem has from inception committed to providing “seamless scaling for Ethereum,” the biggest and oldest smart contracts network in the industry. The launch of the zkEVM testnet in 2022 raised Polygon’s status as the number one layer 2 solutions provider for Ethereum.

According to the latest announcement from the development team, “now it’s time to truly start the revolution to unlock mass adoption and the full potential of Web3.” Following months of pushing the zkEVM to extreme limits, “Polygon Labs is pleased to announce the launch of Polygon zkEVM Mainnet Beta,” which will take place on 27 March 2023 and mark the beginning of a brighter future.

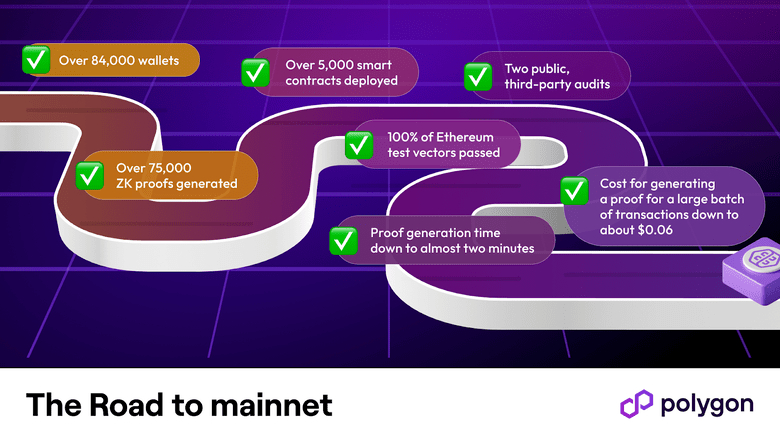

The zkEVM testnet is handing over the button to the Polygon mainnet following the achievement of various key milestones, including the creation of more than 84,000 wallets, 300,000 produced blocks, 75,000 ZK proofs generated, and the deployment of more than 5,000 smart contracts among others.

Polygon Labs reckons that “zkEVM Testnets have brought unprecedented interest and growth from across the entire ecosystem. Along the way, Polygon zkEVM has only gotten better – faster, cheaper, and more secure.” More details regarding the mainnet beta would be released in the coming few weeks with the team maintaining that security as the highest priority.

MATIC Price Is Bleeding but Consider This Bullish Outcome

Polygon has come under heavy selling pressure from the time it topped $1.569. As mentioned earlier, these selling activities are not unique to MATIC, considering Bitcoin is down 4.38% and Ethereum 3.34% in seven days. Experts attribute the market’s downturn to mounting regulatory pressure, especially in the United States.

Meanwhile, support for MATIC price is expected at $1.20 now that the token slipped below a tentative buyer congestion zone around $1.30 – highlighted by the upper rising trend line on the daily chart. The 50-day Exponential Moving Average (EMA) (line in red) at $1.189 is not too far off and may still contribute to the expected resumption of Polygon’s uptrend.

If push comes to shove and MATIC price drops below the 50-day EMA, bulls may have to look down to the 200-day EMA (line in purple) holding the ground at $1.00 for support. Immediate recovery is highly unlikely due to a vivid sell signal as presented by the Moving Average Convergence Divergence (MACD) indicator.

Overhead pressure would keep increasing on top of Polygon as long as the MACD line in blue holds below the signal line in red. Furthermore, the momentum’s direction toward the mean line confirms the bearish grip on MATIC price.

Nevertheless, the launch of Polygon zkEVM on 25 March could function as a catalyst for a bigger upswing targeting highs above $2.00. It would not be surprising to see MATIC price boosted to close the gap to $5.00.

Polygon Alternatives To Buy Today

If you’re looking for other high-potential crypto projects alongside MATIC, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Related Articles:

- Bitcoin Price and Ethereum Prediction: BTC Fails to Break Above $23,725, What’s Next?

- Shiba Inu Price Prediction as $300 Million Trading Volume Comes In – Is It Time to Buy?

- The IMF and the U.S. Support India’s Plan to Coordinate Global Crypto Regulation at G20