Pepe Price Prediction as PEPE Tumbles 12% – Time to Buy the Dip?

The Pepe price has fallen by 12% in the past 24 hours, with the meme token slipping to $0.00000124 as the wider market nurses a 2% loss today.

PEPE is now down by 14% in the last week and by 11% in the past fortnight, yet the coin has actually gained by 10% in a month.

It’s also up by more than 2,000% compared to its all-time low of $0.000000055142 (recorded in mid-April), and with the coin remaining popular as a vehicle for whales, its fall today may provide a good buying-the-dip opportunity.

Pepe Price Prediction as PEPE Tumbles 12% – Time to Buy the Dip?

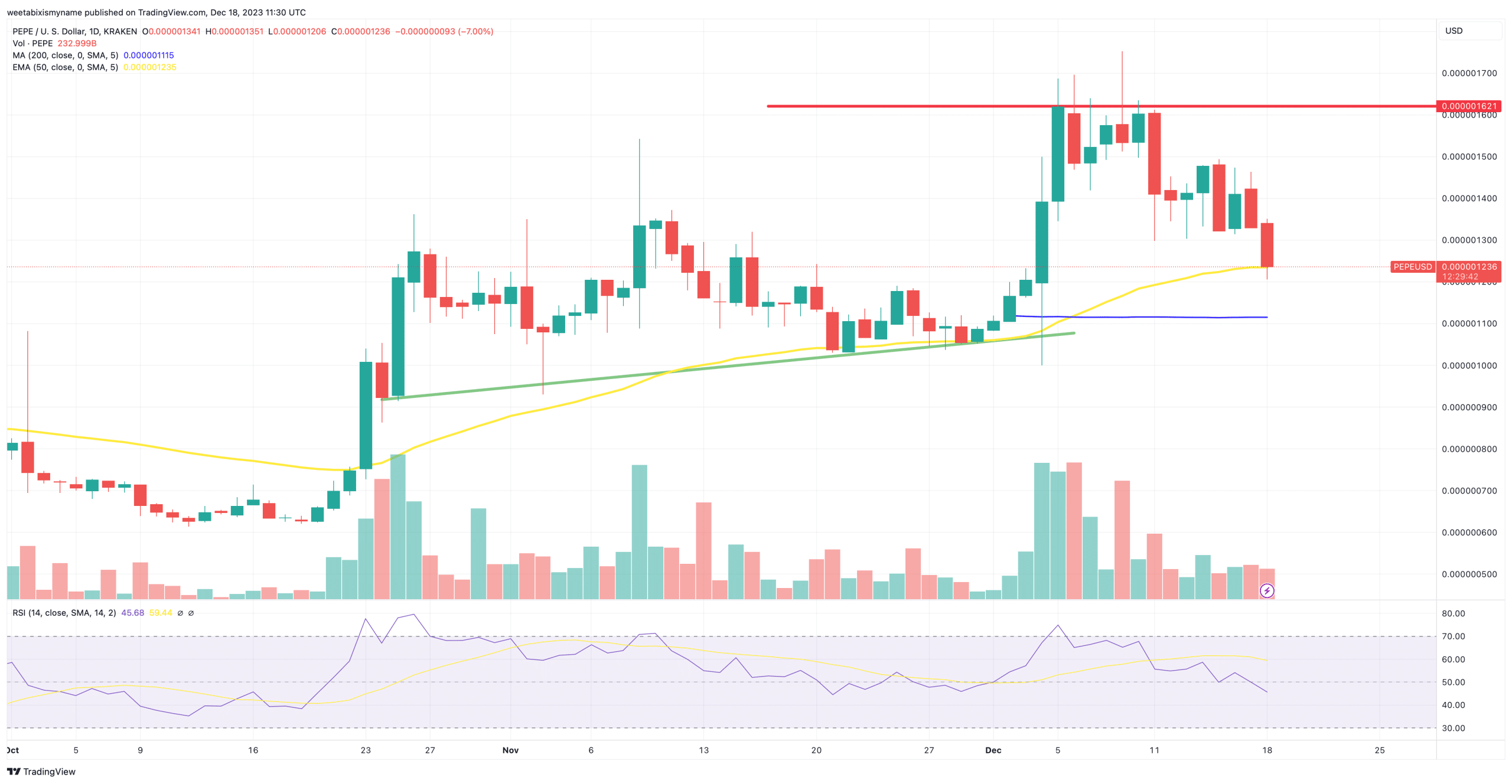

PEPE has lost a serious amount of momentum in the past few days, with its indicators suggesting that it may be in the middle of a medium-term correction.

Most notably, its relative strength index (purple) has dropped below 50 today, having stood as high as 75 at the start of the month.

In addition, its 30-day average (yellow) has flattened out in recent days and looks ready to drop towards or below its 200-day (blue), meaning that a protracted fall may be on the cards.

A key level to watch is about $0.00000110, with this support level (green) vital if PEPE is to avoid further sustained losses.

It’s in this context that its declining trading volume, at around $70 million today, is concerning suggesting a big fall in market interest.

Having said that, PEPE has witnessed plenty of ups and downs this year, with the coin quickly becoming a favorite among manipulative whales since its launch in early April.

There hasn’t been much whale activity as of late, although Justin Sun did withdraw around $76,000 in PEPE a couple of days ago.

Justin Sun withdrew 127,510 $LINK($1.85M), 202,385 $STORJ($200K), 53.68B $PEPE($76.7K) and 13,904 $DYDX($43K) from #Binance 1 hour ago.https://t.co/gt2NZlnGc1 pic.twitter.com/akK7X2huVI

— Lookonchain (@lookonchain) December 16, 2023

This points to continue interest in PEPE, which may rise again strongly once the wider market enjoys another push.

Such a push is likely to arrive in the first or second week of January, when the SEC is due to make a decision on several Bitcoin ETFs.

The SEC’s approval of Bitcoin ETFs could spark a massive bull run, which the more speculative coins such as PEPE may benefit from substantially.

For this reason, traders can expect the Pepe price to rise in the first few weeks and months of the year, even if it will remain vulnerable to sudden dumps.

It could reach $0.0000030 by the end of January.

New Altcoins with Strong Fundamentals

Because PEPE remains something of an unpredictable coin, some traders may prefer to look elsewhere for above-average surges.

Presales currently provide one good source of such surges, with the best presale coins often building strong momentum before listing on exchanges.

One coin doing just this right now is Bitcoin Minetrix (BTCMTX), an Ethereum-based stake-to-mine platform that has raised more than $5.4 million in its ongoing token offering.

#BitcoinMinetrix seeks to revolutionize #Bitcoin Cloud Mining by deploying a Stake-to-Mine system driven by smart contracts. 🚀

Envisioning a secure, effective ecosystem across #Blockchains, overcoming the limitations of typical cloud mining. 🌍 pic.twitter.com/9bC9yL9QUE

— Bitcoinminetrix (@bitcoinminetrix) December 17, 2023

Investors are getting excited about Bitcoin Minetrix because the platform looks set to widen and democratize access to Bitcoin mining.

It will do this by enabling users to stake its BTCMTX token, which will earn them mining credits in return.

Users can then spend these credits on Bitcoin hashing power, which in turn will earn them newly mined BTC.

And by staking they will also earn fresh BTCMTX, meaning that Bitcoin Minetrix could end up being a highly profitable platform.

This seems to be what investors are thinking, given how many have waded into the BM presale.

#Tether freezes 41 wallets linked to OFAC's SDN List, taking precautionary measures. 🔒

CEO Paolo Ardoino emphasizes a safer #Stablecoin ecosystem.

How do you think such actions impact the stability and trust in stablecoin technology?#BitcoinMinetrix attains another… pic.twitter.com/EOIjneI5f3

— Bitcoinminetrix (@bitcoinminetrix) December 12, 2023

The sale is currently entering its final phases, but new investors can still join by going to the Bitcoin Minetrix official website.

BTCMTX currently costs $0.0123 per token, a price which may end up seeming like a steal once the promising new token lists on exchanges in January.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.