More People Seem Interested in Buying Bitcoin (and Ethereum) Than Selling It

It would seem that people are much more interested these days in potentially owning (more) bitcoin (BTC), than they are in selling what they have.

As we’re all well aware off, Google practically means ‘search engine’ at this point, so Google Trends can provide an interesting insight into what it is that people are curious about these days, how much, and how much in relation to the previously recorded curiosity on that matter. And the matter we’re interested in this time is the number one cryptocurrency in the world.

This is particularly intriguing in light of the latest rally bitcoin has been riding on since October, reaching the previous all-time high at the end of November, and even surpassing USD 23,000 just today and then correcting lower. At 8:31 UTC Thursday morning, BTC was trading at USD 22,666, having gone up nearly 17% in a day and 23% in a week.

The most interesting finding on Google Trends is that the query ‘should I buy bitcoin’ beats the ‘should I sell bitcoin’ – by a lot. The spike in both of these terms can be clearly seen in the past day, for the former in particular. The interest in buying bitcoin reached a value of 100, which is its peak popularity in that given time frame (one week in this case), on the evening of December 16, continuing to spike several more times since. In comparison, the interest in selling the coin saw its highest value of just 34 earlier today.

The interest in selling bitcoin was strongest in South Africa, the US, Canada, the UK, and Australia. Meanwhile, people were the most curious about potentially purchasing bitcoin in most of those same countries, with Singapore taking Canada’s place.

Expanding the time frame to 5 years, we see ‘should I buy bitcoin’ reaching its peak of 100 in December 2017, during the previous major bull run. Back then too, people were a lot less curious about selling it in the midst of a rally. Compared to the value of 100 that the interest in buying the coin got, ‘should I sell bitcoin’ was sitting at 18 as its highest point.

Interestingly, compared to that massive peak in interest, the surge we’re seeing today is just 19 for ‘should I buy bitcoin’ and 4 for ‘should I sell bitcoin.’ As industry figures argue, today, a lot more people already know what bitcoin is and how it can be purchased.

This is not all the good news for the number one coin by market capitalization. The searches for just ‘bitcoin’ have jumped in the last day as well. They continue to stand quite high compared to the days leading to this major price appreciation.

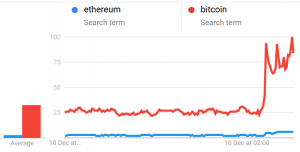

Furthermore, we can compare it to the interest in number two coin by market capitalization, ethereum (ETH). There is no doubt that the searches for the term ‘ethereum’ surged today, still flying high. But when the two coins are compared, there is quite a difference to be noted. Going back to that convenient value of 100 as the peak, in the time frame of 7 days, the interest in ethereum reached the average value of 3, and bitcoin of 34 – suggesting a much higher interest in BTC.

What’s particularly curious is that in the past day, when the peak for ‘ethereum’ alone is easily noticeable, it gets lost when compared to the massive number of searches for ‘bitcoin’ – the rise is barely visible. To put it in numbers, compared to bitcoin’s value of 100, ethereum reached 6.

The same can’t be said for the number 3 coin, XRP. While the searches for bitcoin tower over those for XRP, searches between ‘ethereum’ and ‘xrp’ are much closer in number, with the interest in ETH commonly taking the lead. But today, XRP stands taller. Furthermore, unlike BTC’s and ETH’s ‘lost peaks,’ XRP’s jump this week doesn’t pale in comparison to its 2017 all-time-high. As a matter of fact, XRP reached more than half the value of its greatest peak in interest.

Meanwhile, people who’ve been very interested in ethereum made their searches from North Macedonia, Slovenia, Turkey, Nigeria, and Canada the most, respectively. The highest number of searches about bitcoin were made from Nigeria, followed by South Africa, Switzerland, Austria, and the Netherlands. Both coins have seen great interest across the world, including Australia, the US, the UK, India, Russia, much of Europe, Asia, and South America.

Additionally, between the terms ‘crypto’ and ‘cryptocurrency’, the former seems to have been a lot more popular in general, but both have spiked today. That said, this spike, once again, can’t even be compared to the giant that was the jump seen at the end of 2017 / beginning of 2018.

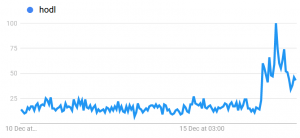

The same scenario has played out for the popular term ‘hodl.’ While seeing quite a spike on December 16, dropping somewhat today, that jump is unnoticeable when compared to the one in 2017/2018.

____

Learn more:

Global Mainstream Media Fills its Boots with Bitcoin News as Prices Rocket

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems