MicroStrategy’s BTC Holdings Flip Green as Bitcoin Climbs to $30,000 – Will Billionaire Michael Saylor Keep Buying?

Popular Bitcoin advocate firm MicroStrategy is witnessing a remarkable increase in the value of its extensive Bitcoin holdings, which exceed 150,000 BTC. This surge in value is due to the recent resurgence of the leading cryptocurrency.

Bitcoin has surged above the $30,000 price peg with an eye for the $31,000 range as the buying frenzy continues to grip the crypto market.

Currently, MicroStrategy’s Bitcoin holdings, totaling 158,245 BTC, are valued at an impressive $4.68 billion. The firm has been actively accumulating Bitcoin, with most fpurchases made at an average price of $29,870 per BTC.

With the digital asset’s recent surge, MicroStrategy has realized a paper profit of $132 million on its initial investment.

The business intelligence software company, chaired by popular Bitcoin evangelist Michael Saylor, has made good on its promises to continue stockpiling the decentralized currency since its first purchase in August 2020.

In 2023, the company significantly expanded its Bitcoin holdings, notably adding 5,445 Bitcoin assets to its portfolio in September at a cost of $147.5 million.

This move occurred when Bitcoin faced challenges in surpassing the $29,000 threshold due to broader financial market fluctuations.

For now, MicroStrategy has no intentions of liquidating its profits. The company’s Chairman and co-founder recently shared an image on X (formerly Twitter) bearing the message “Bitcoin is Stronger.”

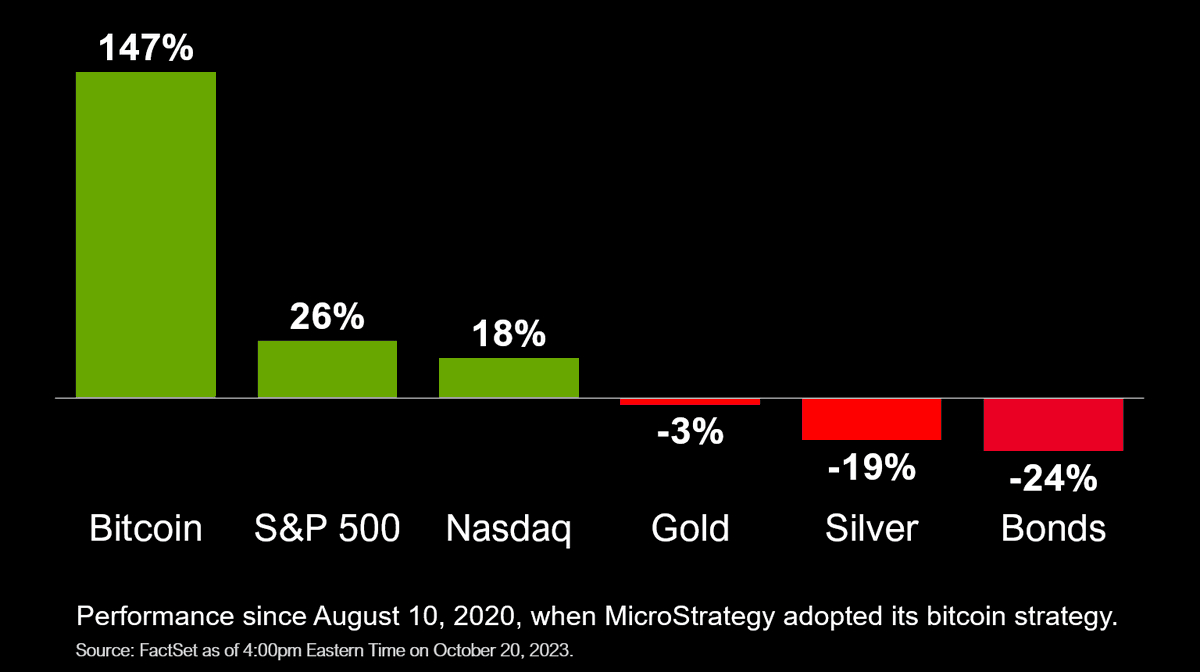

In the image, Saylor illustrated the performance of Bitcoin in comparison to more traditional investment assets such as the S&P 500, Nasdaq, Gold, Silver, and Bonds. This visual comparison encompassed the period since the company’s initial Bitcoin purchase in 2020.

Strong Tailwinds Expected?

In 2021, Bitcoin etched its place in financial market history after its impressive performance. The 14-year-old decentralized currency soared to an outrageous height, with 1 BTC trading at $69,040 in late November 2021.

However, since then, the crypto asset has grappled with challenges in regaining its previous glory, hampered by broader market issues and disruptions in blockchain protocols.

Despite several attempts, it has struggled to breach the $30,000 threshold, with its last significant effort recorded in May 2022.

At press time, Bitcoin is trading at the $30,925.28 price peg, indicating a 3.82% increase in the last 24 hours. Its seven-day performance is also in the green, with the foremost crypto asset surging 10%.

The ripple effects of this bullish momentum are reverberating across the cryptocurrency market, pushing its total valuation to $1.17 trillion, following an addition of over $12 billion.

However, the chances of Bitcoin retaining this momentum are brought to the fore once other technical analytical tools are examined.

Firstly, Bitcoin is trading above its 200-day smooth moving average (SMA) price of $28,320, showing a strong bullish wave building.

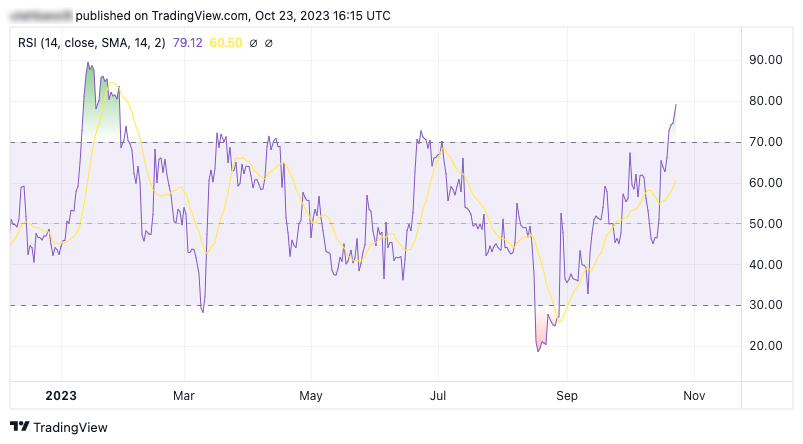

However, its relative strength index (RSI) hints at a potential downtrend. The asset’s current RSI figure stands at 78.98, meaning it is overbought.

An overbought RSI often foreshadows a forthcoming downtrend, implying that Bitcoin’s price may undergo consolidation before attempting another bull run.

If this happens, the asset could dip to its 50-day SMA price of $27,163.65, which would see it shed about 12% from its current value.

However, in the event the bull run is sustained, Bitcoin will likely break above the $31,500 psychological threshold but might find it difficult to crack the $32,000 resistance level.

Michael’s Bitcoin Fervency Set to Pay Off

Saylor has been a prominent Bitcoin advocate since he pivoted his software company into crypto in 2020.

The tech entrepreneur remains fervently committed to his belief that Bitcoin is the solution to government-induced inflation and a means to restore true purchasing power to the public.

Saylor’s unwavering promotion of Bitcoin appears to yield positive results, as more legacy-backed companies in tech and finance sectors are directing their focus toward the crypto space.

Over the past three months, several asset management firms, including BlackRock, BitWise, and VanEck, have submitted applications for spot Bitcoin exchange-traded funds (ETFs).

While the US Securities and Exchange Commission (SEC) is proceeding cautiously in terms of regulatory approval, there is a growing belief that 2024 could mark a significant turning point for Bitcoin’s integration into the mainstream financial landscape.

Bloomberg analysts Eric Balchunas and James Seyffart have recently posited that a spot Bitcoin ETF approval from the SEC is expected within the next 80 days.