MakerDAO to Move $1.6 Billion USDC into Coinbase Custody – Here’s What You Need to Know

MakerDAO (MKR), the decentralized organization that manages the stablecoin DAI, will move $1.6bn of its USD Coin (USDC) reserves to Coinbase to earn a yield of up to 1.5%.

The proposal to have Coinbase custody part of the MakerDAO treasury was passed by the MakerDAO community on Monday, with 75% of the votes being in favor of the move. The $1.6bn represents one-third of MakerDAO’s treasury – the reserve that allows users to deposit collateral in exchange for being issued the DAI stablecoin.

In the proposal, known as MIP81, Coinbase is described as “a longstanding partner” of Maker, and “an established, reputable, and regulated company.”

“This MIP outlines a clear path to providing up to 1.5% APY on USDC in the form of USDC Rewards and optimizing liquidity at zero cost to, and industry-leading security for, Maker,” the proposal said.

According to the proposal, Maker will not pay any custody fees to Coinbase, and the community will need to vote again for an extension if funds are to be held in Coinbase’s custody after a trial period ends at the end of 2022.

The next step for now will be for MakerDAO to set up a new “legal entity” that can officially deposit money into Coinbase’s Institutional Rewards program on behalf of the DAO, a tweet from MakerDAO explained.

Next step.

— Maker (@MakerDAO) October 24, 2022

Following MIP81 approval, Growth, CES, or Strategic Finance Core Unit will post a Signal Request that has to be approved by Maker Governance to onboard a legal entity on behalf of MakerDAO into @Coinbase's Institutional Rewards program.

5/

For Coinbase, the passing of the proposal marks a major achievement, with the amount of capital it custodies for clients now almost doubling from the current $1.7bn, per a blog post from the company.

“By holding USDC in custody in exchange for monthly rewards, MakerDAO will receive additional revenue to the treasury, providing flexibility that it could use to fund operations or provide incentives to attract new users,” the exchange further commented in the blog post.

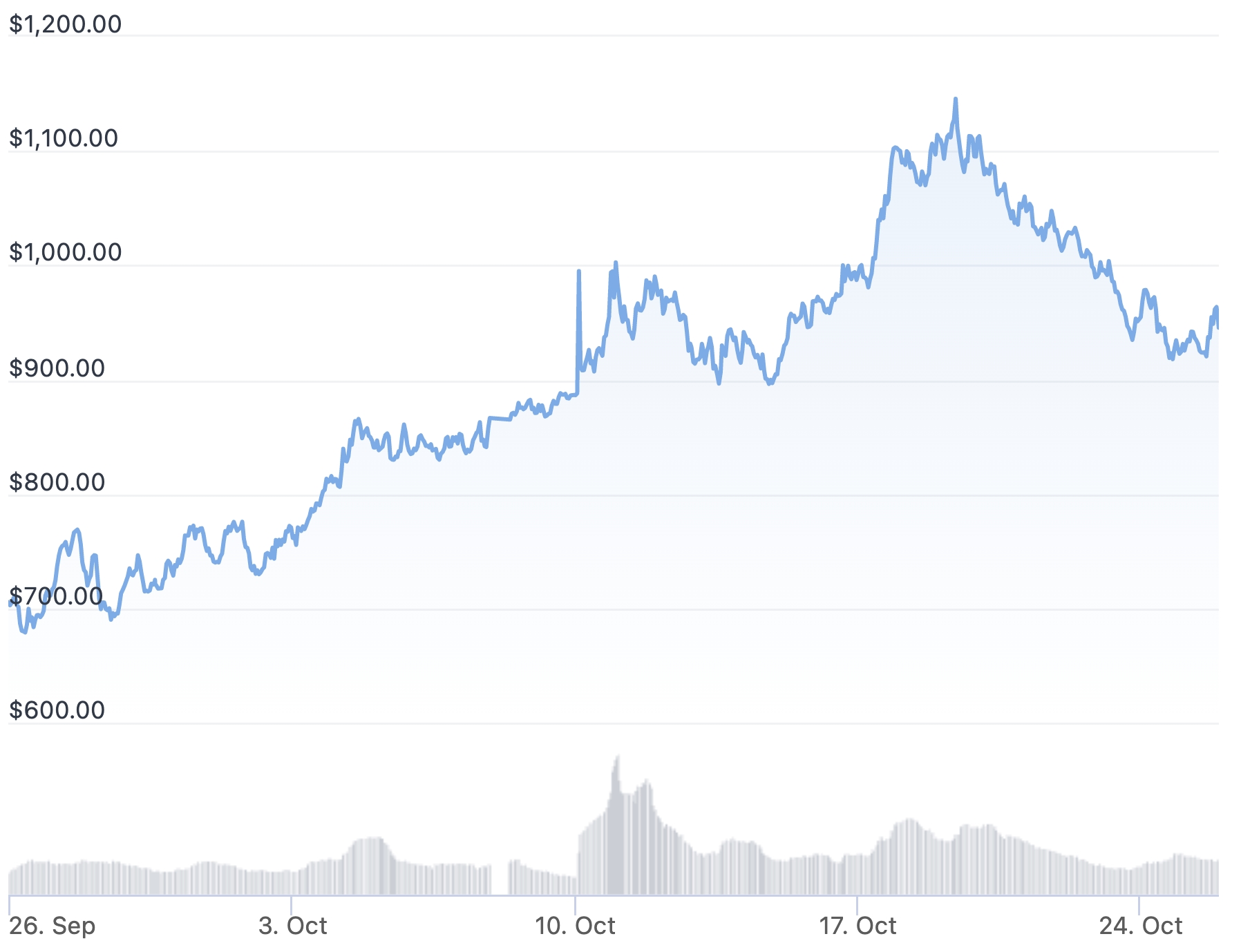

The news that MakerDAO will now earn additional yield on its reserves did not appear to make a major impact on the price of its governance token MKR, which traded down along with the broader market on Monday. As of Tuesday night UTC time, however, the token had recovered some of its losses from yesterday, trading up 2.2% for the past 24 hours to just under $950.

USDC is the second-largest stablecoin in the crypto market with a market capitalization of $43.5bn. By comparison, the most popular stablecoin, Tether (USDT), has a market capitalization of nearly $68bn, per data from CoinGecko.