Look For Trading Ideas Among Competing Ethereum and Cosmos DeFi Tokens – Analyst

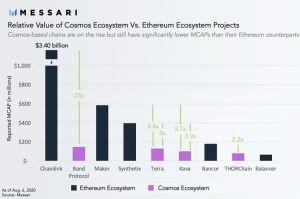

With a growing decentralized finance (DeFi) ecosystem appearing around the Cosmos (ATOM) network, attractive investment opportunities exist based on valuation differences with Ethereum (ETH)-based DeFi tokens, according to an analyst at crypto research firm Messari, Ryan Watkins.

In a recent Twitter thread, he said that “many of the best investments over the past year” have been investment plays that target valuation differences between the lesser-known tokens in the Cosmos ecosystem, and their competitors on the Ethereum network.

According to Watkins, these plays have included tokens like aave (LEND) versus compound (COMP), kyber network (KNC) versus 0x (ZRX), synthetix (SNX) versus maker (MKR), and bancor (BNT) versus other automated market makers (AMMs). And although these have already presented good trading opportunities over the past year, Watkins added that he expects “many more to play out this way” in the future as well.

Following up on these potential trade ideas, however, Watkins also stressed that there may be good reasons for why one project has a lower valuation than another project that appears to be tackling the same problem:

“Lower relative valuations do not necessarily imply undervaluation,” the crypto researcher said, although he added that in an “inefficient market like crypto,” these differences in valuations “could imply mispricings.”

Watkins further pointed to three projects within the Cosmos ecosystem – including terra (LUNA), kava (KAVA), band protocol (BAND), and thorchain (RUNE) – which he argued could all have potential as their valuations attempt to catch up with those of similar projects on Ethereum.

Among these DeFi tokens, Watkins said Terra’s LUNA token is particularly interesting because its blockchain “generates the highest transaction fees of any blockchain outside Bitcoin and Ethereum,” largely thanks to its payments app Chai, which is popular in South Korea.

Despite the popularity of the app, Terra trades at a “significant discount” to other payment companies, Watkins said.

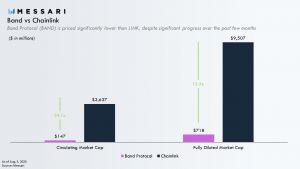

Lastly, as another example of a token that may have “room to go,” Watkins pointed to the new decentralized oracle platform Band Protocol, which is still valued far lower than the competing Ethereum-based oracle service Chainlink (LINK).

“Of course the key difference between Chainlink and Band is that Chainlink is live and operational, while Band is still rolling out its mainnet,” the researcher said, adding that “it could suggest there’s still room to go.”

___

Learn more:

Unchained DeFi Unicorns – The Next Wave of Billion Dollar Companies

Ethereum Saved by DeFi in July, Tron Scores in All Metrics – DappRadar

Ethereum Won’t Give Its USD 4bn DeFi Throne to EOS, Tron Anytime Soon