Kin Price Nosedives After Operator Announced the Shut Down of Kik App

Kin prices have been sent tumbling after the coin’s operator announced it will shut down its Kik messaging app.

In a blog post, Kik Interactive‘s CEO Ted Livingston stated that regulatory pressure from the American Securities and Exchange Commission (SEC) had sparked the decision.

However, the CEO did not specify when the app will be closed, only adding that Kin has over 2,000,000 monthly active earners, and 600,000 monthly active spenders.

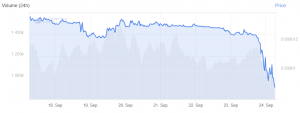

Kin prices took a sharp turn downwards after the news broke, with its 24-hour price rate depreciating by almost 25% after what had been a mostly steady and stable week for the token, ranked 381st by market capitalization.

Livingston wrote, as a justification of Kik Interactive’s decision,

“After 18 months of working with the SEC, the only choice they gave us was to either label Kin a security or fight them in court. Becoming a security would kill the usability of any cryptocurrency and set a dangerous precedent for the industry.”

The CEO stated that the SEC is “working to characterize almost all cryptocurrencies as securities” – thus forcing token operators to abide by American securities laws that date back almost a century.

In a scathing attack on the regulator, Livingston wrote that the SEC had taken his company’s quotes “out of context to manipulate the public to view us as bad actors,” and “pressured exchanges not to list Kin.” He also alleged that the SEC had used underhand tactics, “drawing out a long and expensive process to drain [the company’s] resources.”

The company stated that in addition to shutting down the Kik app, it would also be reducing its staff to just 19 – with 70 employees working on the Kin blockchain project in Tel Aviv, Israel, handed layoff notices yesterday, per media outlet Calcalist Tech.

As reported in January 2018, Kik Interactive, intends to fight the SEC in court over the categorization of their token as a security, arguing that “the tokens represent a new kind of asset that shouldn’t be subject to the same rules as stock or bond offerings.” A legal battle like this could help determine the scope of the SEC’s authority over the ICO (initial coin offering) market and set legal precedent for future cases.

In May, the Kin Foundation, developer of the Kin Ecosystem, set aside USD 5 million for the legal battle.

The cryptocurrency that Kik created, Kin, enjoyed one of the most high profile ICOs of 2017, when it raised almost USD 100 million in September 2017.