Crypto Billionaire Justin Sun Moves $196 Million in Tether To Binance – What is He Buying?

On April 17, blockchain investigator Lookonchain revealed a large transfer of USDT to Binance by Tron Founder Justin Sun. This move follows a pattern of USDT deposits to Binance and ongoing Ether acquisitions by Sun.

Justin Sun Continues Whale Deposits of Tether’s USDT

Lookonchain’s post on X detailed the transfer of $196 million worth of USDT from Huobi to a Binance wallet address by Justin Sun. This transfer occurred in three separate batches: $40 million, $56 million, and $96 million.

Justin Sun withdrew 196M $USDT from #HTX and deposited it into #Binance 7 hours ago.

What will he do?

Address:

TWRmU53wQZdBqSDjVn34j4VS8k1tt7WcNL pic.twitter.com/SalUczKMjI— Lookonchain (@lookonchain) April 17, 2024

According to Arkham’s data, Sun owns over $1 billion in assets across various wallets linked to him, with $280 million USDD algorithmic stablecoin being his largest holding.

Justin Sun’s recent transfer coincides with Binance’s suspension of USDC transactions on the Tron blockchain on March 25. This suspension, encompassing both deposits and withdrawals of the stablecoin, is believed by some to be a response to regulatory scrutiny.

Following Circle’s discontinuation of USDC support on the Tron network (TRC20), Binance will cease support for USDC deposits and withdrawals via TRC20 starting from 5 April 2024, 02:00 am UTC.

Users may continue trading USDC on Binance. Deposits and withdrawals of USDC via other…

— Binance (@binance) March 25, 2024

The purpose of this large transfer remains unclear, fueling debate on X. Some view the transfer as insignificant, while others speculate about potential questionable activities between Sun and Binance.

Justin Sun putting his tether fraud bucks to work over at the fraudulent money laundering Binance exchange! https://t.co/AMcCfkDuGh

— Bitfinex'ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) April 17, 2024

Justin Sun has a history of engaging in substantial cryptocurrency transactions. On February 29, he deposited 100 million USDT to Binance, shortly after a wallet associated with him acquired 168,369 ETH at an average price of $2,894, totaling approximately $580.5 million.

Sun’s blockchain, the Tron network, has recorded a series of downtrends lately, including the depegging of its affiliated stablecoin, TrueUSD.

Sun’s activities are not isolated, as the broader cryptocurrency landscape has seen a surge in large wallet activity.

Crypto Whale Activity Surges

Over the past few months, there has been a notable increase in crypto whale activities, with major players making major moves. Earlier in March, the fifth-richest Bitcoin whale transferred over $6 billion worth of BTC.

Arkham Intelligence data also revealed that Amber Group transferred 1 million Arbitrum (ARB) tokens to Coinbase, totaling $1.13 million. This came after a previous transfer of $9.43 million worth of ARB to an exchange address in March, leaving a balance of $3.57 million.

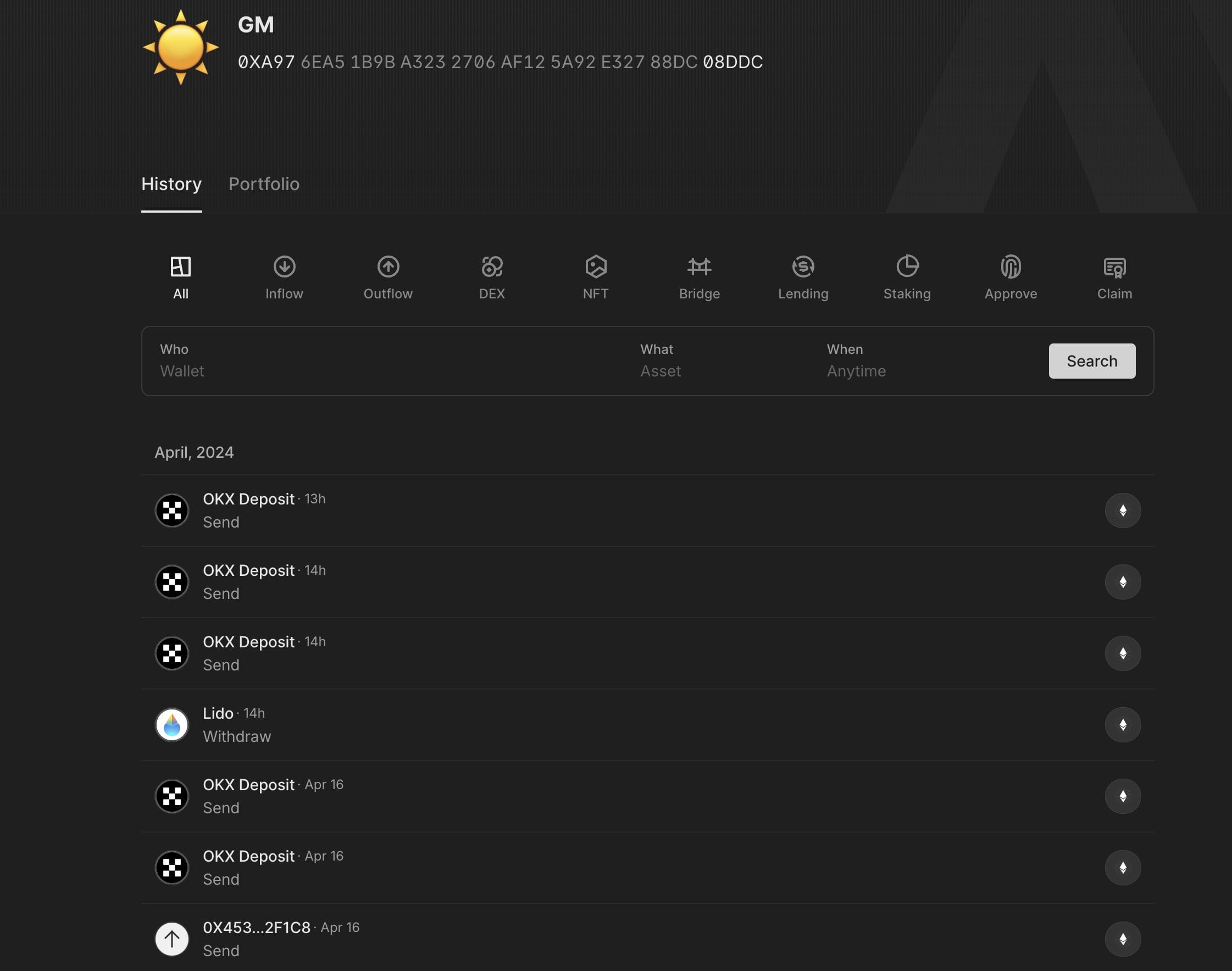

A multi-signature wallet address had also, on April 17, withdrew 6,513 staked ETH from Lido. The unknown wallet owner subsequently deposited 5,100 ETH, valued at $15.72 million, on the OKX exchange.

DeBank data shows a Uniswap (UNI) whale accumulating tokens since October 2023, withdrawing from the MEXC exchange and purchasing on-chain at an average price of $6.20. This whale recently sold their UNI holdings for $6.83, realizing a profit of $250,000 (approximately +10%).

Major crypto whale sell-offs have historically been interpreted as bearish indicators, suggesting potential profit-taking by holders.