Fifth-Richest Bitcoin Whale Transfers Over $6 Billion in BTC After Years of Dormancy – What’s Going On?

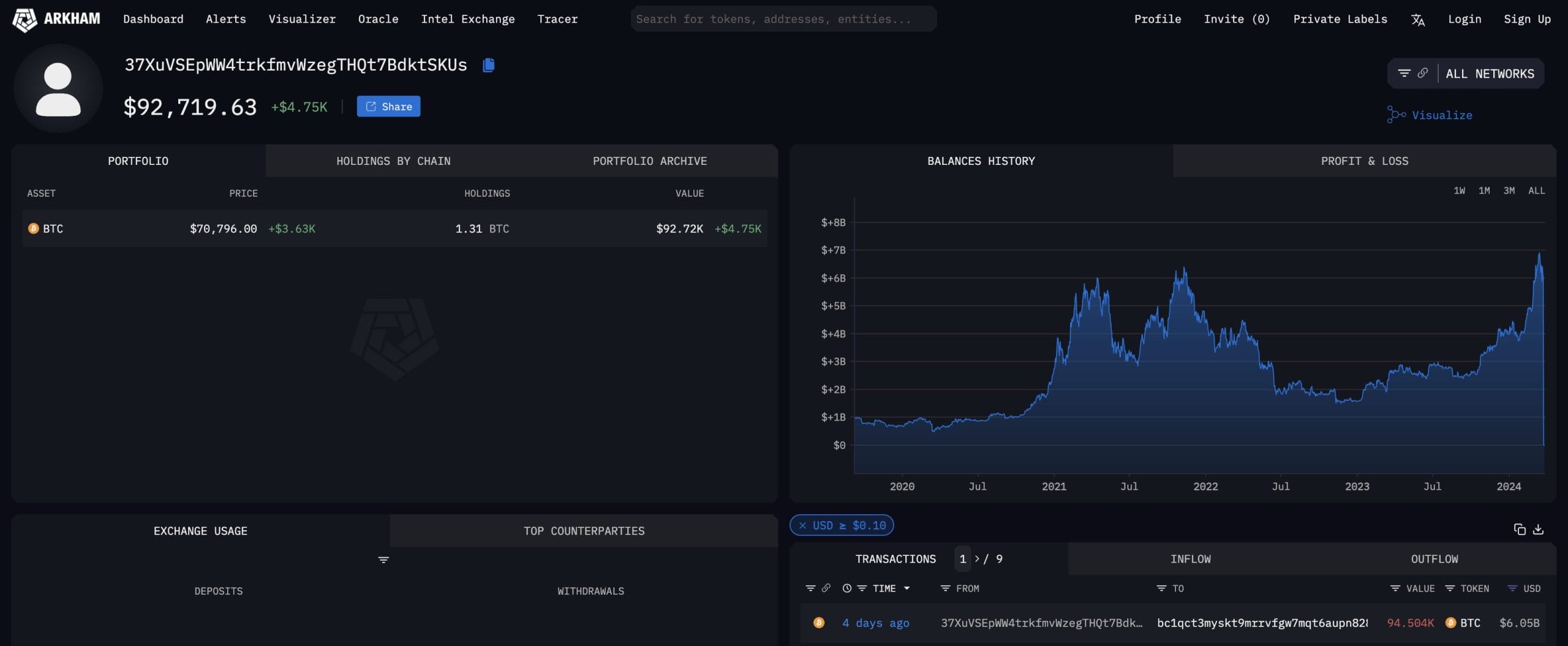

Blockchain investigator firm Arkham Intelligence announced on March 25 that the fifth-richest Bitcoin whale had moved 94,504 BTC worth $6.05 billion to three new addresses.

The Bitcoin wallet address, also dubbed 37X, has been dormant since 2019.

37X Activated: Bitcoin Whale Holds 1.31 BTC After Transfer

Arkham Intelligence revealed in an X post that the Bitcoin whale began the transfer on March 23. In total, the whale sent 94,504 BTC, allocating $5.03B, $561.46M, and $488.40M worth of BTC to three new wallet addresses.

The 5th richest Bitcoin address just moved over $6 BILLION in BTC to three new addresses.

37X moved almost its ENTIRE BALANCE of 94.5K BTC ($6.05B) in the early hours of Saturday 23rd March, leaving only 1.4 BTC in the address.

The 94.5K BTC had not been moved since 37X… pic.twitter.com/mAjpg0oqnD

— Arkham (@ArkhamIntel) March 25, 2024

The on-chain intelligence company further disclosed that the Bitcoin wallet address now has 1.31 BTC stored, valued at $92.7K.

However, the Bitcoin Whale has recorded minimal on-chain interactions since October 8, 2019, and shows no indications of being associated with an exchange.

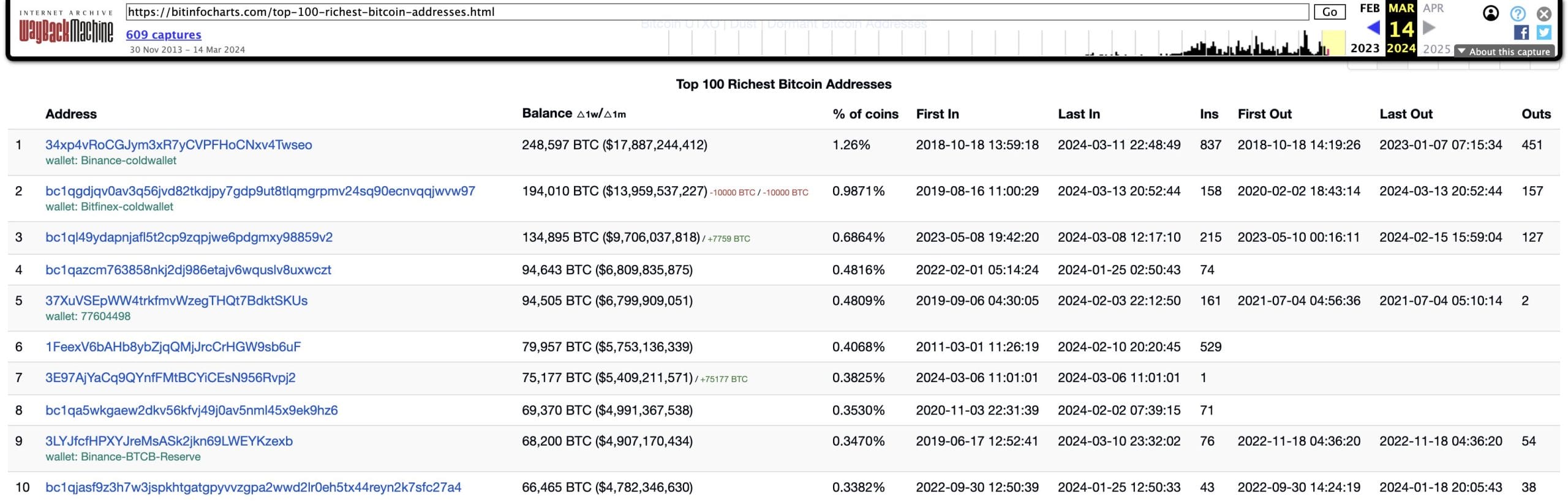

This is the fifth-richest Bitcoin wallet address, according to archives from Bitinfocharts.

Meanwhile, the wallet address that received $5.03B worth of BTC from this Bitcoin whale now ranks as the sixth-richest Bitcoin address, with 78,317K BTC.

It should be noted that such a big transfer from a three-year-long inactive wallet is not the first in recent months.

On January 5, an unknown whale transferred 26.9 BTC (worth $1.17M at that time) from Binance to the public address of Bitcoin Genesis Block. Another sizeable BTC transfer from an inactive wallet sent 6,500 BTC to new addresses in November 2023.

Bitcoin Interest Heats Up with Spot Bitcoin ETF & Upcoming Halving Event

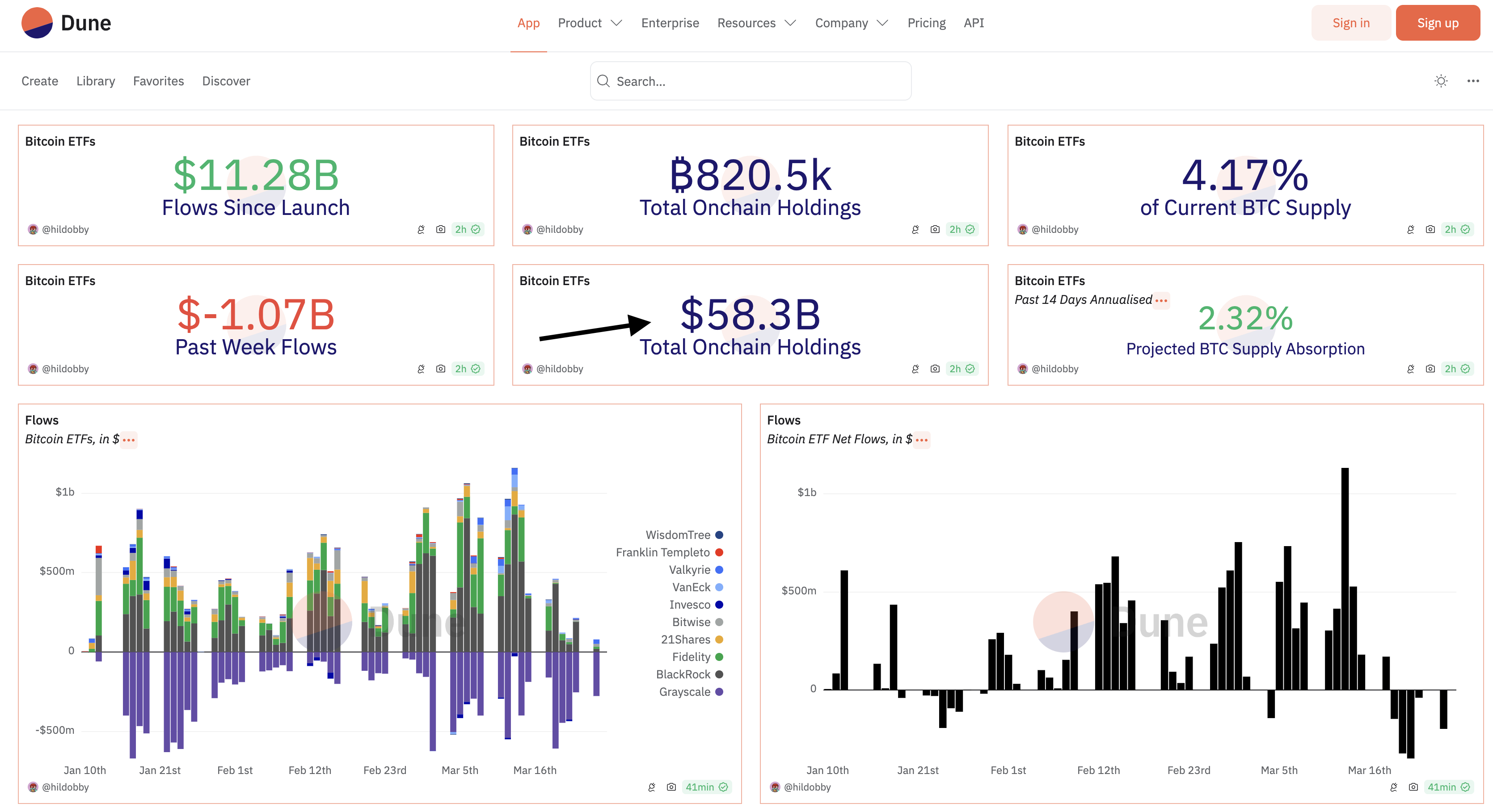

Retail and institutional investors have all taken a shine to Bitcoin following the approval of spot Bitcoin ETFs and the forthcoming Bitcoin halving event scheduled for April 2024.

Bitcoin halving is a quadrennial event that halves the pace at which new coins are released into the market. This makes the current supply of BTC scarcer over time and potentially drives up prices.

A price retracement often accompanies the build-up to Bitcoin halving.

Many market analysts argue that the explosion of spot Bitcoin exchange-traded funds (ETFs) could soften the anticipated price drop. This also aligns with the belief of analysts that the approval of spot Bitcoin ETFs would reduce the power of whales and increase stability.

According to a recent Dune report, Bitcoin ETFs have recorded $58.3B in on-chain holdings, representing 4.17% of the current BTC supply.

Last month, popular crypto analysis firm Rekt Capital explained that the upcoming Bitcoin halving comprises five phases. The first stage is called pre-halving downside, which sees bearish price movements due to investors anticipating the halving event.

5 Phases of The Bitcoin Halving

1. Pre-Halving Downside phase

Approximately 70 days remain until the Bitcoin Halving in April 2024

Historically, any deeper retraces that occur during this orange period tend to generate fantastic Return On Investment for investors in the… pic.twitter.com/I2F7EkBqYa

— Rekt Capital (@rektcapital) February 5, 2024

The second stage is the pre-halving rally, which records major BTC price increases due to short-term traders and investors keen to reap the rewards of the halving mainstream hype.

The third stage is the pre-halving retracement, which he believes to be the market’s current phase. This stage entails investors exiting their positions due to sell pressures.

The fourth phase, known as re-accumulation, is predicted to kickstart after the halving takes place and will see stagnant BTC price movements, which is closely followed by the fifth state, the parabolic uptrend.