History Suggests Ethereum Might Drop After the Imminent Hard Fork

The market behaves in a similar way whenever there is an Ethereum hard fork incoming, a research by cryptocurrency exchange Gate.io showed. Generally, the time before the fork will see ETH price increasing, peaking at the time of the fork, and then correcting “to restore rationality after a cooling-off period,” according to the paper.

The paper, co-authored by Jill Chow, Colin Bao, and Chloe Luo of the Gate.io research team, clarifies that it only considers the price itself before and after the hard fork, but no policy, subjective or market factors, as well as no other uncontrollable conditions. What proved that Ethereum has an effect on the wider market was the infamous DAO hack in 2016, which caused instability throughout the market until the announcement of a hard fork, which led the prices back into the green.

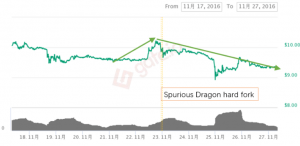

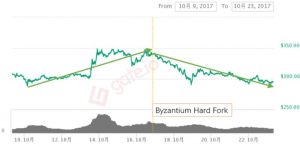

Hard forks that improve the protocol and help Ethereum as a project to move in a better direction, usually cause a greater rise in price. Based on historical market performance around the time of an Ethereum hard fork, the market fluctuations are best summarized in three phases:

- Before the hard fork, the price is usually at a rise;

- At the time of the hard fork – as well as shortly before and after – the price peaks, representing a short stage of uncertainty;

- Following the hard fork, the price of Ethereum usually corrects at different levels.

Ethereum price during the recent hard forks:

______

______

______

ETH is currently down 0.87% in the past 24 hours (UTC 11:33 AM), with a total increase of 12.59% in the past week as of the time of writing. Also, as reported, although the second half of December and beginning of January has been a good period for most cryptocurrencies, Ethereum stands out as one of the biggest winners during the period.

Ethereum price chart:

In light of the research paper, this might be due to the approaching Constantinople hard fork, which is set to happen at block height 7,080,000, to be reached within the next few days.

In other Ethereum related news, developers from Ethereum’s open-sourced community have tentatively agreed to implement ASIC (application-specific integrated circuit) mining hardware resistance into the project following further testing on the proposed code. Mining using ASIC chips would be blocked with this update dubbed ProgPoW [Programmatic Proof-of-Work] and instead replaced with general purpose, or GPU (graphics processing units) hardware.

However, there was no timeline given for this implementation.

As reported by Cryptonews.com, the spectre of re-centralisation is haunting crypto. Its cause: the expansion of ASIC chips, which can mine cryptocurrency more efficiently than GPUs and CPUs (central processing units), but which are so expensive only the biggest companies can run them.