Exclusive: OKCoin Enters Latin America, Sees High Demand

The crypto market is about to welcome even more traders, as OKGroup, the owner of the major crypto-to-crypto exchange OKEx, is entering Latin America via its fiat-to-crypto exchange OKCoin, which offers its services in more than 110 countries.

According to the company, starting today, traders in Argentina can deposit Argentine peso (ARS) in exchange for cryptocurrencies including Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Ripple, Cardano, Stellar, Zcash and 0x, with more being added soon. OKCoin plans to open an office in Buenos Aires and build up a team to support its business throughout Latin America.

“We chose to expand to Latin America because of the high demand from traders looking to get in on the fast growing cryptocurrency markets. Latin American traders tend to be very savvy when it comes to the crypto markets, and they want to have a lot of options aside from Bitcoin and Ethereum, which is exactly what we can bring them,” OKCoin’s Latin American representative, Pablo Magro, told Cryptonews.com.

Moreover, the fact that fiat currencies tend to be more volatile in this region brings “a tremendous opportunity for adoption across the region,” Magro added.

______

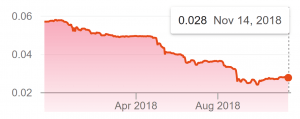

ARS / USD rate:

______

“We decided to start with the Argentine peso in part because Argentina is a relatively advanced market in the world of cryptocurrency and also because the Argentine peso has experienced a lot of volatility. As the value of Argentina’s fiat currency remains uncertain, our hope is that we can help bring some stability to the country’s economy by providing Argentines with an array of cryptocurrency options,” the OKCoin’s representative said, without elaborating what other Latin American fiat currencies will be added on the platform in the coming months. He declined to give estimates for trading volume in the region.

“One of the biggest challenges is to provide the market with the tools to be able to buy/sell digital assets with different payment options. Given that more than 50% of the Latin America population is unbanked, this is crucial to contribute in the growing adoption of this market. We’ve had success with other markets and look forward to offering similar capabilities to the LatAm region,” he said.

According to Magro, there are crypto exchanges covering the LatAm region, but none of them compete head on with OKCoin.

“We bring a unique set of products and services that have been battle tested in other parts of the world. Furthermore, no exchanges offer the liquidity that we do in pairs that are not currently available in the market. We are also the only exchange in the country to offer margin trading at this time, and we’re the most reliable exchange in terms of funding and withdrawal times,” he said.

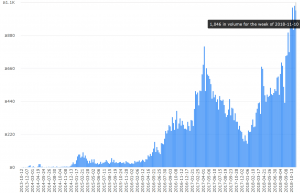

Meanwhile, on the peer-to-peer Bitcoin exchange LocalBitcoins.com, all the Latin American countries listed are showing increasing volumes and some of them are reaching new all-time highs.

Weekly LocalBitcoins, a peer-to-peer bitcoin marketplace, volume (in bitcoin) in Venezuela:

“As the economic cycle continues and the United States continues to raise their interest rates, they put pressure on the emerging market economies, but as we can see, people are getting smarter, the global economy is getting freer, and we now have the tools to protect ourselves from poor monetary policy,” Mati Greenspan, senior analyst at eToro, a social trading platform, commented.