Ethereum Pulls Away from Competition in Dapp Dominance Race

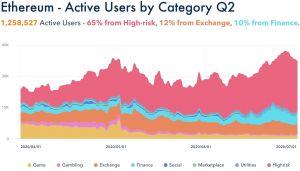

The Ethereum (ETH) network almost doubled its number of active dapp users in the second quarter of 2020, increasing by 97% to close to 1.259 million users and logging a new all-time-high, per a new report from Dapp.com.

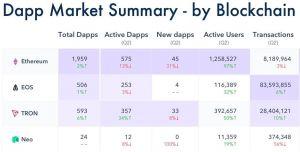

The Dapp.com data shows that from April to June this year, the roughly 2.8 million active users of some 1,394 dapps generated a total of USD 12.43 billion in transaction volume, up 1% from the first quarter of 2020 on 12 public blockchain networks.

As well as Ethereum, these included EOS, TRON (TRX), Steem (STEEM), Hive, Chiliz (CHZ), Terra (LUNA), ICON (ICX), Klaytn, NEO, Tomochain (TOMO), IOST and Vexanium (VEX).

However, there was one worrying development for the industry: Fewer than 100 dapps were launched in the same time period – the lowest number of new dapps launched since 2017.

Ethereum dominance appears to have deepened, as figures show that among active dapp users, almost one in three uses an app on the Ethereum network.

Compared with Ethereum, other major blockchain networks saw considerably slower growth – or even a fall in user numbers.

In Q2, Klaytn, the blockchain network operated by South Korean internet and tech giant Kakao, had some 1.04 million active users but was down 64% compared with the first quarter of 2020.

There were some noteworthy gains away from Ethereum, however. Stablecoin protocol Terra reported a 9% growth, expanding to about 889,000 users, while TRON increased its user base by 50% to some 393,000.

That said, the picture was not overly positive for the industry as a whole. In total, dapp user numbers fell by 21% to roughly 3.811 million compared with the preceding quarter. Quarterly transaction volumes also fell by around 3% to about 177.5 million transactions.

But sluggish spring figures do appear to have been bolstered by a bumper start to summer.

More than half of the total Q2 dapp transaction volume was generated in June, accounting for USD 6.63 billion, nearly double that of the preceding month. The decentralized finance (DeFi) transaction-related volume of Ethereum accounted for a whopping 86% (USD 5.7 billion) of that figure.

The summer solstice ushered in some midsummer heat for the market: June 21 marked an all-time high for transaction volumes generated through finance dapps, spurring positive expectations for the third quarter. The report’s authors dubbed June “the month of DeFi.”

The report also notes that the issuance of the COMP token, the ERC-20 protocol-based asset behind the community governance of the Compound protocol, marked the start of a rapid upward march in the number of daily DeFi dapp users on Ethereum. The token was launched on June 15. Since the tokens’ release, its following has grown to 11,230 active daily users.

{no_ads}