Digital Asset Products Notch Third Consecutive Weekly Inflow, Attract Over $15 Million

Cryptocurrency products recorded inflows for the third consecutive week signaling improved sentiment from institutional investors after a shaky start to the year.

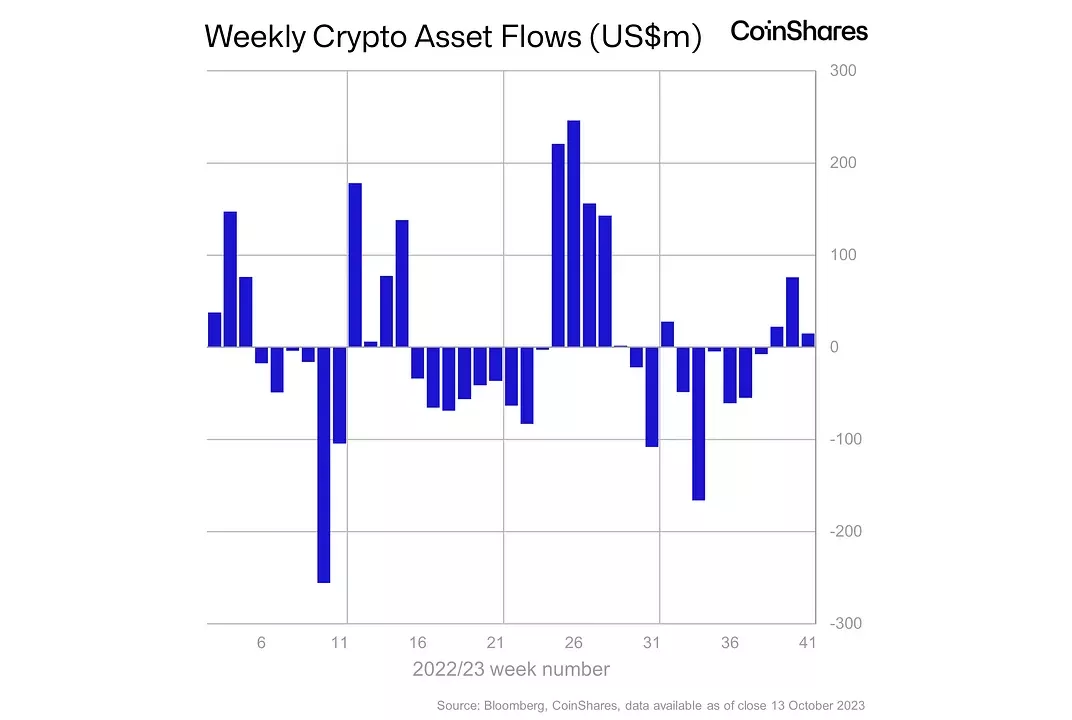

A new CoinShares report on Oct 16 tracking weekly flows into cryptocurrency investment products shows a win for the market, an uptick in big money players, and geographic distortions sparked by regulatory concerns.

According to the report, digital asset products notched $15 million in inflows although trading volumes stood at 27% below the yearly average.

Bitcoin (BTC) remained the biggest gainer posting $16 million inflows in the last seven days while short bitcoin pushed to $1.7 million inflows.

In the previous report, BTC saw inflows of $43 million as the market turned green highlighting positive indicators. Despite the drop in weekly volumes the total entry around the market leader has surged to $260 million igniting bullish interest.

In the previous report, BTC saw inflows of $43 million as the market turned green highlighting positive indicators. Despite the drop in weekly volumes the total entry around the market leader has surged to $260 million igniting bullish interest.

Experts suggest further consolidation of recent wins from institutional clients on the back of the decision of the Securities and Exchange Commission (SEC) decision not to appeal the Grayscale ruling which may lead to a potential approval in the coming months.

“It is worth noting that our data, which is as of Friday’s close, was unlikely to capture the positive news out of the US regarding the SEC not appealing the Grayscale legal challenge, potentially paving the way for a spot-based ETF in the US.”

Altcoins can’t keep up with momentum

Although some altcoins recorded slight gains, it was a poor week compared to previous standards as more activity was seen around Bitcoin.

Ethereum (ETH) saw outflows of $7.5 million a week after recording gains following the launch of future-based Exchange Traded Funds (ETFs). Experts at CoinShares say that the recent decline could be due to concerns about a change in the protocol design.

In the previous release, Ethereum attracted inflows of $10 million after multiple weeks of outflows and was compared to the first week future-based Bitcoin ETFs were launched, a figure described as insignificant compared to the market leader.

Solana (SOL) also notched its highest week since March in the previous report but recorded a slight figure last week as the crypto winter marched on.

Ripple (XRP) recorded little inflows of $0.42 million but was enough to maintain its 25 straight weeks of inflows on the heels of wider community support and strategic partnerships.

“The consistent inflows underscore the investment community’s support, especially considering successful legal challenges against the SEC,” the report reads.

Litecoin, Chainlink, and Tezos posted outflows of $0.28 million, $0.31 million, and $0.25 million respectively.

Geographic disparities continue

The regional divide between European and American investments continues with Europe recording investments from institutional products.

Last week saw a general drop in figures which plunged Europe’s numbers to $7 million, still ahead of the United States plagued with regulatory issues and an “overreaching” SEC.

Germany led the pack with $16 million inflows while Switzerland came in at second spot again with $500,000 net inflows. Sweden was the only European country that saw outflows totaling $7 million.