CryptoQuant Report: ETF Approval Could Lead to “Sell the News” Price Action for Bitcoin

The expected approval of a spot Bitcoin exchange-traded fund (ETF) in January might not translate into a price surge for the cryptocurrency, according to a note by blockchain data firm CryptoQuant.

The note, which was shared with CoinDesk, suggested that the approval of the Bitcoin ETF could trigger a “sell the news” event, causing the number one cryptocurrency’s price to drop, potentially to as low as $32,000.

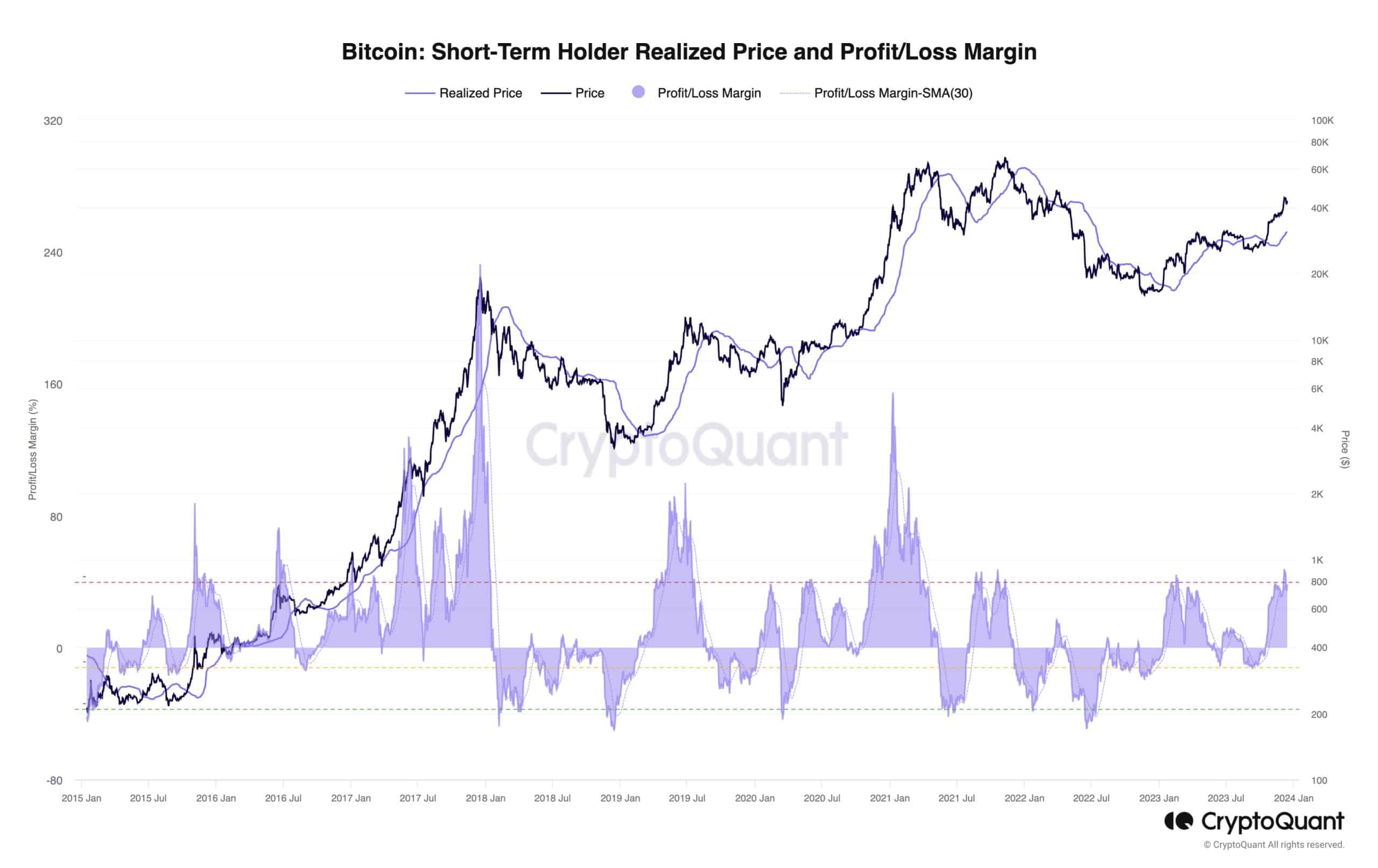

According to CryptoQuant’s data, $32,000 is the current short-term holder realized price, a key on-chain metric often tracked by traders.

The term “sell the news” refers to a phenomenon in financial markets where prices move higher ahead of a bullish event, only to see them decline shortly after. The phenomenon occurs as experienced traders take advantage of the crowded long trade, leading to the closure or liquidation of a large number of leveraged positions.

Will ETF lead to increased institutional adoption?

The potential approval of an ETF is generally seen as a bullish event as it opens the door for more institutional inflows into Bitcoin.

According to Grayscale CEO Michael Sonnenshein, a spot ETF means that as much as $30 trillion in “advised wealth” can potentially be invested in Bitcoin.

However, CryptoQuant noted that the current high unrealized profit margins of around 30% for short-term Bitcoin holders historically precede price corrections, as observed in previous instances.

“Moreover, short-term holders are still spending Bitcoin at a profit, while rallies usually come after short-term losses are realized,” the note said.Top of Form

At the time of writing on Friday, Bitcoin traded at $42,823, down by 2% for the past week.

A price of 32,000 after the ETF approval, expected by January 10, would mean the price needs to drop over 25% from its current level to a level not seen since October.