Could South Korean Crypto Exchanges Be Safe from Bankruptcy Risk?

With some of the biggest names in the crypto exchange game apparently teetering on the cusp of bankruptcy, attention in South Korea is turning to domestic trading platforms. And some are suggesting that the nation’s sector may be safe from insolvency – at least for the time being.

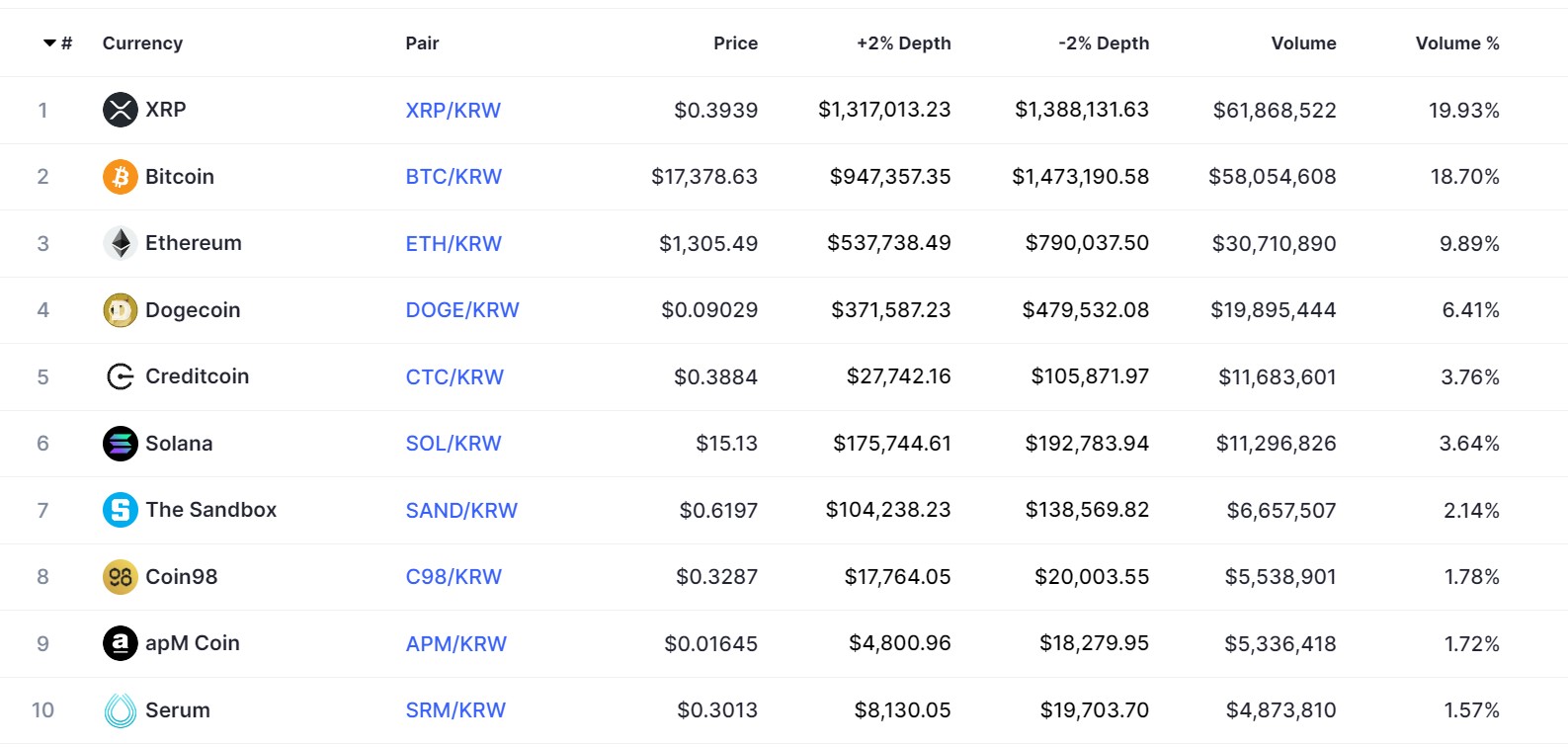

Per a report from the newspaper Kookmin Ilbo, there are some key differences between the likes of FTX and domestic heavy hitters like the “big four” platforms: Upbit, Bithumb, Korbit, and Coinone.

Income is almost entirely transaction fee-based

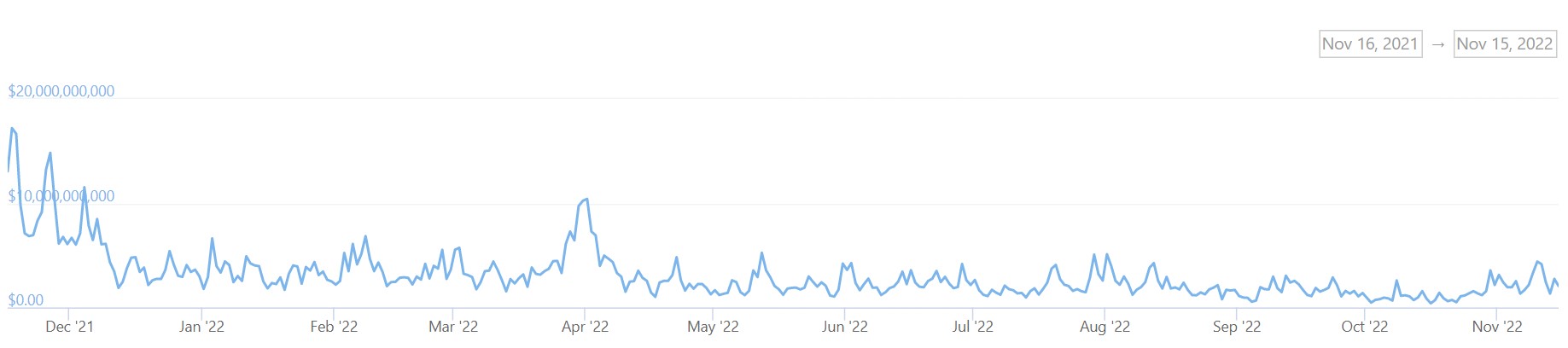

The newspaper claimed its research of the four companies’ financial performance over the years shows an almost 1:1 correlation with the price of Bitcoin (BTC).

For instance, all four posted healthy growth figures in 2017, when BTC prices rose. But in 2018, they generally made heavy losses – with Korbit posting eye-watering losses of almost $350 million. When BTC prices rose again in 2020, transaction volumes (and profits) uniformly shot up.

The newspaper wrote:

“Bithumb turned from a company with a net profit of more than $380 million (in 2017) to a company with losses of more than $152 million [in 2018]. That happened within the space of one year.”

The report’s authors added that the business models used by domestic exchanges were “overly reliant on transaction fees.”

“All four exchanges,” the authors explained, effectively have “no source of income other than commission fees.” Other business interests represented a mere 1% of all four exchanges’ combined pre-tax profits.

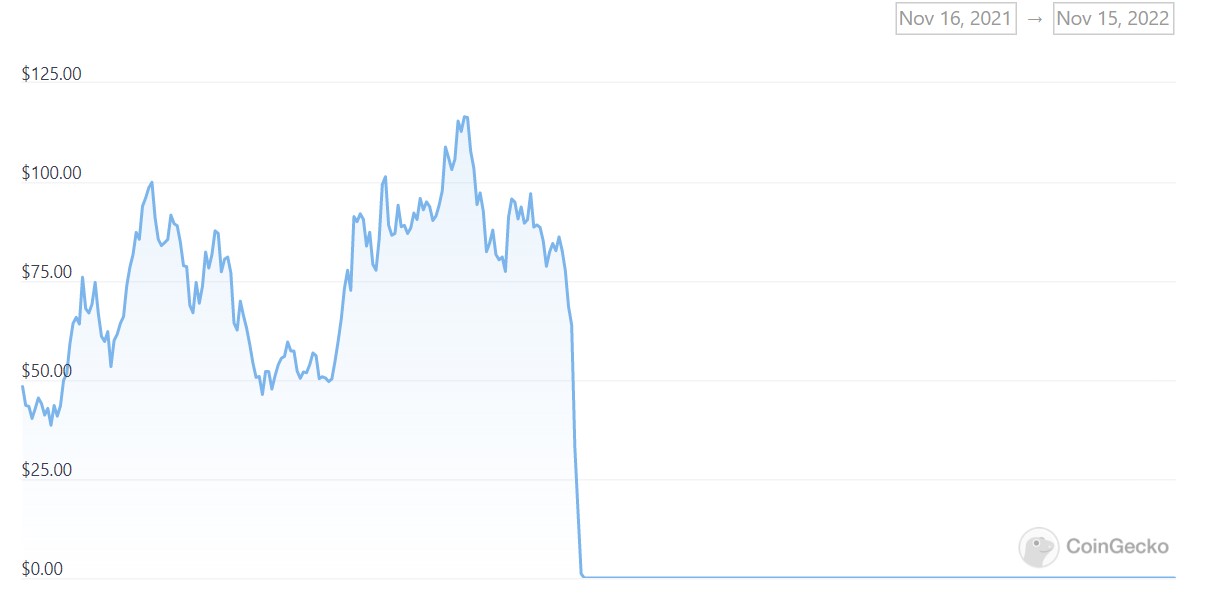

South Korean exchanges don’t issue their own coins

Unlike many of their overseas counterparts, Kookmin Ilbo noted, the fact that domestic exchanges “did not issue their own coins” and did not use these in their business models has “resulted in reduced risk” for the platforms.

Some have asserted that the FTT token was the ultimate undoing of FTX. And the newspaper noted that the sharp drop in Terra ecosystem coins in May effectively sparked the downfall of the once-much-vaunted Terraform Labs.

Regulations: Have they Helped?

Token launches were outlawed in South Korea in late 2017, and regulations have been ramping up ever since. Most of these have focused on exchanges, which have been forced to prove they keep their own funds separate from those of their clients.

Regulators also carry out regular checks on companies’ IT and management systems.

More regulations are likely incoming, too.

Lee Myung-soon, the Senior Vice President of the Financial Supervisory Service, was quoted as stating that more rules for the industry “should be prepared as soon as possible” as a direct response to the FTX collapse.

A Caveat: Lessons from History

The idea that any one company or group of companies is safe from bankruptcy risks is problematic. History has taught us that no platform is 100% safe from the pressures of the market – a lesson that applies to both the TradFi and the crypto sectors.

A prolonged crypto winter marked by low transaction volumes would put enormous financial pressure on South Korean – and other East Asian – exchanges.

The ownership of Bithumb is also a hot political potato at the moment. The exchange has been for sale for several years now and is yet to find a buyer. Allegations of token price manipulation have also dogged the exchange sector.

Furthermore, bad actors are known to have been active in the South Korean crypto scene, with a number of large, bogus exchanges already shut down. Only time will tell if South Korean exchanges are really safe from harm in this increasingly harsh crypto winter.