Coinbase’s Chief Legal Officer Stays Optimistic Amid SEC Battles – Here’s Why

Coinbase‘s Chief Legal Officer is remarkably optimistic despite two ongoing battles with the Securities and Exchange Commission (SEC).

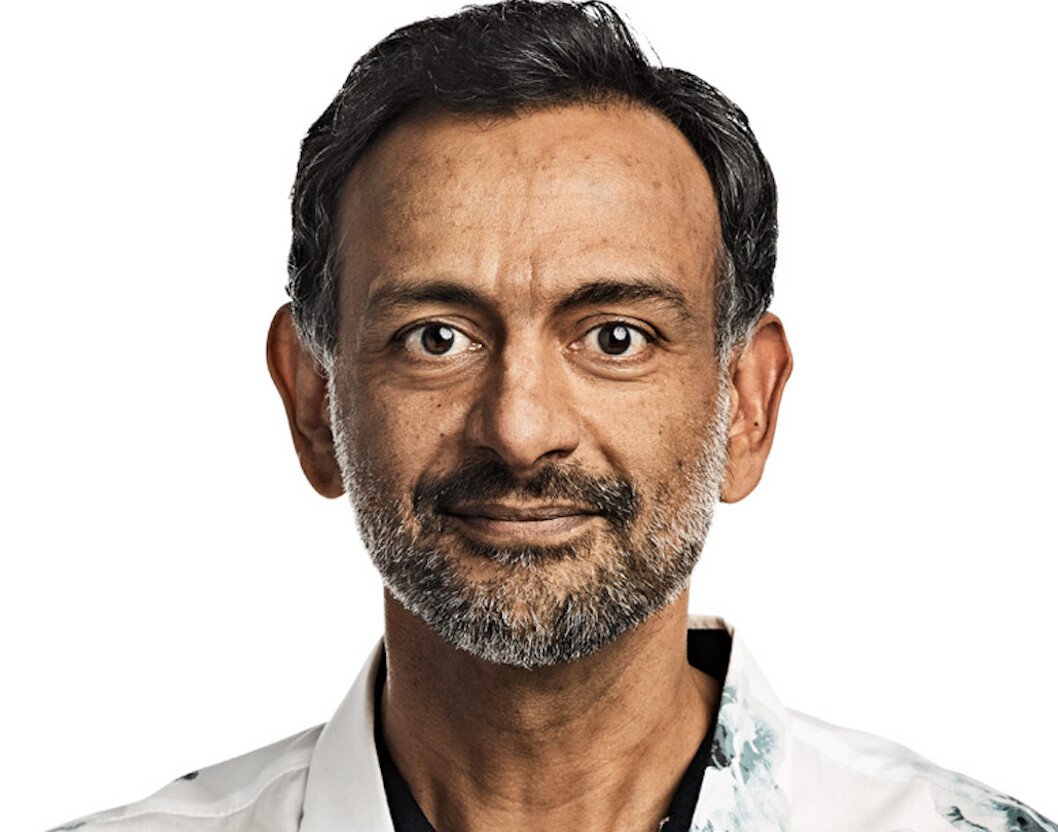

Paul Grewal has expressed optimism about both cases, claiming that they could have a lasting impact on the entire industry.

“We’re optimistic that that’s also going to help shape the landscape and bring clarity for all of us that I think we all desperately need,” he said during a recent conversation with Blockchain Association CEO Kristin Smith at Messari’s Mainnet conference.

Grewal emphasized that the court’s ruling that the SEC’s jurisdiction over the crypto industry is relevant to the case was an encouraging sign.

He also claimed that the lawsuit is an indication of the SEC’s stance towards the entire digital assets and cryptocurrency ecosystem.

“The case against Coinbase is really a case against digital assets and crypto more generally.”

According to Grewal, recent court decisions in crypto-related cases, such as those involving Grayscale and Ripple, have already yielded positive results.

Numerous judges across the country have shown a healthy skepticism towards the SEC’s approach to regulating the industry, their legal theories, and the evidence presented to support their claims of authority over the crypto space.

However, it’s important to note that the SEC’s cases against Grayscale and Ripple are not yet fully resolved.

The agency plans to appeal the July decision in favor of Ripple, and the ruling regarding Grayscale’s rejected application for a spot Bitcoin ETF only requires the SEC to review the application again rather than mandating its acceptance.

Judge Has Until October to Respond to Coinbase’s Motion

Last month, Coinbase officially filed a motion to dismiss the lawsuit from the SEC.

The exchange’s main argument is that it does not offer investment contracts, a special type of securities, as defined by decades of Supreme Court cases and other legal precedents.

He accused the SEC of abusing its discretion, violating due process, and abandoning its own interpretations of the securities laws.

Furthermore, Grewal said the SEC had overstepped its authorities set by Congress by ignoring other binding legal precedents.

The exchange’s motion in the case is under review by the SEC until the first week of October. The presiding judge will then determine whether a full jury trial is necessary.

Back in March, the SEC issued a Wells Notice to Coinbase, signaling a potential lawsuit.

Despite the warning, the company took a proactive approach and filed a lawsuit against the agency to compel the SEC to establish clear regulations for the cryptocurrency industry.

In June, the SEC followed through with its notice and sued Coinbase, accusing the platform of operating as an unregistered securities exchange, broker, and clearing agency. However, Coinbase firmly denies these allegations.

As of late, Coinbase has ramped up efforts to bring about positive changes in US legislation in the crypto sector.

Earlier this week, the exchange launched a new media campaign, encouraging people who are interested in crypto to contact their congressional representatives through its platform to let them know crypto regulation clarity is an important issue for them.