ChatGPT Makes Predictions on the Bitcoin Price After The 2024 Halving – Will BTC20 Also Explode?

With under nine months to go until bitcoin (BTC)’s next halving event, excitement is growing about a potential rally to fresh all-time highs.

When the bitcoin blockchain adds its 840,000th block, which is estimated to occur on the 21st of April 2024, the reward rate for miners is set to half from 6.25 BTC to 3.125 BTC, resulting in a halving of the inflation rate of the bitcoin supply.

The bitcoin issuance rate is halved roughly every four years to make sure that the bitcoin supply never exceeds its inbuilt limit of 21 million tokens.

Bitcoin halving events, such as in 2016 and 2020, have historically occurred ahead of impressive run ups in the bitcoin price, hence why excitement is starting to build up.

Matrixport and British multi-national bank Standard Chartered recently put out forecasts for bitcoin to exceed $100,000 next year after the halving.

Meanwhile, Morgan Creek Capital recent projected bitcoin to rise above $300,000 by the 2028 halving.

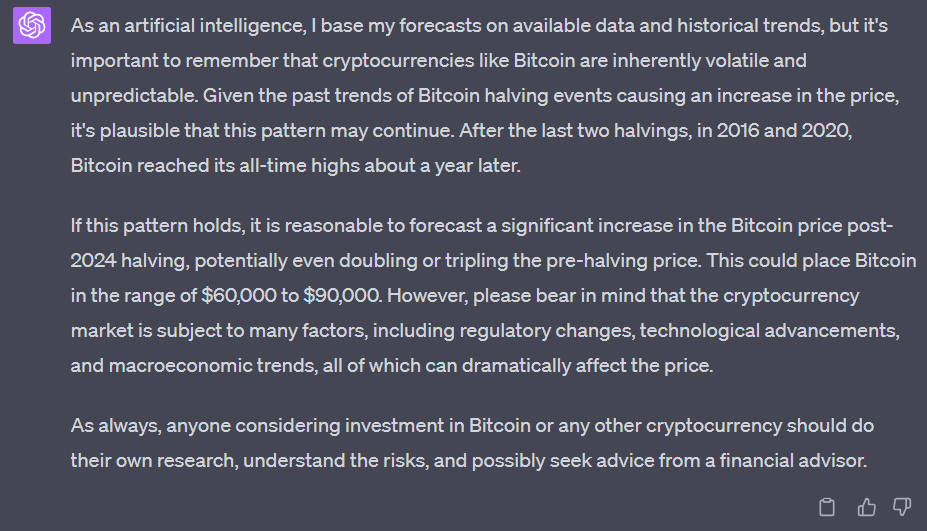

With that in mind, we asked ChatGPT where it thinks the bitcoin price could go after the halving in 2024.

Here’s what the leading artificial intelligence chatbot said.

ChatGPT’s Bitcoin Price Prediction After the 2024 Halving

“Given the past trends of Bitcoin halving events causing an increase in the price, it’s plausible that this pattern may continue,” ChatGPT begins, before noting that “after the last two halvings, in 2016 and 2020, Bitcoin reached its all-time highs about a year later”.

“If this pattern holds, it is reasonable to forecast a significant increase in the Bitcoin price post-2024 halving, potentially even doubling or tripling the pre-halving price… This could place Bitcoin in the range of $60,000 to $90,000”.

However, the chatbot warned that regulatory changes, technological advancements, macroeconomic trends and other factors could all also dramatically influence the price.

If bitcoin was to reach ChatGPT’s forecast of $60-$90,000, that would mean impressive 2-3x gains from the current price just under $30,000 in just a few years.

Very few traditional assets could be expected to perform that well.

And ChatGPT’s forecast is conservative compared to many other long-term bitcoin pricing models.

For example, according to the Bitcoin Stock-to-Flow pricing model, which shows an estimated price level based on the number of BTC available in the market relative to the amount being mined each year, Bitcoin’s fair price right now is around $55K and could rise above $500K in the next post-halving market cycle – that’s around 17x gains from current levels.

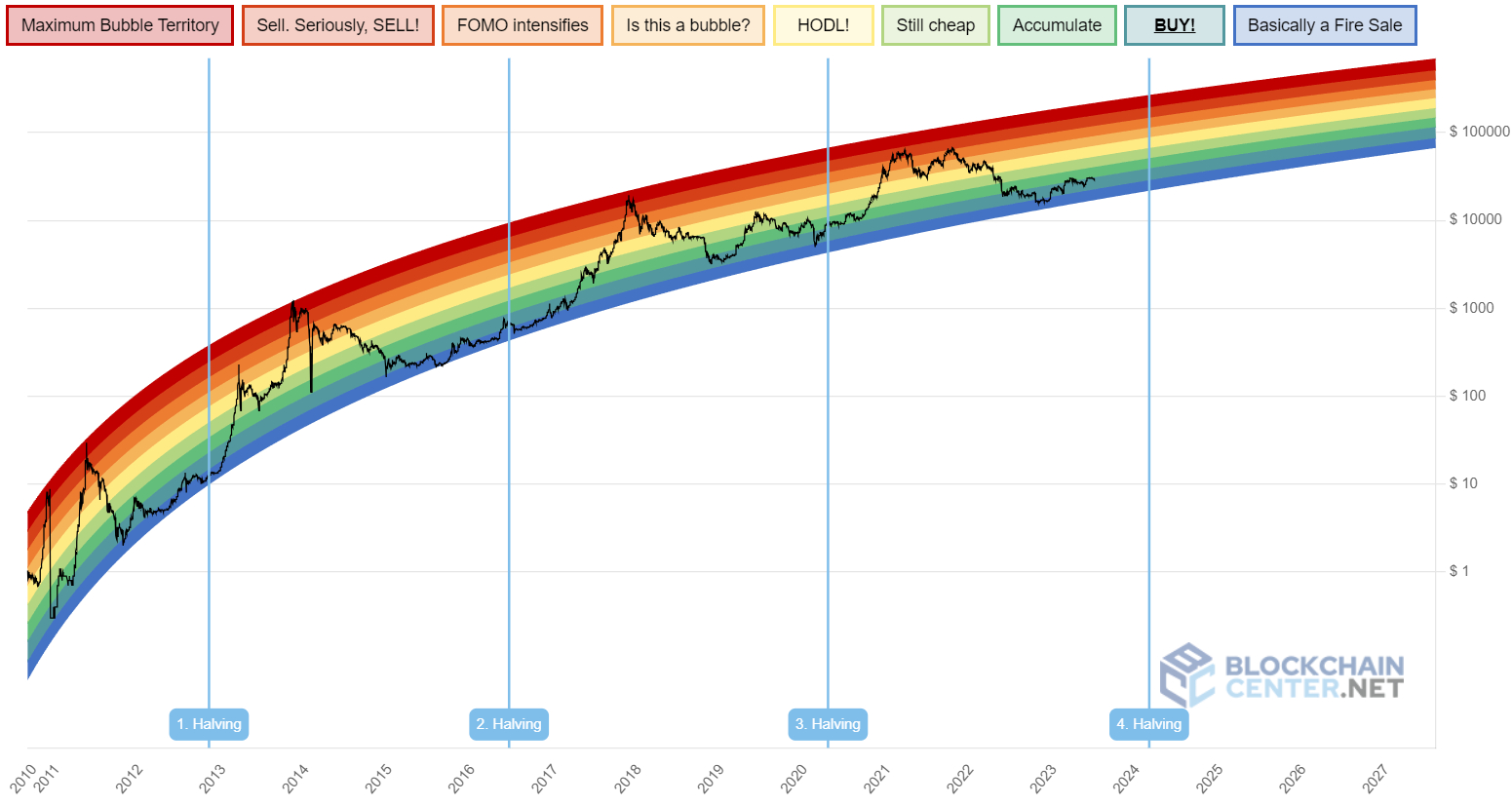

Meanwhile, Blockchaincenter.net’s popular Bitcoin Rainbow Chart shows that, at current levels, Bitcoin is in the “BUY!” zone, having recently recovered from the “Basically a Fire Sale” zone in late 2022.

In other words, the model suggests that Bitcoin is gradually recovering from being highly oversold.

During its last bull run, Bitcoin was able to reach the “Sell. Seriously, SELL!” zone.

If it can repeat this feat in the next post-halving market cycle within one to one and a half years after the next halving, the model suggests a possible Bitcoin price in the $200-$300K region.

That’s around 7-10x gains from current levels.

Could This Bitcoin Alternative Do Even Better?

Billed as “Bitcoin on Ethereum’ and as an opportunity for members of the cryptocurrency community to purchase bitcoin at its 2011 price of $1, a new token called BTC20 has been garnering a lot of hype.

The tokenomics are designed to mimic bitcoin – a 21 million BTC20 token supply cap, with tokens to be released to BTC20 stakers (rather than miners) according to the exact same issuance schedule as bitcoin.

Some are claiming BTC20 is even better than bitcoin, given it runs on an ecofriendly, low energy consuming Proof-of-Stake Ethereum blockchain, rather than on an energy-guzzling Proof-of-Work chain like bitcoin.

As per the project’s whitepaper, BTC20 is looking to raise a maximum of $6.05 million via the sale of BTC20 tokens for $1 each.

With the project having already raised over $4.25 million in just over a week, traders need to move quickly to secure their spot.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.