Bitcoin Oversupply Issue Over & Prices Now Stable, Says Chainalysis

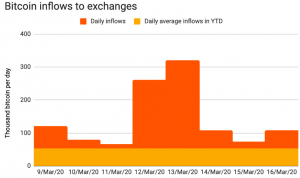

Blockchain and analytics specialist Chainalysis says that although bitcoin (BTC) inflow volumes to exchanges are still high, it looks as though prices have attained some degree of temporary stability.

In a recent report on the state of the BTC market, analyst Philip Gradwell wrote,

“The majority of excess bitcoin arriving at exchanges has been sold, and the worst of the oversupply appears to be finished for now.”

Although the volume of crypto inflow is still twice as high as daily average rates, the most recent run of price volatility may well be at an end.

The market was thrown into chaos on March 12-13, when some BTC sales rate at exchanges soared by nine times the daily average amount, causing disruption at exchanges and a price crash to prices as low as USD 4,000.

Perhaps the most alarming of Chainalysis findings, however, was the discovery that large professional and institutional traders accounted for the lion’s share of sellers, with transfers of between BTC 10 and BTC 1,000 accounting for 70% of all transactions on crypto exchanges late last week.

Regardless, the analytics firm claimed that lasting damage to the market was unlikely. The author wrote,

“The majority of available bitcoin was not cashed out, suggesting that most bitcoiners are happy to hold. At 712,000 more than average, the amount of bitcoin sent to exchanges in the last eight days is unprecedented. But this extra 712,000 represents just 5% of available bitcoin (all mined bitcoin minus all lost bitcoin).”

And the report suggests that more uncertainty could lie ahead – with the coronavirus outbreak losing none of its power to spook the markets.

Gradwell noted,

“Given the uncertainty around the COVID-19 pandemic, it’s hard to predict where the bitcoin market will go next.”

The firm added that traders would be well-advised to keep an eye on exchange volume figures as a potential indicator of things to come.

The author concluded, that “Large increases in exchange inflows have proven to be a good indicator of increased volatility, so we recommend keeping an eye on the amount being transferred to exchanges.”

At pixel time (11:45 UTC), BTC trades at c. USD 5,404 and is up by almost 5% in a day, trimming its weekly losses to 11%. The price is still down by 44% in a month, and up by 35% in a year.

____

Learn more:

Relief to Bitcoin Miners as Difficulty Set For Largest Drop in Five Months

Blame Short-term Bitcoin Holders For the Price Crash Again

10 Crypto Minds Weigh in On Post-Crash Bitcoin and Its Future