Bitcoin Price Prediction: VanEck CEO Optimism, Cathie Wood’s 2030 Forecast & Ripple Outlook

In the ever-shifting world of cryptocurrency, Bitcoin’s recent price movement paints a complex picture, trading at $41,079 with a 2.01% decrease on Monday. Amidst this volatility, notable voices in the industry weigh in, offering diverse outlooks. VanEck’s CEO stands firm in the belief that Bitcoin will retain its status as the premier digital store of value. In a more futuristic projection, Cathie Wood speculates an astronomical rise for Bitcoin, predicting a 3,356% increase by 2030.

Concurrently, Ripple, another major player in the crypto sphere, presents its forecast for 2024, adding another layer to the multifaceted crypto narrative.

VanEck’s Stance: Bitcoin as Premier Value Store

The CEO of investment management company VanEck, Jan van Eck, has expressed his unwavering confidence in Bitcoin (BTC), stating he sees no other cryptocurrency surpassing Bitcoin as the premier digital store on the internet. As the head of a firm managing $76.4 billion in assets, Van Eck dismisses the notion of a Bitcoin bubble.

Instead, he points to the cryptocurrency’s consistent performance, outshining other investment strategies. He predicts that within the next 12 months, Bitcoin will hit new all-time highs, driven by continued growth.

💵 Vaneck CEO saying that: #Bitcoin is a complement to Gold. $BTC got network effect of 50 Million users so there will be no "the flippening".

Those who say that Bitcoin is used by criminals, don't throw the first stone if you are a bank or associated with one 😅

He sums it up… pic.twitter.com/YooKq5KPbq

— Seth (@seth_fin) December 17, 2023

Van Eck also expects simultaneous approval for all applications of exchange-traded funds (ETFs) specializing in spot Bitcoin, including his firm’s bid in the US Market analysts suggest that the US Securities and Exchange Commission’s decision regarding these spot Bitcoin ETFs, involving major players like BlackRock and Grayscale, could positively impact Bitcoin’s price by boosting investor confidence through regulatory clarity.

Cathie Wood’s Bold Bitcoin Prediction for 2030

Cathie Wood, the CEO of Ark Invest and a renowned investor, has made a bold prediction, forecasting Bitcoin (BTC) to reach $1.48 million by 2030. According to Wood’s bullish outlook, a $1,000 investment could potentially yield a return of $34,557, marking a staggering 33,557% gain from its current value.

#ARKInvest’s #CathieWood just reaffirmed her prediction that #Bitcoin (#BTC) has the tendency to reach a million.

This time her numbers were pegged at $1.48 million per BTC by 2030.@giancarloperlashttps://t.co/ISjMFmMSp5

— Blockzeit (@BlockzeitE) December 18, 2023

While skeptics point out challenges in adoption and inherent volatility, Wood underscores factors such as institutional adoption, inflation hedging capabilities, and Bitcoin’s utility in remittances as key drivers of its value. It’s noteworthy that Bitcoin has historically functioned more as a speculative asset than a common currency.

This perspective adds to the ongoing discourse on the future of cryptocurrencies, potentially influencing investor sentiment and contributing to a rise in Bitcoin’s price.

Ripple’s 2024 Crypto Market Outlook; Impact on BTC

Stuart Alderoty, Chief Legal Officer at Ripple, has disclosed their cryptocurrency market forecasts for 2024, focusing on the regulatory landscape. Alderoty anticipates that the U.S. Securities and Exchange Commission (SEC) will maintain its vigilant oversight of the industry.

While he predicts an outcome for the SEC’s ongoing lawsuit against Ripple, he also foresees continued regulatory actions against major players in the sector. He envisions judges serving as a crucial barrier against the SEC’s overreach, potentially setting the stage for future Supreme Court interventions.

Another key aspect of Alderoty’s prediction involves a division among US Congress members over the ideal approach to cryptocurrency regulation, which may place US crypto firms at a competitive disadvantage internationally. Ripple’s predictions highlight persistent regulatory challenges, which could significantly influence the broader cryptocurrency market sentiment, including Bitcoin (BTC).

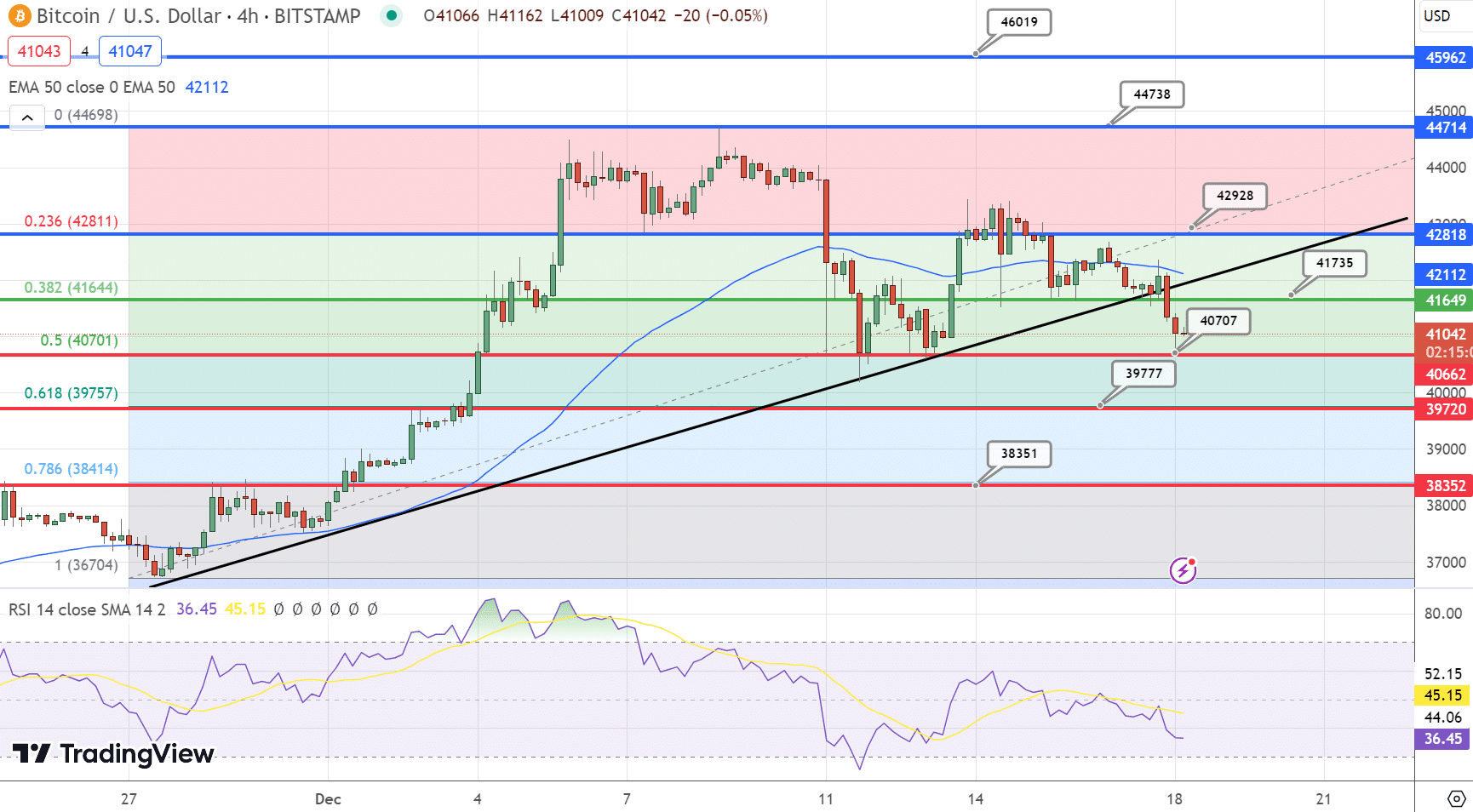

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.