Bitcoin Mining Difficulty Just Made the Highest Jump in Two Years

The pre-adjustment predictions last week seem to have underestimated this Bitcoin (BTC) mining difficulty adjustment, as it went higher than expected.

The third Bitcoin mining difficulty adjustment after the halving saw this measure of how hard it is to compete for mining rewards increase by 14.95% to more than 15.78 T today. This is bringing it closer again to the 16 T level, reached only twice, pre-halving: in March and May this year.

Last time difficulty jumped more was in January of 2018, when it increased by 16.84%.

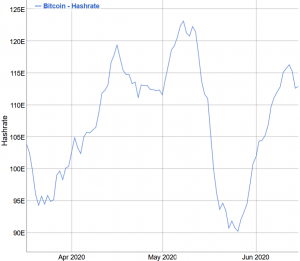

This time, it increased as more Bitcoin miners turned their machines on, increasing hashrate, or the computational power of the network, and decreasing block time. As a reminder, the mining difficulty of Bitcoin is adjusted every two weeks (every 2016 blocks, to be precise) to maintain the normal 10-minute block time (it shows how fast a new block is found). Recently it fluctuated around 8-9 minutes.

Since the previous difficulty adjustment on June 4, hashrate (7-day moving average) jumped by around 8%.

In either case, this difficulty adjustment will cut mining profit margins and force some less efficient miners to shut down their machines.

Also, as reported, miners have started to hodl more of the newly generated BTC at the time when BTC is still failing to breach the psychologically important level of USD 10,000. James Bennet, CEO at ByteTree, told Cryptonews.com that as the price recovers, miners might start offloading their inventory again. “Miners want to get the best price for their bitcoins but still need to cover operational expenses. They are generally not long-bitcoin, but are market savvy,” he added.

At pixel time (16:53 UTC), BTC trades at USD 9,512. It’s up by 1.4% in a day and is down by 2% in a week.