Bitcoin Miners Sell 10,600 BTC, Worth $455.8M in Crypto Renaissance

The world’s largest cryptocurrency by market cap, Bitcoin, is experiencing a massive selloff from none other than its miners.

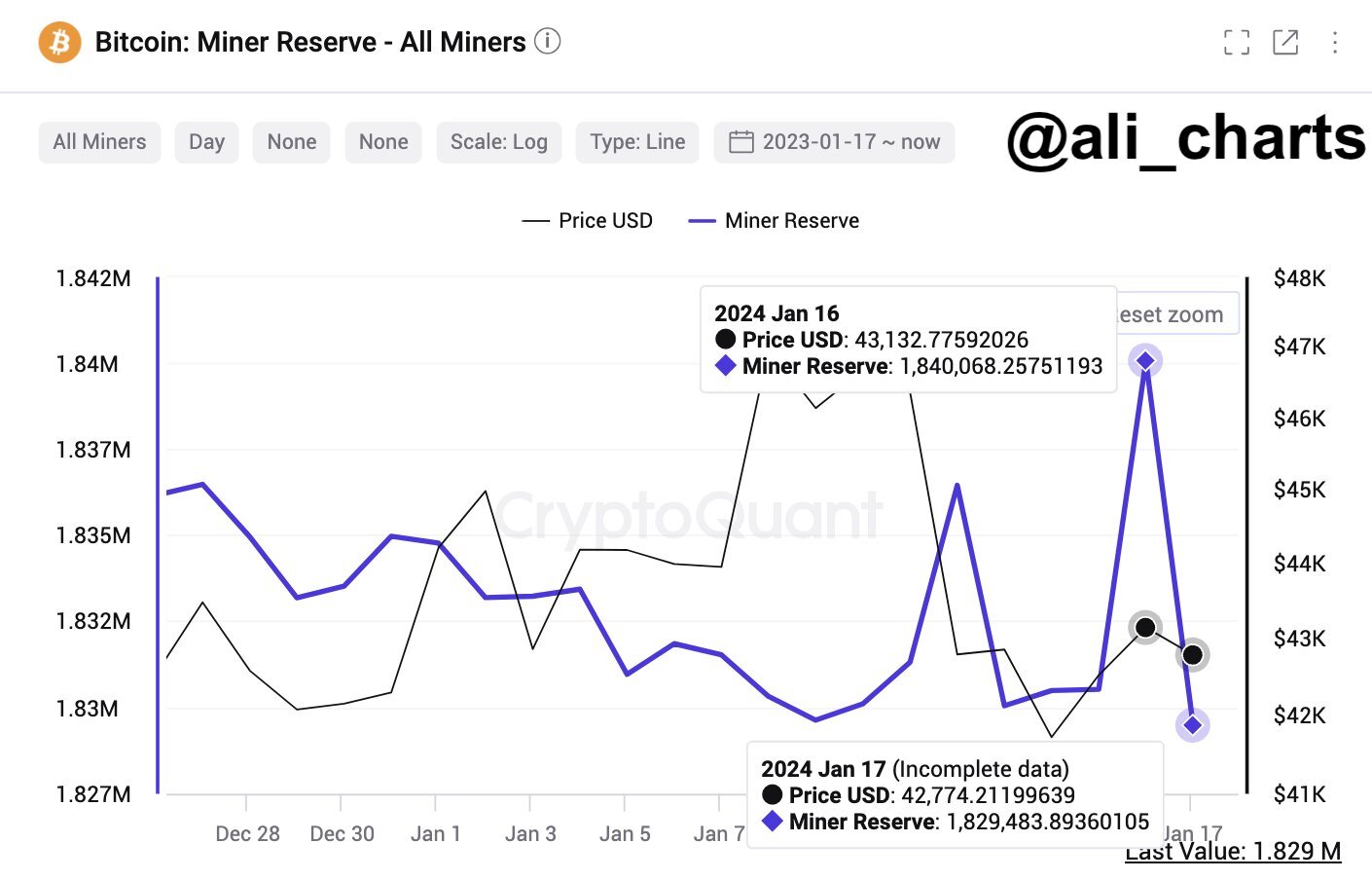

🚨 #Bitcoin Miners in Selling Mode: Recent on-chain data from @cryptoquant_com indicates a substantial increase in selling activity by #BTC miners. In just the last 24 hours, they've offloaded nearly 10,600 $BTC, valued at approximately $455.8 million! pic.twitter.com/JEtasWfR6N

— Ali (@ali_charts) January 17, 2024

Capturing the data on his official X (formerly Twitter) handle, crypto market expert Ali Martinez revealed that Bitcoin miners have offloaded a whopping 10,600 BTC – equivalent to over $455.8 million at current market prices – in the last 24 hours.

Corroborating this information, popular on-chain analytics firm CryptoQuant revealed that Bitcoin miners are actively selling their BTC hoards. According to the platform, crypto exchange netflow total has surged by 130.45% in the last seven-day average.

However, CryptoQuant also notes a decline in exchange Bitcoin reserves, suggesting a slowdown in selling pressure across the crypto landscape. More investors are apparently moving their digital assets off exchanges and storing them individually.

Bitcoin has undergone various cycles in recent months. Following reports of a US Securities and Exchange Commission (SEC) spot Bitcoin exchange-traded fund (ETF) in early 2024, the leading cryptocurrency surpassed the $30,000 price mark, eventually reaching $45,000 before encountering a trend reversal.

At press time, Bitcoin is seeing support within the $41,000 and $43,000 range, although the possibility of a downtrend cannot be ruled out. Nonetheless, the crypto bellwether still maintains positive momentum, supported by several factors.

One key factor is the upcoming Bitcoin halving scheduled for April 2024. This event will significantly reduce the block rewards miners receive by 50%, slicing it from 6.25 to 3.125 BTC.

With low supply and increasing demand, Bitcoin is expected to surpass the $45,000 price mark in the near future.

Another positive development is the historic approval of a spot Bitcoin ETF by the SEC, announced on January 10, 2024.

Looks like they took the link down for now

But I took a screen recording of the full PDF from SEC's website showing approval for all 11 spot bitcoin ETFs

(Pause to read) pic.twitter.com/13wQ1Gx3dc

— Jacquelyn Melinek (@jacqmelinek) January 10, 2024

This event marks a pivotal moment for the crypto space as it basically ushered the deflationary decentralized asset into the traditional financial landscape. This significantly boosts adoption and amplifies market interest in Bitcoin and other similar assets.

Selloffs? No Probs

Despite what looks like a negative outlook with miner sales, the Bitcoin network is still depicting strong demand and an overflooded memory pool.

According to a post on X by Mati, CEO of Quantum Economics, the Bitcoin memory pool (mempool) is currently at full capacity.

The above chart indicates that the amount of data awaiting confirmation is currently double the amount of its previous all-time high (ATH).

Bitcoin is overflooding!!!

The mempool, which is where transactions wait to be confirmed by miners is completely full. This chart shows the amount of data awaiting confirmation, which is currently more than double the previous all time high. pic.twitter.com/E8tnRsYi4U

— Mati (@MatiGreenspan) January 8, 2024

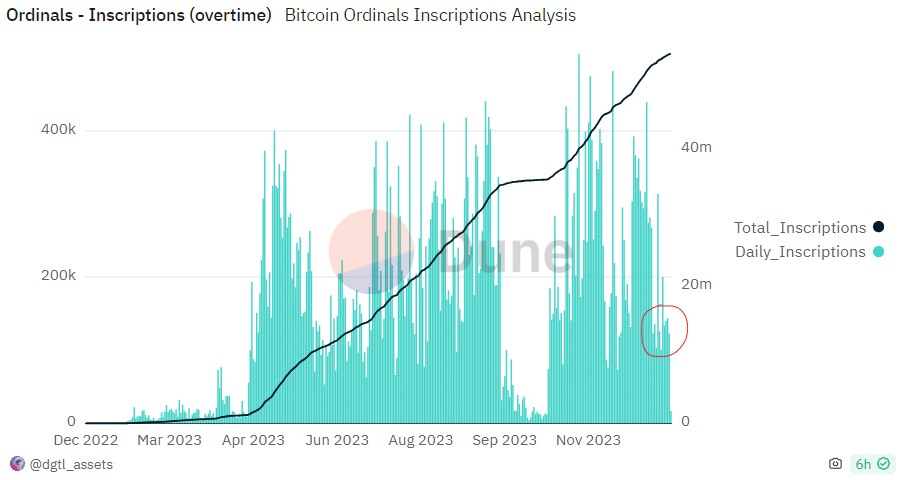

The primary factor contributing to this unusual occurrence is the Bitcoin Ordinals inscriptions service, which allows the recording of metadata on individual satoshis (the smallest unit of Bitcoin).

However, Mati noted that the Bitcoin Ordinals are not yet operating at full capacity. He revealed that only 100,000 inscriptions have been recorded since the beginning of 2024.

Hence, the Bitcoin network is enjoying organic growth without external forces putting much influence on it.