Best Crypto to Buy Now August 29 – XDC Network, Avalanche, Algorand

Bitcoin jumped to a two-week high on Tuesday, August 29, after digital asset manager Grayscale won a lawsuit against the U.S. Securities and Exchange Commission (SEC).

Bitcoin’s price gained $1,400 within the first hour after the news broke. The ruling by the U.S. Court of Appeals for the District of Columbia Circuit stated the SEC was “arbitrary and capricious” in rejecting Grayscale’s proposal for a Bitcoin exchange-traded fund (ETF) that would track the cryptocurrency’s spot price.

With these macroeconomic developments in mind, what are the best cryptos to buy now?

The court ruled that the SEC was wrong to reject the Grayscale #Bitcoin Spot ETF.

— Crypto Rover (@rovercrc) August 29, 2023

What's next?

Likely all the other Bitcoin Spot ETFs are going to get approved, the question really is when, not if.

This ETF is a fully regulated spot ETF, not a synthetic version. A spot ETF… pic.twitter.com/F2BDBJzjbw

“The denial of Grayscale’s proposal was arbitrary and capricious because the SEC failed to explain its different treatment of similar products,” the court document read. “We therefore grant Grayscale’s petition and vacate the order.”

This decision adds Grayscale to the list of firms still waiting for approval from the SEC to launch the first U.S. spot Bitcoin ETF. So far, the regulatory body has rejected all similar proposals.

At the time of writing, Bitcoin is trading at around $27,700 after reaching a high of $28,167 following the news. According to data from the Binance exchange, the uptick was driven by increased buying across all order sizes in an otherwise illiquid market.

Grayscale’s battle with the SEC has been lengthy and gradual. CEO Michael Sonnenshein has insisted the company would continue challenging the regulatory body until receiving approval to convert the existing Grayscale Bitcoin Trust (GBTC) into a Bitcoin ETF.

🚨 JUST IN 🚨

— Sonnenshein (@Sonnenshein) August 29, 2023

The D.C. Circuit ruled in favor of @Grayscale in our lawsuit challenging the SEC's decision to deny $GBTC's conversion to an ETF!

Thank you to everyone who has been on this journey with us, especially our investors. We are grateful for your support and…

“Thank you to everyone who has been on this journey with us, especially our investors,” wrote Sonnenshein on Twitter after the court’s decision. “We are grateful for your support and encouragement. Next up: our legal team is actively reviewing the Court’s opinion.”

Following the news, the GBTC share price jumped over 17% to $20.60. The latest court ruling signals a major win for both Grayscale and the wider cryptocurrency industry in gaining regulatory approval for a Bitcoin ETF in the U.S.

Echoing a sentiment of renewed cryptocurrency market optimism, XDC Network, Wall Street Memes, Avalanche, yPredict, and Algorand are some of the best cryptos to buy now, backed by strong fundamentals and/or optimistic technical analysis

XDC Network (XDC) Technical Analysis: A Potential Breakout on the Horizon

XDC Network (XDC) has been grappling with a key resistance zone for the past five days, trading below both the Fib 0.382 level at $0.05405 and the 50-day EMA at $0.05413.

Today, the cryptocurrency is showing signs of a potential breakout, with an impressive 11.75% move to the upside.

Currently, the 20-day EMA stands at $0.05690, just above the immediate support zone which ranges from $0.05405 to $0.05679.

This zone, which also aligns with the 50-day EMA, provides a robust foundation for XDC’s current upward trajectory.

The 100-day EMA at $0.04818 further reinforces the longer-term bullish sentiment.

XDC’s RSI is currently at 53.85, up from yesterday’s 45.43. This is a positive sign, indicating that buying pressure is increasing and outpacing selling pressure.

The MACD histogram has moved up to -0.00062 from yesterday’s -0.00127, signaling a potential shift in momentum from bearish to bullish.

The market cap of XDC Network has seen a notable increase of 12.34% to $827 million, with the 24-hour trading volume also up by 24.12% to $11.4 million.

These figures suggest a growing interest in XDC among traders and investors, which could fuel further price appreciation.

XDC’s price stands at $0.05982 as of writing, up by 11.75% so far today.

The immediate resistance lies at a horizontal zone ranging from $0.06176 to $0.06503, which coincides with the Fib 0.5 level at $0.06176.

A decisive break above this level could trigger a new wave of buying activity, driving the price further up.

The technical indicators are suggesting a bullish outlook for XDC Network.

Traders should watch for a potential breakout above the $0.06176 resistance level.

From GameStop to $WSM: Join the Hype Train of One of the Best Cryptos to Buy Now

During the crypto market’s unpredictable swings, Wall Street Memes ($WSM) has shone as a standout success, securing over $25 million in its presale.

This current meme coin trend signifies that even in unsteady periods, viral community-led ventures can hold their momentum.

It's priced in pic.twitter.com/7Wf53uioN3

— Wall Street Memes (@wallstmemes) August 28, 2023

Connections to the renowned Reddit group Wall Street Bets, known for their role in the GameStop stock surge, provide $WSM with an inherent network of supporters and participants.

Wall Street Memes pulls in over 40 million social impressions monthly on its comical finance-themed social channels, progressing toward its $1 billion market cap goal.

But Wall Street Memes is more than just memes. Catching the eye of Elon Musk himself, whales have flooded the presale amidst strategic buzz.

The team is reserving 50% of tokens for presale, 30% for community rewards, and 20% for exchange liquidity – focusing beyond hype on ecosystem growth.

The recently unveiled staking feature offers annual percentage yields (APY) up to 101%, incentivizing holding $WSM long-term.

This tactic boosted new crypto BTC20 by 80% since its launch despite market volatility. A $50K airdrop for presale supporters has over 87,000 entries already.

Wall Street Memes is set to launch on major exchanges in a month, expected to surge in price. The team also revealed plans for an on-chain Stake-to-Earn system, adding utility.

With major exchange listings imminent and new developments like staking rewards and airdrops revealed, Wall Street Memes seems ready for liftoff.

Avalanche (AVAX): Consolidation Before Next Move?

Avalanche (AVAX) continues to hold its ground, marking the fourth straight day of positive price action.

Trading at $10.83, up 4.44% so far today, AVAX retested a key resistance zone but was met with swift selling pressure, suggesting that the cryptocurrency may need more time to consolidate before making its next upward move.

The technical indicators paint a nuanced picture for AVAX. The 20-day EMA stands at $10.96, just above the current price, acting as a barrier to further price ascent.

The 50-day and 100-day EMAs are positioned at $11.93 and $12.92 respectively, indicating that AVAX has some ground to cover before it can reach these higher levels.

A critical development is seen in the RSI, which has risen from 32.12 to 42.28. This increase suggests a shift from a bearish to a more neutral outlook, potentially signaling a growing bullish momentum in the future.

Adding to this positive momentum, the MACD histogram has shown a bullish crossover, moving from -0.02 to 0.04. This could be an early indication of a possible trend reversal, from bearish to bullish, in the immediate future.

Avalanche’s market cap has grown by 5.16% to $3.8 billion, and its 24-hour trading volume has surged by 61.41% to $184.8 million. This increased trading activity might be a precursor to increased volatility.

However, investors should take note of the triple confluence of resistance at the horizontal resistance zone of $11.02 to $11.34, in confluence with the 20-day EMA of $10.96 and the Fib 0.236 level at $11.19. This significant resistance zone may thwart immediate bullish ambitions.

On the flip side, the immediate support is found at the current swing low of $9.72 to $10.05. This region could serve as a cushion should AVAX face a downward price action.

While the increase in trading volume, rising RSI, and bullish MACD crossover suggest growing bullish momentum, the proximity of the resistance zone means that AVAX may need to consolidate further before making a meaningful upward move.

Traders and investors should keep a close eye on these technical indicators to gauge AVAX’s next move.

Data-Driven Crypto Success: $YPRED Is One of the Best Cryptos to Buy Now

Crypto startup yPredict has raised over $3.65 million to develop an AI-powered platform for financial forecasting.

The company intends to make sophisticated predictive analytics more accessible to retail cryptocurrency traders through user-friendly tools and an open marketplace.

🔮 yPredict: New article! Predicting #Ethereum price with #SVM model. SVM offers high accuracy (~94%) for crypto price forecasting. Our study shows SVM performs well in predicting ETH prices & explaining volatility. SVM surpasses other models like BNN & GB. #MachineLearning… pic.twitter.com/MILTRsIRmI

— yPredict.ai (@yPredict_ai) August 28, 2023

The yPredict platform will integrate statistical models like ARIMA, developed in the 1970s, with modern AI models like Long Short-Term Memory Networks.

By analyzing historical pricing data, these models can identify patterns and generate accurate price forecasts for cryptocurrencies.

According to a recent yPredict study, Support Vector Machine (SVM) models offer 94% accuracy in predicting Ethereum prices and explaining volatility. SVM surpasses other models in crypto forecasting.

The platform will provide market predictions, sentiment analysis, pattern recognition, and other analytics to empower retail traders to make data-driven decisions.

A key feature is the upcoming yPredict Marketplace, which will allow financial data scientists to monetize their predictive models through a subscription service.

The beta launch later this year could give individual traders an edge previously reserved for institutional players like hedge funds.

Within the context of the AI-powered race for improved financial forecasting, yPredict is determined to establish its presence by making complex crypto price predictions approachable for common traders.

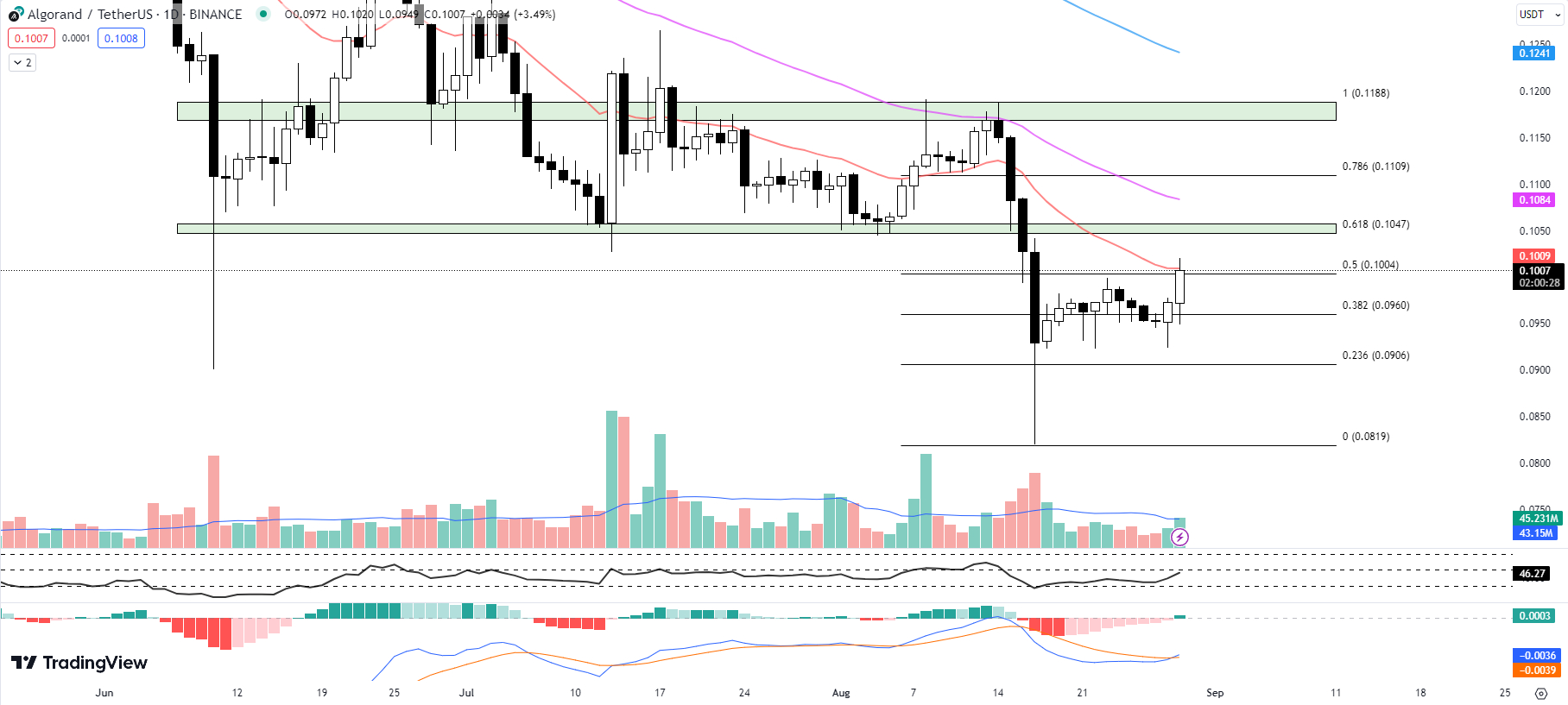

Algorand (ALGO): Indicators Suggest Potential Reversal

Algorand (ALGO) has been showing signs of recovery for the past few days. Following yesterday’s 2.10% move to the upside, ALGO continues to climb, posting a further 3.49% uptick so far today.

Currently trading at $0.1007, ALGO is attempting to surmount its 20-day EMA, hinting at potential bullish momentum.

The 20-day EMA is currently at $0.1009. This is only marginally above the current ALGO price. A breakthrough at this level might confirm the initiation of a bullish trend.

However, the 50-day and 100-day EMAs, which stand at $0.1084 and $0.1241 respectively, indicate that ALGO is still under longer-term bearish control.

The RSI has also shown a significant shift from yesterday’s 38.95 to today’s 46.27. The RSI is used to identify whether an asset is in an overbought or oversold condition.

With its current level below 50, ALGO is still in technically bearish territory, but the upward movement suggests a growing bullish sentiment among traders.

Another encouraging sign for ALGO traders is the MACD histogram, which has shifted from yesterday’s -0.0002 to today’s 0.0003.

This shift represents a newly formed MACD bullish crossover, often interpreted as a buy signal in technical analysis.

Looking at resistance levels, ALGO faces an immediate challenge at its 20-day EMA at $0.1009.

This is followed by the Fib 0.618 level at $0.1047, which coincides with the horizontal resistance zone between $0.1047 and $0.1057. Overcoming these resistance levels could fuel further upward momentum.

On the downside, immediate support for ALGO can be found at the Fib 0.5 level at $0.1004. If ALGO fails to close above this level, the next support level is the Fib 0.382 level at $0.0960.

While ALGO is currently showing signs of a potential reversal, traders should remain cautious. A break above the 20-day EMA and the resistance levels could confirm the bullish trend.

However, falling below the immediate support level might signal a continuation of the bearish trend. Traders are advised to consider these indicators and levels when devising a trading strategy for Algorand.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.