As XRP Robinhood Rumors Swirl, XRP20 Coin Price is Getting Ready to Blast Off for Near-Term 3x Gains

XRP Robinhood listing rumors are swirling, and that’s good news for XRP20 – the yield-bearing ‘XRP on Ethereum’ coin that launched yesterday and continues to see price consolidation above its $0.00092 listing price.

The stake-to-earn XRP20 token started trading on Uniswap decentralized exchange yesterday (Tuesday, August 22), racking up trading volume in excess of $1 million.

XRP20 mirrors the 100 billion supply of XRP but has no affiliation with Ripple, the issuer of the XRP token.

Nevertheless, XRP20 is positioned in the market as a better version of XRP, which means that it will benefit from the bullish sentiment surrounding the ecosystem since a recent ruling in the court case brought by the US Securities and Exchange Commission (SEC).

Market participants saw the judge’s decision as a win for Ripple after she said XRP was not a security when sold in the retail realm. The SEC is appealing that ruling.

Robinhood to relist XRP? More good news for XRP20

The upshot of all that is that a number of exchanges have reappraised their decision to delist the XRP token. Coinbase, for example, has relisted XRP.

Now there are rumors that online broker Robinhood could follow suit. The X (formerly Twitter) rumor mill has seen increasing noise in the past few days claiming that Robinhood could list XRP before the end of 2023.

If the rumors are true and Robinhood list $XRP by the end of the year then prepare for a MASSIVE uptrend

— Crypto Assets Guy (@cryptoassetsguy) August 21, 2023

Robinhood is known for being very tedious when selecting which crypto to list

So if they are getting ready to list XRP they must know something

As I have been saying, Q4…

What is good news for XRP is, by association, good news for XRP20 – the positive newsflow is likely to encourage buying of XRP20 after its solid trading debut.

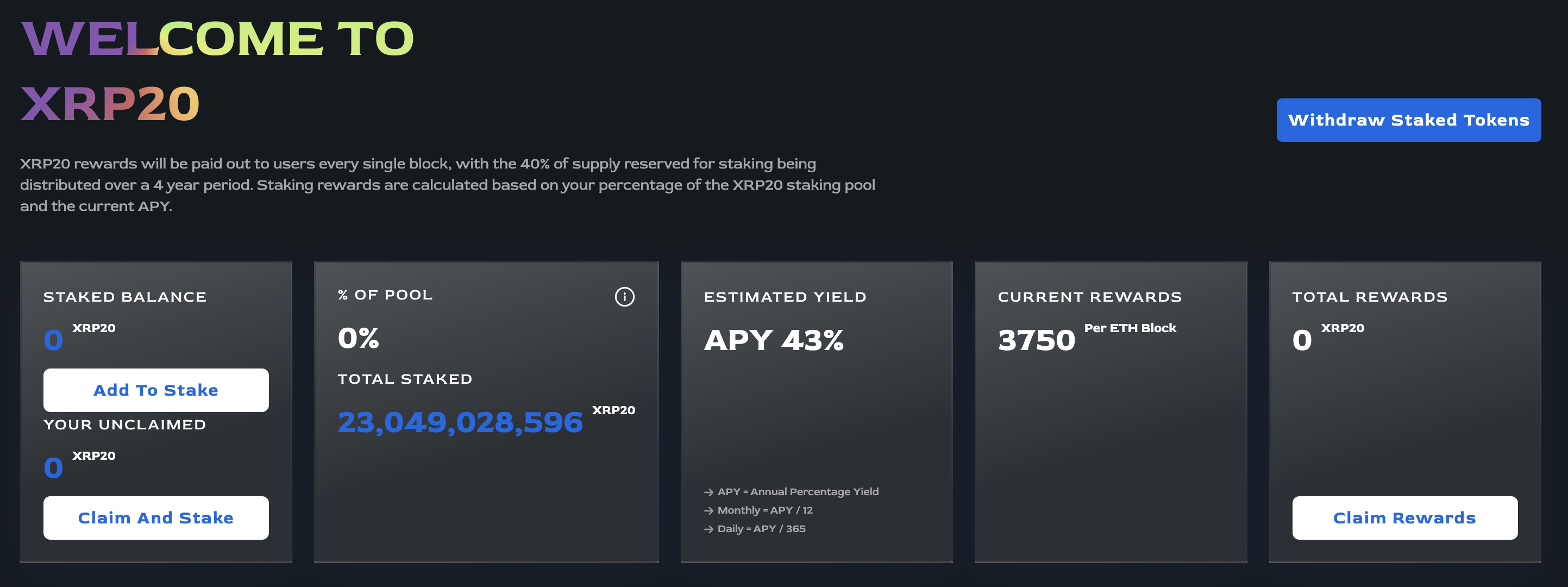

Priced at $0.000948 on Uniswap, according to the latest data from DEXTools, there are now 23 billion tokens staked, amounting to 22% of the total token supply and 56% of the presale allocation.

Forty percent of tokens are allocated to stalking rewards, with 10% each going to DEX liquidity and burning.

XRP20 is a deflationary asset. The burning mechanism works by sending 0.1% of every transaction to a burn address, effectively removing that amount from circulation and bolstering the price of the remaining tokens.

Enthusiasm for ‘version 2’ coins has not abated. There are currently 2,670 holders of the token.

In less than 24 hours, the coin has achieved a 99/99 score on the influential DEXTools trading and data site.

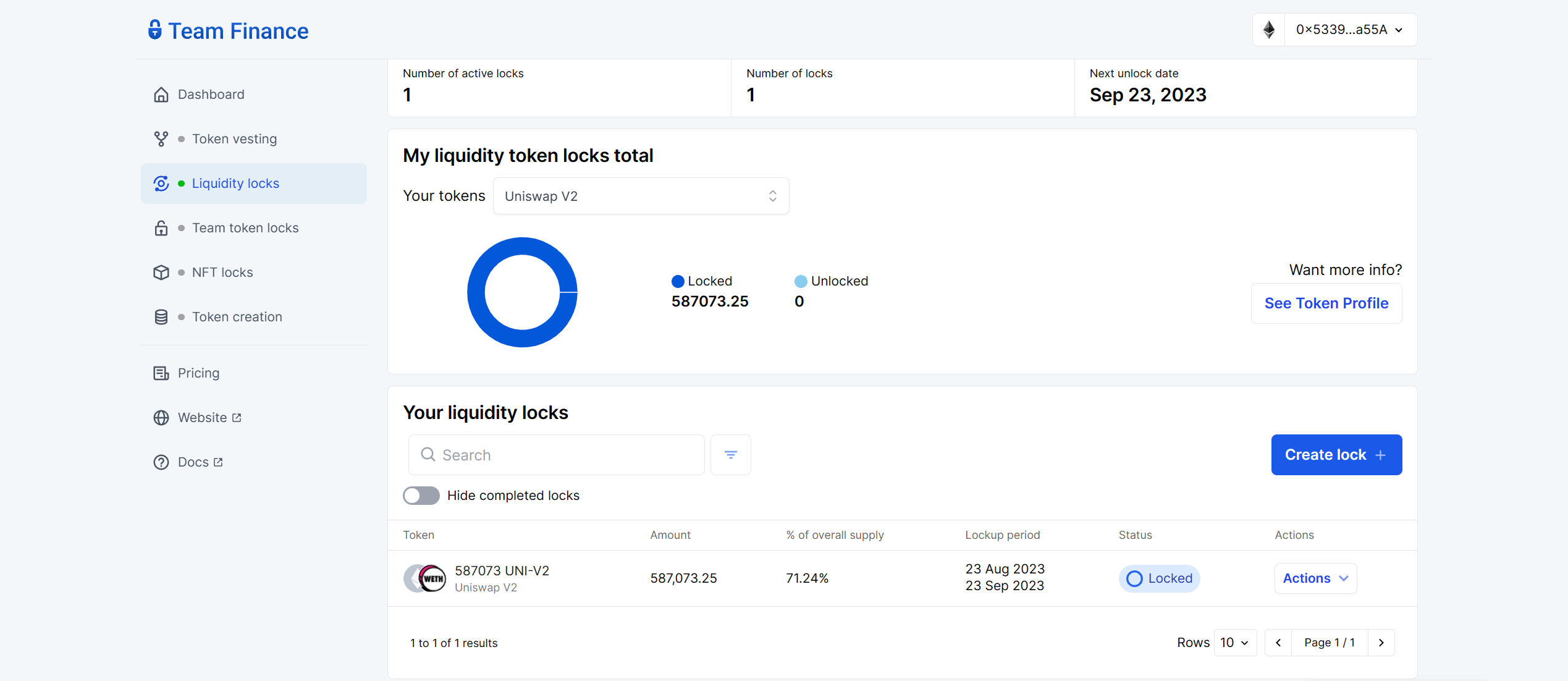

71% of $473,000 XRP20/WETH trading pair liquidity locked on Uniswap V2

Perhaps even more importantly, 71% of the liquidity provision of $468k is locked for one month. Locked liquidity is an indication of the commitment of the team to the project and means there’s no chance of a rug pull or similar nefarious activities by developers.

Since the locked liquidity became apparent on DEXTools, the community trust gauge has moved up to 97.2%

However, buyers do not need to rely on the automated systems of sites like DEXTools and Dexscreener to check token security, although both of those sites show no issues with the XRP20 smart contract.

Helpfully for prospective buyers, the XRP20 team left nothing to chance as far as security goes. Respected blockchain security firm 0xguard conducted an audit of XRP20’s smart contracts.

The audit has now been published on the website for the public to read. No high or medium-level severity issues were found with the smart contracts.

Earn passive income for 4 years with 44% yield

Although there is no affiliation of XRP20 with Ripple or XRP, the former does mirror the token supply of the latter, at 100 billion, but with token rewards emitted for each ETH block produced. XRP20 is a passive income monster.

The XRP20 project’s innovative stake-to-earn utility is funded by allocating 40% of the token supply to paying community rewards.

Staking rewards will be paid out over the next four years. XRP20 runs on the Ethereum blockchain, and 3,750 tokens are emitted per ETH block.

The 7-day lock rule applies to all initiations of staking, not just those tokens staked prior to listing. Tokens continue to earn APY for as long as they are staked.

Stakers can claim their rewards by clicking the claim button or withdraw their tokens from staking by clicking on the ‘withdraw staked tokens’ button on the XRP20 staking dashboard page. You can, of course, also add to an existing stake.

XRP20 builds support above listing price to create an ideal buy setup for 3x gains

Since this morning in the European session, XRP20 has started to trend higher on a shallow incline. At the moment, the coin exhibits a Goldilocks-like behavior – not too hot, not too cold.

That’s probably good news for those considering an entry position for the XRP20/WETH pair.

If the price rises too rapidly, it creates gaps that one large sell trade can take out a lot of progress because of the lack of buyers at multiple points below the sell trade to offer support.

Also supporting the price is the willingness of buyers to enter the fray when the price falls below the list price of $0.000092.

The chances of XRP20 reclaiming its high $0.0001336 have risen significantly in the past few hours, as market sentiment shows signs of turning more bullish after the SpaceX crash in prices amidst Elon Musk’s rocket ship company dumping bitcoin.

And now rumors of Robinhood reopening XRP trading and XRP20’s pitch as a second chance to get into the XRP price at a low price, an entry price for buyers beckons strongly.

The risk-reward ratio of 3 (or 1:3) when buying at the current price level, with a price target at the all-time high, hits the sweet spot for traders.

When the possibility of making a profit is three times greater than the amount you are risking, the chances of coming out ahead in a trade are far better over the long run, or in crypto, given the volatility of markets, that would be over the relatively short run.

Going back to the coin fundamentals briefly touched on concerning XRP20’s advantages over XRP, its decentralization on Ethereum beats the centralized token emission controlled by Ripple, even if the tokens are in escrow.

Also, with XRP20 there are no tokens set aside for founders and team members as there were with XRP.

Last but not least, Ethereum is the most liquid and widely adopted decentralized finance (DeFi) ecosystem in crypto. There are no limits on the possibilities that provides to build on top of the coin infrastructure to add utility way beyond staking and burning.

In summation then, buying into XRP20 today could be the best chance in the current market for securing a blend of passive income and capital gain.