Solana Founder On Critical DeFi Challenges and How To Fix Them

High transaction fees and security are the two most pressing challenges in the decentralized finance (DeFi) industry, according to Anatoly Yakovenko, Founder and CEO of blockchain developer Solana (SOL). The fee challenge can be solved “while maintaining satisfactory decentralization” while improving security requires an industry-wide collaboration, he added in a quick interview with Cryptonews.com.

Here’s what we discussed as the Solana DeFi Hackathon kicked off this past Monday.

Cryptonews.com: What is the most pressing challenge in DeFi now?

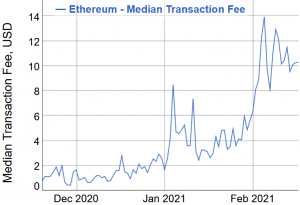

Anatoly Yakovenko: Fees is the most sensitive challenge right now. DeFi is built on the vision of permissionless and accessible finance for anyone and everyone, and currently, high transaction fees are generating friction for [smaller users]. For example, providing USD 100 in liquidity for the SUSHI/ETH pool can cost over USD 100 in network fees during times of congestion.

Even at 100% [annual percentage yield], one wouldn’t be able to recover their costs to participate over 12 months. In addition to that, high fees also make certain use-cases non-viable. An obvious example of this is micropayments.

There are several solutions being worked on within the industry, including Layer 2 scaling solutions such as plasma, rollups, and sidechains, new Layer 1 [solutions] such as Solana, Near, Avalanche, etc.

Can these challenges be solved without hurting decentralization?

These challenges can definitely be solved while maintaining satisfactory decentralization. However, decentralization is a multifaceted metric with several interpretations.

At Solana, we believe the most important factor in determining decentralization is the network’s censorship resistance. Which is relative to the minimum set of nodes within the network that is required to censor or halt the network.

In proof-of-stake (not to be confused with [delegated proof-of-stake]) networks, this threshold is made up of the number of nodes that add up to 33% of the networks staking power. Blockchains like Ethereum 2.0, Cosmos, and Solana all generally share this same characteristic.

The key difference here though is that Solana solves these DeFi challenges by leveraging hardware and bandwidth.

Nodes in Solana can increase their hardware and bandwidth to improve the network’s scalability, speed, and fees.

Ethereum 2.0 takes a different approach and puts high importance on ensuring the hardware and bandwidth requirements for nodes are as low as possible and have a requirement of ETH 32 [USD 61,000] as a minimum to be eligible to run a node. However, both networks can support tens of thousands of nodes.

There are also other solutions such as optimistic rollups, however, these solutions still use a ‘trust and verify’ model, where the system optimistically trusts the network, and relies on nodes to catch any malicious behavior.

What other challenges do you see for Defi?

Security is a critical factor. Composability is extremely powerful, however, as more DeFi protocols start to interact with each other and build on top of each other, the risk of cascading failures across systems grows exponentially. If we really want to build a permissionless settlement layer for democratizing the world’s financial system, it needs to be robust and secure.

We’re already moving in the right direction, and many teams already work to a high standard.

However, it’s important that we continue to maintain a healthy ecosystem and community for security researchers to participate and contribute to DeFi.

Recently Paradigm [a cryptoasset investment firm] launched Paradigm CTF, [an Ethereum focused security competition], which consisted of several blockchain security challenges.

Events like Paradigm CTF and well-designed security bounty programs will be critical in ensuring these DeFi protocols continue to receive the most attention from security researchers, enable exploits to be identified earlier and allow us to deliver more robust protocols.

When security in DeFi might improve significantly?

Security won’t improve overnight, and the technology is evolving rapidly, therefore the attack surface is constantly changing. We may also never reach a point where these protocols are objectively impenetrable. However, we can improve security by collectively working together to enrich resources like Open Zeppelin [a library for secure smart contract development] to ensure developers have pre-audited smart contracts that they can draw on when building out new protocols.

In the hackathon, what Defi-related solutions is Solana looking for?

Solana is focused more-so on DeFi use-cases that specifically leverage its fast blow times, low fees, and high throughput. Therefore payments, micropayments, central-limit-order-books are use-cases which we’re particularly excited about. This is why we’ve been so excited about the potential for Serum (a decentralized exchange that is running on Solana’s mainnet and was created by crypto derivatives exchange FTX and Alameda Research).

Among many ideas announced ahead of the hackathon, what are your favorite ones?

Borrow/lending is one that is my favorite. Once we have a borrow/lending protocol, we can then unlock some really exciting features such as margin trading on decentralized exchanges like Serum. What makes margin trading and borrow/lending so interesting on blockchain is because all on-chain information is available. This information means that we have access to transparent and auditable collateral 24/7/365. We can essentially monitor and price risk in real-time and create extremely efficient borrow/lending protocols around it.

__

At the time of writing (16:48 UTC), SOL, ranked 38th by market capitalization, trades at USD 9.2 and is up by 13% in a day and 2% in a week. The price rallied by 144% in a month.

___

This interview has been edited for space and clarity.

__

Learn more:

– Crazy Bitcoin and Ethereum Fees Dampen Rally, Help Competitors

– DeFi vs. Bitcoin Debate Starts a New Round

– Fed-Published DeFi Study By a European Professor Boosts Industry Morale

– ‘DeFi Will Eat JPMorgan’ But There Are Risks Before That Meal

– DeFi Trends to Watch Out For in 2021 According to ConsenSys and Kraken

– DeFi ‘Genie Is Out’ and Is Set For Growth in 2021

– Yield Farming-boosted DeFi Set For New Fields With Old Challenges in 2021

– If Traditional Finance Moves to CBDCs, 2 Scenarios Open for DeFi – INDX CEO

– DeFi Industry Ponders Strategy as Regulators Begin to Circle

– Crypto Security in 2021: More Threats Against DeFi and Individual Users

– Top 4 Risks DeFi Investors Face

– New Regulatory Lemons Await Somewhere Between DeFi & CeFi