How to Trade Crypto Futures on PrimeXBT in May 2024 – Easy Guide

Futures trading can produce lucrative gains (or large losses) and knowing what you’re doing, and how to trade crypto futures on PrimeXBT is imperative to being able to succeed.

Here we’ll explain futures trading, dive into the details of perpetual contracts, take a closer look at why PrimeXBT is the best platform for trading crypto futures right now, and then walk through how to trade crypto futures on PrimeXBT.

Crypto Futures Trading Explained

To trade crypto futures is to trade contracts, called futures contracts, that constitute a legal agreement to buy or sell a particular asset at a predetermined price at a predetermined time in the future. They are the same as trading regular futures contracts but focus on crypto as the underlying asset.

Futures, Options, and Derivatives: What’s the Difference?

Derivatives are the overarching category that Futures and Options fit into. They are contracts between two parties, where the contract derives its value from a chosen underlying asset—but that asset is never owned by either of the parties.

So Options and Futures are derivatives because they derive their valuation from a select underlying asset, or even a basket of assets, like the S&P 500 index, which are then traded like regular stocks on dedicated Futures or Options exchanges.

Those asking “What are crypto derivatives?” should know that the most popular crypto derivatives are futures and options.

A futures contract is between two parties, the buyer and the seller. The buyer has agreed to purchase an asset at a specific price on a specific date, the seller has agreed to sell an asset at a specific price on a specific date.

This transaction happens regardless of the market value of the underlying asset at the time of the trade—meaning that one party will make a profit and the other will make a loss, depending on how the futures contract price differs from the market price of the asset.

Futures were initially first used in 16th century England, by those who wanted to protect themselves from price volatility. Specifically, they were used between the producer and wholesaler of an asset, say a farm good like cattle or wheat, to reduce their risk and ensure the price of an asset in the future, e.g., at the time of the next harvest. The first organized futures market is said to have been the Dōjima rice market in Ōsaka, Japan, in the 18th century.

Those wondering how to make money trading crypto futures should understand that futures are now typically used by price speculators, as opposed to the hedgers described above, and the underlying asset is rarely delivered and the contracts are settled using their equivalent cash value.

Futures vs Futures Contract

These are essentially the same thing, and buying Bitcoin Futures is the same as buying a bitcoin futures contract. When a trader uses the term futures they could be talking about the whole futures market “I trade futures” or a single asset “I trade Ethereum futures.” When a trader uses the term “futures contract” they are typically talking about a particular asset, “I bought bitcoin futures contracts.”

As mentioned, futures contracts have a definitive settlement date, when the buyer must pay the seller. However, traders will often roll their contract over close to the expiration date to avoid the costs associated with settling the contract—however, they do have to cover the gains or losses of the original contract when doing so.

Rolling futures contracts over like this allows the trader to maintain their position and market exposure.

Exploring Cryptocurrency Futures in Detail

Here we’ll focus on how crypto futures trading works for perpetual futures, as these are the types of futures contracts traded on the PrimeXBT exchange.

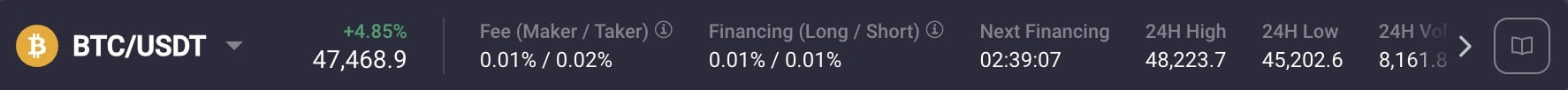

Below is an example of a futures contract on PrimeXBT:

Futures contracts are traded like normal spot trades, however, they can be leveraged, up to 200x on PrimeXBT, and when closed, like spot trades, the difference between your asset (futures contract) and the spot price will define the size of your profit or loss—which can be exaggerated by leverage.

Here we’ll explain the 3 important components of a PrimeXBT futures contracts. These allow you to calculate how much you need to pay to keep your contract open across financing periods, along with how much it costs to open and close it.

- Fee (Maker/Taker): Maker fees are paid by those who place limit orders (upon the execution of their order). Taker fees are paid by those who place market trades that automatically execute. They are labeled as such because Makers provide liquidity, i.e. make markets, and Takers take it.

- Financing (Long/Short): The funding rate that is designed to keep the futures market in line with the spot market price of the asset. This is taken every 8 hours, and a positive number means you pay commission, a negative one means you receive it.

- Next Financing: The next time the financing rate is taken from traders’ accounts (if applicable).

These are the essential parts of a perpetual futures contract and allow you to calculate you how much you need to pay to keep your contract open across financing periods, along with how much it costs to open and close it.

The higher the leverage multiple you select the larger these fees will be, as they are calculated on the size of your leveraged trade, not the size of the margin you’ve provided—seriously eating into your wallet balance for long-term trades when using high leverage.

Best Place to Trade Crypto Futures

The best platform to trade crypto futures, that we’ve found, is PrimeXBT. The PrimeXBT platform supports spot markets for over 30 of the most popular cryptocurrencies in addition to forex pairs, major stock market indices, and a broad selection of popular commodities. In addition to these spot markets, PrimeXBT also supports crypto futures trading where traders can take advantage of up to 200x leverage.

Futures trading fees are at the lower end compared to other crypto exchanges, with a 0.01% Maker fee and 0.02% Taker fee. The funding rate on PrimeXBT is 0.01%, long and short, and is calculated every 8 hours.

The future’s trading dashboard on PrimeXBT is user-friendly and feature-rich, featuring hundreds of indicators and drawing tools (integrated from TradingView), and multiple different market views to give traders all they need to place informed futures trades. A “Summary Module” also provides an overview of existing positions and orders and allows traders to easily and quickly adjust existing trades and positions and either cancel them or close them out.

Outside of its futures trading platform, PrimeXBT offers the aforementioned spot markets, a mobile app, integration with the copy trading platform Covesting (where users can hold $COV tokens to receive a fee discount), 24/7 customer service via Telegram, trading contests, and a multi-layer referral system. While it offers all these features it lacks the staking features present on many of the top crypto exchanges. PrimeXBT is also an unregulated broker.

In addition to all this, PrimeXBT offers an Academy featuring dozens of videos for new and experienced traders, including a series that has crypto futures trading explained. PrimeXBT also offers users weekly Market Research Reports, based on technical and fundamental analysis.

All-in-all, PrimeXBT is our number one choice for where to trade crypto futures.

| Supported Assets | Mobile App | Deposit Fees | Deposit Methods | Futures Trading Fees | Withdrawal Fees | Top Features |

| 30+ Cryptocurrencies, major stock indices, forex pairs, commodities | Yes (iOS and Android) | None for crypto and fiat | Crypto, fiat, and 3rd party crypto purchases | 0.01% Maker 0.02% Taker 0.01%/0.01% Funding Rate (8 hours) |

Varies by cryptocurrency (0.0005BTC for Bitcoin) |

Crypto futures, TradingView integrated charting tools, copy trading, up to 200x leverage, multiple-asset type support, weekly Market Reports |

Pros

- Leverage as high as 200x when trading futures

- Competitive fee structure for futures and spot market trading

- Support for cryptos, forex, stock market indices, and commodities

- Copy trading feature

- Integrated charts from TradingView

- Mobile app for trading on the go

- Weekly Market Research Reports

- Multi-layer referral system

Cons

- Unregulated broker

- No fiat withdrawals (only crypto)

- No demo account

- No staking service for idle assets

- Not available in the US, Canada, and 13 other jurisdictions

Step-by-Step Guide to Trading Crypto Futures on PrimeXBT

Here we provide a step-by-step guide, complete with screenshots, showing you how to trade crypto futures on the PrimeXBT trading platform.

*As PrimeXBT is not available in the US, this is not how to trade crypto futures in US

Step 1: Create an Account

If you don’t already have a PrimeXBT account you’ll need to create one. Head to the PrimeXBT signup page to get a $100 welcome gift when you register and deposit a minimum of $500 to the platform and transfer it to one of the Global Market’s trading accounts—this offer is time limited, and is only available in the first 48 hours after your registration.

Complete the necessary steps for creating an account, including creating a strong password, verifying your email address, and selecting your country.

Step 2: Fund Your Account

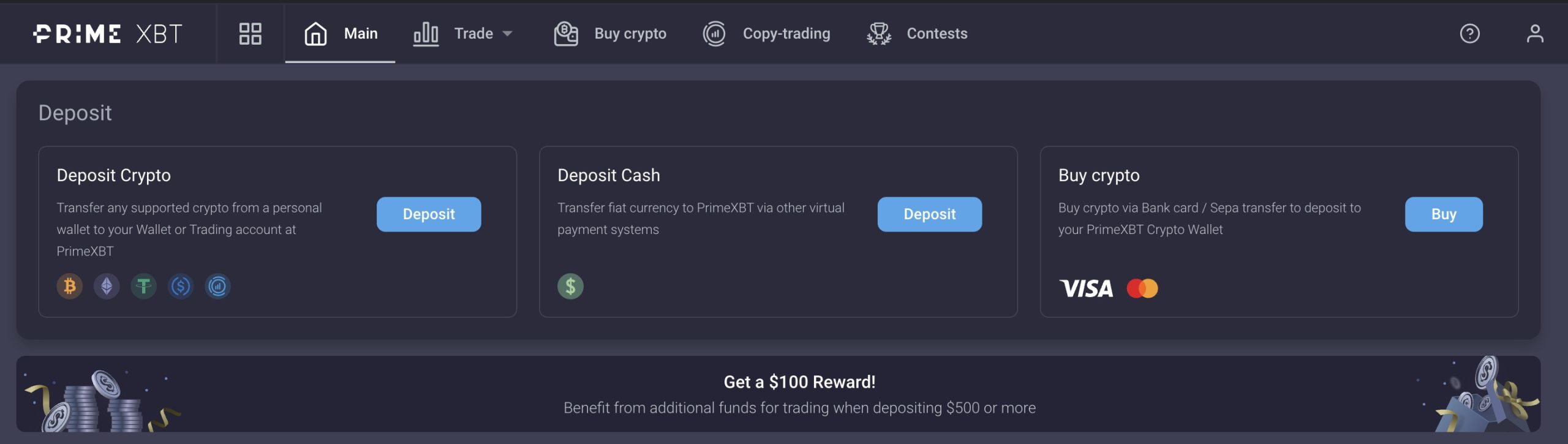

To trade future on PrimeXBT you’ll first need to fund your account so that you can provide the required margin for your futures contract.

In the top left quadrant of the PrimeXBT dashboard, you’ll find a blue “Deposit” button that will take you through to the deposit screen. Accounts on PrimeXBT can be funded through three different means:

- Directly depositing crypto to your account. PrimeXBT accepts BTC, ETH, USDT, USDC, and COV

- Depositing cash to your wallet on the Global Markets. PrimeXBT accepts deposits through Perfect Money and AdvCash (note that this method requires account verification)

- Buy Crypto using a Visa or Mastercard through third party provider BAKSTA

When depositing funds be sure, in the “Deposit To” dropdown box, to select “Wallet”. Follow the instructions with your chosen method to complete your deposit.

Step 3: Head to The Futures Trading Platform

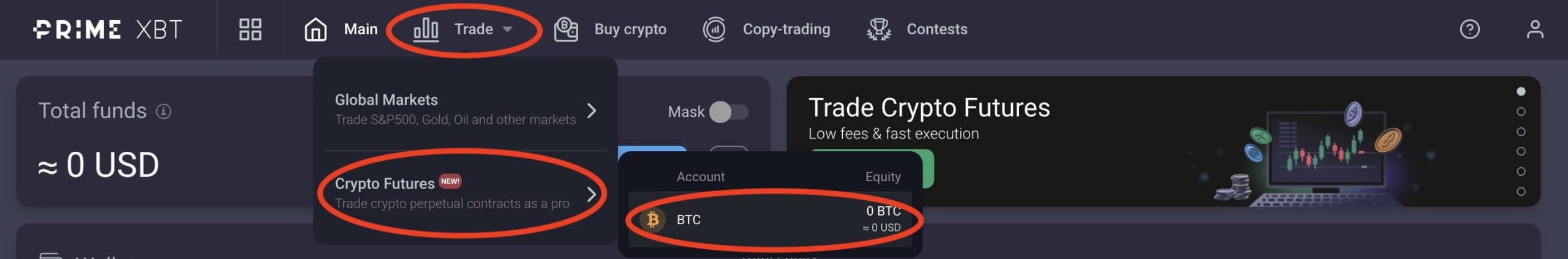

Once your account is funded you’re ready to trade futures. Now you need to find where to trade crypto futures on PrimeXBT.

Go to the menu bar, select “Trade” and then highlight “Crypto Futures” from the dropdown menu. While only Bitcoin is listed in this menu, there are over 30 futures markets available once you enter the trading interface.

Once you’ve clicked this you’ll be taken through to the future platform, and a quick tutorial will be offered to you. You can take this if you want to familiarize yourself with how to trade crypto derivatives on PrimeXBT.

Step 4: Select Your Market

Which cryptocurrencies you have deposited onto, or traded into, on the PrimeXBT platform will determine which ones you can use to buy futures contracts. In the top left corner of the futures platform is the current trading pair and a dropdown arrow.

Clicking this will allow you to select a market that you have the cryptocurrency to trade on. Note that if you don’t already own this cryptocurrency you’ll either have to deposit in it your wallet or head to the Global Markets page to buy it.

Step 5: Transfer Funds to Your Futures Account

In the top right hand corner of the futures platform, you’ll find a green button labelled “Fund”. Clicking this will allow you to choose how much of that cryptocurrency you want to transfer to your futures account.

Now you’re set to begin trading futures.

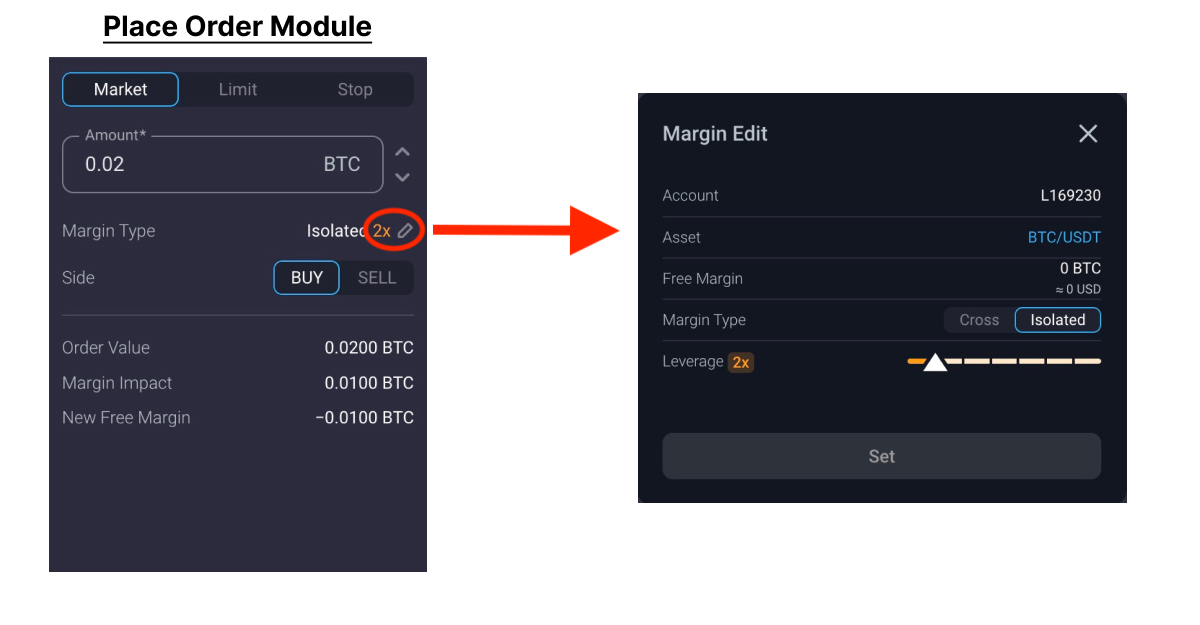

Step 6: Set the Parameters of Your Trade

Your trade with vary depending on your funds, risk tolerance, and sentiment toward the current state of the market. In the “Place Order” module you will find the parameters for your trade.

If you click the pencil next to your “Margin Type:” you’ll open up the “Margin Edit” module and be able to adjust your margin and liquidity parameters.

Once you’re happy with your margin parameters you can close the “Margin Edit” module and finalize your trade in the Place Order module.

Once finished you can click “Place Buy Order” to place your trade.

Step 7:Add Stop-Loss and Take-Profit Levels

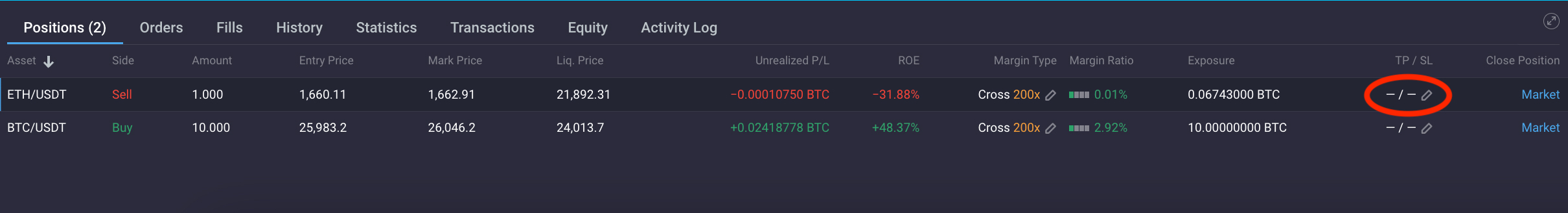

In the “Summary Module” at the bottom of the page you’ll find your existing trades (if you placed a market trade then your trade should automatically appear here).

The penultimate column, “TP/SL”, lists your Take Profit and Stop Loss limits. Note that they are not filled because, currently, you can’t add them at the moment of your trade on PrimeXBT.

It is a best practice, and highly recommended, to set these limits for your trade, and you can do so by simply clicking the pencil next to the TP/SL for the trade that you want to set these limits for.

If you placed your trade as a Limit or Stop order then you’ll find these under the “Order” tab in the “Summary Module”.

Step 8: Monitor Your Trades

Now you’re trading futures on PrimeXBT! You can use the futures platform to monitor the markets and your existing positions, with the ability to adjust your Margin Type, Leverage, Stop Loss, and Take Profit levels. You can even close out your trade to market. This is all done from the “Summary Module” at the bottom of the page.

Withdrawal Limits on Unverified Accounts

PrimeXBT allows users of unverified accounts to withdraw up to $20,000 in a 24 hour period from the platform—requiring withdrawals of larger amounts in a 24 hour period to require verification. Withdrawals that trigger an alert for suspicious activity can also be stopped and subject to a manual review process.

If you’re wondering how to report crypto futures trading on taxes, you can read our article covering crypto tax rules around the world for 2024.

Conclusion

Now you know all about crypto futures you can go ahead and begin trading them—being cautious of the amount of leverage you use at the same time.

PrimeXBT is our preferred platform for trading futures, because of its competitive fees, the number of markets it offers, and its user-friendly interface featuring charting tools from TradingView.

FAQs

Can You Trade Futures on PrimeXBT?

Yes, perpetual futures markets are available for over a dozen cryptos on PrimeXBT with up to 200x leverage.

Is PrimeXBT Safe?

PrimeXBT is an unregulated exchange and, for that reason, it is recommended that users do their research and exercise caution before using it.

Do You Need KYC on PrimeXBT?

No, you don’t need to complete KYC to use the PrimeXBT platform, and non-verified accounts can withdraw up to $20,000 in cryptocurrencies in a 24 hour period.

References

- Understanding Futures – Schwab.com

- Forwards and Futures in Tokugawa-Period Japan: A New Perspective on the Dōjima Rice Market – ScienceDirect.com

- What is ‘Leverage’ – economictimes.indiatimes.com

- What to Know About Derivatives and How They Allow Investors to Hedge, Leverage, and Speculate – BusinessInsider.com

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Sergio Zammit

Sergio Zammit

Kane Pepi

Kane Pepi

Eric Huffman

Eric Huffman