Is Bitcoin a Ponzi Scheme?

Is Bitcoin a Ponzi Scheme? Bitcoin was often referred to as a fraud during its early years. This viewpoint is still shared by some opponents of cryptocurrencies and decentralization.

But the reality is simple – while Bitcoin is a high-risk asset class, it’s far from a Ponzi Scheme. Not only are there regulated futures and ETF markets, but some of the world’s largest institutions have exposure to Bitcoin.

This article explores why some people view Bitcoin as a Ponzi Scheme, and why this sentiment couldn’t be further from the truth.

What is a Ponzi Scheme?

To fully understand why Bitcoin isn’t a Ponzi Scheme, let’s begin with a clear definition.

- According to the SEC, a Ponzi Scheme is “an investment scam that involves the payment of purported returns to existing investors from funds contributed by new investors.“

To simplify this definition, Ponzi Schemes rely on a constant flow of new people who are willing to part with their capital. This new capital inflow is used to pay existing members of the scam. This process repeats itself until the Ponzi Scheme can no longer attract new victims. This is usually because the Ponzi Scheme has been discovered for what it is – a fraud and a scam.

An Example of a Famous Ponzi Scheme – Bernie Madoff

One of the largest Ponzi Schemes in US history was carried out by Bernie Madoff – a ‘reputable’ and ‘trusted’ hedge fund manager. Madoff was also the former chairman of the NASDAQ. Madoff’s fund defrauded investors for more than 20 years. The fund consistently outperformed the market benchmarks, meaning constant flows of new capital were invested.

These newly invested funds were used to pay earlier investors who decided to cash out their holdings. US authorities – including the SEC and the FBI, finally uncovered the truth in 2008 – Madoff had lost more than $50 billion from client-owned capital. Madoff was subsequently sentenced to 150 years in prison.

Ponzi Scheme vs Pyramid Scheme: What’s the Difference?

- Both Ponzi and Pyramid Schemes are fraudulent activities aimed at scamming investors. However, there’s a slight difference in how the scam is developed.

- Ponzi Schemes make promises of high financial profits. Early backers are often paid returns with money acquired from new investors. This happens until the money flow dries up, or the Ponzi Scheme is investigated by authorities.

- While Pyramid Schemes also make bold claims about guaranteed returns, the focus is on recruitment. For instance, a new investor pays the existing member who recruited them. And then that member does the same with new investors. Similar to Ponzi Schemes, this process continues until the Pyramid Scheme either disappears or is shut down by authorities.

What Bitcoin and Ponzi Schemes Have in Common

Still asking the question – how is Bitcoin a Ponzi Scheme? Now that you know how Ponzi Schemes work, let’s look at what they have in common with Bitcoin.

Rapid Value Appreciation

One of the core selling points of Ponzi Schemes is the promise of fast and easy riches, otherwise referred to as get rich quick schemes. This last point is how Ponzi Schemes successfully attract so many people.

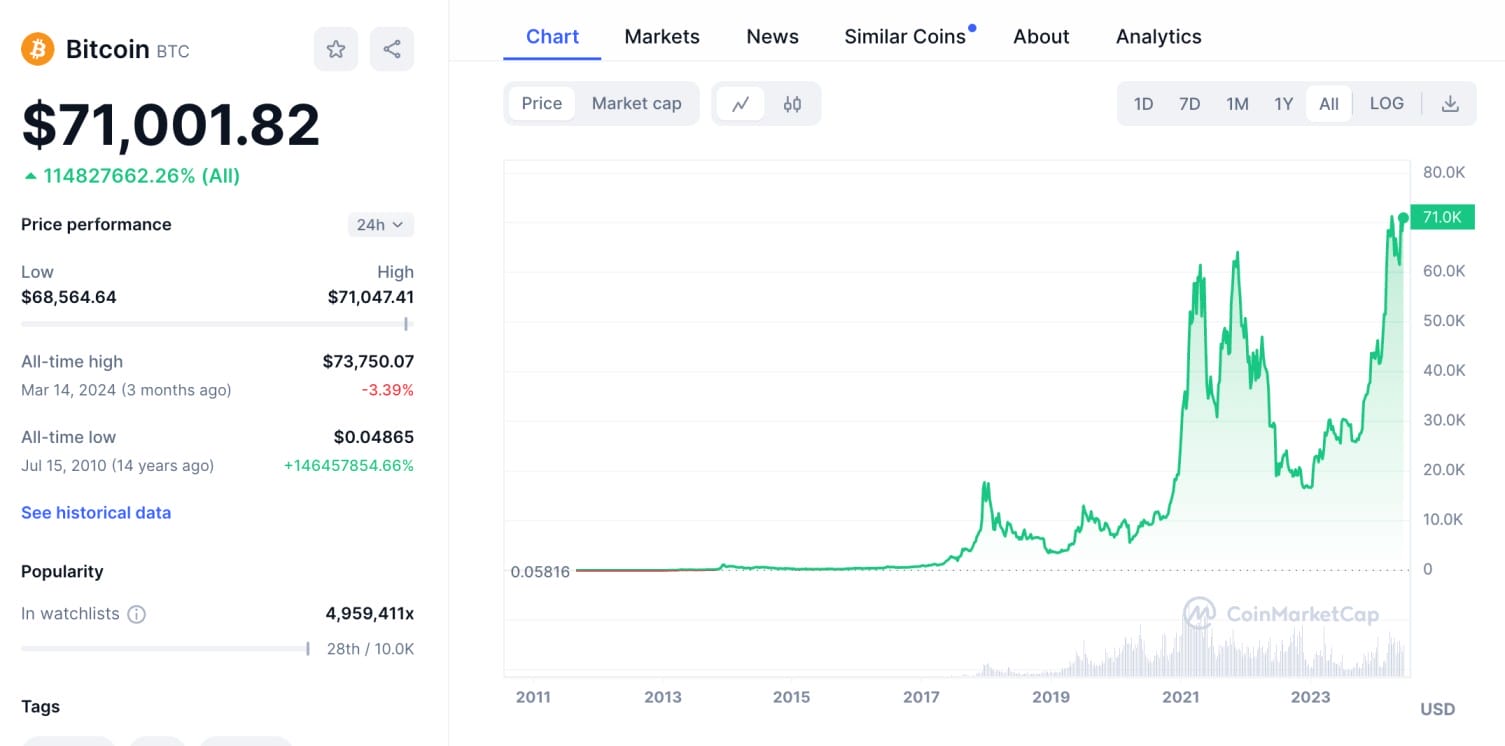

While Bitcoin isn’t a Ponzi Scheme, it has generated significant returns since launching in 2009. Especially for those who bought Bitcoin early. For example, Bitcoin was trading for cents during its initial years. Bitcoin has since hit all-time highs of over $73,000 – translating to returns of millions of percent.

In contrast, it would take thousands of years for the stock market to replicate similar returns. However, it’s also important to remember that Bitcoin is an emerging asset class. Similar to tech stocks with unproven concepts, emerging assets often witness rapid appreciation during the growth stages.

This doesn’t make them a Ponzi Scheme. On the contrary, those buying emerging assets take considerable risks – which are built into the rewards.

Speculative Nature

Another characteristic of Ponzi Schemes is their speculative nature. Investors are lured in by the high-risk high-return nature of the respective project. This was exactly what Bernie Madoff capitalized on. As mentioned, Madoff’s fund falsely reported unprecedented gains year after year.

Without questioning the legitimacy of these above-market returns, investors blindly injected capital to get a piece of the action. Similarly, although Bitcoin is often cited as a medium of exchange and a store of value, its use cases are irrelevant to most buyers. Instead, people typically buy Bitcoin for its speculative nature.

Once again, this doesn’t make Bitcoin a Ponzi Scheme. The same high-risk investors would have bought Tesla stock in 2010. While many market commentators said that electric vehicles were a ‘fad’, Tesla is now the world’s largest carmaker by market capitalization.

What’s more, those who speculated on Tesla in 2010 have since witnessed growth of over 13,000%. Over the same period, the S&P 500 has grown by about 415%.

Early Adopter Advantage

While most people lose money when unwittingly investing in a Ponzi Scheme, early adopters often do well. As mentioned, this is a core characteristic of how Ponzi Schemes work.

For example:

- The Ponzi Scheme promises high returns of 50% per month

- A minimum redemption period of one month is required. This means investors must wait at least one month before requesting a withdrawal.

- One of the first investors injects $5,000 into the Ponzi Scheme.

- After the first month, the investor is paid their 50% – which is $2,500

- That $2,500 payment is funded by new victims who joined after investor 1

- Therefore, while investor 1 makes money, the new victims will likely lose out

So, how does this compare to Bitcoin? Well, similar to how growth stocks work, those investing early often get the most favorable entry price. This is because growth stocks will have a much smaller market capitalization toward the beginning of their journey. But, as growth stocks continue to increase revenues and net income, their share price will follow suit.

This means investing early, while risky, can offer a substantial upside. Bitcoin is no different. For example, consider that in early 2017 – Bitcoin had a market capitalization of about $16 billion. Today, Bitcoin is valued at over $1.35 trillion – meaning it has a higher market capitalization than most blue-chip companies.

Crucially, however, nobody knew for sure in 2017 that Bitcoin would be where it is today. Those buying Bitcoin at that time took a speculative punt – which came to fruition. This doesn’t make it a Ponzi Scheme.

Hype and Promotion

Ponzi Schemes must create hype and FOMO (fear of missing out). Otherwise, they won’t be able to attract new capital inflows – meaning there’s a chance they’ll be found out. This is often achieved through aggressive marketing campaigns. The idea is simple – the more people reached the more victims the Ponzi Scheme will attract.

Now, it’s important to remember that Bitcoin is a decentralized project – so it isn’t run by any single person or authority. This means Bitcoin doesn’t engage in any marketing campaigns.

However, there’s no denying that many existing Bitcoin holders like to ‘Shill’ their investments. This is the art of self-promotion, where holders encourage other people to also buy Bitcoin. This practice is especially common on social media. Nonetheless, Shilling is a personal choice and has no endorsement from Bitcoin – which is merely a decentralized piece of immutable code.

No Minimum Investor Qualifications

Another characteristic of Ponzi Schemes is that they’re notorious for attracting ‘unqualified investors’. These are everyday retail clients who have little to no experience of what they’re investing in. Instead, they trust their capital is being looked after by the respective project. Little do they know that they’re unwittingly investing in a Ponzi Scheme.

Similarly, many people who invest in Bitcoin don’t truly understand how it works. There’s a lack of understanding about Bitcoin’s immutability, which means the underlying code cannot be amended. Nor is there an understanding of Bitcoin’s decentralized nature, fixed and predictable supply, or proof-of-work mining system.

Even so, many retail clients invest hard-earned money in traditional assets that they don’t understand. Mutual funds, for example, simply collect capital from investors. The fund will determine which assets to buy and sell, and when. This means investors have no say in where the capital goes. This doesn’t make mutual funds a Ponzi Scheme, nor Bitcoin.

Why Bitcoin is Not a Ponzi Scheme

We’ve covered why Bitcoin is often associated with conventional Ponzi Schemes. Now let’s explore why Bitcoin is a legitimate and sustainable ecosystem with credible use cases.

Legitimacy and Structure

First, it’s important to understand the basics of Bitcoin’s structure. Unlike Ponzi Schemes – which are typically run by a single person, or a small group of people, Bitcoin is a decentralized network. This means Bitcoin can’t be controlled by any person or entity – let alone a government or central bank.

On the contrary, Bitcoin operates on transparent code, which can’t be amended unless it reaches a majority consensus. Moreover, Bitcoin transactions are peer-to-peer, meaning senders and receivers connect without a third party. Even more important is the Bitcoin supply.

3.125 Bitcoins are added to the circulating supply approximately every 10 minutes. This amounts to about 450 Bitcoins per day. This supply dynamic reduces by 50% every four years – known as the Bitcoin halving. As such, the Bitcoin supply is both predictable and fixed. Put otherwise, nobody can suddenly issue new Bitcoins outside of this structure.

Regulation and Transparency

Bitcoin itself isn’t regulated. However, Bitcoin operates in many regulated markets. For instance, if you want to buy Bitcoin with a credit card, you’d need to go through traditional anti-money laundering processes. This means providing personal information and uploading ID verification documents – such as a passport or a driver’s license.

This ensures that Bitcoin exchanges comply with existing Know-Your-Customer (KYC) laws. In addition, Bitcoin futures were approved in 2017. This gave institutional investors exposure to Bitcoin in a regulated environment. In early 2024, the SEC also approved Bitcoin ETFs – making the institutional investment process even smoother.

It’s also important to note that Bitcoin is a transparent ecosystem. This is in complete contrast to Ponzi Schemes – which operate secretive and opaque structures. For example, every Bitcoin transaction that has ever taken place can be viewed on the public blockchain. This transparency further cements Bitcoin’s status as a digital currency for the people.

Sustainability

While Ponzi Schemes are short-lived, Bitcoin is a sustainable phenomenon. It’s often described as a store of value, considering its predictable and limited supply. While the Bitcoin increases every 10 minutes – this won’t be the case once 21 million Bitcoins have been issued. At this stage – which is expected to happen in about 116 years, no more Bitcoins will ever be created.

The 50% halving mechanism also ensures that Bitcoin is a sustainable asset. Each halving event makes Bitcoin more scarce. Meaning – its value can increase organically over time. This is why Bitcoin is often compared to gold. However, unlike gold, Bitcoin is easily transportable and stored.

Moreover, Bitcoin can be split into small units at the click of a button. This will ensure that anyone can access Bitcoin – even if it has a substantial cost price. Crucially, each Bitcoin can be broken down into 100 million units – known as Satoshis.

Value is Determined by Market Forces

Bitcoin’s value rises and falls like any other asset. However, unlike stocks and other traditional assets, Bitcoin doesn’t trade on a single, centralized exchange. Instead, it trades on hundreds of different exchanges across the world. So, when you check the Bitcoin price, this is averaged out across each independent marketplace.

Most importantly, Bitcoin’s value is determined by the forces of demand and supply. Its price increases when there are more buyers in the market. And when there are more sellers in the market, the price declines. This ensures fair, transparent, and fully functional trading conditions. This isn’t the case when investing in Ponzi Schemes.

Can a Crypto Project be a Ponzi Scheme?

We’ve now answered the question – is Bitcoin a Ponzi Scheme? While we’ve confidently debunked the Ponzi Scheme myth, this isn’t to say that other cryptocurrencies don’t fall within this category. On the contrary, millions of digital assets have been created – many, if not most, are crypto investment scams.

Many different types of scams are increasingly becoming popular in the broader crypto market. For instance, ‘rug pulls’ are common with new tokens. Somebody creates a new crypto project, launches it, and artificially inflates the token’s value. The creator will hold a substantial number of tokens, and dump them on the markets when the time is right.

The scammer gets rich while victims are left holding worthless tokens. Another common scam is the ‘honeypot’. This is where the underlying smart contract can be amended to scam token holders. For example, the scammer might prevent holders from selling, or they might simply withdraw the liquidity pool.

Examples of Crypto Ponzi Scams

Let’s look at some examples of large-scale Ponzi Schemes that have resulted in significant losses for investors.

HyperFund

Founded in 2020, Hyperfund was a project that claimed to facilitate crypto mining operations. It offered a membership plan that distributed a share of the mining revenues, with promises of huge returns for investors.

However, no such operation existed – HyperFund was nothing more than a Ponzi Scheme. The SEC subsequently charged the duo behind HyperFund, which it estimates resulted in $1.9 billion in investor losses.

CryptoFX

CryptoFX was a popular crypto trading platform that targeted the Latino community. It ‘guaranteed’ high returns through various investment products – including cryptocurrencies and NFTs.

No such investment products existed. The SEC charged 17 people behind the CryptoFX Ponzi Scheme – which is believed to have netted the scammers over $300 million.

Signs That You Are Investing in a Crypto Ponzi Scheme

Knowing whether or not you’re investing in a crypto Ponzi Scheme can be difficult. Many crypto projects are run by anonymous people, so there’s no accountability if things go wrong. What’s more, most crypto investments are decentralized, so there’s no financial intermediary that can block or reverse fraudulent transactions.

These risks are built into the potential upside – with many cryptocurrencies generating significant returns. Equally, however, many cryptocurrencies are unsuccessful, meaning investors lose some or even all of their capital. This section explores some of the red flags to look for before investing in a crypto project.

Consistently High Returns

Be mindful of crypto projects that make bold claims about high returns. Especially when terms like ‘guaranteed’ are used. Nothing is guaranteed in the investment landscape – and certainly not when trading cryptocurrencies.

- For instance, suppose you come across a crypto project that offers Ethereum staking rewards.

- This is a legitimate industry – staking allows users to earn passive income when depositing coins in the Ethereum network.

- However, while the average Ethereum APYs are 4%, this project offers APYs of 25%.

- This is a red flag, as the APYs are considerably higher than the norm.

Therefore, the project could be a Ponzi Scheme.

Unregistered Investments

Investors should also be careful when investing in projects that aren’t registered or approved by the relevant authorities. This is a complex assessment to make, as crypto regulations vary from one country to the next.

For example, if the project sells tokens to US clients, as they’re deemed securities, it must be registered with the SEC. If not, the SEC can levy substantial fines on the project and demand that investor funds be returned.

Unlicensed Sellers

Similarly, investors should ensure they purchase crypto tokens from a licensed provider. For example, trading platforms like Coinbase and Gemini are regulated in multiple markets – including the US. This ensures that investors can buy and sell cryptocurrencies in a safe and licensed environment.

However, many trading platforms operate without regulatory approval. This often means that investors can trade tokens without completing KYC processes – which can be illegal depending on the payment currency and jurisdiction. You might also have issues with withdrawals when using an unlicensed platform – especially if it’s based in a country with weak investor protections.

Secretive or Complex Strategies

Transparency is key when investing in crypto projects. Investors should be cautious when investing in concepts or strategies they don’t understand. For example, if the project claims to solve an existing problem that hasn’t been done before – explore how it can achieve this.

If the methods aren’t clear, this could be a red flag. After all, Ponzi Schemes are notorious for developing secretive methods, meaning investors are forced to trust that their money is safe.

Difficulty Receiving Payments

One of the first signs that you’ve invested in a crypto Ponzi Scheme is difficulty receiving payments.

- For example, suppose you’ve invested in a crypto auto trading platform that promises minimum returns of 10% per week.

- You invested $5,000 into the platform. Your account shows profits of $500 in the first week.

- Three more weeks have passed and you’ve made another $1,500.

- This means your balance is $7,000, which includes $2,000 worth of profit.

- You’re happy with your gains and request a withdrawal.

- The withdrawal remains pending for several days. You contact the platform multiple times but receive no response.

In this instance, you’ve likely invested in a Ponzi Scheme – and the funds will never be returned.

Recruitment of New Investors

Ponzi Schemes can only survive if they continuously recruit new investors. This ensures additional capital flows are invested, which are often used to pay early backers.

If you’ve invested in a project that offers rewards when recommending new investors, be cautious. Especially if the rewards are substantial.

Pressure to Reinvest

Ponzi Schemes leverage pressure tactics to prevent investors from cashing out their artificial gains. After all, if the investor requests payment and it’s never received, this will result in reputational damage.

Therefore, Ponzi Schemes will try to convince investors that it’s best to keep their capital where it is. In doing so, they’re promised even higher returns.

What to Do If You Suspect a Crypto is a Ponzi Scheme

It’s important to remember that not all crypto projects are Ponzi Schemes. However, some steps should be taken if you suspect a project is running a scam. These steps should be taken before you part with any money.

Do Your Research

Comprehensive research and due diligence are the most effective strategies. You’ll want to dig deep into the project – leaving no stone unturned. Start by researching the management team. Understand what projects they’ve previously worked on and whether they were a success. You’ll want to feel confident that the crypto project is being driven by continent and credible people.

You might find that the crypto project is run by an anonymous team. This is often the case with meme coins. While this is increasingly common in the crypto space, remember that there’s no accountability if the project fails. You should also research the whitepaper. Analyze the fundamentals of the project, such as what solutions it claims to offer.

The roadmap should also be assessed. There should be milestone targets for each objective. Missing a roadmap milestone can be a red flag. You’ll also want to evaluate any wallet addresses that are associated with the project. This could also yield red flags – especially if a large percentage of tokens are held by one wallet.

Ask Questions

If you have any concerns about the project – it’s time to ask questions. Most crypto projects have a Telegram group that’s run by admins. Join the Telegram group and direct your questions to the right person. If you don’t receive a response, post the question again.

If the project is legitimate, the question will be answered. Everyone within the group will also see the response, meaning the project is being transparent. However, if you notice the question has been deleted by the admin, this is a major red flag. Some admins go one step further by removing people from the Telegram group when asking questions they don’t want to answer.

Seek Professional Advice

Sometimes it’s best to speak with a professional before investing – especially in the crypto landscape. Be sure to collect the facts before proceeding, such as what the project is claiming to offer, where it’s based, and what you’re required to do as an investor. The professional will provide advice based on what’s presented. You can then make a decision accordingly.

Report Suspicions

If you strongly believe the crypto project is a Ponzi Scheme – consider reporting it to the relevant authorities. This will increase the odds of the project being shut down, and those behind it prosecuted. It will also prevent other victims from losing money.

For example, if you’re based in the US, you can file a report with the FBI Internet Crime Complaint Center (IC3). Those based in the UK can report scams to the FCA via the online contact form or telephone number. Other nationalities can search for the respective agency in their home country.

Conclusion – Why Bitcoin is Not a Ponzi Scheme

In summary, we’ve debunked the question – Is Bitcoin a Ponzi Scheme? Bitcoin is a decentralized network that can’t be controlled by any single person or authority. The Bitcoin supply is fixed, immutable, and predictable – meaning new coins can’t be created manually.

What’s more, Bitcoin is traded in multiple regulated markets – including futures and ETFs on Wall Street. However, while Bitcoin isn’t a Ponzi Scheme – many projects in the crypto space are. Therefore, tread with caution before investing in a project.

Bitcoin Ponzi Scheme FAQs

How do crypto Ponzi Schemes work?

Crypto Ponzi Schemes usually make bold promises about ‘guaranteed’ returns, which are often substantially higher than the norm. Other scams include rug pulls, pumps and dumps, and honeypots.

How do we know Bitcoin isn’t a Ponzi Scheme?

Unlike Ponzi Schemes, Bitcoin isn’t run by a single person or small group of people. It’s a decentralized blockchain with transparent transactions, immutable code, and a predictable supply.

How do you identify a crypto Ponzi Scheme?

Common red flags of a crypto Ponzi Scheme include promises of high returns that seem good to be true, aggressive marketing tactics, and an anonymous team.

Can you get Bitcoin back after being scammed?

No, unlike a credit card scam, Bitcoin is a decentralized network that doesn’t use financial intermediaries. This means law enforcement agencies are unlikely able to recover stolen Bitcoin.

Does Jamie Dimon Think Bitcoin is a Ponzi Scheme?

Jamie Dimon – the CEO of JPMorgan Chase, has long been an adversary of Bitcoin. Dimon was recently quoted as saying Bitcoin is a “public decentralized Ponzi scheme”.

References

- Crypto investment scams (FCA.org.uk)

- Justice Department Announces Distribution of Over $158.9M to Nearly 25,000 Victims of Madoff Ponzi Scheme (justice.gov)

- Ponzi schemes Using virtual Currencies (sec.gov)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman