How to Mine Ethereum in 2024: Is it Still Possible?

Ethereum mining refers to a process to validate transactions and secure the Ethereum network. However, the Ethereum network no longer supports mining, having moved to staking in 2022.

The switch to proof of stake in September 2022 made Ethereum a planet-friendly crypto, reducing energy usage by more than 99% compared to proof of work mining. Now, the network uses ether (ETH) to secure the blockchain rather than energy.

However, proof of work still sees wide usage in crypto blockchains, including Bitcoin, Ethereum Classic, Litecoin, Dogecoin, and many others. In this guide, we’ll discuss the history of mining Ethereum, as well as alternatives if you want to put your mining hardware to work.

Can You Still Mine Ethereum?

The Ethereum network no longer supports mining. Instead, the network uses proof of stake (PoS) to validate network transactions.

If you’re weighing what to mine after Ethereum, you can consider Ethereum Classic, which came about following an early fork in the Ethereum chain. Both Ethereum and Ethereum Classic networks support smart contracts, which are computer programs that run on the blockchain network.

However, Ethereum Classic still uses proof of work (PoW) to mine Ethereum Classic (ETC), whereas Ethereum has transitioned to PoS as its consensus method.

To learn more about Ethereum’s transition to PoS and other features of the cryptocurrency, read our What is Ethereum guide.

What is Ethereum Mining?

Ethereum mining refers to a process of solving a puzzle to “mine” a new Ethereum block where the blockchain can hold transactions.

Miners, which are computers running specialized software, generate cryptographic hashes (a one-way encrypted string of numbers and letters) until a miner finds a hash that matches the block data and has the required difficulty level. When that miner finds a block, the miner earns a mining reward paid in ETH.

Prior to the switch to PoS in 2022, mining was the method by which the Ethereum network validated transactions and increased the supply of ether, the cryptocurrency used to pay for transactions on the Ethereum blockchain network.

Mining uses key inputs to generate a hash. Hashing refers to one-way encryption. Using a given algorithm (Keccak-256 for Ethereum transactions and Ethash for Ethereum mining), the same input will always generate the same hash output.

Hashing Example

Hashing offers a more convenient and more secure way to handle data.

For example, the entire text of Poe’s poem, The Raven, which is 1,067 words long, generates the following short hash using the Keccak-256 algorithm, which is utilized throughout the Ethereum network.

Aa542010e0eec8b9584dcd8153789a18a957211bbede4b3febe59e59ef0353

When it used PoW, Ethereum used hashes in mining, with hashing still used in many network functions following the move to PoS.

The previous block becomes a hash, the current block header becomes a hash, and block transactions are also hashed. Lastly, mining uses a nonce, a number used only once as a variable.

Miners compete to find a hash value that includes all the required data as well as the nonce, which also satisfies a difficulty level. The difficulty level changes periodically as the total network hash power ebbs and flows.

However, this is a simplified description of Ethereum mining. Ethereum blocks consider more inputs compared to Bitcoin and some other PoW networks.

Ethereum’s Move to Proof-of-Stake in 2022

Mining requires considerable energy consumption because mining nodes across the planet generate rapid-fire hashes competing to find the next block. This is the “work” in proof of work. The successful hash is the proof needed to mine a new block.

2021’s Ethereum Improvement Proposal (EIP) 3675 proposed a change from PoW to PoS. In the short term, the Ethereum chain would run PoS next to PoW, maintaining two separate chains before merging the two chains on September 15, 2022.

As a result of Ethereum’s move to PoS, mining is no longer possible on the Ethereum network. However, the way in which mining worked for Ethereum in the past still exists for Ethereum Classic. It also closely parallels the mechanics used for other proof-of-work blockchains, like Bitcoin, Litecoin, Dogecoin, and Kaspa. Get more information on Ethereum’s network transition by reading out ‘What is Ethereum 2.0‘ guide.

How Ethereum Mining Used to Work Pre-2022

Earlier, we briefly discussed how mining centers on generating hashes to mine a new block. New blocks link a parent block using a hash as well, creating a chain. If any data in a block were to change, it would break the chain going forward by creating new hash values. The energy investment in mining (or re-mining) blocks is what makes PoW secure.

However, to mine Ethereum, mining rig operators needed specialized equipment and often banded together in mining pools to increase the frequency of mining rewards for each miner.

Choosing Mining Hardware

In the early days of crypto mining, aspiring miners could use their CPU to generate hashes. However, as network hash rates increased, the network also increased the difficulty. This caused miners to seek out more powerful hardware, including high-end graphics processors (GPUs).

Eventually, the competition to generate hashes faster led to specialized hardware, including field-programmable gate arrays (FPGAs) and application-specific integrated circuits (ASICs). These specialized devices were built for hashing rather than serving double duty, as was the case with CPUs and GPUs.

However, Ethereum’s choice of Ethash for its mining algorithm made the mining process ASIC-resistant, particularly when compared to Bitcoin, which uses SHA-2 as its mining algorithm. This brought closer parity between mining with high-end graphics cards and specialized ASICs compared to Bitcoin.

One can learn more about the intricate differences between these two popular blockchains by going through our Bitcoin vs Ethereum review.

This remains true for Ethereum Classic, which still uses PoW and can still be mined efficiently with either GPU or ASIC-equipped machines.

Selecting Mining Software

Ethereum mining software served as a connection between the network or mining pools, covered next, and the mining rigs themselves. Which software best fit the task often centered on the mining rig’s hardware and operating system.

For instance, the following table details some of the top GPU options for mining Ethereum Classic.

| Software | Supported OS | Supported GPU |

| Ethminer | Linux, Windows | AMD, Nvidia |

| lolMiner | Linux, Windows | AMD |

| T-Rex | Linux, Windows | Nvidia |

| Phoenix Miner | Windows | Nvidia |

Joining a Mining Pool

While it was theoretically possible to mine a block individually, the frequency with which a miner could successfully mine a block made solo mining impractical as the network hash rate increased. The solution was found in mining pools.

A mining pool aggregates the hash rate of individual miners so that the entire pool works toward finding a new block. When the pool successfully mined a block, the mining reward was split proportionally, usually according to the contributed hash rate of each miner.

The pool itself took a small fee, although the fee represented a tradeoff in which miners could earn mining rewards sooner, allowing them to pay for ongoing operating costs. Mining pools remain popular for leading proof-of-work blockchains.

How Ethereum Works Now with Proof-of-Stake

Ethereum’s proof-of-stake consensus mechanism allows the network to validate transactions with a fraction of the energy usage. Instead of mining (PoS), the network uses staking in which validator nodes commit ETH as collateral to help secure the network.

- Validators must stake 32 ETH as collateral.

- The network randomly selects validators to assemble the next block.

- The Ethereum network randomly selects validators to assemble blocks and validate transactions.

- Validators that successfully add a new block to the chain earn a staking reward.

- Validators that do not follow protocol are subject to slashing, putting the staked ETH at risk.

32 ETH represents nearly $100,000 at press time, putting the idea of running a validator out of reach for most ETH holders. However, Ethereum staking platforms offer a way to get started with smaller amounts of ETH. In exchange, the staking provider usually takes a percentage of staking rewards, passing the balance to individual stakers.

Most Profitable Alternatives to Ethereum Mining

If you’re already invested in the Ethereum mining ecosystem, you can put your Ethash ASICs to use with several other coins.

However, once you get further down the list beyond Ethereum Classic, the smaller market cap of other coins may indicate liquidity challenges. In short, it might be difficult to sell the Ethash coins you mine.

Ethash ASIC-Mineable Cryptocurrencies

- Ethereum Classic (ETC)

- MOAC (MOAC)

- Halo Platform (HALO)

- TCC (TCCW)

- EtherZero (ETZ)

- Etho Protocol (ETHO)

- Bitcoin (B2G)

Alternatively, you can use your GPU to mine popular cryptocurrencies. GPU mining offers more flexibility to change mining algorithms.

GPU-Mineable Cryptocurrencies

- Monero

- Dogecoin

- Ravencoin

Mining Ethereum Classic

The Ethereum chain launched in mid-2015, but by mid-2016, it had split into two chains: Ethereum and Ethereum Classic. This was a hard fork. Going forward, each chain would have its own history of transactions.

Many former Ethereum miners switched to mining Ethereum Classic when the Ethereum chain switched to PoS later in 2022. Others continue to mine ETC using Ethereum cloud mining.

Ethereum Classic is seen by some as the true chain, although both chains share a common beginning. In 2016, following a now-infamous hack of The DAO, the Ethereum blockchain split. Notably, Ethereum has a much higher market capitalization compared to Ethereum Classic.

The DAO Hack

The DAO was an early decentralized organization formed to fund upcoming projects on the Ethereum blockchain. Using a recursive calling vulnerability, an attacker drained much of The DAO’s treasury.

To undo the damage, the community voted on a proposal to invalidate transactions related to the hack. When the proposal passed, Ethereum and Ethereum Classic became two distinct chains. The Classic chain still holds transactions related to The DAO hack as valid.

Mining Other Altcoins on Proof of Work

We covered a list of Ethash-compatible coins earlier. If you own an Ethash ASIC, you’re limited to mining Ethash coins with that equipment. However, GPU mining opens up a world of possibilities.

Scrypt Algorithm Coins

- Dogecoin (DOGE)

- Litecoin (LTC)

- Quantis (QUAN)

Other GPU-Mineable Cryptocurrencies

- Vertcoin (VTC)

- Bitcoin (BTC)

- Haven Protocol (XHV)

- Bitcoin Gold (BTG)

- ZCash (ZEC)

Stake-to-Earn Bitcoin Mining with Bitcoin Minetrix

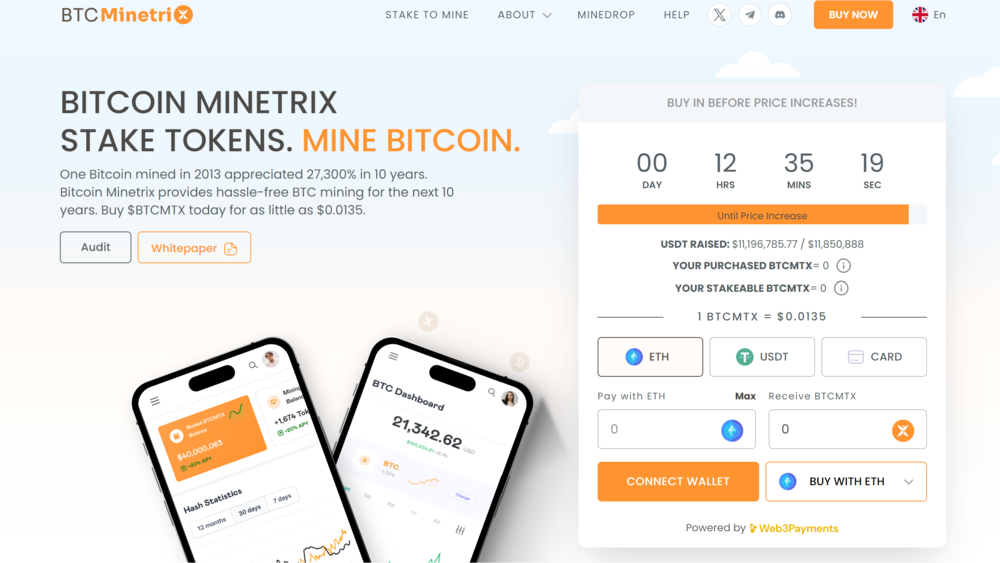

Mining hardware and operating costs can add up quickly. Cloud mining offers a potential solution to hardware costs, allowing users to “rent” hashing power on cloud computers. However, the cloud mining industry as a whole doesn’t have a stellar reputation, and many cloud providers have disappeared without warning.

A new protocol called Bitcoin Minetrix promises a user-friendly and transparent way to begin cloud mining. In this case, you’d be cloud-mining Bitcoin, and there’s no need to be a tech guru to get started.

Bitcoin Minetrix uses a staked BTCMTX token on the Ethereum blockchain that represents your mining power. To access Bitcoin mining power, users burn their BTCMTX tokens.

Currently, BTCMTX is still in presale and has raised a whopping $11.2M since launching, but BTCMTX can be staked to earn more BTCMTX tokens at a current rate of 158.5 per ETH block, which can later be used to mine BTC.

It’s important to note that this token-based cloud mining app is not yet live. Phase 2 includes app and software development, with Phase 3 bringing launch and the ability to mine and withdraw BTC.

As a presale token, BTCMTX remains speculative. Read through the Bitcoin Minetrix site to understand the project roadmap and token distribution. Interested buyers can also keep tabs on this innovative cloud mining project by following the Bitcoin Minetrix socials (X and Telegram) and reading the whitepaper.

Getting Started With Bitcoin Minetrix

If you think Bitcoin Minetrix might be right for you, you can follow these simple steps to get started with the program.

- Set up a compatible crypto wallet. MetaMask and Coinbase Wallet are both supported.

- Connect your wallet to Bitcoin Minetrix. Tap the Buy Now button at the top of the page and then select Connect Wallet.

- Choose your investment amount. Bitcoin Minetrix allows you to buy BTCMTX with ETH or USDT. Alternatively, you can top up your ETH balance directly from the interface. To reduce fees, consider buying ETH through a trusted crypto exchange to fund your wallet.

- Select Buy Now or Buy and Stake. Staking allows you to grow your BTCMTX balance while waiting for launch.

Conclusion

While Ethereum mining is no longer possible, several alternatives still exist, with Ethereum Classic being a common choice for those already invested in Ethereum-specific mining equipment. GPU mining offers a wider range of options, including Bitcoin, although dependent on a rising price, Litecoin, Dogecoin, and several others.

For those committed to the Ethereum space, staking offers a viable alternative, with staking reward yields typically in the 3% to 4% range. We found that Bitcoin Minetrix offers the best of both worlds; with the cost-effectiveness of the ETH staking protocol users can stake-to-mine BTCMTX tokens to earn non-tradable ERC-20 token credits that can be burned in exchange for BTC cloud mining power. Follow the link below and explore the exciting new cloud-mining possibilities offered by Bitcoin Minetrix today.

FAQs

Can you still mine Ethereum?

ETH (ether on the Ethereum blockchain) is no longer mineable. The Ethereum blockchain switched to proof of stake in 2022, making Ethereum mining obsolete.

Is mining Ethereum still profitable?

Ethereum can no longer be mined. However, Ethereum Classic still supports mining and can be profitable with a high-end graphics card or Ethash ASIC miner.

How long does it take to mine 1 Ethereum?

Ether (ETH) is no longer mineable. However, Ethereum Classic can be mined, and mining one ETC takes approximately four days at 2,500 MH/s.

What is the difference between mining and staking?

Mining uses proof of work to secure the blockchain by requiring significant computational power to add a new block to the blockchain. By contrast, staking uses cryptocurrency as collateral to secure the network, rewarding validators with a staking reward for successfully adding new blocks to the blockchain.

References

- EIP-3675: Upgrade consensus to Proof-of-Stake (ethereum.org)

- The Merge (ethereum.org)

- ETHASH (ethereum.org)

- CRITICAL UPDATE Re: DAO Vulnerability (ethereum.org)

- Roadmap (bitcoinminetrix.com)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Kane Pepi

Kane Pepi