How to Buy Bitcoin with eToro – Beginners Guide

v

v

Bitcoin is still the largest cryptocurrency by total value and often the first cryptocurrency trade for new buyers. In this guide, we’ll detail how to buy Bitcoin with eToro and some of the trading platform’s key features.

We’ll also dig into the fee structure for eToro bitcoin trading and explore eToro Wallet for bitcoin storage.

Let’s start with some basic background, like why Bitcoin?

Introduction to Buying Bitcoin on eToro

As the first cryptocurrency, Bitcoin (BTC) is also the most established crypto asset. Worldwide daily trading volume for Bitcoin exceeds $22 billion, and the price of BTC has nearly tripled in the past 12 months.

That’s not to say Bitcoin’s price only increases. Traders who bought at the all-time high of over $68,000 are still down about 36% at press time. Bitcoin trading and roller coasters share a lot in common.

If you’re investing for the long term, expect some ups and downs. This has proven true throughout Bitcoin’s history, but Bitcoin has rewarded early investors handsomely.

$1,000 invested in bitcoin in December 2010 would be worth more than $177 million today, just 13 years later.

By comparison, $1,000 invested in the S&P 500 would be worth just over $5,000 over the same period.

The good news is that you can buy both on eToro — Bitcoin, exchange-traded index funds, and much more.

Advantages of Using eToro for Bitcoin Trading

Bitcoin’s leadership position means you have your choice of places to trade. So why trade Bitcoin eToro?

For beginners in particular, eToro offers one of the easiest ways to get started with Bitcoin.

- Fast onboarding: eToro streamlines the process of opening a trading account. In most cases, you can be up and running in about 5-10 minutes.

- Easy account funding: eToro supports bank deposits without a deposit fee. Depending on your location, conversion fees may apply, however. (eToro accounts trade in USD.)

- Simple trading fees: You’ll pay a flat 1% for crypto trades.

- Copy trading: You don’t need to be a trading savant to trade well on eToro. Copy trading lets you identify successful traders on the platform and copy their trades.

- Well-funded demo account: Every account gets a virtual portfolio with $100,000 in virtual funds. Practice trading without risking real money.

- eToro Bitcoin wallet: The eToro Money app serves as a capable Bitcoin wallet, letting you take custody of your Bitcoin or send and receive Bitcoin off-platform. Unfortunately, it’s not available for US customers.

You May be interested in How to Buy Bitcoin with PayPal

Step-by-Step Guide to Buying Bitcoin on eToro

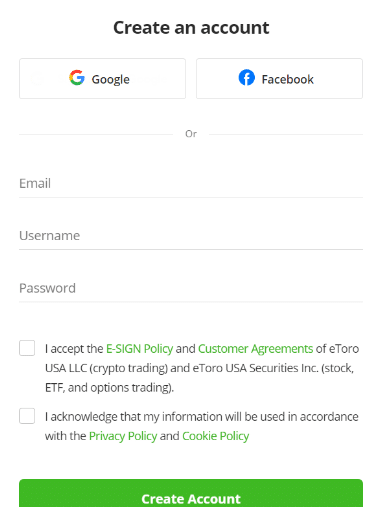

Step 1: Opening an eToro Account

Visit eToro to get started. Tap the Join Now button. Provide your email address, and choose a username.

In the following screens, you’ll also provide your name, address, and phone number. eToro uses two-factor authentication to secure your account by texting a code to your phone.

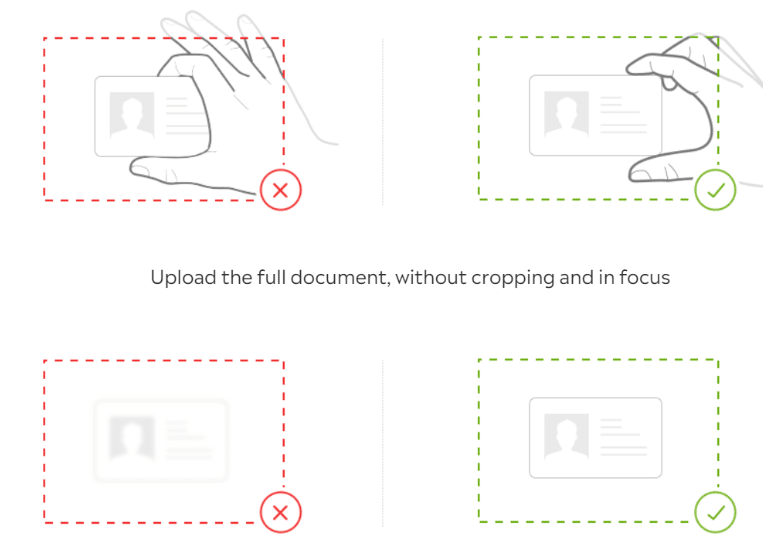

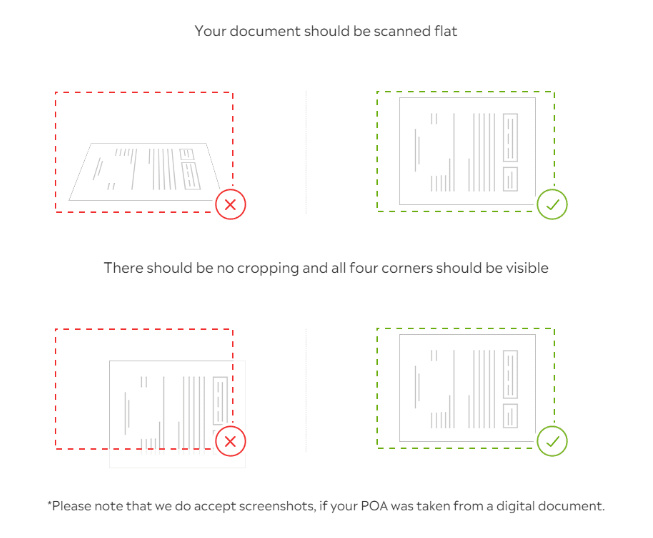

Step 2: Completing KYC (Know Your Customer)

To comply with regulations, eToro requires identity verification. To complete this step, you’ll need to upload a copy of your government-issued photo ID, such as a driver’s license or passport.

You may also need to provide a utility bill in your name to confirm your address.

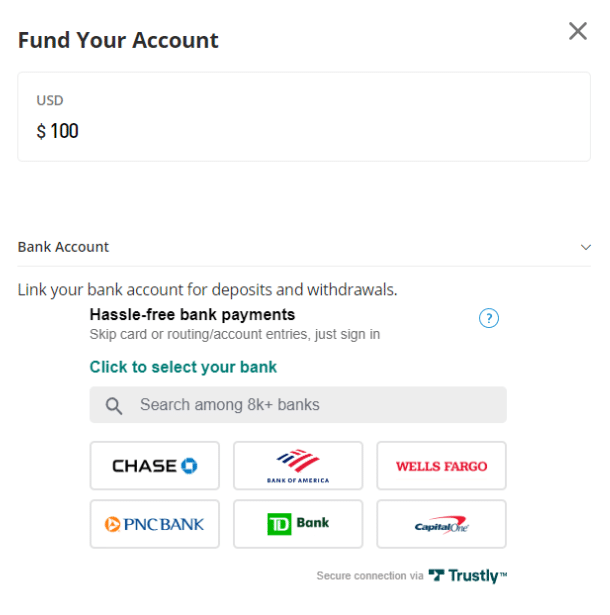

Step 3: Making a Deposit

Link a payment method. eToro supports bank transfers. In some regions, additional payment methods may be available, including Skrill or Neteller.

With eToro, you can deposit a minimum of $10 but varies across countries. However, the minimum trade for cryptocurrencies is $10, so depositing $10 or more often makes sense.

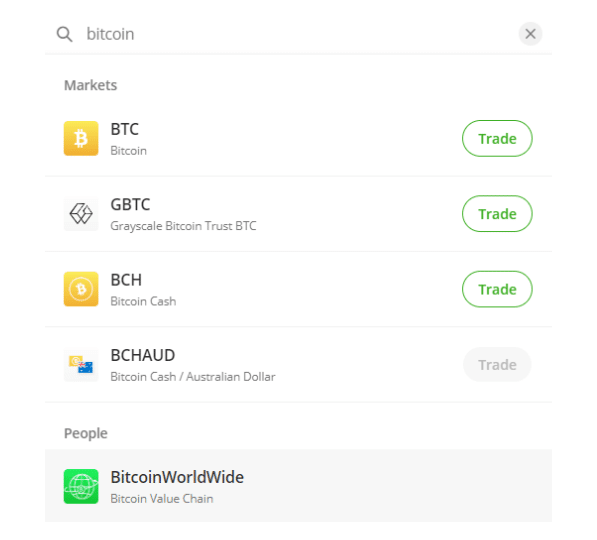

Step 4: Searching for Bitcoin

Use the search bar to find Bitcoin or BTC, the trading ticker for Bitcoin. Tap the Trade button to open the trading box.

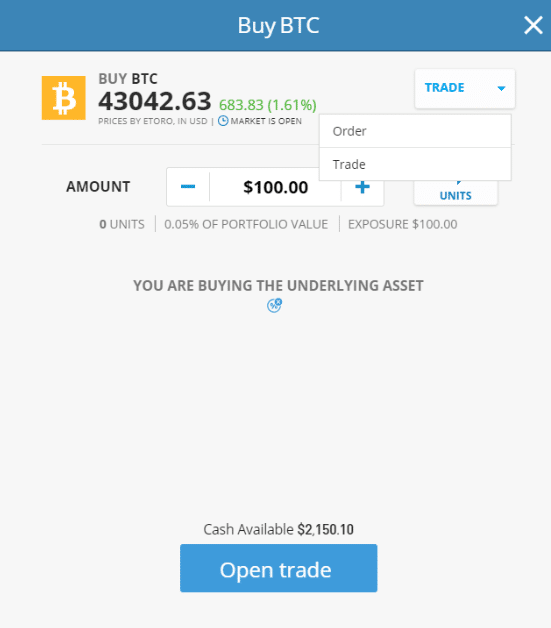

Step 5: Placing a Bitcoin Order

eToro supports both market orders (a quick trade at market prices) and limit orders (you set the price). By default, (Trade) market orders are selected. Limit orders give you more control over pricing but might not fill immediately (or at all if the market price moves).

Choose a trade type and set a trade amount.

Past performance is not an indication of future results.

If everything looks good, open your trade.

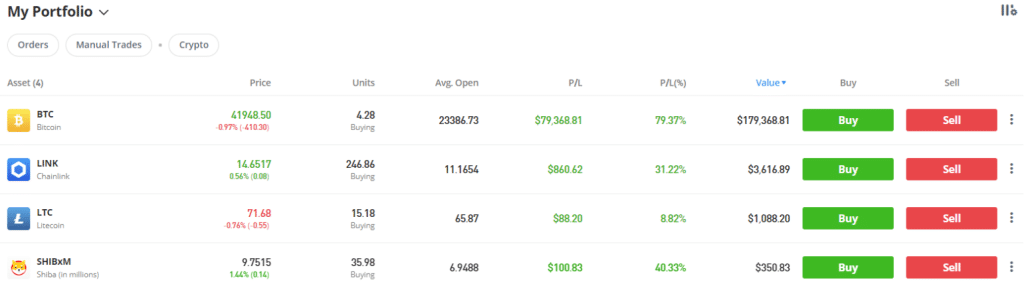

Once your trade executes, you’ll see your balance in the Portfolio section linked on the left menu.

Past performance is not an indication of future results.

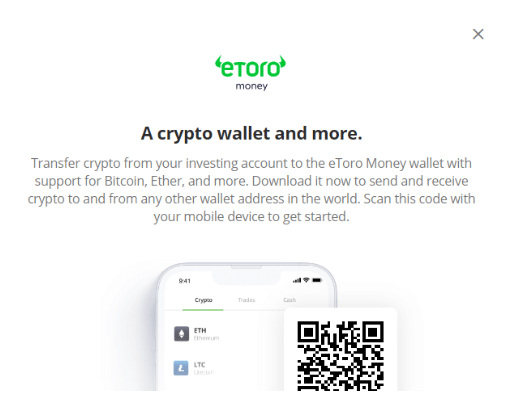

Step 6: Optional Setup of eToro Bitcoin Wallet

Now that you know how to purchase Bitcoin on eToro, it’s time to think about storage.

eToro can store your Bitcoin for you in your trading account. However, some traders prefer to move their BTC to a separate crypto wallet. The eToro Money app provides an easy way to store your Bitcoin and uses the same username and password as your eToro account. However, eToro Money is not available for US customers.

How Do Crypto Wallets Work?

Cryptocurrencies like Bitcoin are stored at an address on the blockchain and the assets at that address are controlled by a private key. A crypto wallet provides a secure way to store your private key to ensure only you can access your crypto.

Most wallets use a 12 or 24-word phrase that can be used to recover the wallet and the assets. But if someone else gains access to this phrase they can also control the assets at your address. This makes security tantamount.

eToro Wallet offers secure storage of your crypto but uses a login combined with two-factor authentication to access your wallet.

The easiest way to setup a Bitcoin wallet in the app is to initiate a transfer from your eToro trading account.

- Tap on the Portfolio link.

- Choose BTC in your portfolio.

- Select the trade you want to move to your wallet.

- Tap Transfer to Wallet on the Edit Trade screen.

- Review and complete the transfer if everything looks correct.

Using this method, eToro automatically sets up your wallet and completes the transfer.

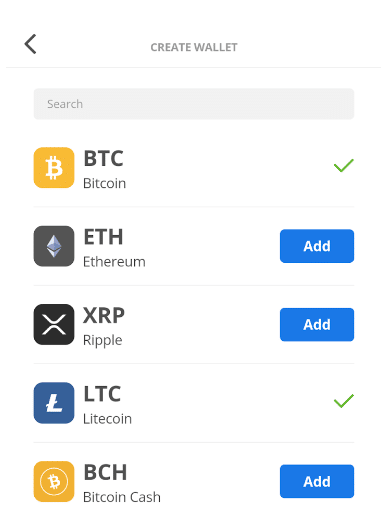

You can also set up your wallet manually.

- Tap on Get Wallet App on the left menu to scan the QR code and download the app to your mobile device.

- Use your eToro account login credentials to log into the app. Then, tap on Create Wallet and choose BTC.

Transferring Bitcoin to eToro Wallet

Once set up, you can transfer additional amounts to your wallet as needed. The eToro Bitcoin wallet lets you send and receive Bitcoin to and from other wallets. However, there’s currently no way to send Bitcoin back to eToro for trading.

Why Choose eToro for Bitcoin Investing?

eToro isn’t the cheapest way to trade BTC. The platform’s trading costs fall about mid-market, lower than other simple trading platforms but higher than complex trading platforms. We’ll explore trading costs in more detail shortly.

eToro’s strength lies in its combination of features that make it both easy to use and powerful.

User-Friendly Platform for Beginners

Bitcoin trades on eToro take just a few seconds from start to finish. The well-designed UI carries over to the mobile app, making it easy to find your way around.

eToro also offers a demo account. Every trading account gets $100,000 in virtual funds. This feature gives new traders a way to learn trading basics and test out strategies. Virtual portfolios support many of the site’s features, including advanced charts and buy/sell indicators.

- Open and close basic trades

- Learn to use stop loss and take profit orders

- Test Copy Trading or Smart Portfolios before investing real money

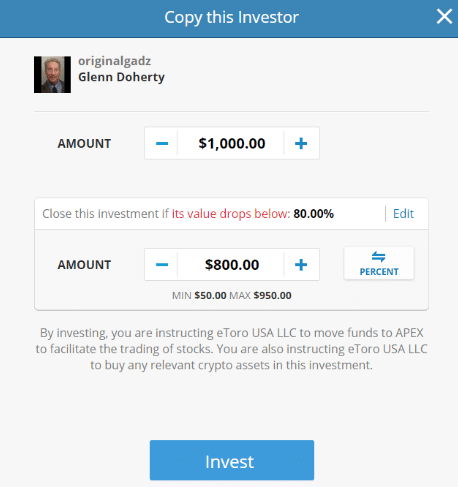

CopyTrader, another popular feature on the eToro, lets you find successful traders and allocate a trading balance to follow their moves. When they buy, you buy. CopyTrader takes the guesswork out of trade timing by following the lead of traders with a proven track record.

Past performance is not an indication of future results.

Beginners may not be familiar with every trading term. eToro’s help center does what it says on the tin. Start a search for limit orders, and you’ll get a basic overview of how limit orders work and links to walkthroughs.

Investment Diversification Options

While this guide focuses on how to invest in Bitcoin on eToro, the platform offers a wide range of trading choices. This allows you to diversify your portfolio without using multiple platforms. Most crypto trading platforms focus on crypto assets, whereas eToro offers a wide range of investment options.

In the US, you can choose from several investment options:

- Stocks: Over 3,000 tradable stocks

- Exchange-traded funds (ETFs): Over 300 choices, including index ETFs and sector ETFs

- Crypto: Choose from popular assets like BTC and ETH or trading favorites such as DOGE and SHIB

In other regions of the world, additional options are available:

- Currencies (forex trading)

- Commodities (Oil, gold, wheat, and more)

- Options trading

- Leverage trading

Automated Trading Tools and Features

eToro makes basic trades intuitive but also offers ways to put your trading on autopilot.

Two main features let you invest without making manual trades.

- CopyTrader

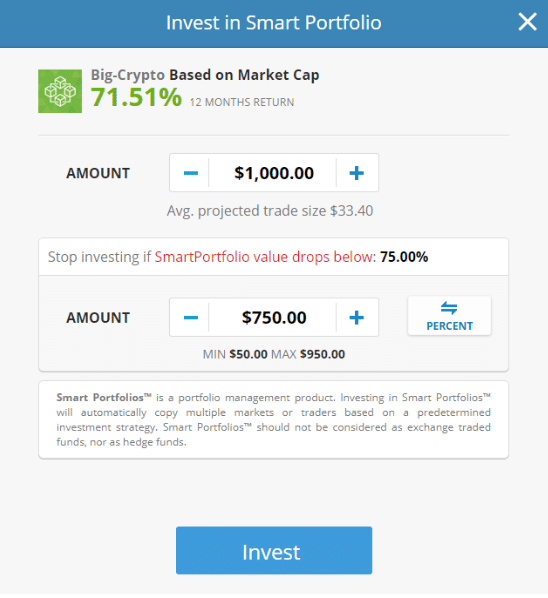

- Smart Portfolios

We covered CopyTrader earlier. This feature lets you follow the moves of lead traders on the platform. You can view performance history and trader bios and then scan their recent trades or current portfolios. Follow a trader you like with just a couple of clicks. The caveat is that CopyTrading requires a minimum investment of $200.

When you set up a copy trade, you can also set a trigger to exit the position, cutting your losses if the market turns against your trade.

Smart Portfolios, formerly called Copyportfolios, work much like ETFs in that they target certain sectors or investment goals. For example, the @Crypto-currency portfolio tracks the value of the two leading cryptocurrencies, BTC and ETH. By comparison, the @Big-crypto portfolio expands the offering to 19 cryptocurrencies. 40% of the portfolio goes to BTC and ETH, with the remaining 60% providing exposure to other leading crypto assets.

Past performance is not an indication of future results.

Tradable assets vary by region. Smart Portfolios require a $500 minimum investment.

Fractional Investing and Low Minimums

Minimum trades for crypto and stocks on eToro are just $10. This makes trading accessible to casual investors and those who want to build a position over time.

Fractional investing on the platform lets you buy based on a dollar amount rather than buying whole shares or an entire Bitcoin, for example. With many popular stocks like Tesla and Nvidia trading for hundreds per share, fractional investing lets you get started with as little as $10.

The same holds true for crypto investments. Bitcoin currently trades in the mid $40,000 range, but you can invest $10, $100, or any amount that fits your budget.

Understanding eToro’s Fee Structure

Trading fees on eToro follow a simple pattern for crypto trades.

You’ll pay 1% of the trade plus a spread.

A spread is the difference between the buy and sell price for an asset.

For example, let’s assume the existing orders include buy orders for BTC at $44,000 and sell orders at $44,001. In this example, the spread is $1. But you won’t pay the full dollar in this example unless you buy one full bitcoin.

The amount you pay with a spread on eToro varies based on volatility and market conditions. Assets with more volatility can bring wider spreads.

Spreads like this are common on simple trading platforms and offer a way to lock in your price briefly. Without spreads, the price can change between the time you click a buy or sell button and the time your trade executes.

Your buying price includes eToro’s commission and the spread. When you view a new position in your portfolio, you’ll likely see a loss of about 2%. That’s because selling the position will also incur a 1% fee, and you’ll sell at the market sell price, which includes the spread.

In crypto trading, that 2% “loss” can reverse quite quickly.

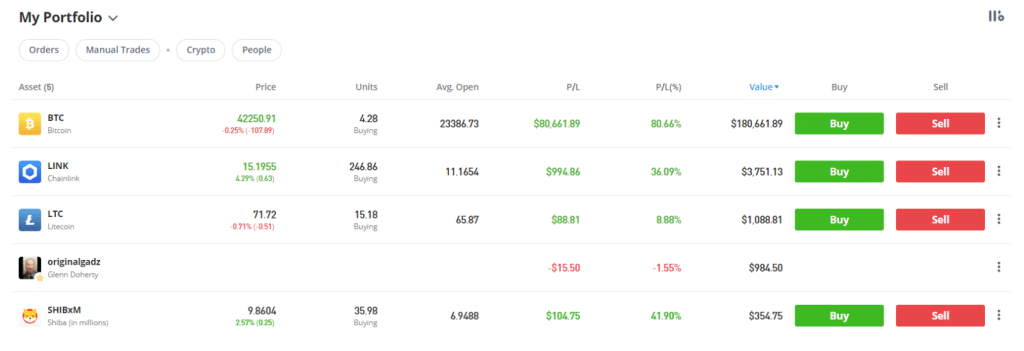

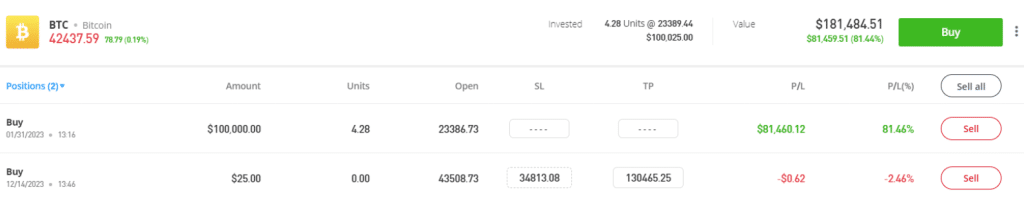

CopyTrading and Smart Portfolios for crypto assets see the same fee structure. For example, all of the trades below showed a 2% loss initially. The CopyTrader position (2nd from the bottom) is new and still shows a 1.55% loss if the position were to be closed immediately. The others would turn a profit.

Past performance is not an indication of future results.

The CopyTrader position (2nd from the bottom is new and still shows a 1.55% loss if the position were to be closed immediately. The others would turn a profit.

Deposit, Withdrawal, and Trading Fees

| Crypto Trading Fees | 1% plus spread |

| Stock and ETF Trading Fees | 0% plus spread |

| Deposit Fees | None; conversion fees apply for non-USD deposits |

| Withdrawal Fees | $5 |

| Crypto Withdrawal Fees | Varies by network demand |

Crypto trading comes with a 1% commission on eToro, but when trading stocks and ETFs, you’ll only pay a market spread.

Likewise, deposits are also free on eToro, a rarity in the space. Competing platforms like Coinbase charge a deposit fee. (Standard bank transfers are usually free, however).

You’ll pay a withdrawal fee, though, which at $5 makes it prudent to let balances build a bit before withdrawing.

- $5 on a $100 withdrawal equals 5%

- $5 on a $1,000 withdrawal equals 0.5%

- $5 on a $10,000 withdrawal equals 0.05%

There’s also a $30 minimum withdrawal to consider. At this level, the withdrawal fee adds nearly 17% to trading costs.

Bitcoin Storage and Transfer Fees

eToro doesn’t charge anything for Bitcoin storage, whether you store your BTC on the platform or in the eToro Money wallet app. Note, eToro Money is not available for US customers.

However, you’ll pay a network fee to move your crypto off the platform to the wallet app. eToro charges actual network mining fees with a cap on both ends. The minimum fee is $1, whereas the maximum fee is $100.

Initially, you’ll pay a 2% fee, which is later adjusted to the true cost, respecting the caps previously mentioned.

It’s also worth noting that the minimum BTC withdrawal is 0.007195 BTC.

| BTC Minimum Withdrawal | 0.007195 BTC (currently about $310) |

| Placeholder Fee | 2% |

| Minimum BTC Withdrawal Fee | $1 |

| Maximum BTC Withdrawal Fee | $100 |

Bitcoin mining fees can be volatile, spiking during increased demand. Consider using an online mining fee calculator to estimate your costs before making a move.

How Are Bitcoin Mining Fees Calculated?

Bitcoin mining fees are calculated based on the size of the transaction details in bytes. This means a $10 transaction might cost the same as a $10 million transaction.

Transactions are bundled in blocks, but space is limited. When the network is busy, mining fees to send Bitcoin can spike as transactions compete for space in blocks.

Summary of All eToro Fees

For simple trades, expect a simple fee structure on eToro.

- No deposit fee (currency conversion fees may apply)

- 1% trading fee plus a spread for crypto trades

- 0% commission plus a spread for stocks and ETFs

Withdrawal costs add to your trading costs, however.

- $5 withdrawal fee (USD)

- $30 minimum withdrawal

- Network or mining fee for crypto withdrawals

Security Measures for Bitcoin Trading on eToro

Crypto as an industry remains largely unregulated, but eToro takes important steps to register with and acquire licenses from regulators in key markets.

- UK: Registered with the Financial Conduct Authority (FCA)

- Europe: Registered with the Cyprus Securities Exchange Commission (CySEC)

- Australia: Registered with the Australian Securities & Investments Commission (ASIC)

- US: Registered with the Financial Crimes Enforcement Network (FinCEN); eToro is also licensed in most US states as a money-transmitting business.

However, trading cryptocurrencies on eToro is not regulated by any of these entities.

The platform also provides several security features and account protections.

- Accounts are secured with two-factor authentication, which helps prevent unauthorized access to your trading account.

- Most crypto assets on the platform are held in cold storage, meaning the crypto wallets that hold your Bitcoin and other cryptocurrencies are not connected to the internet.

- Cash balances for US accounts are FDIC insured up to $250,000.

- US ETFs, stocks, and options are insured against broker insolvency for up to $250,000 through the SIPC.

The Role of eToro Wallet for Secure Storage

To protect larger Bitcoin balances, you can move your coins off the platform using eToro Money. Keep in mind, eToro Money isn’t available for US customers. From there, you can also transfer your bitcoins to another wallet, including a hardware cold wallet that doesn’t connect to the internet.

Selling Bitcoin on eToro

Because eToro uses a flat percentage-based fee for crypto trades (regardless of size), you can sell as needed without impacting your trading costs.

However, it’s still important to consider minimum trade requirements. On eToro, the minimum trade is $10.

You also have the option to sell all of your holdings in an asset or just a single position.

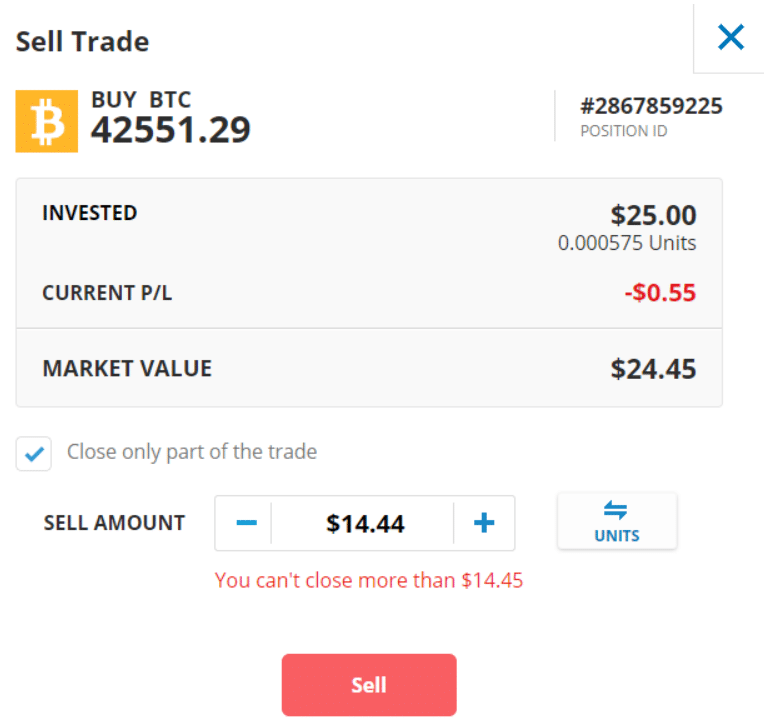

Here’s an example:

Let’s say you open a $25 position. The minimum trade requires you to keep trade at least $10. This means you can’t sell $20 worth of Bitcoin because only $5 would be remaining (not enough to trade).

Past performance is not an indication of future results.

Take Profit and Stop Loss Orders

To sell a position or part of a position on eToro, tap on Portfolio on the left menu and then select the asset you want to sell.

You can sell immediately, assuming the trade respects minimum trading amounts — or you can set an order to sell at a price you choose by using stop-loss or take-profit orders.

Stop-loss and take-profit options offer a way to trade without watching your computer or phone to manage your trades.

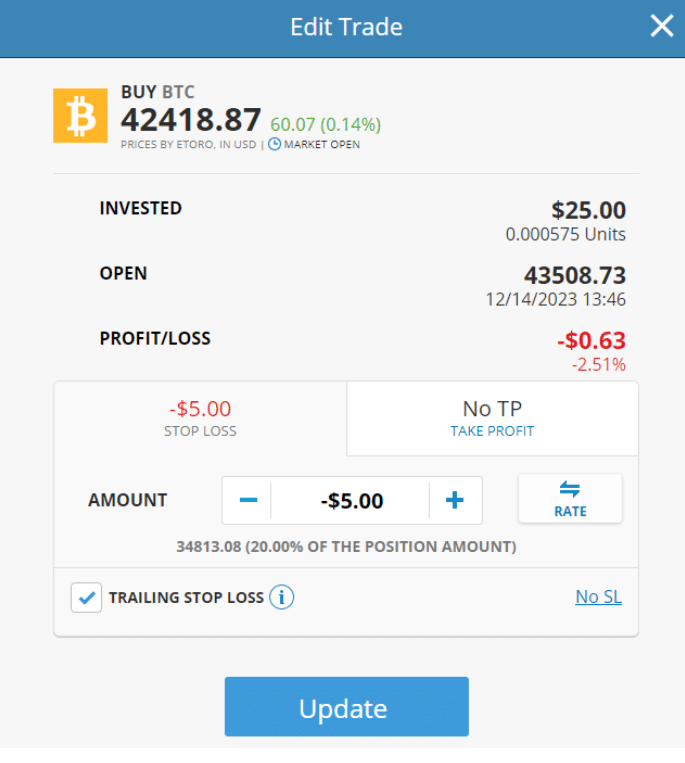

Stop-loss orders automatically close your position to protect your trading capital.

The order below uses a trailing stop-loss order that follows the trade as the value increases, adjusting the stop-loss to protect your downside while also protecting your profits.

Past performance is not an indication of future results.

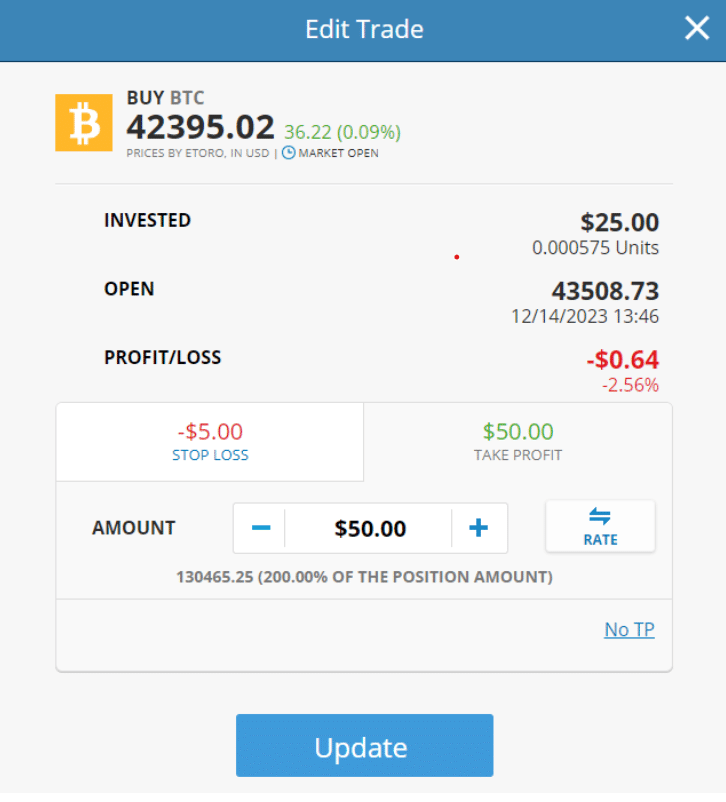

Take-profit orders let you set a price to automatically exit the trade with a profit.

In the example below, eToro will sell the position when its value doubles.

Past performance is not an indication of future results.

You can view or update your order settings for each position from the Portfolio tab. The second order uses both a trailing stop and a take profit order.

Past performance is not an indication of future results.

How Are Bitcoin Trades Taxed?

In many countries, like the US, Bitcoin is treated as property for tax purposes. This means profitable trades must be reported as capital gains, whereas losing trades are capital losses.

The IRS in the US requires that traders report cost basis and trade values in USD. Assets held longer than a year are taxed at long-term capital gains rates, whereas short-term trades are taxed at the same rate as ordinary income.

Fractional Bitcoin Investments

Bitcoin’s code ensures scarcity by setting the maximum amount of bitcoins to 21 million. Each of these trades for over $40,000 at current prices.

But you can buy as little as $10 worth on eToro.

Although Bitcoin’s maximum supply is capped, Bitcoin is divisible, which allows you to buy smaller amounts.

eToro also supports fractional shares for stocks and ETFs.

FAQs about Buying Bitcoin on eToro

Common Queries Answered for New Users

Is eToro safe to buy Bitcoin?

eToro is a and well-regulated broker with a history dating back to 2007. The brokerage holds is registered with regulators in major markets, including FinCEN in the US and the FCA in the UK. Addition safeguards like SIPC insurance for stocks, ETFs and options as well as FDIC insurance for US cash balances contribute to a safer trading environment on eToro.

Can you buy actual Bitcoin on eToro?

Yes. When you buy Bitcoin on eToro you can withdraw your Bitcoin to an external wallet from which you can spend your Bitcoin or send it to another wallet.

Can I transfer bitcoins to eToro?

No. Currently, there is no way to transfer bitcoins to the eToro trading platform. However, you can receive bitcoins with the eToro Wallet.

How do I withdraw Bitcoin from eToro?

To withdraw Bitcoin from eToro, select a BTC position from your portfolio and then select “withdraw.” Only the eToro Wallet is supported for withdrawals. Alternatively, you can sell the position and withdraw the proceeds to your funding source.

How can I cash out from eToro Wallet?

To cash out from eToro Wallet, you can send your bitcoins to another wallet or exchange. Currently, there is no way to move Bitcoin back to the eToro trading platform to close your position.

Where does eToro store Bitcoin?

eToro keeps most crypto assets in cold storage, which refers to crypto wallets that are not connected to the internet.

Conclusion

eToro’s newbie-friendly platform makes it well-suited to people learning how to invest in Bitcoin and other cryptocurrencies. The availability of of stocks and ETFs help to build a diversified portfolio ot manage risk more effectively. Trade crypto alongside stocks and ETFs.

A predictable 1% trading fee makes trading cost-effective and trading tools like Copy Trading, Smart Portfolios and a $100,000 demo account provide a way to learn the ropes without being a trading guru.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. Cryptonews is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

References

- https://www.etoro.com/customer-service/regulation-license/

- https://brokercheck.finra.org/firm/summary/298361

- https://www.etoro.com/en-us/customer-service/state-disclosures/

- https://www.etoro.com/customer-service/help/1306618852/where-are-my-cryptoassets-held/

- https://www.etoro.com/en-us/customer-service/help/1492946212/are-my-assets-with-etoro-usa-insured/

- https://www.sipc.org/for-investors/what-sipc-protects

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. Cryptonews is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

Sergio Zammit

Sergio Zammit

Kane Pepi

Kane Pepi