8 Best Crypto Sniper Bots for 2024

Sniper bots are crucial if you’re a short-term crypto trader looking for a quick entry and exit. Simply set your trading parameters and the sniper bot will automatically place the required orders.

In this guide, we explore the best crypto sniper bots for traders in 2024. Discover reliable and profitable sniper bots for various chains and trading strategies.

List of the 8 Best Sniper Crypto Bots in 2024

Let’s start with an overview of the 8 best crypto sniper bots:

- Sniper Trading Secrets – All-in-One Sniping Package With Educational Tools and Pre-Built Strategies

- Unibot – Best Option for Sniping ERC-20 Tokens on the Uniswap Exchange

- Photon – Lightning-Fast Sniper Bot for Trading Solana Meme Coins

- Trojan – Top-Rated Telegram Bot With Copy Trading and DCA Tools

- WagieBot – Multi-Chain Sniper With Anti-Rug and Honeypot Checks

- Polybot – Popular Sniping Tool for Buying and Selling New BEP-20 Tokens

- DexCheck – One of the Fastest Ways to Trade Tokens From the Telegram App

- LootBot – Perform Automated DeFi Tasks Including Staking, NFT Mints, and Airdrops

The Top Crypto Sniper Bots Reviewed for Traders

Let’s explore the best crypto sniping bots listed above. We cover everything traders need to know; including supported chains, strategies, pricing, reliability, and security.

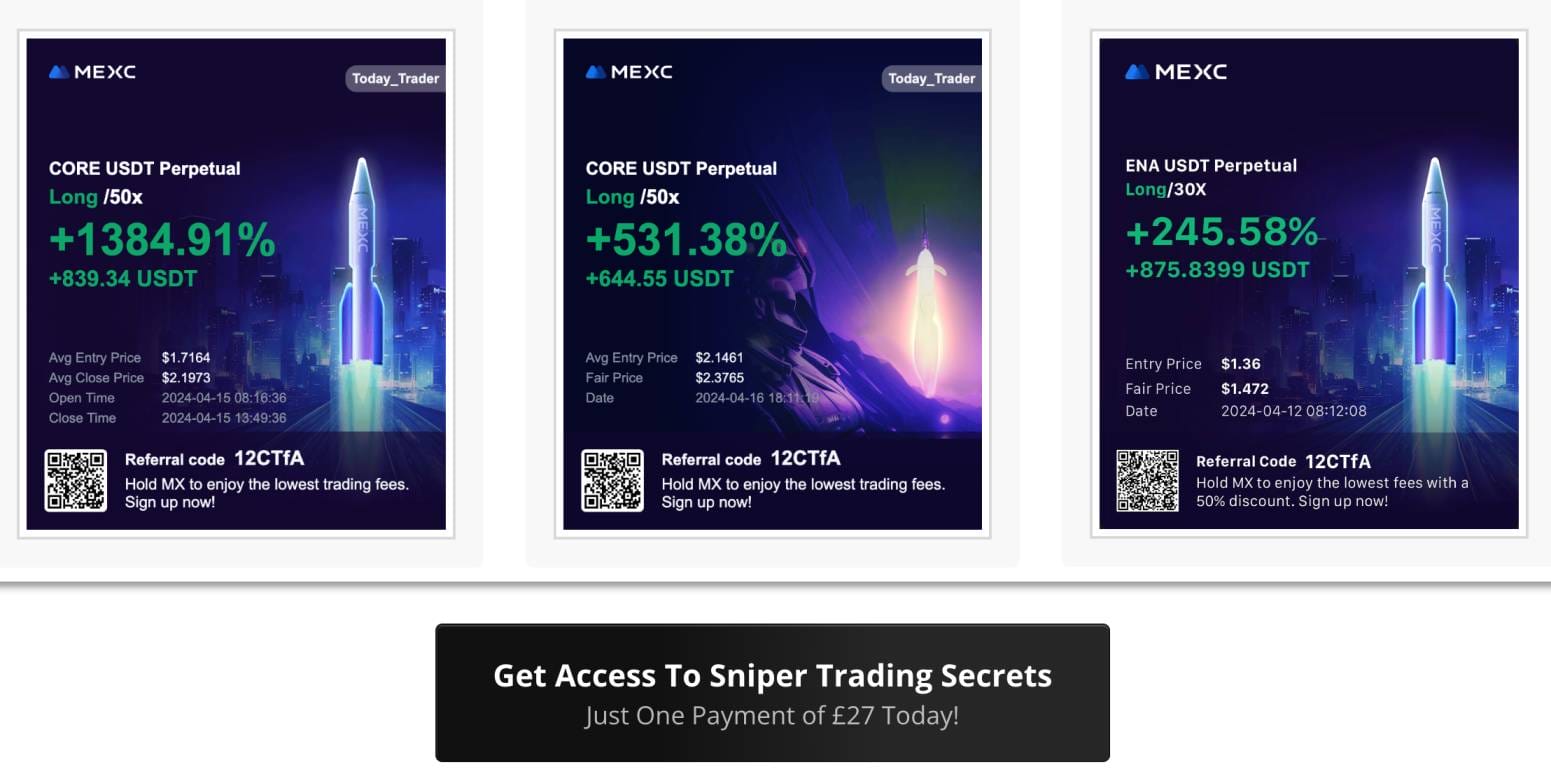

1. Sniper Trading Secrets – All-in-One Sniping Package With Educational Tools and Pre-Built Strategies

The overall best option – especially for beginners, is Sniper Trading Secrets. This is an all-in-one solution for speculative crypto traders. Sniper Trading Secrets teaches newbies how to spot the next 100x coins. All strategies are supported, so you can choose a method that aligns with your goals. This includes everything from scalping and day trading to short-selling.

Its educational resources are split into five key models. This explains how and where to find profitable trading opportunities, the secrets of successful ICO investing, proven strategies for portfolio scaling, and insights into technical indicators and chart movements. Sniper Trading Secrets also offers access to its exclusive trading room.

This is a live chat room where the best cryptocurrencies to buy are revealed in real-time. Most selections are meme coins but utility tokens are also covered. The trading room is also ideal for speaking with expert crypto traders and like-minded investors. Sniper Trading Secrets charges a one-time fee of just £27. It comes with a 365-day money-back guarantee – no questions asked.

Pros

- All-in-one sniping package with educational tools

- Learn how to find the next crypto to explode

- Live trading room with real-time altcoin picks

- Charges a one-time fee of just £27

- Comes with £200 worth of free bonus materials

Cons

- Makes bold claims about daily investing returns

- A new market entrant with a limited track record

2. Unibot – Best Option for Sniping ERC-20 Tokens on the Uniswap Exchange

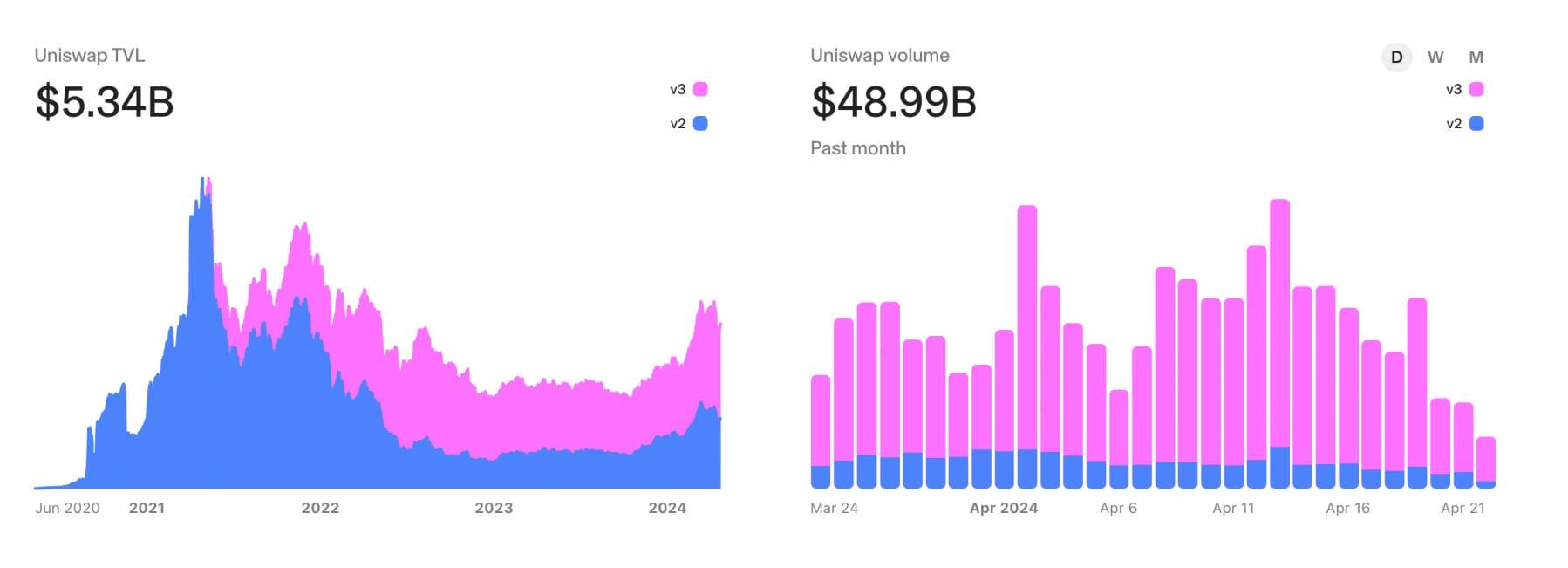

Unibot is one of the best crypto sniper bots for trading ERC-20 tokens. It’s compatible with Uniswap, the leading decentralized exchange for Ethereum-based projects. According to Unibot, it has facilitated more than $895 million worth of sniping trades to date. It also claims to execute trading positions 6 times faster than Uniswap.

Unibot comes with many features. Beginners might wish to start with limit orders. This enables traders to buy or sell Uniswap tokens at specific prices. Another tool for beginners is the mirror sniper. This enables users to ‘copy’ a successful crypto trader. Simply provide the bot with the wallet address you want to mirror.

Unibot is also ideal for protecting privacy. It shields trades made by the bot, ensuring they’re not linked to your wallet address. Unibot also offers a real-time market scanner. This notifies the bot when new tokens are added to Uniswap. It can snipe them instantly, meaning you’re ahead of the broader market. Unibot integrates with Telegram for seamless accessibility.

Pros

- The best crypto sniper bot for ERC-20 tokens

- Executes trades 6 times faster than Uniswap

- Mirror sniper feature supports real-time copy trading

- Receive signals whenever new Uniswap tokens launch

- Compatible with Telegram for increased privacy

Cons

- Only supports the Uniswap exchange

- Some features are still being developed

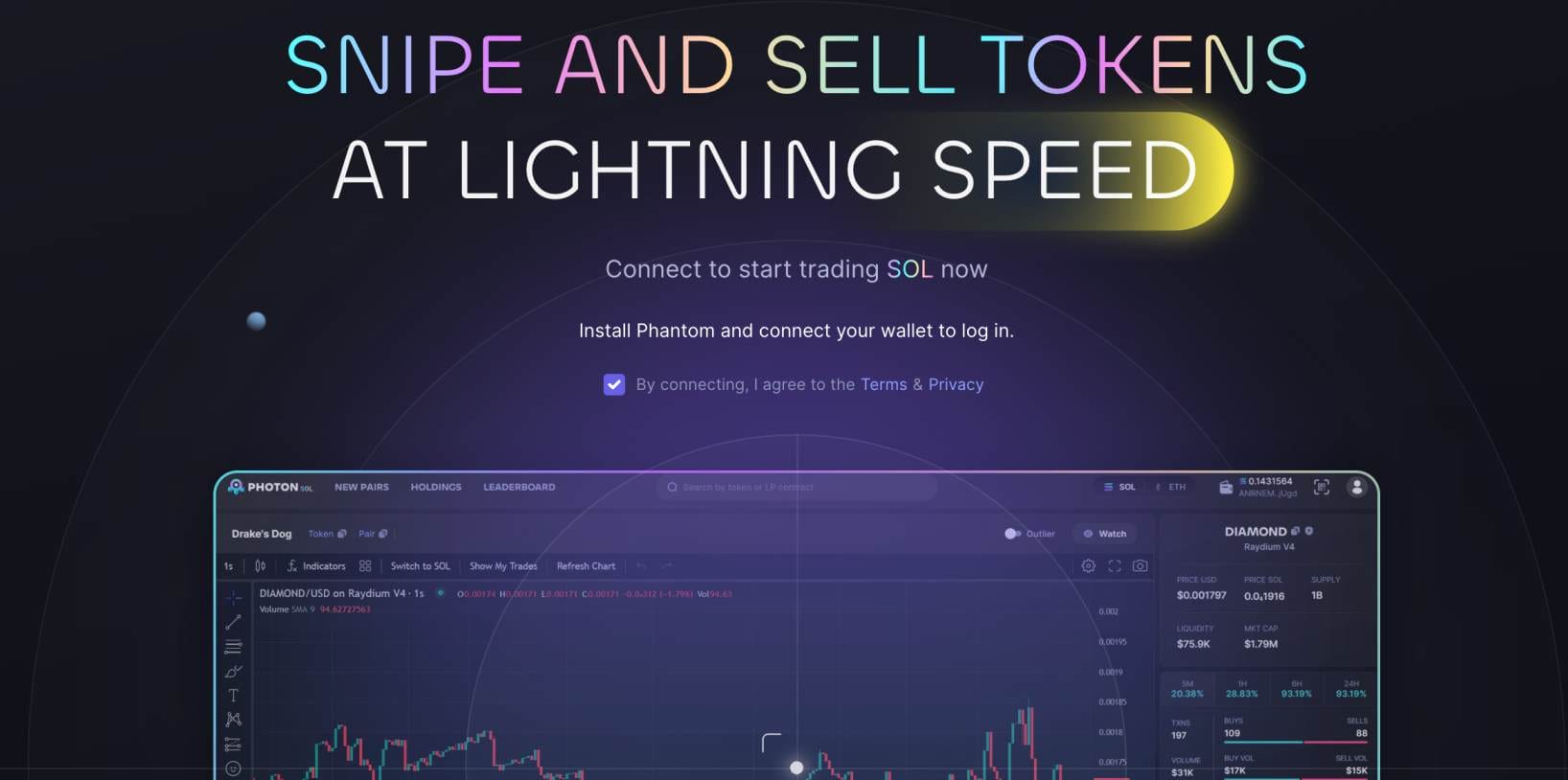

3. Photon – Lightning-Fast Sniper Bot for Trading Solana Meme Coins

Photon is a great option for finding the best Solana meme coins. First, you’ll need to connect the Photon bot to Phantom, which is a self-custody wallet for the Solana network. You can then set your preferred trading parameters. The possibilities are endless in this regard. For example, you might want the bot to invest $10 whenever new Solana-based tokens launch.

However, considering how many scams are present, additional parameters are recommended. For instance, the Photon bot might only invest once minimum trading volumes or token holders have been met. The bot can also filter tokens based on the liquidity pool size. And whether the pool has been locked, and for how long.

The Photon bot can also snipe tokens based on price performance. For example, it can follow market trends by purchasing tokens with at least 50% gains in the prior hour. Crucially, Photon locks in profits based on your requirements. Photon is compatible with the two best decentralized exchanges for Solana tokens – Raydium and Jupiter.

Pros

- Top sniper crypto bot for trading Solana tokens

- Find the best meme coins before they explode

- Unparalleled filters for custom bot parameters

- Connects directly to the Phantom wallet

- Compatible with Raydium and Jupiter

Cons

- Only supports the Uniswap exchange

- Some features are still being developed

4. Trojan – Top-Rated Telegram Bot With Copy Trading and DCA Tools

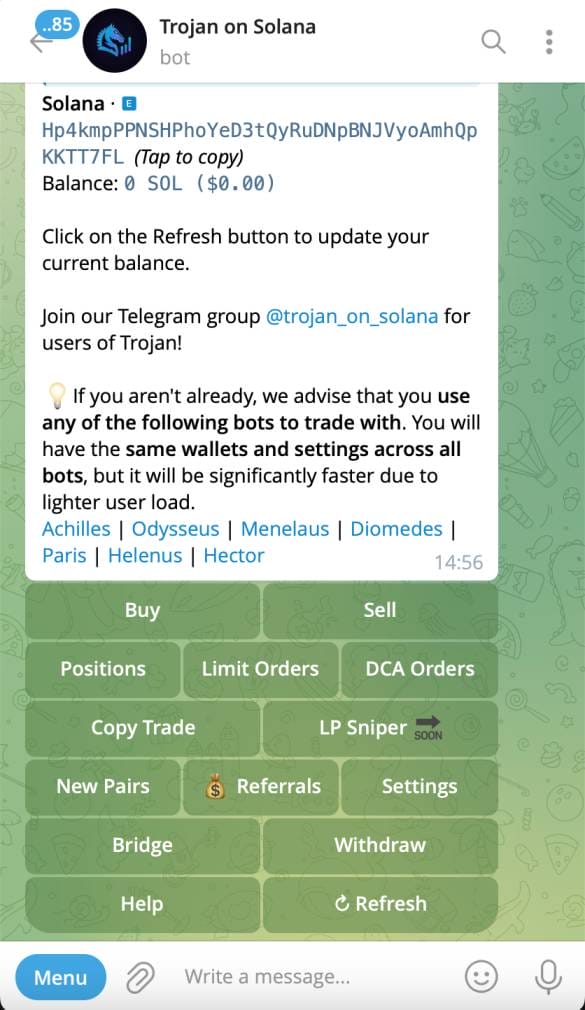

Next on this list of sniping crypto bots is Trojan. This popular trading bot was launched in mid-2023 and now boasts over 47,000 X followers. Its sniping bot is compatible with the Solana network. No other blockchain standards are supported. Nevertheless, accessibility is provided on the Telegram app.

After joining the Trojan Telegram group you’ll be provided with a unique wallet address. You’ll need to send SOL to this address before the bot starts trading. Trojan’s bot comes with many useful features. This includes a dollar-cost averaging (DCA) tool. Simply choose your preferred Solana tokens, set the amount and investing frequency, and the bot takes care of the rest.

Copy trading is also supported by Trojan. This enables you to replicate buy and sell positions from specific wallet addresses. There’s also a ‘New Pairs’ button. Clicking it reveals the latest Solana trading pairs to launch. Key statistics like volume, liquidity, and wallet holders are provided in real-time. Other tools include limit orders and position monitoring.

Pros

- Feature-rich sniping bot for the Solana network

- Replicate orders from selected wallet addresses

- Real-time data on new trading pair launches

- Supports custom DCA strategies

- A growing community of over 47,000 followers on X

Cons

- Only compatible with the Solana network

- Doesn’t connect with external wallets

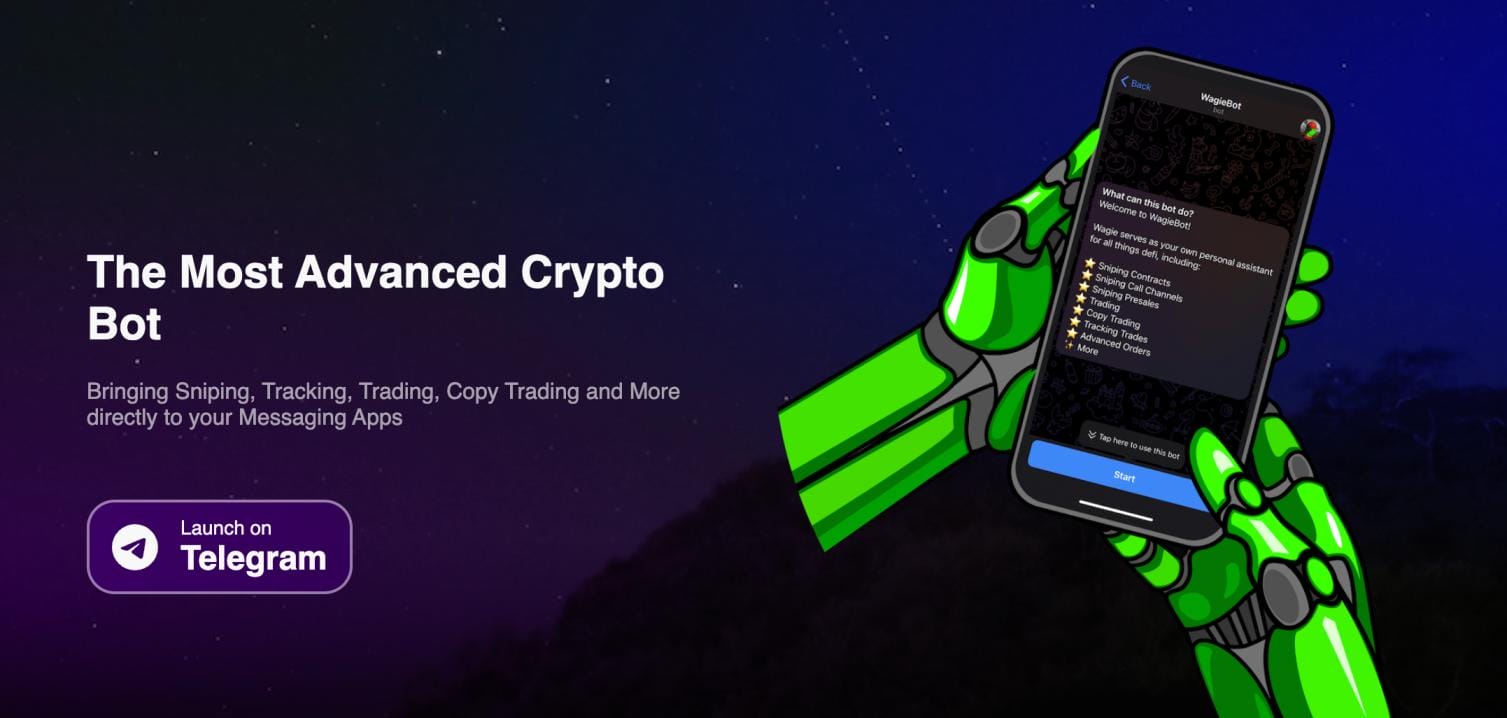

5. WagieBot – Multi-Chain Sniper With Anti-Rug and Honeypot Checks

WagieBot is another sniper bot for crypto that works with the Telegram app. Unlike many bots, WagieBot is a multi-chain sniper. This includes the Ethereum, BNB Chain, Solana, and Arbitrum networks. This means the bot can simultaneously buy and sell tokens from multiple ecosystems.

Similar to other Telegram-based bots, you’ll be provided with a unique wallet address. Make sure you deposit the right coins for the respective network. WagieBot comes with plenty of advanced features. This includes anti-rug pull and honeypot checks – giving yourself the best chance possible of avoiding scams.

There’s also a copy trading tool; meaning you can mirror any wallet address from supported networks. You can also use WagieBot to snipe brand-new tokens from decentralized exchanges. Another useful tool is anti-mev protection. This ensures you avoid being front-run by other bots – which can result in huge slippage.

Pros

- One of the best crypto sniper bots for multi-chain access

- Compatible with Ethereum, BNB Chain, Solana, and Arbitrum

- Risk-management tools help avoid rug pulls and front-running

- Features include new token snipes and copy trading

- Trades are executed in milliseconds

Cons

- Only available on the Telegram app

- Doesn’t work with Polygon or Base tokens

6. Polybot – Popular Sniping Tool for Buying and Selling Brand-New BEP-20 Tokens

Polybot is one of the best options for trading BEP-20 tokens, which is the native standard for BNB Chain projects. This is because Polybot is compatible with PancakeSwap. This is where new BEP-20 tokens begin trading before being launched on centralized platforms. Polybot enables users to buy tokens as soon as the PancakeSwap listing goes live.

The bot will cash out the position when the stated profit target is met. For example, the bot could sell the tokens once 20% gains are achieved. It can then move on to the next opportunity. Polybot is also compatible with PinkSale launches. So, it can invest in the respective presale, hold the tokens, and then cash out once they’re listed on PancakeSwap.

In addition to BNB Chain and PancakeSwap, Polybot is also compatible with ERC-20 tokens on the Uniswap exchange. It also supports other popular ecosystems, such as Polygon, Fantom, Base, and Celo. However, do note that Polybot is one of the most expensive options; it charges $599. This is a one-time fee with lifetime access and updates.

Pros

- A great option for sniping BEP-20 tokens on PancakeSwap

- Also supports Ethereum, Base, Polygon, and other popular networks

- Automatically buy and sell new tokens based on pre-defined targets

- Able to invest in presales held on the PinkSale platform

- Beginners have access to video tutorials

Cons

- Charges a one-time fee of $599

- Doesn’t support copy trading

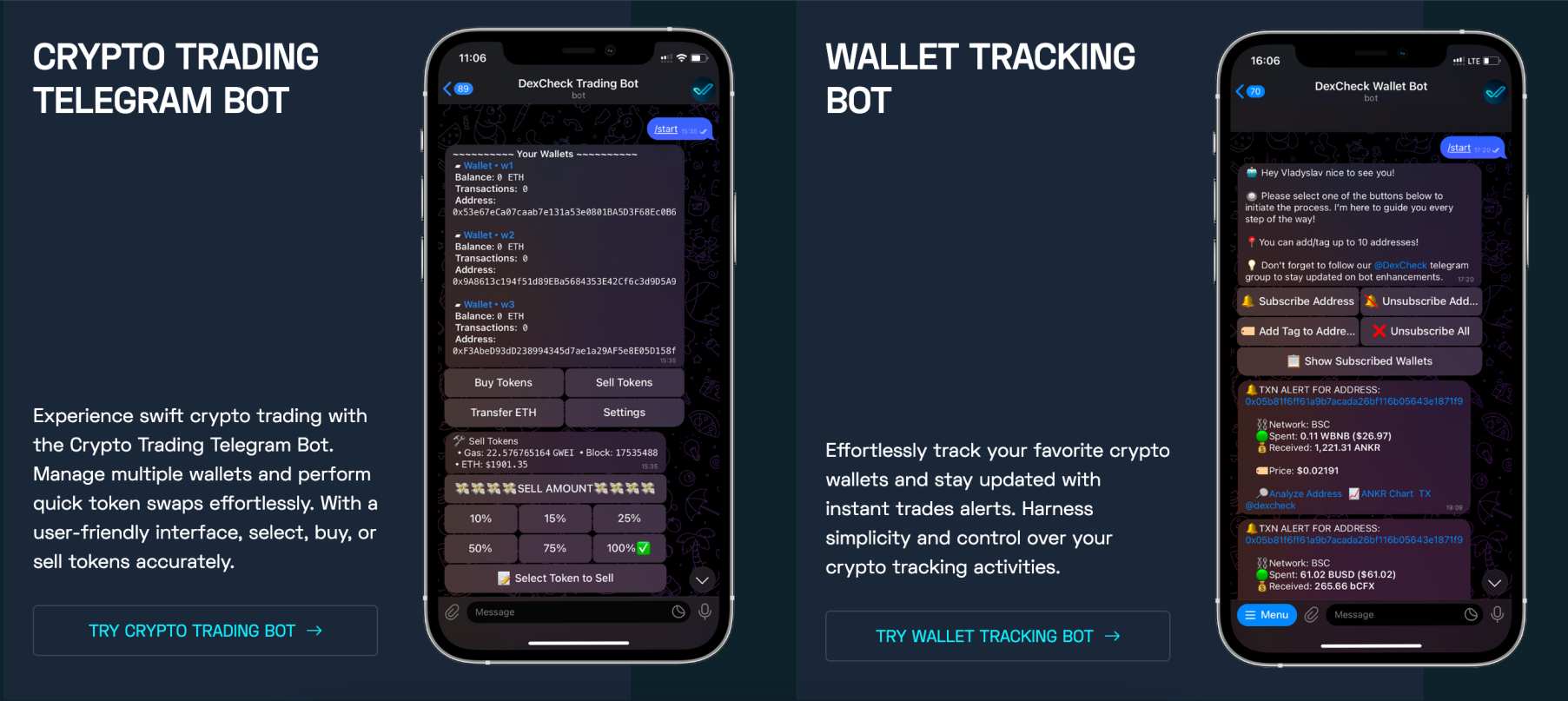

7. DexCheck – One of the Fastest Ways to Trade Tokens From the Telegram App

DexCheck is also one of the best crypto sniper bots. This option is ideal for traders who prefer taking a more hands-on approach. This is because DexCheck enables users to manually trade tokens on decentralized exchanges. However, it’s considerably faster and more user-friendly; everything is conducted from its Telegram channel.

First, users must deposit coins to the provided wallet address. The deposit will be credited near-instantly – a new message will be posted from the Telegram bot. Next, let DexCheck know what token you want to buy via its smart contract address. The investment amount can be stated in token terms (e.g. 40 USDT) or the percentage size (e.g. 10% of the wallet balance).

The trade will be conducted in real-time, meaning the tokens will arrive in your DexCheck wallet in milliseconds. DexCheck also offers a wallet tracking tool. This enables you to follow the most successful crypto traders. It also offers a new token scanner. Simply click the ‘Sniper Token’ button to instantly invest.

Pros

- Fast-track investments on decentralized exchanges

- Trades are executed in milliseconds

- Choose investment stakes in token or percentage terms

- Instant buy feature for new token snipes

- Follow the smart money by tracking profitable wallet addresses

Cons

- The free plan comes with many restrictions

- Premium plans can only be purchased with DCK tokens

8. LootBot – Perform Automated DeFi Tasks Including Staking, NFT Mints, and Airdrops

LootBot is a great option for automating tasks on decentralized finance (DeFi) platforms. This offers a whole new world of opportunities. Rather than manually scan the best DeFi products for your needs, LootBot does everything on your behalf. For example, it connects with SyncSwap and Velocore to automate staking investments.

It also connects with NFT minting platforms. Not to mention decentralized swapping and lending tools. LootBot also automates the airdrop farming process. This maximizes airdrop rewards directly to your wallet. LootBot can also be used to trade tokens on decentralized exchanges. However, only the ERC-20 standard is supported.

All LootBot features can be accessed on the Telegram app. However, full functionality requires a premium plan. This starts from $50 per connected wallet/chain. Fees are reduced by 50% when paying in LOOT tokens. LootBot’s native token has a market capitalization of just $6.5 million, and they’re up over 120% in the past year.

Pros

- One of the best crypto sniper bots for automating DeFi tasks

- Supports staking, NFT mints, airdrops, and lending

- Also offers instant ERC-20 token swaps

- Its native token is up over 120% in the prior year

Cons

- Can only be accessed on the Telegram app

- Swaps can only be made on the Ethereum network

What are Sniping Bots in Crypto?

Sniping bots help crypto traders automate tasks, such as buying and selling tokens on decentralized exchanges. They’re particularly popular with traders who want to buy brand-new meme coins as soon as they’re listed. This often means a first-mover advantage, as traders can invest at the lowest price possible.

Crypto sniping bots can usually be customized, ensuring they follow the trader’s preferred strategy. For example, once a new token has been sniped, the bot might begin cashing out as the price increases. In addition, traders can choose the trigger requirements. This means new tokens are only purchased once certain conditions have been met.

For instance, tokens that have been trading for at least 10 hours, or with a minimum trading volume of $1 million. Alternatively, sniper bots can focus on tokens with locked liquidity pools, a minimum number of holders, or specific percentage gains over a particular time frame. The possibilities are endless when using the right crypto sniping bot.

That said, bots aren’t only suitable for sniping new tokens. Some bots come with additional features like copy trading. This means the bot replicates orders from another trader. All it needs is the trader’s public wallet address and the preferred stake size. Sniping bots can also automate manual strategies, such as dollar-cost averaging and airdrop farming.

A Closer Look at How Crypto Sniper Bots Work

Sniper bots are a broad term that covers many trading strategies, services, and automated tasks. Let’s take a closer look at how they work by discussing the key features and benefits.

New Token Snipes

Ever wondered why new token launches often witness huge growth in the first few minutes? The answer is sniping bots. Put simply, sniper bots enable traders to buy tokens as soon as they’re listed on decentralized exchanges. Oftentimes, new tokens have a nano market capitalization of under $100,000. This means their value can increase 10-fold in hours, sometimes minutes.

And by getting in on the action first, sniping bots typically secure the best price possible. This strategy is ideal for making quick gains before the market settles. For instance, many sniping bots will gradually cash out as the price increases. This ensures sell orders don’t collapse the price, meaning the bot maximizes returns.

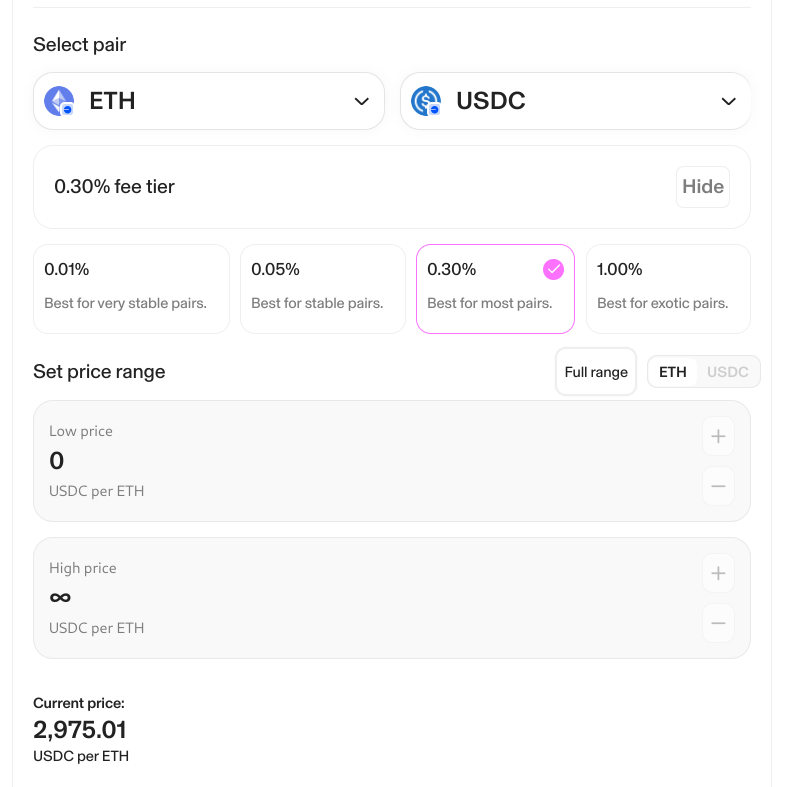

It’s important to choose a sniping bot that’s compatible with your preferred network and decentralized exchange. For example, some bots only work with ERC-20 tokens on Uniswap. While others specialize in Solana-based tokens on Raydium and Jupiter. Some bots offer multi-chain support, meaning they can snipe tokens on multiple network standards.

Custom Trading From the Telegram App

The best crypto sniper bots work alongside the Telegram app. This enables users to buy and sell tokens without leaving Telegram, offering increased privacy and accessibility. The sniping bot will generate a unique wallet address once the user joins its group. The wallet can then be funded with crypto.

After that, the sniping bot can place orders on your behalf. For example, suppose you want to swap USDT for another ERC-20 token. You’d simply need to paste the token’s unique contract address and state the required swap quantity. The bot will complete the swap in milliseconds. The newly purchased tokens are automatically deposited in your wallet.

Dollar-Cost Averaging Strategies

Sniper bots are also ideal for creating and deploying dollar-cost averaging strategies. This feature is rarely supported by decentralized exchanges, so sniper bots offer a simple workaround. This strategy is suitable for both short and long-term crypto investors.

For example, suppose you’re a short-term speculator who wants to buy a new token. The sniper bot could make strategic purchases every 10 minutes. After several hours of trading, your cost basis will have been averaged out. This reduces the risks of buying at the peak.

Long-term investors can use a similar strategy but over longer periods. For instance, suppose you want long-term exposure to 20 different tokens. The bot could make 20 individual purchases simultaneously on a daily or weekly basis. This would be a laborious task when done manually.

Automate Launchpad Investments

Some crypto sniper bots can automate launchpad investments. This means investing in the best crypto presales from platforms like PinkSale. The bot can be programmed to only invest in presales that meet certain conditions.

For example, you might only be interested in projects that have been audited, and the smart contract renounced. Alternatively, the bot could focus on launches with a fixed token supply or with a maximum hard cap.

Either way, the bot can accumulate tokens before the exchange listing. After that, the bot can offload the presale tokens based on your target profit range.

New Token Scanners

Creating and launching new crypto tokens has never been easier or more cost-effective. Unfortunately, this means the markets are flooded with new launches. The vast majority will fail. Moreover, many new tokens are created as rug pull scams. This makes it even harder to discover legitimate token launches.

This is another area where sniper bots can help. Some bots come pre-installed with anti-rug mechanisms. This will notify you that a particular launch has a high likelihood of being a scam. This might be because the smart contract can be amended. Or because the liquidity pool hasn’t been locked. Either way, this is an invaluable tool when investing in new tokens.

Do Crypto Sniper Bots Make Money?

Whether or not crypto sniper bots are profitable depends on the strategy. It’s simply not possible for the bot to snipe every new token that launches. If it did, this would require thousands of trades every day across multiple networks. We’re now at the stage where new tokens launch by the minute.

This is because creating a new token no longer requires programming knowledge. Many beginner-friendly tools streamline the process – so users only need to provide basic information (e.g. the name of the token and its total supply). With this in mind, profitable sniper bots follow specific strategies, which are created by the user.

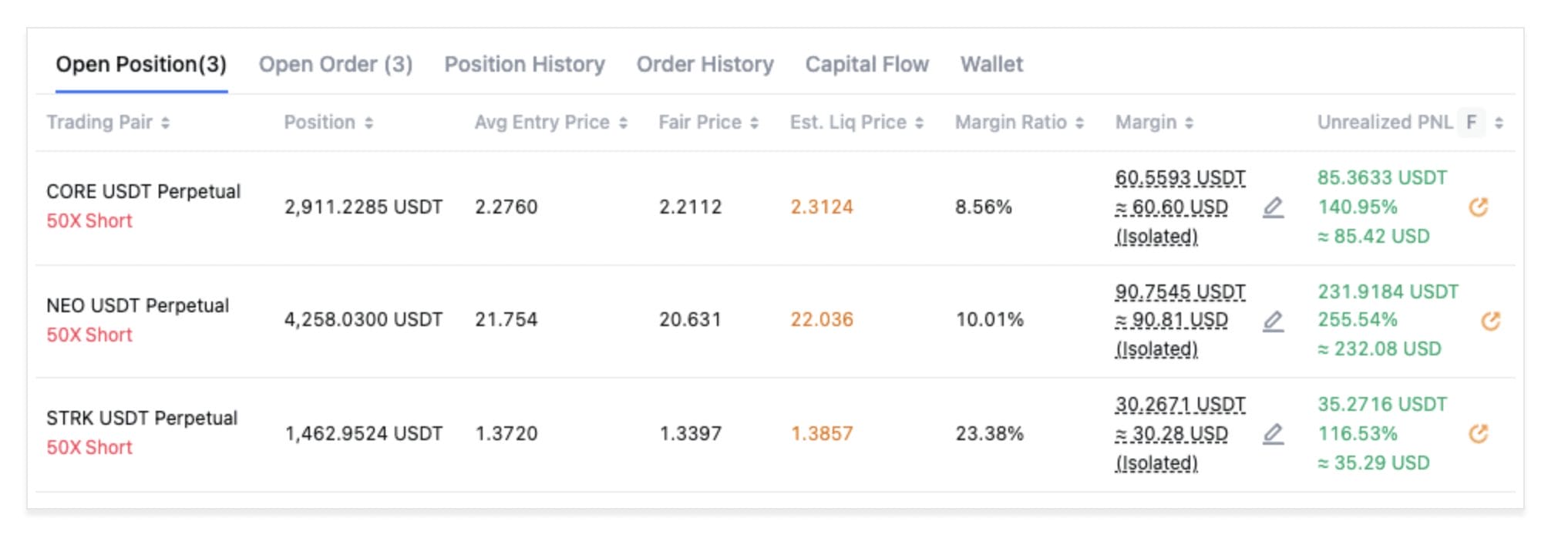

Here’s an example of what the required trading parameters might look like:

- Chain: Solana

- Launch Time: Between 8 and 10 hours

- Market Cap: Between $500,000 and $1 million

- Volume: Minimum trading volume of $1 million

- Liquidity Ratio: At least 30% of the real-time market capitalization

- Holders: No more than 15% of the supply should be held by any one wallet

In addition, profitable trading bots must have an extensive diversification policy. Especially when buying new tokens with limited trading history. For instance, if the bot buys 20 different tokens, only 1 might succeed. That 1 token success could be enough to generate substantial gains.

Crucially, don’t get sucked in by crypto influencers on social media. You’ll only ever hear about the winning trades, not the losing ones.

Best Practices When Selecting a Sniping Crypto Bot: Our Methodology

An increasing number of bots are entering the market. As such, we developed a methodology to rank the best providers. We focused on reputation, security, compatible networks, key features, pricing, and performance.

Read on for guidance on how to select the best crypto sniper bot for you.

Reputation and Security

The most important factor when using crypto sniper bots is safety. The industry is still nascent, so bot providers rely on trust and reputation. The key issue is the way that some bots require direct funding. For example, Telegram-based bots generate a wallet address that is unique to the user. Similar to centralized crypto exchanges, this means the user doesn’t control the private keys.

This is a huge security risk, but often the norm when using crypto snipers. In this instance, only add small amounts to the wallet address. That said, some of the best crypto sniping bots connect to existing self-custody wallets. For example, Photon connects with the Phantom wallet, which is compatible with Solana decentralized exchanges.

While Photon doesn’t have access to your private keys, security risks should still be considered. After all, the sniper bot has access to the wallet’s balance – which it needs to place orders. So you’ll need to weigh up the pros and cons before proceeding. Ultimately, sniper bots are best used for inconsequential amounts, so never connect them with your primary wallet.

Supported Networks and Exchanges

Next, you’ll need to assess which network standards the sniper bot supports. This will determine which tokens you can trade.

- For example, if you want to buy and sell ERC-20 tokens on Uniswap, the bot must support the Ethereum network.

- Alternatively, if you’re interested in BEP-20 tokens on PancakeSwap, support for the BNB Chain is needed.

If you don’t have a specific preference, opt for a multi-chain sniper bot. This means it can trade tokens from more than one network. Not only will this present a wider range of trading opportunities but you won’t need to manage multiple bots.

Custom Parameters

If you’re looking for a plug-and-play service, sniper bots likely won’t be suitable. After all, bots can’t magically determine which tokens have the best chance of success.

The sheer number of new crypto tokens in the market means that bots need specific parameters to follow. The bot will only buy and sell tokens based on these conditions. Therefore, make sure you choose a sniper bot that offers full customization.

Some of the metrics to look for include:

- Minimum trading volume within a specific time frame. For example, the bot should only consider new tokens with at least $1 million traded in the prior 6 hours.

- Minimum liquidity that’s locked. This ensures there’s enough liquidity for the bot to trade. It also ensures the liquidity can’t be withdrawn by the contract owner.

- Market capitalization range. You’ll want to focus on token valuations that align with your risk tolerance. For example, high-risk traders might want tokens valued at under $1 million. While more risk-averse traders might set the minimum at $100 million.

- Custom price performance. Bots can be programmed to buy tokens that meet price performance targets. For instance, tokens that have increased by at least 30% in the prior 2 hours.

Not only should the bot come with custom buy parameters, but the same should apply to sell orders. This ensures the bot maximizes the profit potential. For example, you could program the sniper bot to cash out 10% of the position every time the token price increases by 5%.

Pricing

Crypto sniper bots are developed to generate revenue. This means the leading providers charge fees. Prices can vary considerably from one bot to the next. What’s more, some bots come with a monthly subscription, while others have a one-time fee. Either way, the pricing structure should align with your investment budget.

For example, Polybot charges a one-time fee of $599. This won’t be suitable if you’re planning to trade a few dollars here and there. After all, you’ll need to make at least $599 just to cover the purchase. A more budget-friendly option is Sniper Trading Secrets, which charges just £29 for lifetime access.

Features and Tools

Consider what features and tools you’re after when selecting a sniper bot. As mentioned, some sniper bots are ideal for discovering brand-new crypto gems. However, there are many other use cases to consider. For example, you can use sniper bots to swap tokens without visiting a decentralized exchange.

This feature is often accessible via the Telegram app. Not only does this increase accessibility but Telegram offers enhanced privacy. Some sniper bots are ideal for automating custom strategies. This can include dollar-cost averaging, arbitrage trading, and Martingale systems.

Is it Legal to Use a Crypto Sniping Bot?

In general, crypto sniper bots are perfectly legal. They simply offer a means to automate manual trading tasks. However, sniper bot usage is increasingly becoming a hot debate. For a start, sniper bots were blamed for Solana’s recent network issues – with over 75% of transactions failing. While Solana is working on a fix, this highlights the broader risks.

An even greater concern is related to fairness. Bots are deemed to have an unfair advantage over the average trader. Sure, bots are available on a global basis. But bots are only profitable when programmed correctly. This is the secret sauce that will never be shared by successful traders.

What’s more, there is a fine line between a ‘first-mover advantage’ and ‘market manipulation’. In the traditional financial landscape, market manipulation can result in prolonged sentencing. While enforcement is more challenging, regulators will prosecute those found guilty of manipulating crypto prices – with or without sniping bots.

Ultimately, as long as you’re using sniping bots to replicate your own strategy, you shouldn’t face any issues.

Crypto Sniper Bots Pricing: How Much to Pay?

Some crypto sniper bots are free, although expect limited functionality. The best-performing bots with the most features charge fees.

This can be a monthly or one-time fee, and prices can vary considerably. The main consideration is that fees are suitable for your trading budget.

For example, somebody risking thousands of dollars per trade won’t have an issue paying over $100 in monthly fees. However, this won’t be suitable for someone risking $10 per trade. After all, you’d need to secure a 10x trade just to cover the subscription.

Conclusion

Crypto sniping bots are ideal for automating your trading goals – especially when buying and selling new tokens on decentralized exchanges. However, they’re not a get-rich-quick solution, so ensure you’re well-informed on how profitable bots work.

An affordable option to consider is Sniper Trading Secrets. For a one-time fee of just £27, you’ll have access to an all-in-one sniping package. This includes access to the live trading room, where you’ll receive expert picks on the next crypto to explode.

FAQs

What are sniper bots?

Sniper bots are used by crypto traders to automatically buy and sell tokens. They’re commonly used on decentralized exchanges as a means to ‘snipe’ new token launches.

What are some legit crypto sniping bots?

Some of the leading sniping bots are Unibot, Photon, and Trojan. Beginners might prefer Sniper Trading Secrets, which includes educational resources and expert altcoin picks.

Do exchanges allow crypto sniping bots?

Most sniping bots use decentralized exchanges, which simply connect traders with liquidity pools and smart contracts. This means decentralized exchanges cannot prevent bots, regardless of whether or not they allow them.

References

- Number of cryptocurrencies worldwide from 2013 to January 2024 (Statista)

- Fraudsters are using bots to drain cryptocurrency accounts (CNBC)

- Former stockbroker sentenced to more than five years in prison for penny-stock securities fraud scheme (U.S. Department of Justice)

Eric Huffman

Eric Huffman

Alan Draper

Alan Draper

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi