10 Best Crypto Margin Trading Exchanges in 2024

Crypto margin trading is a high-risk, high-return investment strategy. Put simply, you’ll be applying ‘leverage’ to your positions, meaning you’re trading crypto with more money than you have in your account.

This guide reveals the best margin platforms to trade crypto in 2024. Read on to discover the leading platforms for low margin requirements, supported markets, competitive fees, and user-friendliness.

List of The Best Crypto Margin Trading Exchanges

The 10 exchanges listed below offer the best margin trading crypto experience:

- eToro – Overall Best Place to Trade Crypto With Margin

- MEXC – Trade Crypto With a 0.5% Margin Requirement

- OKX – Buy Bitcoin With an Upfront Margin of Just 10%

- Binance – Great Option for Trading BTC/USDT Delivery Futures

- PrimeXBT – Trade $20,000 Worth of Bitcoin With Just $100

- Coinbase – US Clients From Selected States Get 3x Leverage

- Bybit – 125x Leverage on Bitcoin Perpetual Contracts

- KuCoin – Popular Crypto Exchange to Trade Altcoins With Margin

- Kraken – Crypto Spot Margin Accounts With 5x Leverage

- Margex – Get 100x Leverage via Anonymous Trading Accounts

The Top Crypto Margin Trading Platforms Reviewed

The Bitcoin margin trading platforms listed above will now be reviewed in full. Be sure to read through each one to select the most suitable platform.

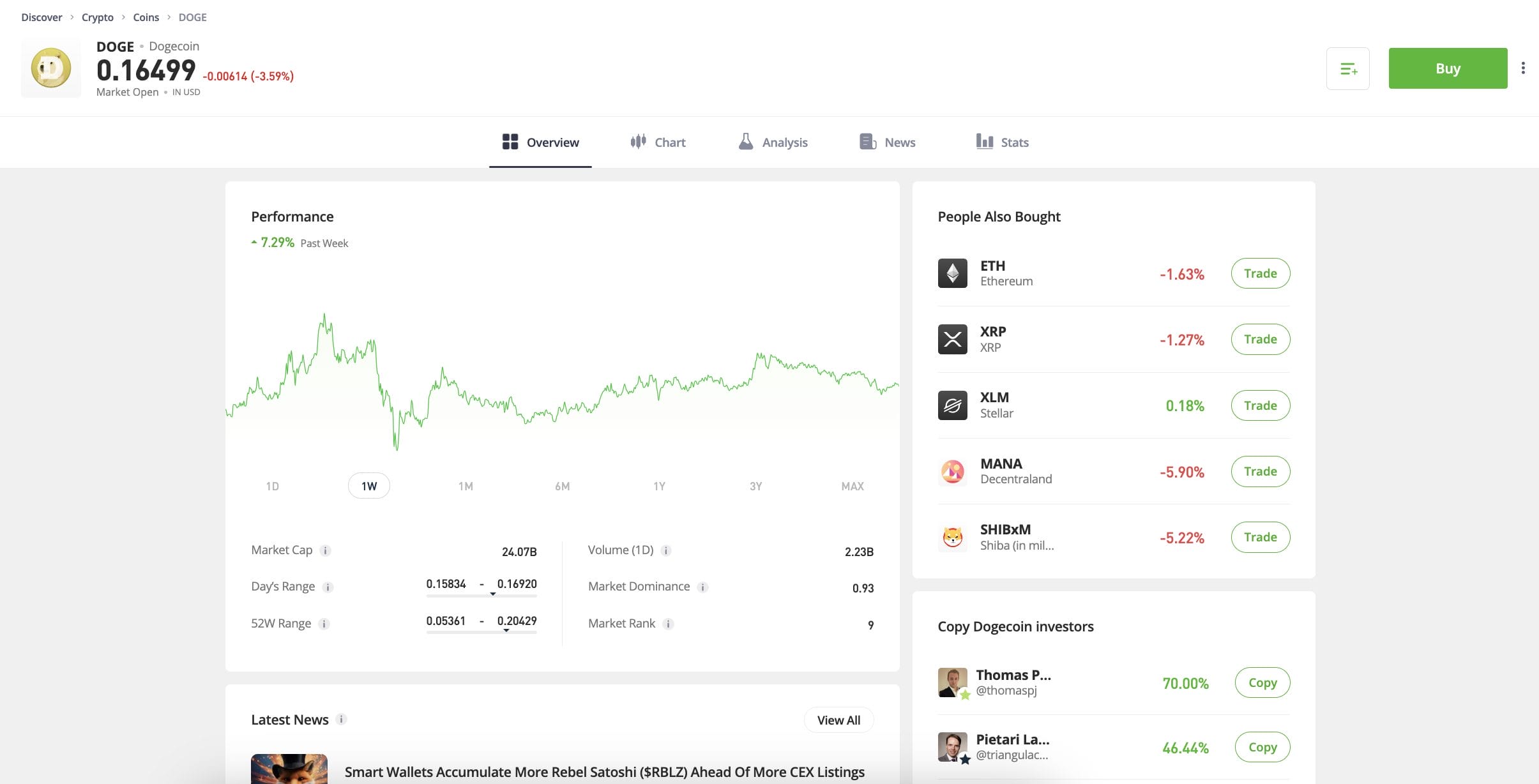

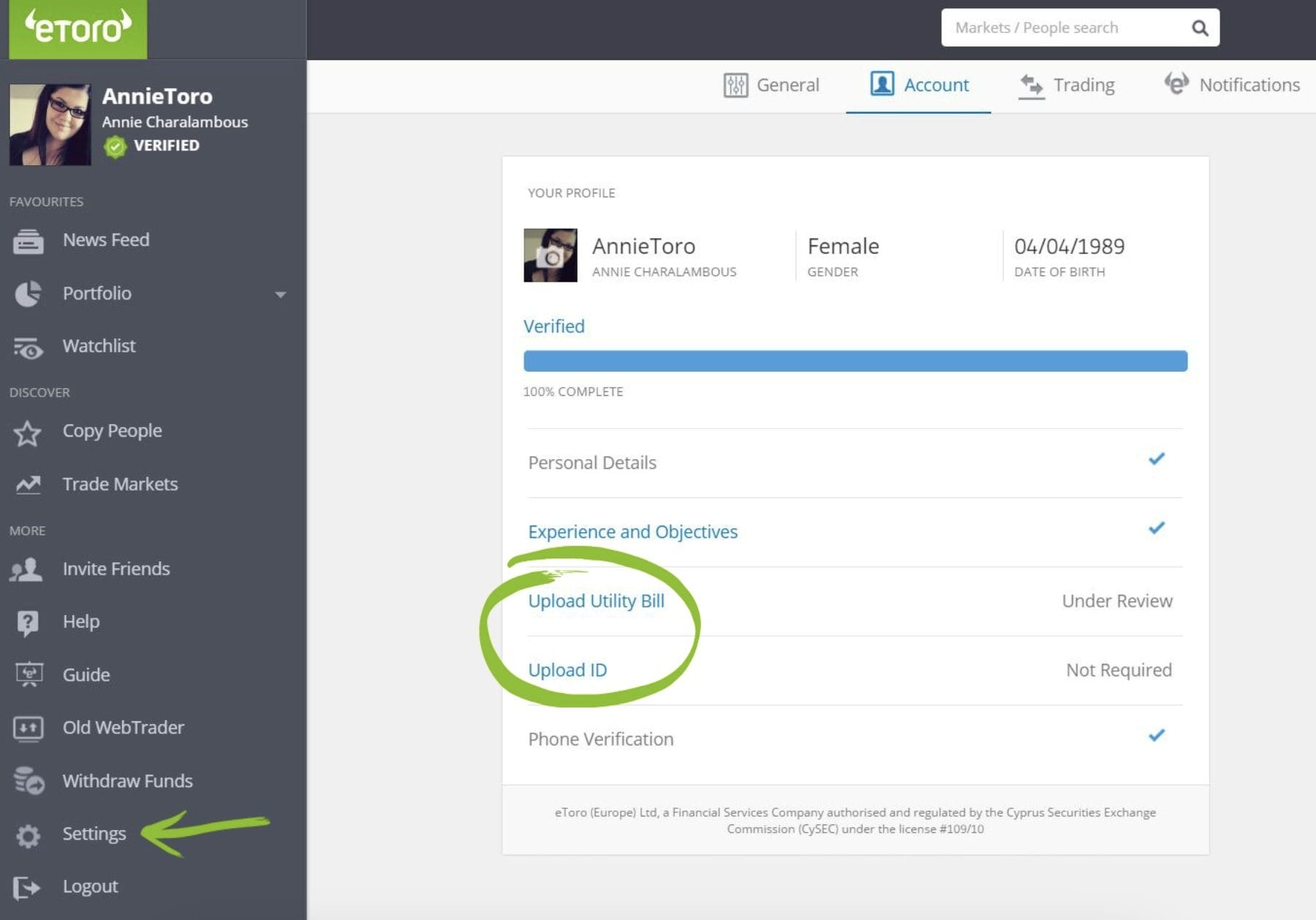

1. eToro – Overall Best Place to Trade Crypto With Margin

Our top pick is eToro, a regulated online broker that lists dozens of crypto trading pairs. This includes leading cryptocurrencies like Bitcoin, Ethereum, Solana, XRP, BNB, Shiba Inu, and Cardano. All cryptocurrencies can be traded against USD. If you’re based in an eligible country, eToro allows you to trade cryptocurrencies via contracts-for-differences (CFDs).

This means you only need to put up a 50% margin. Put otherwise, you’ll be trading with leverage of 1:2. Although this is lower than other margin platforms, eToro offers many benefits that aren’t available elsewhere. For a start, eToro is regulated by FINRA, CySEC, FCA, and ASIC. It keeps client funds in segregated bank accounts and offers institutional-grade security controls.

With over 30 million users, eToro is also the leading copy trading platform. This means you can invest in cryptocurrencies passively. The minimum deposit at eToro starts from $10, but this depends on the country of residence. Accepted payment methods include debit/credit cards and e-wallets. No deposit fees apply on USD payments.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| eToro | Crypto CFDs | 50% | 1% | Yes, but not for margin trading |

Pros

- Safe and regulated crypto margin trading platform

- Supports 80+ USD-denominated pairs

- Go long or short via crypto CFDs

- USD deposits via debit/credit card are fee-free

- Minimum account requirements start from $10

Cons

- Minimum margin requirement of 50%

- Margin facilities banned in some countries – including the US/UK

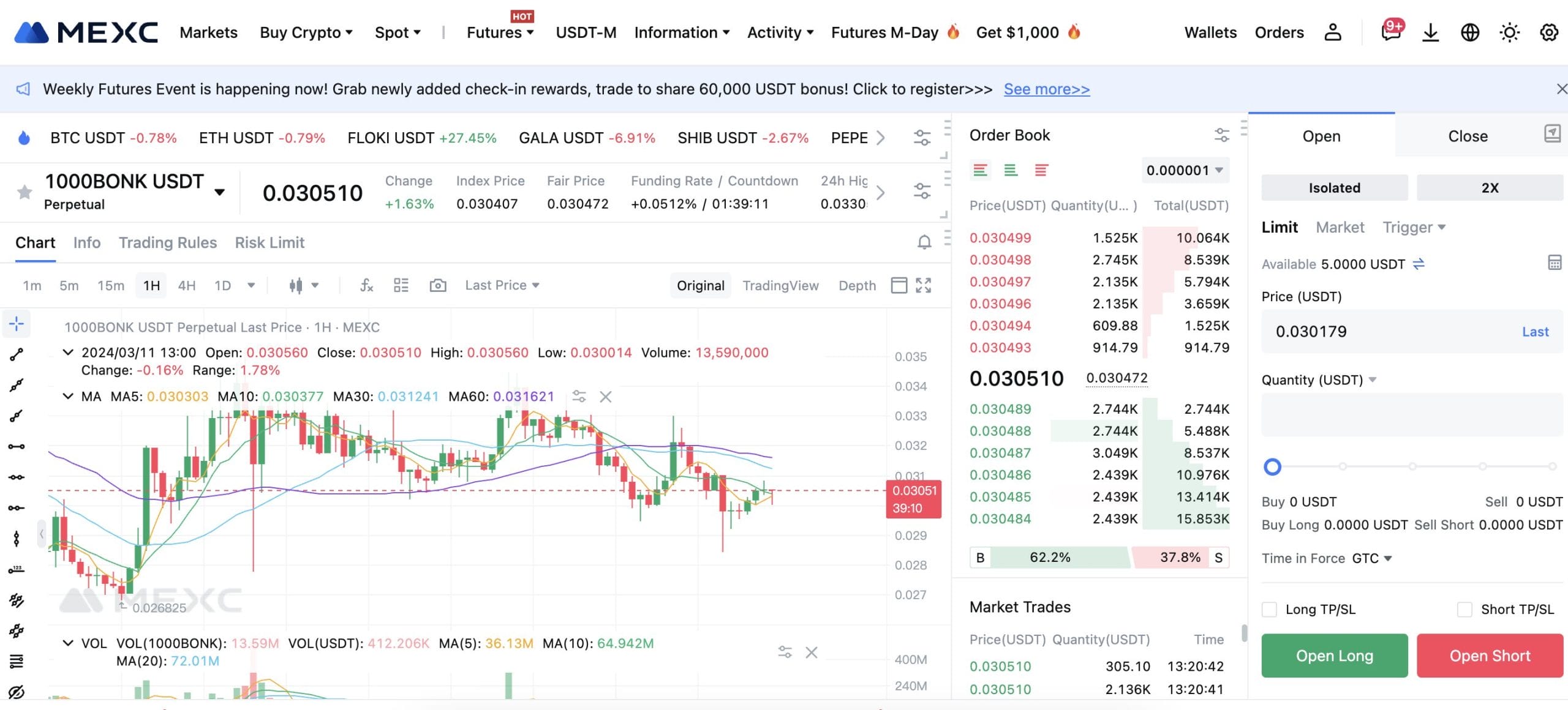

2. MEXC – Trade Crypto With a 0.5% Margin Requirement

We found that MEXC is the best option if you’re looking for the lowest margin requirements. Put simply, you can trade major cryptocurrencies like Bitcoin with a 0.5% margin. This means for every $1,000 traded you need just $5, translating to leverage of 200x. Although lower-cap coins come with higher margin requirements, limits are still generous.

For example – some of the best meme coins, such as Bonk, can be traded with leverage of up to 125x. All leveraged markets on MEXC are available as perpetual futures. These trade like traditional futures contracts but without an expiry date. We found that MEXC is also one of the best options for low fees.

Futures trading fees start from just 0.01% per slide. This means you’re paying just $1 for every $10,000 traded. Another benefit of MEXC is it offers advanced trading tools. This includes real-time charts and technical indicators. However, these tools might not appeal to beginners. MEXC is available via standard browsers and a native app for Android and iOS.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| MEXC | Perpetual futures | 0.5% | 0.01% | No |

Pros

- Minimum margin requirements of 0.5%

- Margin products offered as perpetual futures

- Hundreds of trading markets are supported

- Futures trading fee of just 0.01% per slide

- Lists of the best new cryptocurrencies to buy

Cons

- US clients are not accepted

- Doesn’t offer leveraged options markets

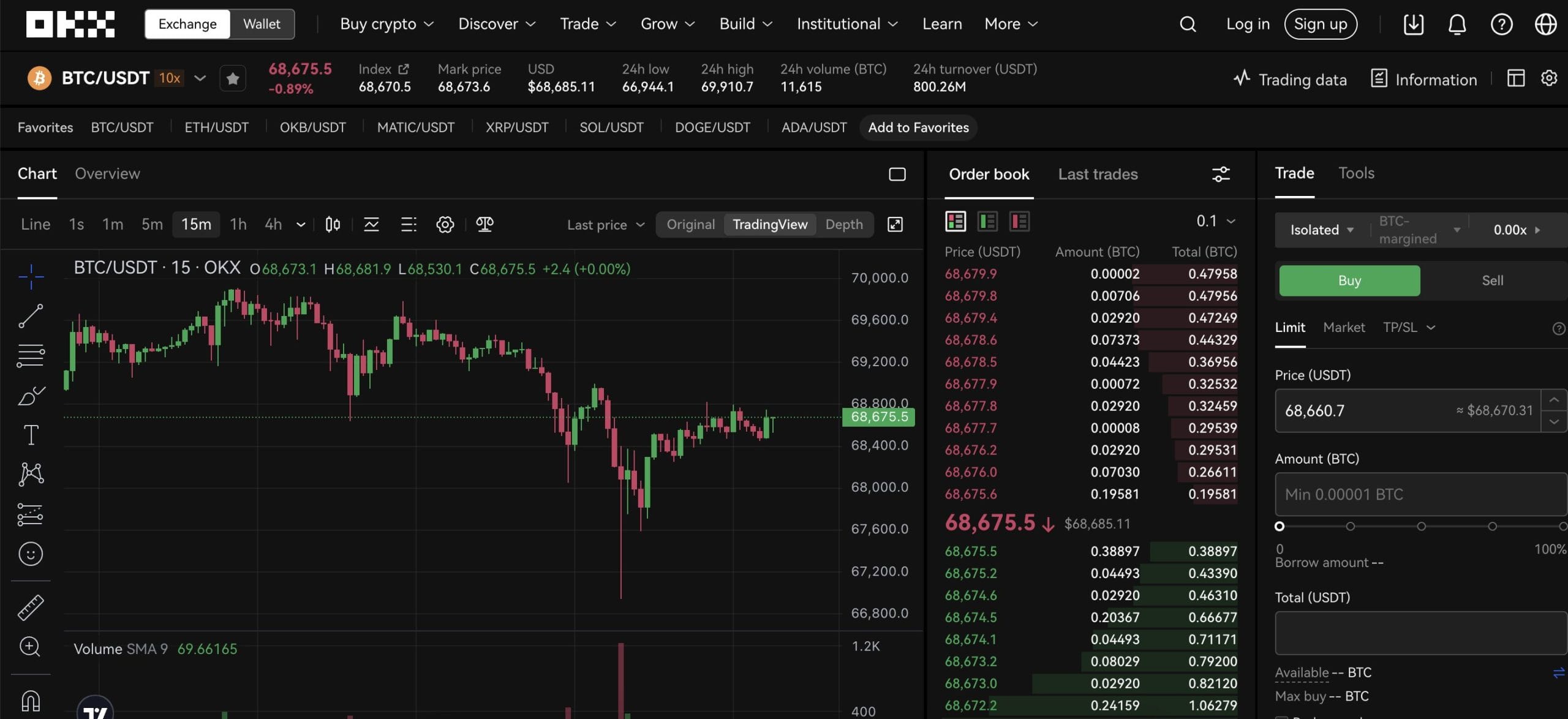

3. OKX – Buy Bitcoin With an Upfront Margin of Just 10%

Next is OKX, a popular crypto exchange boasting over 50 million global clients. It offers a wide range of margin products. First, you’ll find traditional margin accounts on the best cryptocurrencies to buy. The minimum margin requirement on large-cap coins like Bitcoin is 10%. This means you can invest 10 times your bankroll.

Unlike perpetual futures and CFDs, you’ll actually own the underlying digital assets. However, margin calls and liquidation still apply. This means you can’t withdraw the cryptocurrencies while the trade is still open. OKX also offers margin accounts on smaller-cap coins but with higher requirements.

For example, you can invest in Filecoin with a margin requirement of 20%. Alternatively, you can trade leveraged futures and options at OKX. These products come with much lower upfront requirements. For example, you only need to put on 1% when trading BTC/USDT futures. Spot, futures, and options fees start from 0.1%, 0.05%, and 0.03%, respectively.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| OKX | Spot margin accounts, perpetual futures, options | 1% | Spot, futures, and options fees start from 0.1%, 0.05%, and 0.03%, respectively | No |

Pros

- Buy Bitcoin with a 10% margin requirement

- Lower-cap coins like Bonk and Filecoin are also supported

- Also offers margin facilities via perpetual futures and options

- Some of the lowest trading fees in the industry

- Great reputation for client safety

Cons

- Doesn’t accept US clients

- Not the most beginner-friendly trading platform

4. Binance – Great Option for Trading BTC/USDT Delivery Futures

We found that Binance is one of the best margin platforms for delivery futures. Unlike perpetuals, delivery futures come with an expiry date. There are two markets supported, BTC/USDT and ETH/USDT. These markets support the next two trading quarters. Long and short positions are supported and margin requirements stand at just 5%.

Binance also supports perpetual futures. Not only will you have access to a much larger range of cryptocurrencies but also lower margin requirements. For example, BTC/USDT requires an upfront margin of just 2%. Smaller-cap coins come with higher requirements. In addition, Binance also supports options for Bitcoin and Ethereum.

Not that margin requirements vary depending on the strike price and expiry date. There are many different ways to trade with margin on Binance. While most traders opt for DIY investing, Binance also offers copy trading and automated bots. Although Binance offers a separate platform for US clients, this doesn’t support margin. Most other countries are accepted.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| Binance | Delivery and perpetual futures, options | 1% | Futures and options trading fees start from 0.02% and 0.3%, respectively | Yes, but not for margin trading |

Pros

- The best option for trading delivery futures

- Offers the largest liquidity levels in the industry

- Also offers perpetual futures and options

- Hundreds of trading pairs are available

- Super-low trading commissions

Cons

- The US website doesn’t support crypto margin trading

- Binance was recently fined $4 billion for money laundering offenses

5. PrimeXBT – Trade $20,000 Worth of Bitcoin With Just $100

Another popular margin trading platform is PrimeXBT. You can trade a wide selection of markets, including some of the best altcoins. This includes Cardano, BNB, Shiba Inu, TRON, Axie Infinity, and Decentraland. The minimum margin requirement on PrimeXBT was recently reduced to 0.5%.

This means you can trade $20,000 worth of Bitcoin with an account balance of just $100. Like other crypto margin trading sites, higher requirements are needed when trading smaller-cap coins. Nonetheless, there are two options when trading at PrimeXBT. First, eligible clients can trade the spot markets via CFDs.

Second, PrimeXBT also offers futures trading. This will appeal to more experienced crypto traders. PrimeXBT also offers CFD markets on other asset classes. This includes forex, commodities, and indices. PrimeXBT offers a native trading dashboard with plenty of advanced tools. It also offers a proprietary mobile app for iOS and Android.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| PrimeXBT | CFDs and futures | 0.5% | Futures and CFD trading fees are 0.05% and 0.01%, respectively | No |

Pros

- Trade leveraged CFDs and futures markets

- Recently reduced minimum margin requirements to 0.5%

- Supports dozens of popular altcoins

- Offers 24/7 customer support via live chat

- Proprietary platform will appeal to pro traders

Cons

- Does not accept US clients

- Too advanced for beginners

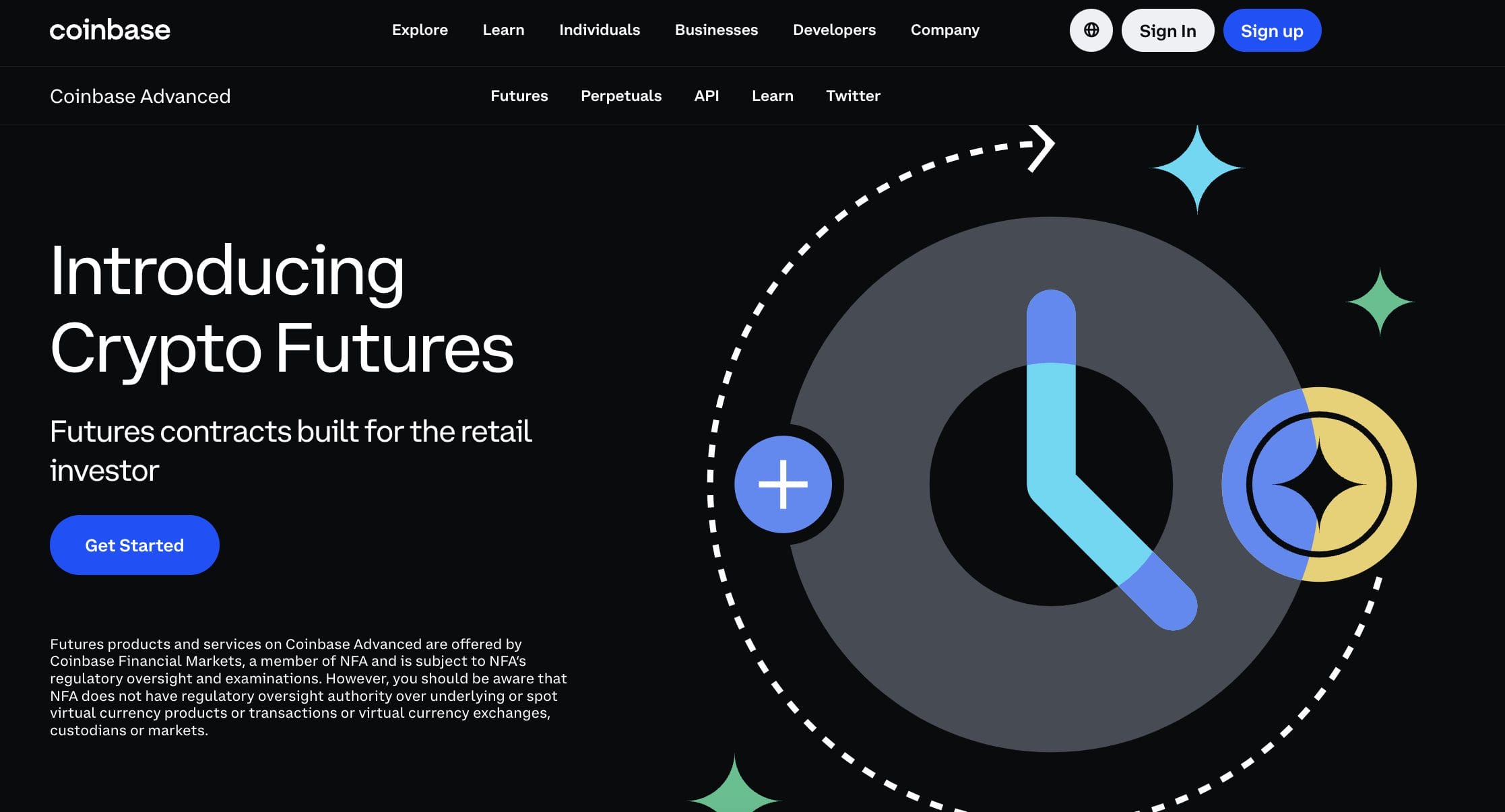

6. Coinbase – Best Option for Crypto Margin Trading USA

If you’re a US-based retail client, Coinbase will be the best crypto margin trading platform for you. Its newly revamped platform – Coinbase Advanced (formally Coinbase Pro) enables US clients to trade perpetual futures. Many markets are supported, including Bitcoin, Ethereum, Solana, Chainlink, Litecoin, Ethereum Classic, and Dogecoin.

Coinbase has a minimum margin requirement of 10%. This enables you to trade $1,000 worth of crypto with just $100. Traders can go long or short on their preferred futures market, ensuring profits can be made in all trading conditions. In terms of deposits, Coinbase accepts ACH, domestic wires, PayPal, and debit/credit cards.

That said, one of the main drawbacks is that Coinbase doesn’t publish its futures trading fees. It notes that fees will vary based on the account tier. We do know that Coinbase Advanced spot commissions start from 0.5% per slide. However, futures fees will likely be lower. Coinbase is one of the only viable options for Americans seeking margin.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| Coinbase | Perpetual futures | 10% | Futures fees are not published | Yes |

Pros

- Best crypto margin trading platform for USA traders

- Supports Bitcoin and plenty of altcoins

- Trade with a 10% upfront margin requirement

- Go long or short on all available markets

- Instantly deposit USD with a debit/credit card and PayPal

Cons

- Doesn’t publish its futures trading fees

- Some payment methods cost up to 3.99%

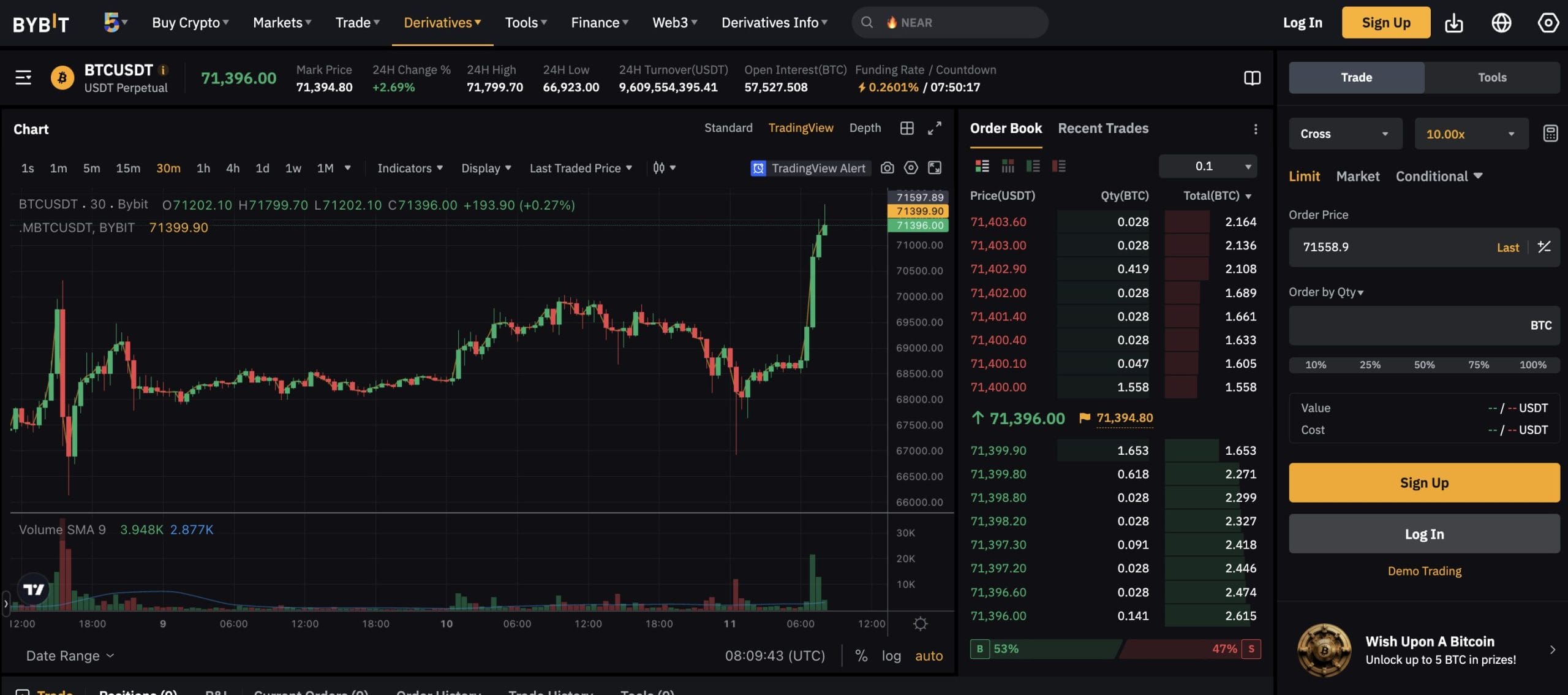

7. Bybit – 125x Leverage on Bitcoin Perpetual Contracts

Next is Bybit, which is also one of the best crypto exchanges for margin trading. It offers a huge range of leveraged markets across multiple instrument types. If your main priority is getting the lowest margin requirement, you’ll want to trade Bitcoin perpetual contracts. In doing so, you only need to put up a 0.8% margin.

This amounts to leverage of 125x, so you can trade $12,500 worth of Bitcoin with just $100. Bybit also offers perpetual futures on over 100 other cryptocurrencies. This includes everything from ApeCoin, Filecoin, and Bonk to Pepe, Ethereum, and Litecoin. Margin requirements will vary depending on the market.

We like that Bybit also offers leveraged markets via delivery and inverse futures, not to mention options. The latter currently only covers Bitcoin, Ethereum, and Solana. Bybit is also a solid option for competitive fees. Futures can be traded from just 0.02% per slide. That’s just $2 for every $10,000 traded.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| Bybit | Perpetual, delivery, and inverse futures, options | 0.8% | 0.02% | No |

Pros

- Trade Bitcoin with a margin requirement of just 0.8%

- Supports leveraged futures on 100+ coins

- Futures contracts include perpetual, delivery, and inverse

- Also offers Bitcoin, Ethereum, and Solana options

- Futures fees of $2 for every $10,000 traded

Cons

- Bybit no longer serves UK clients due to an FCA warning

- Highly advanced trading platform will not appeal to newbies

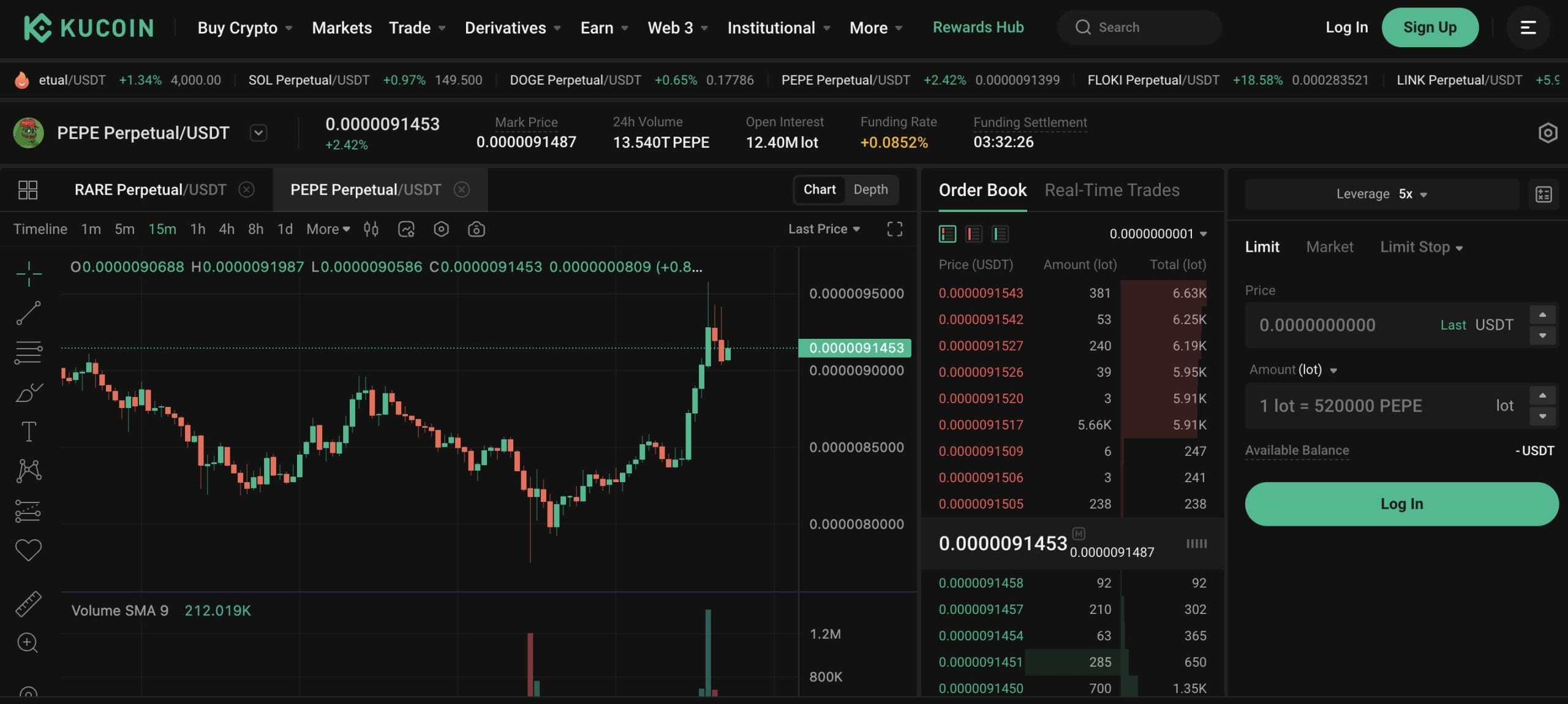

8. KuCoin – Popular Crypto Exchange to Trade Altcoins With Margin

Next is KuCoin, a tier-one exchange with over 30 million clients. We found that this is one of the best options for trading altcoins with margin. It offers more than 280 futures markets, so you’ll never be short of trading opportunities. This includes meme coins like Pepe, Dogecoin, Shiba Inu, Bonk, and Floki.

Crucially, KuCoin boasts huge trading volumes, so even altcoins function in a liquid market. For example, more than $47 billion worth of futures have been traded in the prior 24 hours. Two different types of futures are supported by KuCoin. This includes USD-margined and inverse contracts. The maximum leverage offered by KuCoin is 100x.

This enables users to trade Bitcoin with a 1% margin. While altcoins come with lower limits, many still offer leverage of 30x. This translates to a margin requirement of just over 3.3%. In addition, KuCoin also supports leveraged tokens. The benefit here is that users aren’t required to borrow funds. As such, no financing fees apply.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| KuCoin | USD-margined and inverse futures, leveraged tokens | 1% | 0.06% | No |

Pros

- Trade USD-margined and inverse futures contracts

- Minimum margin requirement of 1%

- A great option for trading leveraged altcoins

- One of the largest crypto platforms for daily volume

- Also one of the best P2P crypto exchanges

Cons

- Lower futures commissions are available elsewhere

- Doesn’t offer crypto options

9. Kraken – Crypto Spot Margin Accounts With 5x Leverage

Consider Kraken if you want to trade crypto with margin but aren’t interested in derivatives. It offers leverage of up to 5x on various cryptocurrencies from the spot trading markets. 5x leverage, converting to a 20% margin requirement, is available on Bitcoin, Ethereum, Dogecoin, and XRP.

You’ll get either 3x or 4x on other popular altcoins. This includes Solana, Avalanche, Cardano, Chainlink, and Polygon. Leveraged accounts must be traded on the Kraken Pro dashboard. This is an advanced trading portal that comes with plenty of analysis features, including technical indicators and drawing tools.

In terms of fees, you’ll pay up to 0.02% to open a leveraged trade. This drops to 0.015 when trading Bitcoin. You’ll pay the same percentage fee again every four hours. This is known as a rollover fee. In addition to leverage accounts, Kraken also offers futures trading. This marketplace comes with higher leverage limits of up to 50x.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| Kraken | Margin accounts and perpetual futures | 2% | Up to 0.02% to open a margin trade. Futures positions from 0.05% per slide. Margin is charged up to 0.02% every four hours | Yes, but only to Eligible Contract Participants (ECPs) |

Pros

- A trusted crypto exchange that was founded in 2011

- Offers margin trading accounts with up to 5x leverage

- Pay just 0.02% to open a margin position

- Also offers perpetual futures with 50x leverage

- Accepts US clients from most states

Cons

- Charges up to 0.02% on margin trades every four hours

- Reduced fees are only offered after trading $100,000 within 30 days

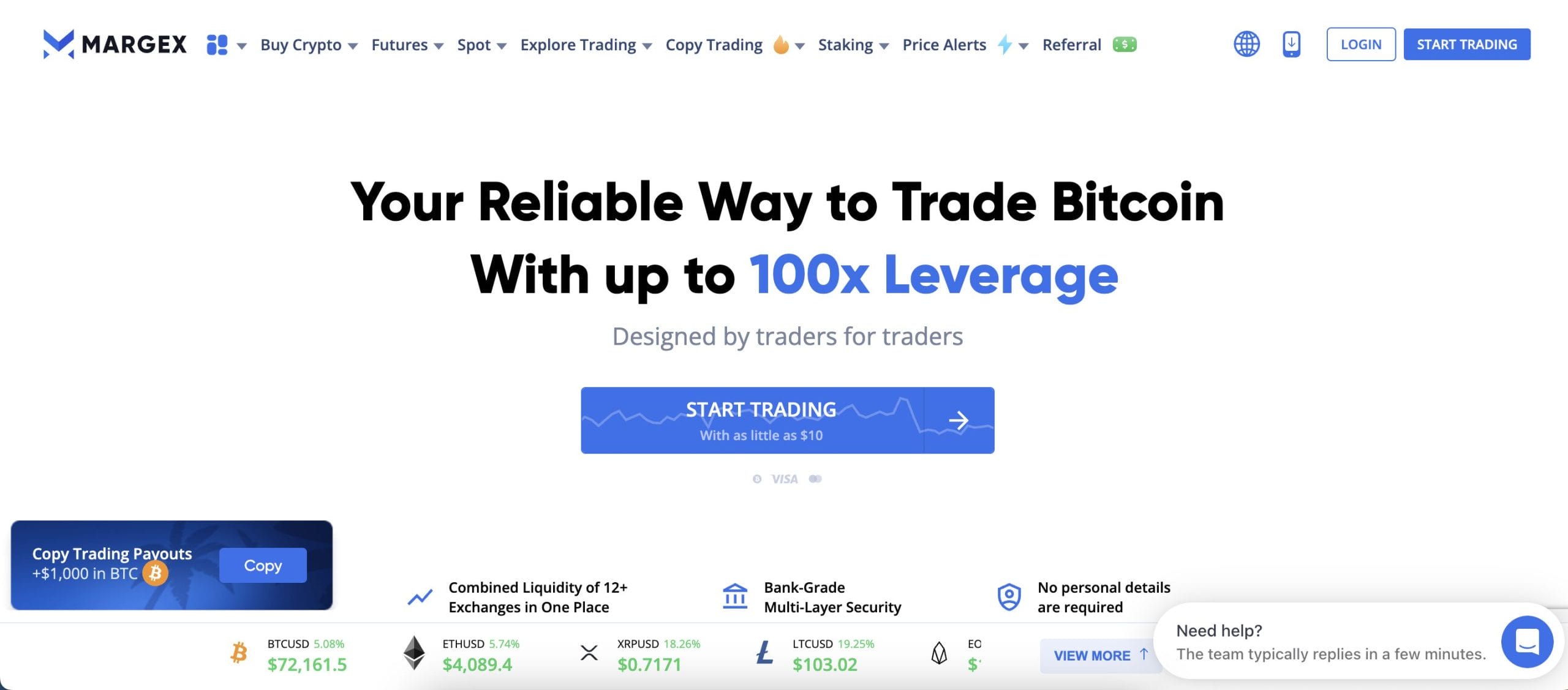

10. Margex – Get 100x Leverage via Anonymous Trading Accounts

Last on this list of crypto margin trading exchanges is Margex. This is a great option for those who want to remain anonymous. This is because Margex enables users to sign up without revealing their identity. This is on the proviso that you’ll be depositing crypto into your account. Fortunately, Margex supports many coins, including Bitcoin, Tether, Ethereum, and XRP.

Once you’ve made a deposit you can use your balance to get 100x leverage. Margin accounts are offered via perpetual futures contracts. Coin-M futures are settled in the underlying crypto, such as Bitcoin or Ethereum. Alternatively, you can trade perpetual futures that are settled in stablecoins. Options include Tether, USD Coin, and Dai.

We like that Margex offers a simulated trading dashboard. This enables you to buy and sell leveraged futures without risking any funds. The demo platform mimics live trading conditions, including volume and price action. Margex charges trading fees of 0.06% per slide. Financing fees will also apply but vary depending on external factors.

| Margin Platform | Margin Instruments | Min. Margin Requirement | Trading Commission [per Slide] | US Clients? |

| Margex | Perpetual futures | 1% | 0.06% | No |

Pros

- Trade crypto with a minimum margin requirement of 1%

- No KYC requirements when opening an account

- Perpetual futures can be settled in the underlying crypto asset

- Competitive trading fees of just 0.06% per slide

- Currently offering a $100 bonus to new clients

Cons

- Not available to residents of the US, Canada, or Hong Kong

- Doesn’t support the spot trading markets

What is Crypto Margin Trading?

Crypto margin trading is a way to amplify your investment stakes. This is because you’ll be trading with more than you have in your account. Margin is essentially a loan between you and the crypto exchange. This means you’ll pay interest while the margin trade remains open. Margin is expressed as a percentage. This is how much you must put up front to execute the position.

- For example, suppose your chosen exchange has a minimum margin requirement of 2%.

- You want to trade $20,000 worth of Bitcoin.

- In this instance, you’d only need $400, which is 2% of the $20,000 position.

- Put otherwise, you’ve applied crypto leverage of 50x on this trade ($400 x 50 = $20,000).

Crypto margin can be accessed in various ways. Most traders opt for perpetual futures, as some platforms offer leverage of over 100x. Options are another way to trade with margin, as you’re only required to pay a small premium to execute the trade. You can also trade with CFDs, which mimic spot trading prices.

Before opening a margin trading account, make sure you’ve considered the risks. The exchange will close your position if it declines by too much. This is known as ‘liquidation’. As we explain in more detail later, the lower the margin requirement the higher the liquidation risk. Being liquidated means you lose your entire stake.

How Does Crypto Margin Trading Work?

Let’s take a closer look at how crypto margin trading works. First, let’s explain the difference between ‘margin’ and ‘leverage’. You must understand how these terms work before proceeding.

- Margin: This is the amount of money you need to put up to execute the trade. Margin is expressed as a percentage. For example, a $100 trade with a 1% margin requirement means you need just $1 in your account.

- Leverage: Expressed as a multiple, leverage is the amount you’re amplifying your initial stake by. It’s essentially the opposite of a margin requirement. For instance, a $1 margin with 100x leverage allows you to open a $100 position.

As the above example shows, margin and leverage are connected.

Let’s look at a more detailed example to clear the mist:

- Let’s say you want to trade Ethereum. You want to go long on ETH/USD, but you only have $500 in your account.

- Fortunately, the exchange has a minimum margin requirement of just 2% on ETH/USD.

- So, a 2% margin requirement gets you 50x leverage.

- For instance, suppose you entered a $25,000 buy order. A 2% margin would amount to just $500, which aligns with your balance.

Now let’s see how margin can amplify your profits when speculating correctly:

- You went long on a $25,000 ETH/USD position.

- One week has passed and ETH/USD has increased by 20%

- This means your $25,000 position is now worth $30,000, resulting in a $5,000 gain

If you had traded without margin, your ETH/USD position would have been worth just $500. So, 20% gains would have meant a $100 profit. In contrast, trading with a 2% margin secured a $5,000 gain.

How We Selected The Best Crypto Margin Trading Exchanges

An increasing number of crypto exchanges are offering margin facilities. This means traders have many options when choosing a provider.

Some of the key factors to look for include the minimum margin requirement, supported markets (e.g. Bitcoin, Ethereum) and instruments (e.g. CFDs, futures), and security. Fees should also be considered, including commissions and financing costs. Let’s take a closer look at these key factors. This will help you understand our methodology when ranking the best margin trading crypto exchanges.

Lowest Margin Requirements

We found that crypto traders favor platforms with the lowest margin requirements. In a nutshell, the lower the requirement, the more you can trade with. The table below shows how much trading capital a $100 balance would get you, based on differing margin requirements:

| Margin Requirement | Leverage |

Maximum Position per $100

|

| 50% | 2x | $200 |

| 20% | 5x | $500 |

| 10% | 10x | $1,000 |

| 5% | 20x | $2,000 |

| 2% | 50x | $5,000 |

| 1% | 100x | $10,000 |

| 0.50% | 200x | $20,000 |

As you’ll see from the table above, low margin requirements mean high leverage limits. For instance, a margin requirement of 0.5% gets you 200 times your account balance. This means you can control a $20,000 trade with just $100.

Most Crypto Trading Pairs

We also explored what crypto pairs can be traded with margin. Platforms with the largest selection of markets were prioritized. For example, if you’re looking to trade medium and large-cap coins against the US dollar, eToro is the best option.

Supported pairs include BTC/USD, ETH/USD, XRP/USD, LTC/USD, and BNB/USD. eToro also supports other popular currencies. For example, you can trade large-cap coins against the pound, euro, yen, Australian dollar, and more.

Alternatively, if you’re looking to trade smaller-cap coins with margin, MEXC is the best option. It has low margin requirements on many up-and-coming coins. This includes meme coins, layer two projects, BRC-20 tokens, and more.

Market Capitalization vs Minimum Margin Requirement

- Just remember that there’s usually a correlation between market capitalization and minimum margin requirements.

- For example, you only need to put up 0.5% when trading Bitcoin at MEXC.

- However, if you want to trade PancakeSwap, the margin requirement is increased to 0.8%.

- Nonetheless, this still gets you 125 times your margin stake.

Highest Security

Robust security is crucial when trading crypto with margin. This is why eToro ranks as the overall best option. Sure, it has a high minimum margin requirement of 50%. However, eToro is regulated in multiple jurisdictions. It holds tier-one licenses and deploys institutional-grade security.

What’s more, you’ll be trading CFDs at eToro. CFDs merely track crypto spot prices, meaning you won’t own the underlying coins. This removes the risk of being hacked, as there are no coins to steal.

We found that MEXC also offers solid security controls. This includes two-factor authentication, SMS verification, and withdrawal whitelisting. Ultimately, you should never prioritize low margin requirements over safety.

Best Trading Tools

Margin trading is a short-term investment strategy. This means you’ll need access to analysis and research tools. Otherwise, you won’t be able to speculate on market prices with any conviction.

Some of the most important tools to look for include:

- Reliable Pricing Charts: At a minimum, the margin crypto trading platform should offer reliable pricing charts. This means prices should mirror live market conditions in real-time. Any delays between order placement and chart movements will mean you’re constantly one step behind the broader markets.

- In-Depth Order Books: It’s also important you have access to in-depth order books. This will allow you to see what buy and sell orders have been placed on the platform. Order books give you insights into which way the markets might swing.

- Multiple Order Types: Seasoned margin traders use a wide range of order types. This enables them to enter and exit the market at the best prices possible. Look for margin platforms offering limit, stop-loss, take-profit, trailing stop-loss, and good-to-canceled orders.

- Technical Indicators: The best trading platforms offer technical indicators like the MACD, Stochastic Oscillator, Relative Strength Index, and Moving Averages. In addition to drawing tools, these indicators will help you predict market movements.

- Copy Trading: If you don’t know how drawing tools or technical indicators work, look for a margin platform offering copy trading. This will enable you to ‘copy’ a margin trader. Anything they trade will be replicated in your own account, offering a passive trading experience. We found that eToro is one of the best crypto copy trading platforms.

Lowest Interest Rates on Margin

Beginners are often unaware that they need to pay additional fees when trading with margin. This is because you’re borrowing funds from the margin platform. As such, you’ll need to pay financing fees.

This will vary depending on various factors, such as real-time borrowing rates and the number of long/short orders in the market. Nonetheless, the financing fee is multiplied by your overall position size. This means the less margin you put up, the more you’re being charged.

In addition to margin financing, you should also check what trading fees apply. For example, MEXC offers 0% commissions when trading the spot markets. Alternatively, you’ll pay just 0.01% on leveraged futures. In contrast, Coinbase Advanced commissions start from 0.5%.

The Advantages of Crypto Margin Trading

The benefits of trading crypto with margin are summarized in the following sections:

Increased Market Exposure

The main advantage of crypto margin trading is that you can amplify your market exposure. For example, suppose you’ve got $1,000 to invest. Now that Bitcoin has set a new all-time high, you want to enter a long position.

You deposit the $1,000 into a margin trading account. The minimum margin requirement on BTC/USD is 1%. This means your $1,000 deposit allows you to enter a long position worth $100,000 (1% of $100,000 = $1,000).

Now suppose BTC/USD increases by 50%. On a $100,000 margin position, you’ve made $50,000. Had you only invested your $1,000 account balance, you would have made just $500.

Short Selling Opportunities

Most margin trading products are derivatives. This means you don’t own the underlying asset. The benefit is that derivatives can be traded long or short. As such, you can make money if the price of a crypto pair declines.

- For example, let’s say Ethereum has peaked at $5,000.

- You believe that a market correction is likely.

- Therefore, you place a sell order on ETH/USD CFD at eToro.

- If ETH/USD declines by 10%, you’d make a 10% profit.

This wouldn’t be possible when trading the spot markets.

Hedging Against Risks

Margin trading products are also ideal for hedging.

- For example, suppose you’re. currently invested in XRP.

- While you’re concerned about legal proceedings with the SEC you want to avoid selling.

- In this instance, you could purchase some XRP/USD put options.

- If the SEC outcome is positive, your original XRP investment will rise, while the XRP puts will decline.

- If the SEC outcome is negative, the XRP puts will rise, while your original investment will decline.

- The outcomes in both scenarios offset one another.

Hedging without margin products like options, futures, or CFDs is challenging. This is because spot markets do not support short-selling.

Do I Need a Credit Check When Margin Trading?

- We’ve established that crypto margin trading requires traders to borrow funds from their exchange platform.

- In turn, you’ll pay interest on any capital borrowed.

- However, unlike a traditional loan, margin trading platforms don’t require credit checks.

- This is because the margin trade will be liquidated if it declines by a certain amount.

- As such, there is no risk for the exchange offering when offering margin.

The Risks of Crypto Margin Trading

Margin trading is very risky. Consider the following risks before proceeding.

Magnified Losses

Margin trading can amplify your trading profits. However, it will also amplify your losses. Therefore, when trades don’t go to plan, you could lose a lot more than you had anticipated.

- For example, suppose you’re long on LTC/USD futures.

- You put up a 10% margin, meaning you’re trading with 10x leverage. Your margin stake is $1,000.

- The LTC/USD futures have declined by 25%.

- You’d be looking at a $250 loss without margin (25% of a $1,000 stake).

- However, you traded with a 10% margin, so your $250 loss is amplified by 10. This means you’ve lost $2,500.

As we cover next, your margin trade could be liquidated before losses get out of hand. This means you’d lose your entire stake.

Liquidation Risk

The biggest risk when trading crypto with margin is being liquidated. This is a term that you must understand. In simple terms, liquidation happens when your margin trade declines by a certain percentage.

This means the exchange closes the position on your behalf. In turn, you lose the initial margin that you put up.

- The liquidation point will depend on how much margin you’re trading with.

- For example, if you’re trading with a 5% margin, and the position declines by 5%, you’ll likely be liquidated by the exchange.

- The lower the margin requirement the higher the liquidation potential.

- For instance, if you’re trading with a 1% margin, the position only needs to decline by 1% before you’re liquidated.

As you get closer to the liquidation point you should receive a margin call. This will be a notification or email from the exchange. The margin call allows you to add more margin to your account. This gives you additional breathing space.

Interest Costs

Margin trading can be a costly strategy. This is due to financing costs. Some margin platforms charge an overnight fee. This means you’re charged for each day the position remains open.

Other platforms, such as Kraken, charge a financing fee every four hours. Either way, the more capital you borrow from the exchange the more you’re paying in interest. This will eat away at your potential profits.

High Complexity

Trading cryptocurrencies with margin is best left for experienced traders. After all, margin products are typically backed by complex derivatives. Beginners could lose a lot of money without a firm understanding of how these derivatives work.

How to Start Crypto Margin Trading: Step-by-Step

Read on for a step-by-step walkthrough on how to trade crypto with margin. We’ll use eToro for this guide, as the platform is ideal for beginners. What’s more, eToro is regulated by multiple tier-one bodies, so your capital is safe.

Note: eToro offers margin via crypto CFDs, which aren’t available in all regions. This includes the US, the UK, and Hong Kong. Users from these countries can consider one of the other margin trading platforms listed above.

Step 1: Open an Account

Opening an eToro account takes minutes. Visit the eToro website and click on ‘Sign Up’. A registration form will appear. Complete it by typing in your personal information and contact details.

Confirm your mobile number and email. Next, eToro will ask you to complete the KYC process. This means uploading some government-issued ID and proof of residency. eToro will verify the documents instantly.

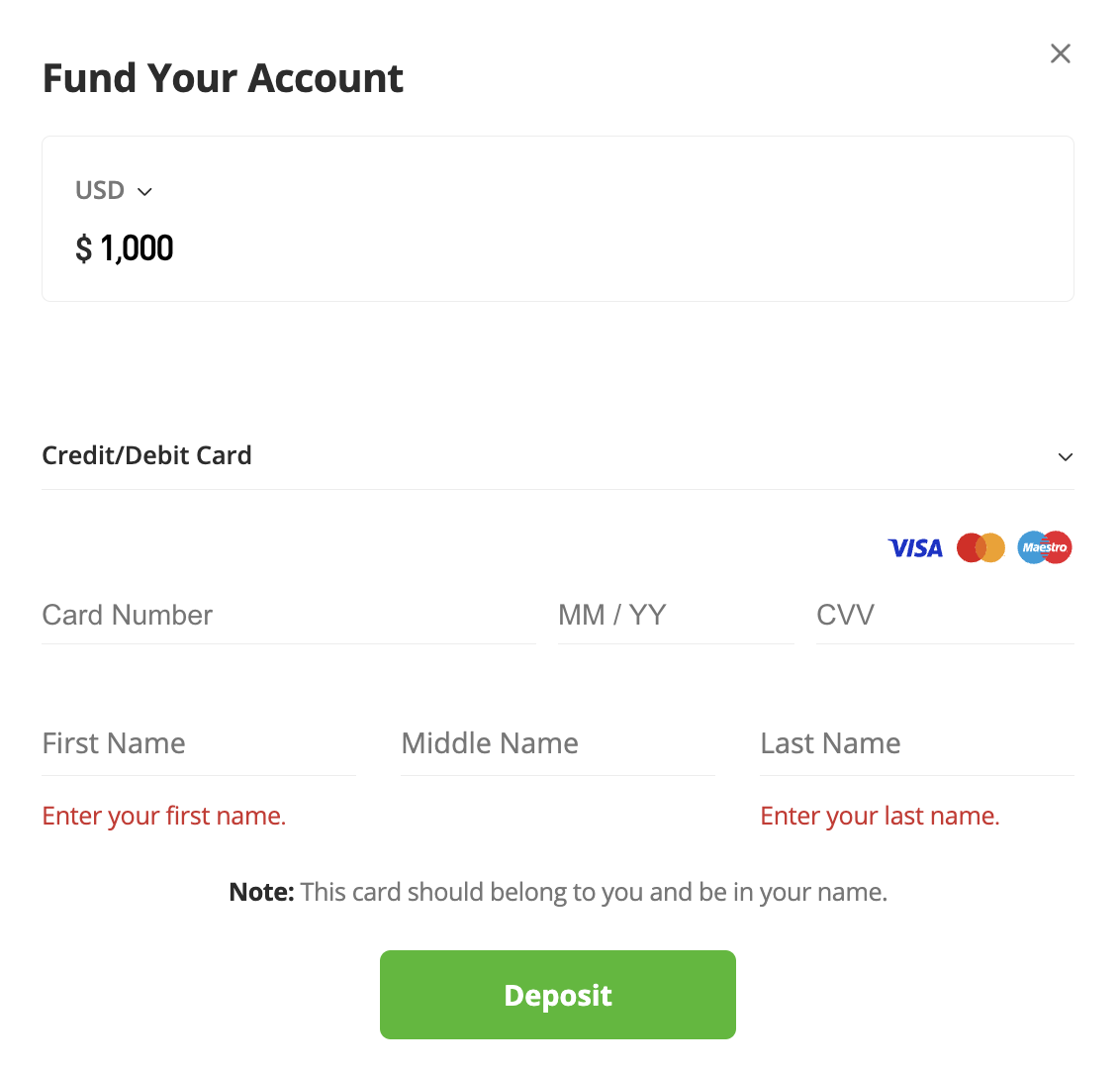

Step 2: Deposit Funds

The next step is to make a deposit. The minimum deposit starts from $10 but will vary depending on where you live. Accepted payment methods include Visa, MasterCard, Maestro, PayPal, Skrill, Neteller, and WebMoney.

Local payment types are usually available too. Once again, this will depend on your country of residence.

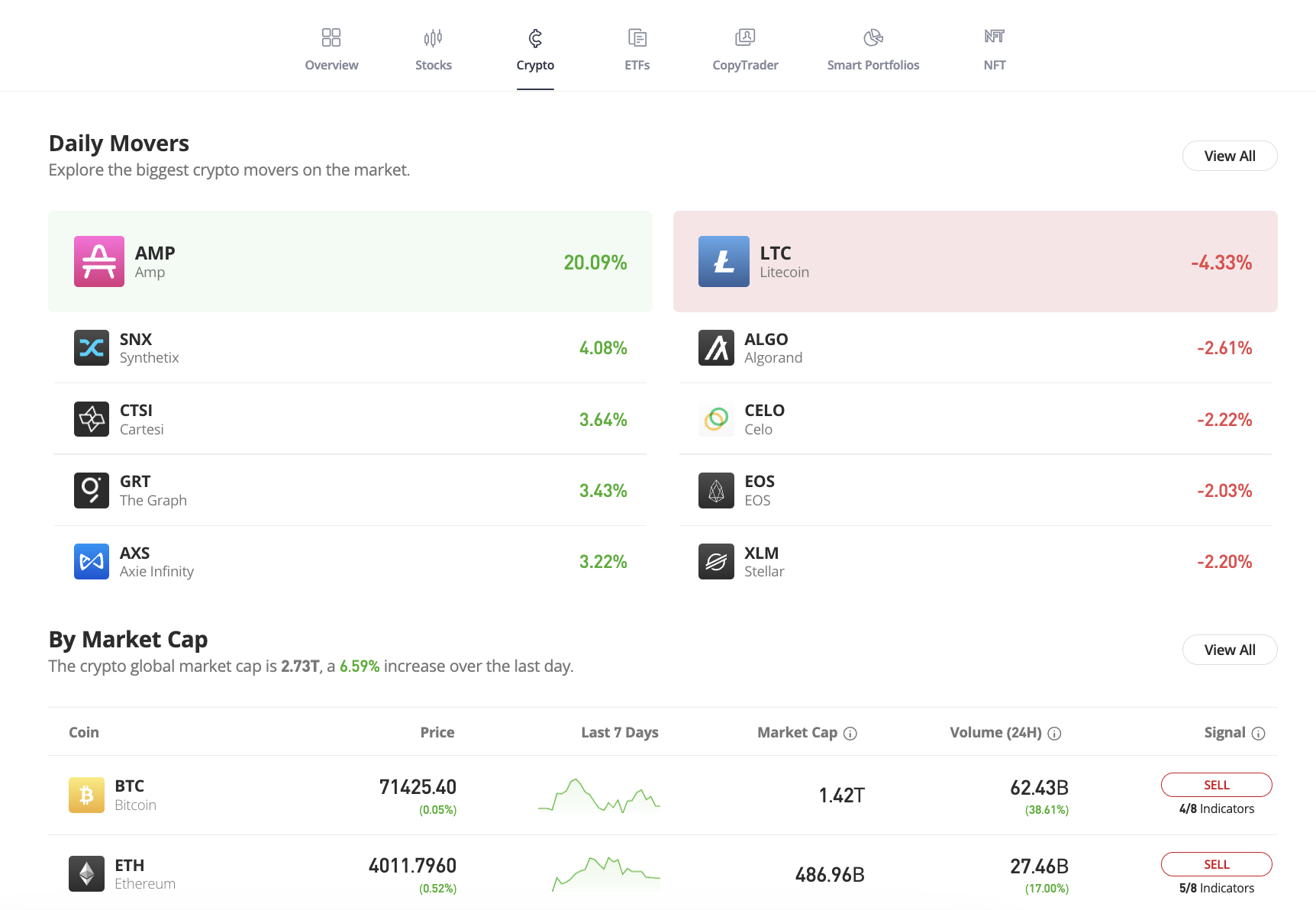

Step 3: Search for Crypto CFD Market

eToro offers more than 100 crypto CFD markets. This includes major coins like Bitcoin and Ethereum, which can be traded against multiple currencies like USD, EUR, GBP, and JPY. You can also trade crypto-crosses like ETH/BTC and BCH/LTC.

Click on ‘Discover’ followed by ‘Crypto’ to find your preferred market. Alternatively, use the search bar at the top of the eToro dashboard.

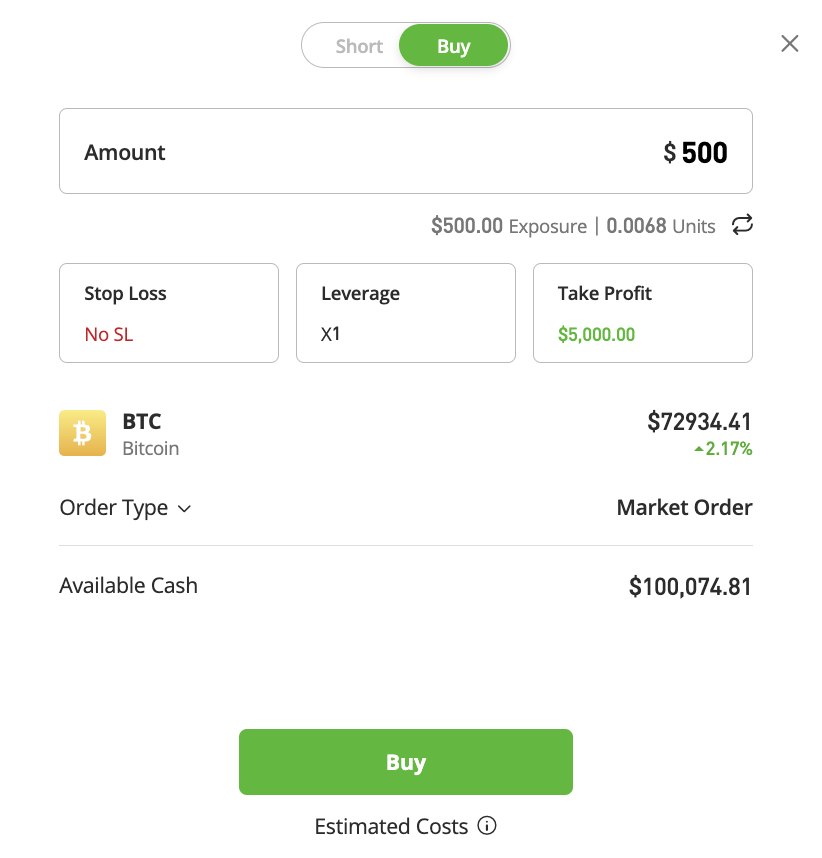

Step 4: Place a Margin Trade

The final step is to place an order. Type in the amount of money you want to risk. This will be your margin.

Next, change the leverage ratio from 1x to 2x. This means you’re trading with a 50% margin. You also need to choose between a buy (long) or sell (short) order.

eToro also enables you to set a stop-loss price. This should be considered, as margin trading can result in extended losses. Finally, confirm the order.

Best Practices for Margin Trading Crypto

Following some best practices will ensure your margin trading career is a success from the get-go. Here are some tips to get you started:

Educate Yourself Before Trading

Educating yourself on how crypto margin works is crucial. Learn about the different margin products in the market, such as perpetual futures and CFDs. Understand how their prices correlate with the spot trading markets.

You should also understand how margin calls and liquidation works, and what risk management tools can help you avoid large losses. You should also educate yourself on technical analysis and charting tools.

Utilize Risk Management

Margin trading should only be considered alongside a sensible risk management strategy. This means protecting your trading bankroll at all times.

For example, consider capping your maximum trade size to 1%. So, if your bankroll is $1,000, never risk more than $10. You should limit how much margin you deploy. For instance, consider starting with just 50%.

This will enable you to trade with twice your margin balance. What’s more, with a 50% margin, you can greatly reduce the risk of being liquidated. You can reduce the margin percentage once you become more comfortable with how things work.

Choose a Trustworthy Exchange

It’s also important to use a trustworthy exchange when trading with margin. We mentioned that eToro is regulated by multiple tier-one bodies, including the FCA and CySEC (but keep in mind that cryptocurrencies are not regulated). Moreover, eToro offers two-factor authentication and keeps its clients’ capital in segregated bank accounts.

If you’re using a traditional exchange, make sure it has audited proof of reserves. This ensures the exchange has enough capital to operate effectively, including covering client deposits 1:1.

Use Stop-Loss and Take-Profit Orders

Stop-loss orders should always be used when trading crypto. And even more so when trading with leverage. Stop-loss orders ensure you avoid losing too much on a single trade. For example, suppose you go long on BTC/USD. You deploy a stop-loss order at 5%. This means no matter how low BTC/USD trades, you can only lose 5%.

Take-profit orders should also be considered. These close your margin trade when you hit your profit target. For example, you might want to make 25% gains. Simply add 25% to the entry price and deploy a take-profit order. If the target price is executed the trade will be closed.

Conclusion

While margin allows you to increase your crypto market exposure, make sure you understand the risks. Should your margin trade decline by too much, the entire position could be liquidated.

If you’re ready to start trading crypto with margin today, consider eToro. This social trading broker offers a 50% margin on over 100 pairs. eToro also offers copy trading, enabling you to trade with margin passively.

FAQs

How do you use a crypto margin trading bot?

Choose a crypto margin bot from a reputable platform and connect it to an exchange via an API. Set your bot parameters, including your margin limits. The bot will then trade on your behalf.

What is the best crypto margin trading exchange in the US?

The best crypto margin exchange for US clients is Coinbase. Americans can trade perpetual futures with a minimum margin requirement of 10%.

Is crypto margin trading risky?

Yes, crypto margin trading is very risky. If the position declines by too much it will be liquidated. This means losing the entire margin stake.

Is crypto margin trading legal?

Crypto margin trading is legal in most but not all countries. For example, retail clients in the UK cannot trade crypto with margin.

What is the highest margin you can use for trading crypto?

MEXC offers 200x leverage, meaning the minimum margin requirement is just 0.5%. This means a $20,000 trading position can be opened with just $100.

What does liquidation mean in crypto?

Liquidation happens when a crypto margin trade is closed by the exchange. This is because the position value has declined by too much, so the trader loses the entire margin.

References

- US seeks more than $4 billion from Binance to end criminal case (Bloomberg)

- Unauthorized firm – ByBit (FCA)

- Bitcoin’s Rally Is Creating Around 1,500 ‘Millionaire Wallets’ Daily (Bloomberg)

- Cryptocurrencies recover after bitcoin pulls back from new record (CNBC)

Eric Huffman

Eric Huffman

Michael Graw

Michael Graw