What is the Bitcoin Lightning Network?

The Bitcoin Lightning Network is a secondary layer on the Bitcoin network that allows fast and nearly free Bitcoin transactions. Launched in 2018, the Lightning Network aims to solve Bitcoin’s scalability problems, enabling up to one million transactions per second, far higher than traditional payment networks like Visa.

In this guide, we’ll explore how this innovative Layer 2 network functions and how Lightning Network capacity can help fulfill Satoshi’s vision of an electronic peer-to-peer cash system.

What Does the Lightning Network Do?

When Bitcoin launched in 2009, the fledgling network changed the way many of us view money. However, some early critiques of the network pointed to Bitcoin’s scalability challenges.

Bitcoin works from a transaction cost standpoint when relatively few people need to transact and when the price of bitcoins in USD is relatively low. Other concerns pointed to the average ten-minute block time.

As early as 2010, Hal Finney, a Bitcoin pioneer, pointed out the need for secondary level payment systems. Ultimately, those who foresaw Bitcoin’s scalability issues proved to be accurate. Transactions remain slow, with about seven transactions per second throughput. Additionally, the network is ill-suited for small transactions in which the transaction fee often exceeds the transaction amount.

The Lightning Network aims to solve these scalability and cost problems. It also brings a new feature to Bitcoin transactions: privacy. More on that in a bit.

In February 2015, a paper authored by Joseph Poon and Thaddeus Dryja of SF Bitcoin Devs detailed the scalability issues and proposed a solution called the Lightning Network. The proposed network would operate as a Layer 2, a network on top of the Bitcoin network, but would not be a separate blockchain.

By 2016, the same authors released DRAFT Version 0.5.9.2 of the white paper, with the Lightning Network launching its Mainnet in January of 2018. Today, the Lightning Network hosts an estimated 6.6 million monthly transactions, according to a research report from River, although the number may be much higher.

Transactions on the network include peer-to-peer payments, everyday purchases like a cup of coffee at the local shop, and high-value transactions. The Lightning Network has made Bitcoin effective as a currency for day-to-day use. Payments are near instantaneous, and costs are nearly non-existent. Costs to send bitcoin using the Lightning Network come in 1,000% lower than traditional payment systems like Visa and Mastercard.

How Does the Lightning Network Work?

Layer 2 networks for other blockchains typically take the form of additional blockchains. Arbitrum, for example, is a separate Layer 2 blockchain that passes transactions back to the Ethereum blockchain (Layer 1) for secure storage.

The Lightning Network takes a different approach based on multi-signature (multisig) wallets, payment channels, and Hashed Time-Locked Contracts.

The network doesn’t use an additional blockchain — but it does use nodes, computers that run Lightning Network-compatible software that enable routing on the network. These nodes run various implementations of the Lightning software, but each is compatible with Basis of Lightning Technology (BOLT) specifications that govern the network.

Multi-Signature Wallets

The Lightning Network uses multisig wallets as a basis for transactions. The funds in the wallet act as a sort of collateral for transactions between two parties.

Parties that want to transact each send bitcoin to a multisig wallet, a shared crypto wallet that requires two or more signatures to spend. These signatures come from separate wallets held by the parties funding the multisig wallet. A multi-signature wallet prevents one party from taking the funds in the wallet while also encouraging good behavior because both parties have posted collateral.

Once the wallet is funded, the deposit transactions are recorded to the Bitcoin blockchain, and a Lightning Network channel is created. We’ll discuss payment channels in the next section.

The parties can continue transacting back and forth, with the balance of the multisig wallet adjusted on a ledger as each transaction occurs.

For example, let’s say Jack and Jill each deposit one BTC. They transact back and forth as needed using the Lightning Network. However, the balance of the multisig remains at two BTCs. A separate ledger tracks the “IOUs” for each transaction, adjusting the balance due.

When Jack and Jill close the channel, the multisig spends the remaining balance, sending the appropriate amount to each person. The final transaction (settlement) is recorded on the Bitcoin blockchain. However, other payments back and forth remain private.

Payment Channels

Payment channels act as two-way roads in which either party can send bitcoins to the other party. In the earlier example, Jack and Jill set up a multisig wallet to open a payment channel. If they both send one bitcoin to the wallet and then Jack sends another 0.5 bitcoins to Jill, Jill’s side of the channel increases to 1.5 bitcoins.

If Jill later sends Jack 0.25 bitcoins, the Lightning Network tracks the transaction, adjusting the balance due for both parties. Because the wallet’s funds act as collateral for debits and credits between the two parties, the total size of a transaction between the two parties cannot exceed the two bitcoins held in the multisig wallet. But what if you need to send bitcoins to someone else?

Lightning does this as well. Payment platforms like CashApp and Strike use the lightning network to route payments between users without requiring users to set up payment channels with each other.

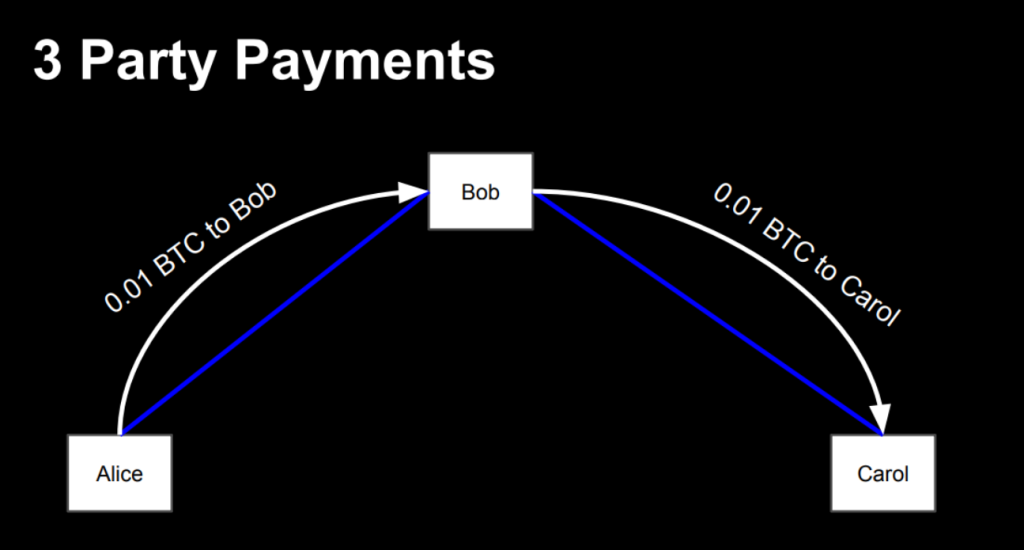

The diagram below from the 2015 paper shows how channels in common can facilitate transactions if you don’t have a direct channel with someone else. Alice needs to send 0.01 BTC to Carol. Both Alice and Carol have open channels with Bob. The Lightning Network can intelligently route the payment through Bob, allowing Alice and Carol to transact easily.

As before, the multisig used to route the payment must hold an equal or greater amount of bitcoin than the transaction amount (0.01 BTC). Wait, how do we know Bob won’t keep the payment? The Lightning Network solves that as well. We’ll cover the details in the next section.

Hashed Timelock Contracts (HTLCs)

You may have heard that the Bitcoin network doesn’t support smart contracts, which are computer programs that run on the blockchain. That’s not completely accurate; Bitcoin supports simple contracts using “Script.”

The Lightning Network uses Hashed Timelock Contracts, also known as HTLCs, to route payments through eligible channels without risking the assets as they “hop” through the network. These smart contracts use Bitcoin’s Script language to create conditional transactions.

Like other smart contracts, HTLCs work like switches. If A happens, then do B. Payments made via HTLCs are atomic (all or none) and trustless, meaning that we don’t need to trust an intermediary to complete the transaction. The contract governs the transaction’s security. Let’s look at the contract’s logical flow in plain English.

For example, let’s say Alice wants to send Bob 0.5 bitcoins. To make this work, Alice needs to send Bob a secret message that he will use to confirm he is the recipient.

Alice will send Bob 0.5 bitcoins if:

- Bob can verify he has the secret message, a hexadecimal string for which Bob must return a matching hash;

- And Bob can provide a valid wallet signature using his wallet’s private key to confirm the correct recipient.

Then, Bob can have the funds.

However, HTLCs also use “else” if the conditions aren’t met. This is where the timelock becomes important.

- If Bob does not respond within 8 hours, the transaction reverts (atomic transactions).

A hash is an encrypted value. The same input always returns the same hashed output.

The secret, which Bob must prove he has by returning the correct hash, prevents forwarding nodes from seeing the recipient. This feature secures the payment while also preserving the privacy of the transaction.

Other parties who may receive the payment accidentally won’t have the secret message and can’t prove they own Bob’s wallet. In this regard, Lightning Network payments offer a safer option compared to Bitcoin transactions. The Bitcoin network allows errors like incorrect addresses.

The good news is that Lightning Network wallets handle most of the details. Neither Alice nor Bob need to be blockchain experts to complete the transaction.

Advantages of the Lightning Network

The Lightning Network makes Bitcoin viable as a payment method for small payments. In fact, with near-zero fees, the Lightning Network opens the possibility of micropayments and small transactions for businesses that wouldn’t be possible with the comparatively higher Visa or Mastercard fees.

Enhanced Scalability

One area where Bitcoin faces challenges is scalability. How would the network handle millions of transactions in a short period of time? At seven transactions per second, it can’t. Transactions that can’t fit into blocks would wait indefinitely in the mempool, which itself will become unmanageable.

Lightning’s ability to clear transactions instantaneously allows Bitcoin to scale to the needs of a worldwide user base.

Lowered Transaction Fees

Fees for Lightning transactions come in much lower than Bitcoin transactions. Although opening and closing payment channels incur transaction fees on the Bitcoin network, transactions while using an open channel incur minimal fees. Nodes earn a base fee to use the node for hops as well as a fee based on the size of the transaction.

While the cost of a standard Bitcoin transaction is often measured in dollars, Lightning transactions often cost just pennies.

Instant Transactions

A Bitcoin transaction takes about 10 minutes on average to get one confirmation. As each new block is added to the blockchain, the confirmation count increments. Larger transactions aren’t considered final until six confirmations, about an hour.

By contrast, Lightning transactions are completed nearly instantaneously. Fast clearance makes Lightning viable for everyday purchases.

Challenges and Risks of the Lightning Network

The Lightning Network changes the game for Bitcoin, but the network still has some challenges ahead. In addition, there may be some risks for users.

Centralization Concerns

The low fees of the Lightning Network combined with the requirement for wallet balances larger than transaction values creates centralization in the network, with clusters or larger nodes handling much of the network’s traffic and little reward for smaller nodes. Larger nodes also tend to have more connections, requiring fewer hops for those transacting on the network.

Node operation can be complex, again pointing the network at node operators who have a budget for technical staff.

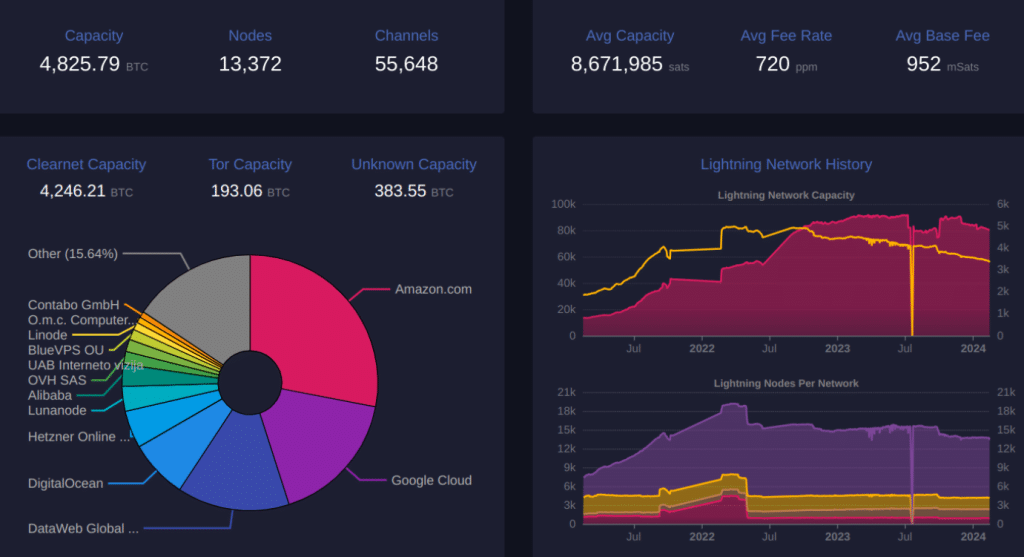

In addition, nearly 50% of Lightning Network nodes operate on AWS and Google Cloud. While some see this trend as bringing more reliability to the network, others raise an eyebrow when seeing two cloud providers host half the network’s nodes. Other cloud providers, such as DataWeb Global Group and Linode host a large percentage of the remaining nodes.

While not a single point of failure, the network is not as distributed as it might appear when only viewing the number of nodes worldwide.

Security Measures

Like all software, crypto protocols may have flaws that can be exploited. In October 2023, Antoine Riard, a Bitcoin core developer, published a paper detailing a potential security issue that could lead to a loss of funds on the Lightning Network.

Users should research the network and its risks carefully before making transactions.

Bitcoin Wallet Considerations

It’s also important to consider your wallet choices. Custodial wallets, provided by an exchange or another provider, such as Wallet of Satoshi, Strike, or Cash App, often make Bitcoin easier to use. However, the provider holds the private keys to your wallet. A password breach or a sudden withdrawal freeze puts your bitcoins at risk.

Non-custodial wallets come with a learning curve but give you control over the private keys that control your bitcoins on the blockchain. To go further, a hardware wallet offers offline storage of your private keys, providing two-factor authentication that requires input from a device in your possession.

The Future of the Lightning Network

Lightning payments increased more than 1,200% from 2021 to 2023, possibly due in part to custodial wallet providers, including Cash App, Wallet of Satoshi, and Strike which drive traffic on the network. In El Salvador, where Bitcoin is legal tender, the Chivo wallet brings another easy-to-use custodial wallet.

El Salvador could become a model for other nations, although Bitcoin’s price volatility since the adoption of Bitcoin as legal tender makes it more difficult to measure the move’s success. If other countries adopt Bitcoin, the Lightning Network will play a role.

Additionally, companies like Zap, the company behind the Strike app, are pitching the lightning network as a way for merchants to transact with reduced payment fees. In effect, merchants can accept and receive USD payments, but in the background, Zap’s network of Lightning nodes performs the payment magic.

Considering Zap’s approach, uses for the Lightning Network can reach far beyond peer-to-peer Bitcoin transactions. The network can serve as a payment rail for the transfer of other currencies.

The future of the network could be bright, although the network itself still remains largely unknown. In many cases, consumers using the Lightning Network may not even be aware of the tech that makes instant Bitcoin payments possible.

It’s possible that Lightning could replace traditional payment rails in some parts of the world or in specific use cases. However, the network still faces some challenges.

Potential security flaws and centralization with cloud servers could pose the largest risks. Ease of use remains a challenge as well, and not just for Lightning. Crypto, in general, brings usability issues compared to traditional payment systems. Wallets and point-of-sale interfaces are improving, however.

In time, Bitcoin with Lightning may be as easy to use as a debit card.

Conclusion

The Lightning Network operates as a secondary layer for the Bitcoin network. Lightning’s innovative structure brings near-instantaneous transactions with transaction fees a small fraction of those for on-chain Bitcoin transactions. As an added benefit, Lightning brings privacy benefits to Bitcoin. The only transactions recorded on-chain are when parties open or close a payment channel with a multisig wallet. Other payments between parties remain private.

Lightning still has its challenges ahead, with security concerns at the forefront. However, both Bitcoin and Lightning leverage a worldwide community of experts to address concerns and suggest ways to make Lightning safe and suitable for everyday use now and in the future.

Lightning Network FAQs

What is the Lightning Network?

The Lightning Network is a secondary payment network for Bitcoin transactions that allows much faster transactions as well as reduced transaction costs.

Can I send bitcoin on the Lightning Network?

Yes. Lightning supports sending Bitcoin from one wallet address to another and helps ensure privacy because individual payments on payment channels are not recorded on the blockchain.

How do I access the Lightning Network?

To access the Lightning Network, you’ll need a Lightning-compatible wallet, such as Electrum (a self-custody wallet). Custodial wallets such as Wallet of Satoshi or the Strike app offer also support Lightning transactions.

Should I use the Lightning Network?

You can consider the Lightning Network for smaller transactions where Bitcoin fees make transactions impractical. However, some transactions are better served by on-chain records, making a standard Bitcoin transaction a better choice.

References

- Bitcoin Bank (bitcointalk.org)

- Lightning Network (lightning.network)

- The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments (lightning.network)

- The Lightning Network Grew by 1212% in 2 Years (river.com)

- Bitcoin Lightning Network is 1,000x cheaper than Visa and Mastercard: Data (cointelegraph.com)

- BOLT #0: Introduction and Index (github.com)

- Hashed Timelock Contract (HTLC) (lightning.engineering)

- Bitcoin Lightning Network is 48% Centralized on AWS & Google Cloud (ccn.com)

- Replacement Cycling Attacks on the Lightning Network (github.com)

- El Salvador Just Became The First Country To Accept Bitcoin As Legal Tender (npr.org)

- Zap’s New Product Lets Merchants Take Dollars Over Lightning Network (coindesk.com)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Alan Draper

Alan Draper

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi