Tokenized Future: Hong Kong’s Regulatory Shifts Towards Digital Assets

Hong Kong is mapping out clear guidelines for tokenization and digital assets despite the recent regulatory action taken against crypto exchanges.

The city aims to achieve a mix of innovation and consumer protection for both the developers and the users. This initiative, as part of a broader push, is steered towards placing Hong Kong at the center of fintech evolution in Asia.

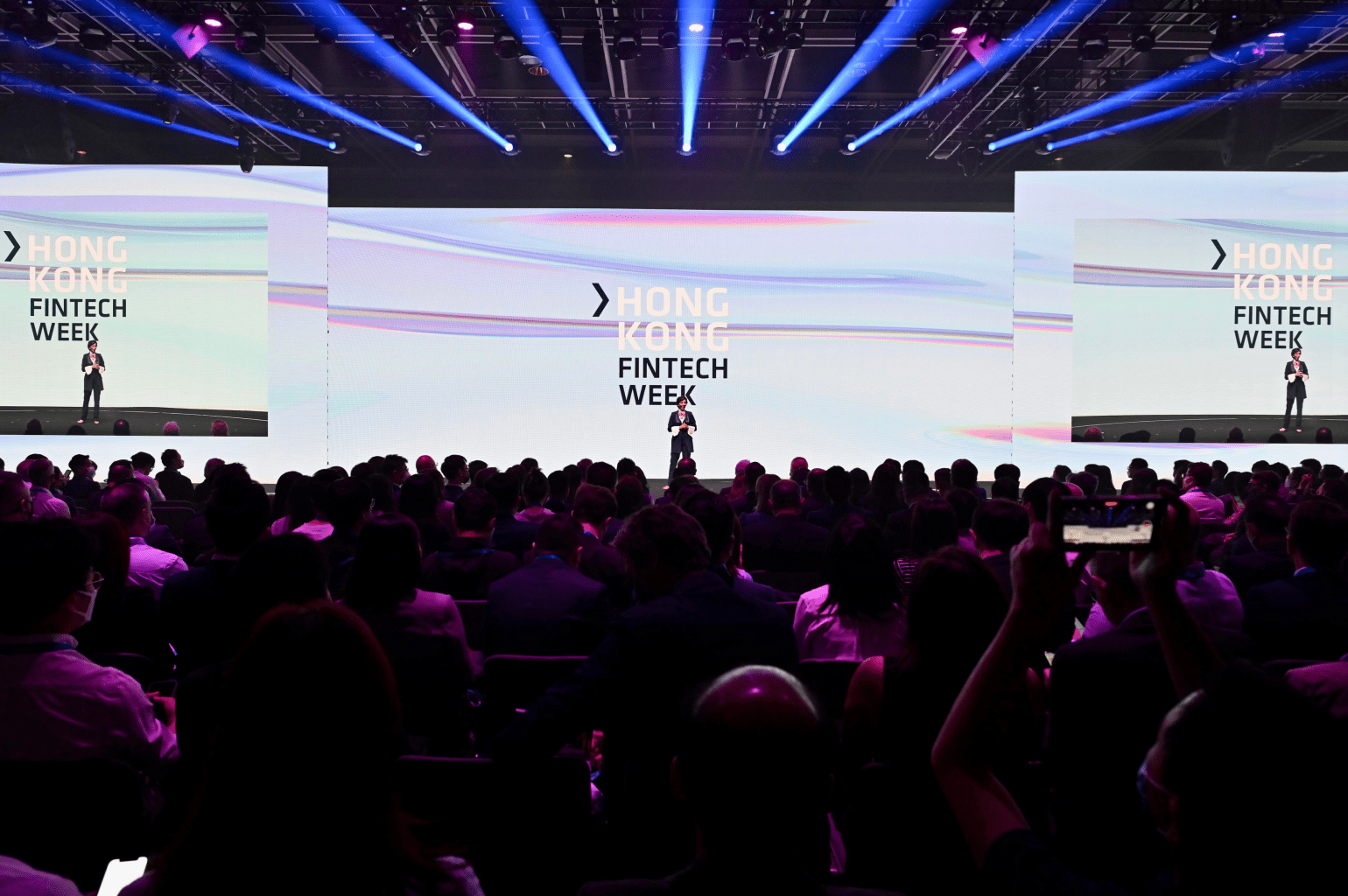

During Hong Kong FinTech Week 2023, the city’s financial regulators have provided evidence that they are still very much focused on the push towards becoming a global hub for modern financial technology. Christopher Hui, Hing Kong’s Secretary for Financial Services and the Treasury, has voiced strong support for web3 innovation.

The city financial authorities’ pro-Web3 stance remains unchanged despite recent crackdowns on crypto exchanges like JPEX. “We have been asked many times whether JPEX will affect our determination to grow the web3 market,” Hui said. “The answer is a clear no.”

New Platforms and CBDC Initiatives in the Pipeline

One notable initiative is the new Integrated Fund Platform (IFP) as listed in a press release. Developed by the Hong Kong Exchanges and Clearing Limited (HKEX), the IFP targets the retail fund sector. It aims to better serve various stakeholders through a streamlined process.

Cross-boundary e-CNY applications are also on the table. This central bank digital currency (CBDC) step is set to benefit inbound and outbound visitors between the Mainland and Hong Kong.

On tokenization, the Securities and Futures Commission (SFC) is prepared to release circulars. These documents will cover intermediaries engaging in tokenized securities-related activities.

Hong Kong is Advancing Tokenization

The city’s government also intends to “expand the regulatory remit to cover the buying and selling of VAs [virtual assets] beyond trades taking place on VA trading platforms.”

Eddie Yue, Chief Executive of the Hong Kong Monetary Authority (HKMA), pointed out that tokenized bonds have moved beyond the concept stage. “In fact, we, ourselves, assisted the government to issue the world’s first-ever tokenized government green bond earlier this year in order to demonstrate the compatibility of Hong Kong’s legal and regulatory environment with this very new issuance format,” Yue said.

He also mentioned that dialogues are already in place with the industry to explore more tokenized issuances. “Moving forward, we can expect a rise in the tokenization of differences in order to support the gradual adoption of tokenization,” Yue added.