The Curious Case of Selling Stake in Football Club for ICO Token

The Italian football club Rimini, playing this season in the country’s Serie C division, has become the first to sell part of its shares in exchange for cryptocurrency. Around 25% of the team’s shares were sold in exchange for Quantocoin (QTC), a Gibraltar-based token, which is currently seems to be not listed on any exchange, and they’re currently at the third stage of their token sale.

The buyer is Heritage Sports Holdings (HSH), whose partner and shareholder is Pablo V. Dana, also co-founder and CEO of the QTC project. No other details about the transactions were given.

Rimini’s president Giorgio Grassi stated in a press release: “Heritage Sports Holdings, with its partner Quantocoin, will try to bring to the team and to the city new ideas and synergies from the sporting, brand image and technological point of views. Heritage Sports Holdings’ participation is innovative in view of its crypto payment system and its use of blockchain technology.”

As of the time of writing, neither Quantocoin nor the Rimini football club have replied to a request for comment, while HSH was not available for comment.

Quantocoin claims it has developed a “next-generation model for the future of financial services and digital banking”.

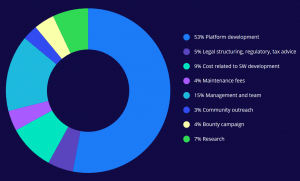

During their private pre-sale last November and their initial coin offering in December-February, the startup raised USD 11 million, according to their website. Now, during their distributional token offering the startup aims to sell 70 million QTC tokens (QTCt) until the end of April in 2019. Initial price for 1 token starts at USD 1.2. Management and team of the project should get 15% of the raised capital, according to the website of the startup.

Allocation of raised capital:

According to their roadmap, the startup had to submit its token for listing on “major cryptocurrency exchanges” in Q1, however, there were no updates on the matter. The company released its first app version this summer and plans to obtain banking license in Q3 of 2019.

More acquisitions to come

Meanwhile, Heritage Sports Holdings was established in 2013, and according to their website, “the scope of the company is to develop the world’s largest club ownership under the same proprietorship by 2020.”

“In 2016 we initiated the acquisition for our own portfolio of football teams throughout Europe with the objective to reach 10-12 participations in teams within 2020,” it added. Besides the stake in Rimini, the company owns shares in Gibraltar United, UD Los Barrios, and Mantova clubs.

HSH operate both as facilitators for investors in first tier clubs, and as direct investors in second and third division clubs.

“Our focus as a holding company is to invest in lower division clubs throughout Europe. To secure funding, to bring the teams a proper management and to enhance the Clubs image; initially with the support of our Legends, subsequently with the results obtained on the pitch,” the company explained on its website.

HSH intends to use cryptocurrency in the industry more often, according to Dana, Forbes reported. One of its goals will be the fight against corruption, especially in using cash, such as the accusation that Qatar bought votes as they won the right to host the World Cup in 2022.

Also, one of the clubs HSH owns, Gibraltar United, this July crept into the spotlight by becoming the world’s first football team to introduce cryptocurrency. Back then, Dana said all player contracts will include payment agreements in Quantocoin by next season, according to a report in The Guardian.

Pablo V. Dana talks about the deal with Gibraltar United in an interview:

However, Weiss Ratings, the American rating agency for stocks, mutual funds, cryptocurrencies, ETFs and financial institutions, has tweeted their congratulations to all parties, still striking a cautionary tone, without elaborating any further.