Telegram Rakes in USD 1.7 billion in Two Rounds

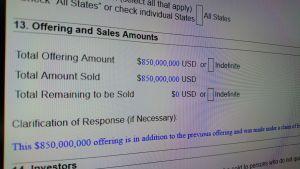

Telegram’s founders, Pavel and Nikolai Durov, reported raising USD 850 million in the second round of their Initial Coin Offering (ICO), according to a notice signed with the US Securities and Exchange Commission (SEC).

This amount was also raised in the first round of the ICO, that had taken place between January 29th and February 13th.

Although their identities remain unknown, the ICO saw 94 different investors participating since March 14th, the starting date of the offering. The ICO seeks investment to support the development of the Telegram messenger app and its own blockchain platform Telegram Open Network.

The type of securities offered – “Other” – is specified as “Purchase Agreements for Cryptocurrency” in this case. The offering stands under Federal Exemption 506(c), which states that, as long as all investors are accredited and the company takes reasonable steps to verify their accreditation, “a company can broadly solicit and generally advertise the offering and still be deemed to be in compliance with the exemption’s requirements.”

The raised amount will not be used for paying anyone, according to the notice: under Use of Proceeds, they estimated “USD 0” to be used for “payments to any of the persons required to be named as executive officers, directors or promoters,” clarifying that it is, “Unknown at this time. The issuers intend to use the proceeds for the development of the TON Blockchain, the development and maintenance of Telegram Messenger and the other purposes described in the offering materials.”

A local news outlet reported that one of the first round’s investors was Russian billionaire Roman Abramovich, who is said to have invested USD 300 million – an amount that was refuted by Jon Mann, Abramovich’s spokesperson, although he remained silent on Abramovich’s part in the ICO.

Until now, two investors in this ICO have made their identities known: founder of payment service provider Qiwi, Sergei Solonin, and founder of Wimm-Bill-Dann foods, David Yakobashvili.

Also, three large venture capital firms, Benchmark, Kleiner Perkins Caufield & Byers, and Sequoia Capital are reportedly listed among potential investors during the private pre-sale.

Read more about the encrypted story of the largest ICO in history here.