Sei Price Prediction as it Surges 60% in 7 Days – What’s Fueling This Momentum?

Sei (SEI), the token that powers the recently launched and much-hyped Sei Network blockchain, has continued to pump in recent days, despite the broader cryptocurrency market succumbing to profit-taking and deleveraging.

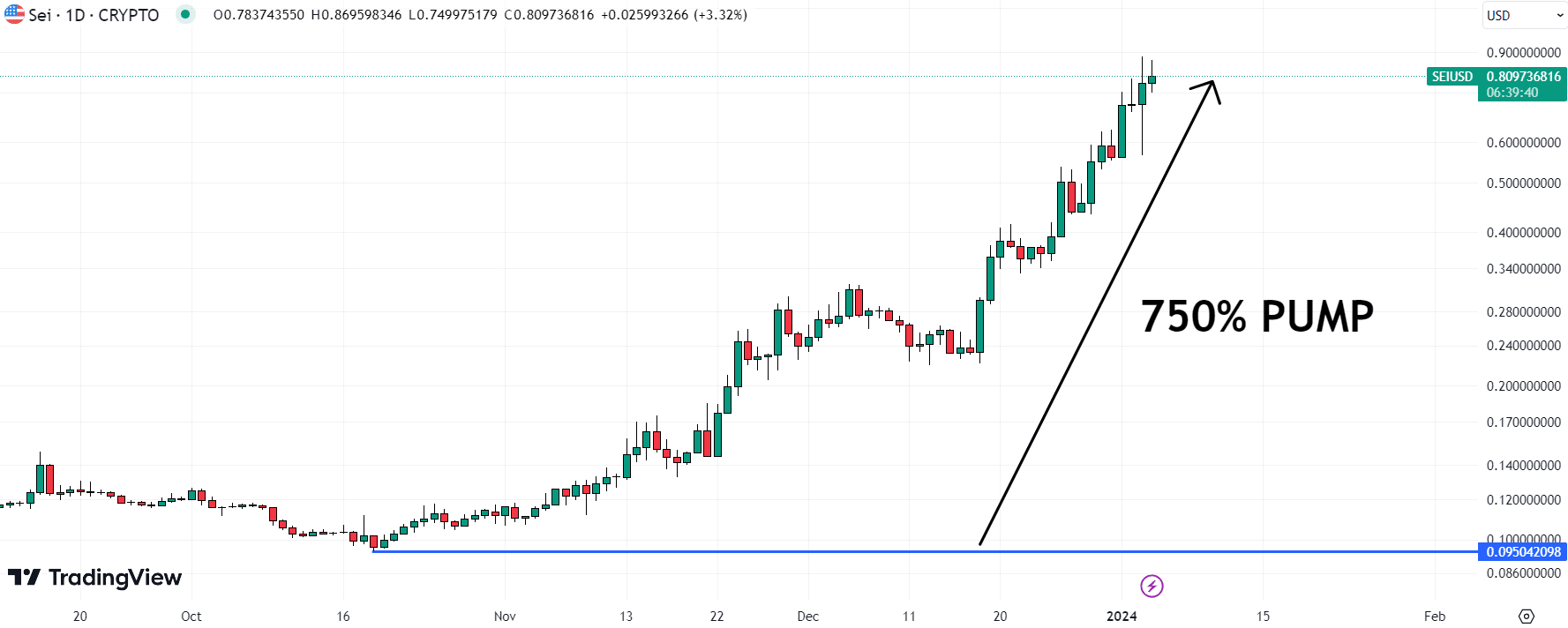

SEI/USD was last changing hands just above $0.81 per token, up another 3% on Thursday and just below the all-time highs it printed close to $0.90 on Wednesday.

That takes the cryptocurrency’s run of gains in the past seven days to more than 70%.

Indeed, SEI is now more than 750% higher versus the record lows it printed in mid-October under $0.10, making it the fourth best-performing cryptocurrency over the past 90 days in the top 100 by market capitalization, behind only Bonk (BONK), ORDI (ORDI) and Celestia (TIA).

What’s Fuelling This Surge?

As risk appetite in the cryptocurrency market has picked up in recent months, investors have been hunting higher potential returns by looking towards Bitcoin (BTC) and Ethereum (ETH) alternative layer-1 blockchains with a strong value proposition and use case, like Solana (SOL), Avalanche (AVAX) and also Sei (SEI).

Sei’s unique selling point is that it is a trading-focused blockchain designed fast transactions, low fees and other features designed to support trading activity.

Sei Network’s blockchain is also Ethereum Virtual Machine (EVM) compliant, meaning that protocols originally built for the Ethereum network can easily run on Sei.

And much like we have seen with the Solana and Avalanche blockchains in recent weeks, on-chain activity on the Sei Network has been rapidly heating up.

As per a tweet by Sei Daily last week, Sei Network just hit one billion in transactions.

🎉 Total Transactions on @SeiNetwork has reached 1 Billion! pic.twitter.com/7jO5G5ZZsx

— Sei Daily (@SeiDailyTK) December 25, 2023

Much of that rise in activity can be explained by a rise in popularity of Sei Network-issued meme coins like SEIYAN and SEILOR, which have market caps in the region of $50 and $30 million respectively.

Price Prediction – Where Next for Sei (SEI)?

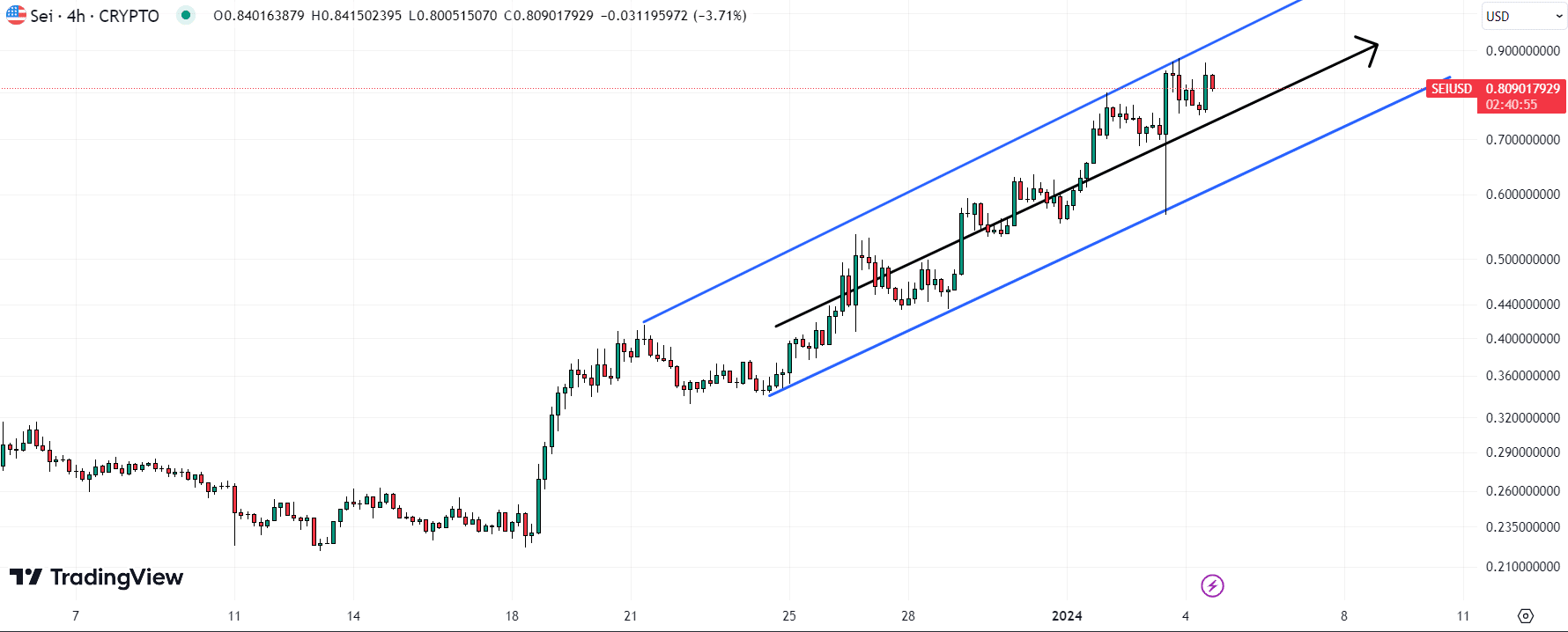

Sei remains comfortably in a short-term bullish trend channel and, unless this trend channel breaks down, price predictions are set to remain bullish.

In truth, a pullback is probably overdue at this point.

SEI’s 14-day Relative Strength Index (RSI) has been above 70 (signaling overbought market conditions) for over a week.

But at a still relatively modest market capitalization of just $1.8 billion, as per CoinGecko (and $8 billion fully diluted), scope for further upside remains strong.

If Sei Network is to become a widely used blockchain in the coming years, we could be looking at a valuation in the tens or even hundreds of billions, suggesting investors who get in now could still bag 10x or more gains with SEI.

SEI Alternative to Consider – Sponge V2 ($SPONGEV2)

SEI could deliver holders gains in the region of 10x this bull market.

That’s not bad, but many meme coin investors are aiming higher, i.e. for gains in the region of 100x.

They should look no further than Sponge V2 ($SPONGEV2), the reincarnation of the legendary Spongebob Squarepants-themed $SPONGE token, which reached a market cap of nearly $100 million earlier in 2023 and delivered gains to its earlier investors in the region of 100x.

$SPONGE token holders will be able to stake their tokens to receive an equivalent amount of $SPONGEV2 tokens, as well as to start earning staking rewards (paid out in $SPONGEV2) with a minimum APY of 40%.

$SPONGEV2’s main advantage over $SPONGE is that it will power a new play-to-earn game, the details of which are yet to be released.

But we do know that there will be a free version and paid version of the game.