New Research Reveals Ethereum’s Chicken or The Egg Problem

Ethereum’s upcoming economic model might not be lucrative enough to sustain a secure, diverse and solvent validator network, according to digital asset research firm Delphi Digital. In their new report concerning the biggest dapp (decentralized application) and smart contract platform, researchers outline a dilemma that the planned trade-off between the network security and ether issuance calls into question the platform’s long-term viability.

“We absolutely believe that continued Ethereum adoption and building on the platform will help the fee market develop, but it becomes a bit of a chicken or the egg situation,” according to the 64-page report.

After the successful Constantinople hard fork at the end of February, Ethereum is one step closer to moving away from the Proof of Work to the Proof of Stake consensus algorithm. Essentially, it will enable Ethereum holders to become network validators and use the weight of their balances to validate transactions. If any of the validators turn out to be corrupted, they lose their tokens as a punishment.

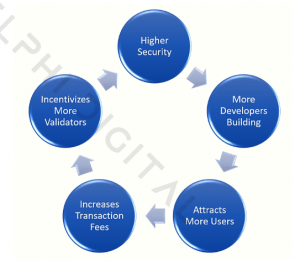

“A diversified and profitable validator network is crucial for the security and longevity of the network, but that’s unattainable under the currently proposed specs without significant network fees. At the same time, expansion of network fees will only occur with substantial dapp growth and general adoption, and that’s difficult to imagine being built on a network that’s not considered secure,” wrote Delphi Digital researchers. “We believe the currently proposed issuance model for ETH after this transition may not provide enough yield to incentivize prospective validators.”

The monumental change in the platform’s governance, also known as Ethereum 2.0 Serenity Upgrade, is set to begin sometime between Q4 2019 and Q1 2020. The shift will enable faster synchronous confirmation times, higher scalability, and quick virtual machine (VM) executions.

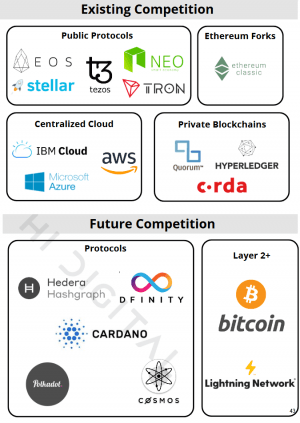

The report points out that Ethereum has won the short-term race to network effects, but now the game is turning into the race to scale. In fact, many platforms already boast of better scalability, but it usually comes at the expense of decentralization and its benefits.

(In a recent speech, Vitalik Buterin, co-founder of the Ethereum platform, said that when a blockchain project claims they can do 3,500 transactions per second due to a different algorithm, “what we really mean is ‘We are a centralized pile of trash because we only have seven nodes running the entire thing.’”)

“Our primary concern is that Ethereum’s layer 1 scaling plans under Serenity will not be fully implemented until 2021 at the earliest. That is a long time for the platform to be in a state of flux. With the knowledge that significant changes are on the horizon, combined with the fact that the network still does not scale, will developers choose to build on another platform to avoid the headache?,” the researchers asked.

Alternative approach

Aside from emphasizing issues in the current plan, the report also suggests a potential solution.

“Our opinion is that the currently proposed model focuses too much on the long term dilutive effects of a high issuance rate, potentially at the cost of near term sustainability. We propose that Serenity’s block reward starts off at a higher level and then gradually tapers off. “

According to the research company, increasing the block reward would help the network to avoid a massive systematic risk, which would create a reliable buffer before the system can heavily rely on the fee market to support the validators.

___

Read more about the main challenges and solutions for Ethereum in 2019:

- What about Casper, Sharding, and Plasma?

- Will ICO regulations bring down Ethereum?

- Dapps might rescue Ethereum yet

- Adoption is imminent, ConsenSys believes

- Ethereum and macro trends