More Hong Kong Banks Set to Join Digital Yuan Pilot, Gov’t Confirms

Hong Kong’s government says more banks based in the country are preparing to join Mainland China’s digital yuan pilot.

Mainland China’s central bank, the People’s Bank of China (PBoC), wants to expand its CBDC’s cross-border applications.

And it seemingly wants even more overseas banks to join the pilot, as it focuses on international e-CNY expansion.

Per Kwongwah, Christopher Hui, Hong Kong’s Secretary for Financial Services and the Treasury, told attendees at a Shenzhen fintech conference that “more Hong Kong banks” would be invited “to participate.”

Hui also talked up the recent linking of the digital yuan network to Hong Kong’s fast payment system (FPS), saying the connection “adds value to digital CNY wallets.”

The government minister added that “the preliminary technical testing” phase for digital yuan adoption in the cross-border payments space was now “complete.”

He added that the PBoC and the Hong Kong Monetary Authority (the HKMA; Hong Kong’s central bank) were now in a “second phase of technical testing.”

Hui stated that the government would update the “relevant regulatory and compliance protocols” to “support innovative cross-border applications of the digital yuan.”

He reiterated claims that Hong Kong wants to “facilitate retail payments” using both the FPS and the digital yuan.

And he spoke of a “two-way interconnection” between the two innovations. But the minister refused to put a timeline on further developments.

More Banks Keen to Join Digital Yuan Pilot?

Hui’s comments came after the Hong Kong-based banking giants HSBC and Hang Seng Bank joined China’s digital yuan pilot earlier this week.

The duo joined a group of “four foreign banks” that “officially announced the launch of digital yuan business.”

Also joining the digital yuan pilot is Standard Chartered, a UK bank with a strong presence in Asia, as well as the mainland Chinese arm of Taiwan’s Fubon Bank.

Hong Kong Deepening Digital Yuan Bond?

China and Hong Kong have made several digital yuan-themed “cross-border” breakthroughs this year.

Mainland Chinese tourists can, for instance, use their digital yuan wallets to top up accounts on their Octopus apps and smartcards.

Hong Kong residents and visitors can use the Octopus app to pay for public transport fees and make micropayments.

Hong Kong visitors to the mainland have also been encouraged to use the digital yuan to pay public transport fees in cities like Shenzhen.

🇨🇳 China Links Digital Yuan to ‘World’s Biggest Commodities Market’

A state-owned Chinese bank will link the digital yuan to the “world’s biggest small commodities market” via the latter’s payment platform.#CryptoNews #Chinahttps://t.co/ONK9IVOJxF

— Cryptonews.com (@cryptonews) November 27, 2023

Hong Kong, Shenzhen Key Parts of Digital Yuan ‘Expansion’ Plans

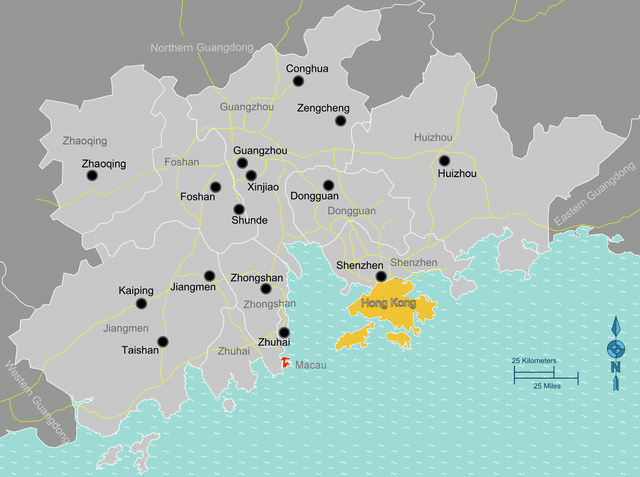

The PBoC also talked up the CBDC advances made in Hong Kong, Shenzhen, and elsewhere in the Guangdong-Hong Kong-Macao Greater Bay Area (aka the Pearl River Delta).

quoted Mu Chang Chun, the Director of the PBoC’s Digital Currency Research Institute, as stating that Shenzhen has been instrumental in “supporting the e-CNY’s cross-border exploration.” Mu said:

“Shenzhen’s first-mover advantages in international trade and cross-border finance will help the city. They will allow the city to create a model of digital yuan-powered cross-border payments for the entire Guangdong-Hong Kong-Macao Greater Bay Area.”

Mu also spoke of the importance of mBridge, a CBDC project under the umbrella of the Bank for International Settlements.

The HKMA and the PBoC are currently working on mBridge pilot with the Thai and UAE central banks.

The initiative focuses on using international CBDCs to process cross-border payments.

Mu said that projects like these could help regulators eliminate “unregulated cross-border payments.”