Long-Term Bitcoin Hodlers Buying the Dip

Despite a brutal price crash last week, long-term bitcoin (BTC) “hodlers” are still not scared away, and instead appear to be using the lower prices as a buying opportunity, a new analysis showed.

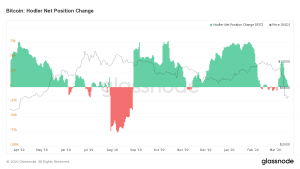

According to the report, prepared by blockchain analysis firm Glassnode and published on Thursday, a metric known as the “Hodler net position change” is currently showing a reading above zero (green area on the chart), indicating that hodlers on average are accumulating bitcoin again.

Similarly, a reading below zero, indicated by a red area on the chart, means that long-term hodlers have become net sellers, which was seen for a brief period around last week’s major sell-off.

“We can see that this February, when prices approached USD 10,000, hodlers stopped accumulating more BTC, potentially having identified it as a market top,” Glassnode noted, adding that “during the crash last week, hodlers began accumulating, signaling confidence in BTC at this price point.”

“Long-term investors appear to have identified this as the bottom, which today’s price increase supports,” the report further noted.

Glassnode’s report thus appears to support to generally positive sentiment surrounding bitcoin lately.

According to a technical strategist at Fundstrat Global Advisors, Rob Sluymer, BTC has held above its 200-week average, which he sees as an important long-term structural support level for most asset classes, and one that worked for the cryptocurrency in both 2015 and 2018.

“For now, technically we will again give bitcoin the benefit of the doubt that it is attempting to bottom but recognize bitcoin will likely need months of consolidation to repair the technical damage now in place,” he told Bloomberg.

Vijay Ayyar, Singapore-based head of business development at crypto exchange Luno, added that recent prices were potentially below running cost for many miners. “Miners are also better off just buying Bitcoin at such prices so there could be that aspect as well,” he told Bloomberg.

As of press time on Friday (10:30 UTC), bitcoin has already seen a strong recovery from last week’s crash, regaining more than 70% from its low of USD 3,858 on March 13. Over the past 24 hours alone, the gain made up nearly 24% for the number one digital asset, which currently trades at a price of USD 6,725.

___