Japan: Gov’t Mulls Securities-like ICO Regulations

The Japanese government could be set to introduce a set of initial coin offering (ICO) regulations, following recommendations from experts and the country’s top financial governance agency.

Per media outlet Nikkei, the regulatory Financial Services Agency (FSA) hosted the Study Group on the Cryptocurrency Exchange Industry on November 1, with a number of leading academics and industry leaders in attendance.

The group recommended the government to consider regulating ICOs under the Financial Instruments and Exchange Act (2006), in order to “protect investors.” The act, which was drawn up in part by the FSA, lets the regulator police securities and conventional public offerings.

Nikkei quotes a member of the group as stating, “If ICOs do indeed perform the same functions – and carry the same risks – as public offerings, then the same sort of regulations should apply.”

The panel of experts was keen to point out the fact that “some 80% of ICOs are thought to be fraudulent.” ICOs are currently outlawed in Japan’s biggest local economic rivals, South Korea and China, and cryptocurrency-related fraud has become a political hot potato in Japan in recent months.

Tokyo is also considering making changes to the way citizens declare cryptocurrency-related earnings on tax returns, with the cabinet reportedly debating the matter in detail earlier this week.

______

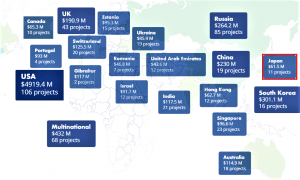

Geographical distribution of projects based on origin of the project team, Q2 2018